UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1)

OR 13(e)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

MANCHESTER

UNITED plc

(Name of Subject Company (Issuer))

TRAWLERS

LIMITED

(Offeror)

a

company limited by shares incorporated under the laws of the Isle of Man and wholly owned by

JAMES

A. RATCLIFFE

(Offeror)

(Names

of Filing Persons (identifying status as offeror, issuer or other person))

Class A

Ordinary Shares, Par Value $0.0005 Per Share

(Title of Class of Securities)

G5784H106

(CUSIP Number of Class of Securities)

Tristan

Head, Officer

Trawlers Limited

Fort

Anne

Douglas, IM1

5PD, Isle of Man

Tel.

(+44) 1624 826200

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on

Behalf of Filing Persons)

Copies

to:

Andrew

Jolly, Esq.

Hywel

Davis, Esq.

Slaughter

and May

One

Bunhill Row

London

EC1Y 8YY, United Kingdom |

|

Krishna

Veeraraghavan, Esq.

Benjamin

Goodchild Esq.

Paul,

Weiss, Rifkind, Wharton & Garrison

1285

6th Ave

New

York, NY 10019, United States |

|

| ¨ | Check

the box if the filing relates solely to preliminary communications made before the commencement

of a tender offer. |

Check the

appropriate boxes below to designate any transactions to which the statement relates:

| x | third-party

tender offer subject to Rule 14d-1. |

| ¨ | issuer

tender offer subject to Rule 13e-4. |

| ¨ | going-private

transaction subject to Rule 13e-3. |

| ¨ | amendment

to Schedule 13D under Rule 13d-2. |

Check the

following box if the filing is a final amendment reporting the results of the tender offer. ¨

If applicable,

check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer) |

This

Amendment No. 1 (this “Amendment No. 1”) amends and supplements the Tender Offer Statement on Schedule TO

originally filed with the Securities and Exchange Commission (the “SEC”) on January 17, 2024 (together with any

amendments or supplements hereto, the “Schedule TO”) related to the offer (the “Offer”) by

Trawlers Limited (“Purchaser”), a company limited by shares incorporated under the laws of the Isle of Man and wholly

owned by James A. Ratcliffe, a natural person (together with the Purchaser, the “Offerors”), to purchase up to 13,237,834

Class A ordinary shares, par value $0.0005 per share (“Class A Shares”), of Manchester United plc (the “Company”),

a Cayman Islands exempted company, which, based on information provided by the Company, represents 25.0% of the issued and outstanding

Class A Shares as of the close of business on December 22, 2023, rounded up to the nearest whole Class A Share, at a price

of $33.00 per Class A Share, in cash (subject to certain adjustments as described in Section 13 — “Summary of the

Transaction Agreement and Certain Other Agreements” of the Offer to Purchase (as defined below)), without interest thereon,

less any required tax withholding, as described in the Offer to Purchase, dated January 17, 2024 (together with any amendments or

supplements thereto, the “Offer to Purchase”) and in the related Letter of Transmittal (together with any amendments

or supplements thereto, the “Letter of Transmittal”), which are attached to the Schedule TO as Exhibits (a)(1)(A) and

(a)(1)(B), respectively (which collectively constitute the “Offer Documents”). Unless otherwise indicated, references to

sections in this Amendment No. 1 are references to sections of the Offer to Purchase.

The

information set forth in the Offer Documents is hereby expressly incorporated herein by reference in response to all items of information

required to be included in, or covered by, the Schedule TO, and is supplemented by the information specifically provided herein. Except

as specifically provided herein, this Amendment No. 1 does not modify any of the information previously reported on the Schedule

TO.

Amendment

to the Schedule TO

| ITEMS

1, 4 AND 11. | SUMMARY

TERM SHEET; TERMS OF THE TRANSACTION; AND ADDITIONAL INFORMATION. |

Items

1, 4 and 11 of the Schedule TO are hereby amended and supplemented by adding the following text thereto:

On

February 12, 2024, the Offerors extended the expiration date of the Offer to one minute after 11:59 p.m. Eastern Time

on February 16, 2024, unless extended or earlier terminated, in either case pursuant to the terms of the Transaction Agreement. The Offer

was previously scheduled to expire at one minute after 11:59 p.m. Eastern Time on February 13, 2024.

Computershare

Trust Company, N.A., the depositary for the Offer, has advised the Offerors that, as of 5:00 p.m. Eastern Time on February 9, 2024, 19,431,468

Class A Shares, representing approximately 36.7% of the outstanding Class A Shares, have been validly tendered (and not validly withdrawn)

pursuant to the Offer.

| ITEM

10. | FINANCIAL

STATEMENTS. |

| Item

10 of the Schedule TO is hereby amended by replacing the text under such Item with the following: |

(a),

(b) The information set forth in Section 10 — “Source and Amount of Funds” of the Offer to

Purchase is incorporated herein by reference.

Item 12 of the Schedule TO is hereby amended and supplemented by adding the following exhibit:

| Index No. | |

|

| (a)(5)(A)* | |

Letter to Shareholders, dated February 12, 2024. |

Amendments

to the Offer to Purchase and the Other Exhibits to the Schedule TO

ITEMS

1 THROUGH 9 AND 11.

The

Offer to Purchase and Items 1 through 9 and Item 11 of the Schedule TO, as amended, to the

extent such Items incorporate by reference the information contained in the Offer to Purchase,

is hereby amended and supplemented as follows:

| 1. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the bullet

under the caption “DO THE OFFERORS HAVE FINANCIAL RESOURCES TO MAKE PAYMENTS IN THE

OFFER?” in the Summary Term Sheet on page 4 in its entirety to read as follows: |

• Yes.

We estimate that the total amount of funds required to purchase a number of Class A Shares equal to the Offer Cap will be approximately

$437 million at or prior to the closing of the Offer based on the Offer Price. The total amount of funds required for Purchaser to complete

the purchase of the Sale Shares, the Closing Share Subscription and the Subsequent Share Subscription will be approximately $909 million,

$200 million and $100 million, respectively, for an aggregate amount of approximately $1.21 billion and, together with the amount of

funds required to purchase the Class A Shares pursuant to the Offer, assuming a number of Class A Shares greater than or equal to the

Offer Cap are validly tendered (and not validly withdrawn as described in Section 4 — “Withdrawal Rights”),

an aggregate amount of approximately $1.65 billion. We expect that the purchase of the Class A Shares in the Offer will be paid from

cash available to (whether directly, or through entities controlled by) James A. Ratcliffe, which would be sufficient to cover all amounts

that may become payable pursuant to the Offer, the purchase of the Class B Shares held by Sellers that are being sold pursuant to the

Transaction Agreement (the “Sale Shares”) and, the Closing Share Subscription (as defined below) and the Subsequent

Share Subscription (as defined below), in each case, including related transaction fees, costs and expenses. See Section 10 — “Source

and Amount of Funds” and Section 13 — “Summary of the Transaction Agreement and Certain Other

Agreements.”

• As

of February 12, 2024, James A. Ratcliffe’s liquid assets (primarily consisting of cash and readily marketable securities) were

in excess of $4 billion. James A. Ratcliffe’s net worth is significantly in excess of those liquid assets, primarily consists

of his ownership in the INEOS Group and not subject to material guarantees or contingencies that would adversely affect his

net worth.

| 2. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the bullet

under the caption “SHOULD THE OFFERORS’ FINANCIAL CONDITION BE RELEVANT TO MY

DECISION TO TENDER IN THE OFFER?” in the Summary Term Sheet on page 4 in its entirety

to read as follows: |

• Purchaser

has been organized solely in connection with the Offer and has not carried on any activities other than entering into the

Transaction Agreement or in connection with the Transaction Agreement and the Offer. As described above, we expect to have

sufficient funds necessary to purchase a number of Class A Shares equal to the Offer Cap and cover all amounts that may become

payable pursuant to the Offer, the purchase of the Sale Shares, and the completion of the Closing Share Subscription (as defined

below) and the Subsequent Share Subscription (as defined below). The form of payment consists of cash that will be provided by James

A. Ratcliffe from cash available to (whether directly, or through entities controlled by) James A. Ratcliffe and the Offer is not

subject to any financing conditions. As of February 12, 2024, James A. Ratcliffe’s liquid assets (primarily consisting of cash

and readily marketable securities) were in excess of $4 billion. James A. Ratcliffe’s net worth is significantly in excess of

those liquid assets, primarily consists of his ownership in the INEOS Group and is not subject to material guarantees or

contingencies that would adversely affect his net worth. See Section 10 — “Source and Amount of

Funds.”

| 3. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the first

bullet under the caption “IF I DECIDE NOT TO TENDER, HOW WILL THE OFFER AFFECT ME?”

in the Summary Term Sheet on page 8 in its entirety to read as follows: |

• If

you decide not to tender your Class A Shares, you will still own the same number of Class A Shares, and we expect that the

Company will remain a public company listed on the NYSE. Purchaser’s purchase of Class A Shares pursuant to the Offer will

reduce the number of Class A Shares that might otherwise trade publicly. Under the terms of the Transaction Agreement, Purchaser

has also agreed to (a) purchase the Sale Shares and (b) subscribe for (i) an additional 1,966,899.062 Class A Shares

and 4,093,706.998 Class B Shares, at the Offer Price, for an aggregate subscription price of $200 million, at the Closing (as

defined in Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”)

(the “Closing Share Subscription”) and (ii) an additional 983,449.531 Class A Shares and 2,046,853.499 Class B

Shares, at the Offer Price, for an aggregate subscription price of $100 million, at the Subsequent Closing (as defined in Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements”) (the “Subsequent Share Subscription”), each

of which will occur following the Expiration Time. Upon (i) consummation of the Offer, assuming a number of Class A Shares greater than

or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in Section 4 — “Withdrawal Rights”),

the purchase of the Sale Shares and the completion of the Closing Share Subscription, each Class A Share will retain approximately 96%

of the voting power that it held in the Company as of December 22, 2023 and (ii) consummation of the Offer, assuming a number of Class

A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in Section 4 — “Withdrawal

Rights”), the purchase of the Sale Shares, and the completion of the Closing Share Subscription and the Subsequent Share Subscription,

each Class A Share will retain approximately 95% of the voting power that it held in the Company as of December 22, 2023, in each case,

as Purchaser will acquire newly issued and outstanding Class A Shares and Class B Shares in such transactions. We cannot predict

whether the purchase of the Sale Shares or the completion of the Closing Share Subscription or the Subsequent Share Subscription would

have an adverse or beneficial effect on the market price for, or marketability of, the Class A Shares or whether it would cause

future market prices to be greater or less than the offer price of $33.00 per Class A Share. See Section 7 — “Possible

Effects of the Offer on the Market for the Class A Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations.”

| 4. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the third

paragraph under Section 7—“ Possible Effects of the Offer on the Market

for the Class A Shares; Stock Exchange Listing; Registration under the Exchange Act;

Margin Regulations” on page 24 in its entirety to read as follows: |

Possible

Effects of the Purchase of the Sale Shares and the Completion of the Share Subscriptions on the Market for the Class A Shares. Under

the terms of the Transaction Agreement, Purchaser has agreed to (a) purchase the Sale Shares and (b) subscribe for (i) the

Closing Share Subscription and (ii) the Subsequent Share Subscription, each of which will occur following the Expiration Time. Upon

(i) consummation of the Offer, assuming a number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not

validly withdrawn as described in Section 4 — “Withdrawal Rights”), the purchase of the Sale Shares and the

completion of the Closing Share Subscription, each Class A Share will retain approximately 96% of the voting power that it held in the

Company as of December 22, 2023 and (ii) consummation of the Offer, assuming a number of Class A Shares greater than or equal to the

Offer Cap are validly tendered (and not validly withdrawn as described in Section 4 — “Withdrawal Rights”),

the purchase of the Sale Shares, and the completion of the Closing Share Subscription and the Subsequent Share Subscription, each Class

A Share will retain approximately 95% of the voting power that it held in the Company as of December 22, 2023, in each case, as Purchaser

will acquire newly issued and outstanding Class A Shares and Class B Shares in such transactions. We cannot predict whether

the purchase of the Sale Shares or the completion of the Closing Share Subscription or the Subsequent Share Subscription would have an

adverse or beneficial effect on the market price for, or marketability of, the Class A Shares or whether such subscription would

cause future market prices to be greater or less than the Offer Price.

| 5. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the first

paragraph under Section 10—“Source and Amount of Funds” on page 27

of the Offer to Purchase in its entirety to read as follows: |

The

Offer is not conditioned upon Purchaser’s ability to finance the purchase of Class A Shares pursuant to the Offer. Purchaser

estimates that the total amount of funds required to purchase a number of Class A Shares equal to the Offer Cap will be approximately

$437 million at or prior to the closing of the Offer. The total amount of funds required for Purchaser to complete the purchase of the

Sale Shares, the Closing Share Subscription and the Subsequent Share Subscription will be approximately $909 million, $200 million and

$100 million, respectively, for an aggregate amount of approximately $1.21 billion and, together with the amount of funds required to

purchase the Class A Shares pursuant to the Offer, assuming a number of Class A Shares greater than or equal to the Offer Cap are validly

tendered (and not validly withdrawn as described in Section 4 — “Withdrawal Rights”), an aggregate amount of

approximately $1.65 billion. Purchaser expects that the purchase of the Class A Shares in the Offer will be paid from cash available

to (whether directly, or through entities controlled by) James A. Ratcliffe, which would be sufficient to cover all amounts that may

become payable pursuant to the Offer, the purchase of the Sale Shares (as defined in Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements”) and, the Closing Share Subscription and the Subsequent Share Subscription,

in each case, including related transaction fees, costs and expenses.

As

of February 12, 2024, James A. Ratcliffe’s liquid assets (primarily consisting of cash and readily marketable securities) were

in excess of $4 billion. James A. Ratcliffe’s net worth is significantly in excess of those liquid assets, primarily consists

of his ownership in the INEOS Group and is not subject to material guarantees or contingencies that would adversely affect

his net worth.

| 6. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the first

paragraph under Section 13 —“ Summary of the Transaction Agreement and Certain

Other Agreements” on page 31 of the Offer to Purchase in its entirety to read

as follows: |

The

following summary of the material provisions of the Transaction Agreement and the certain other agreements (as defined below) and all

other provisions of the Transaction Agreement and the certain other agreements discussed herein are qualified in their entirety by reference

to the Transaction Agreement and the certain other agreements, copies of which, excluding the equity commitment letter, are filed as

Exhibit 99.1 to the Current Report on Form 6-K filed by the Company with the SEC on December 26, 2023, and are incorporated

herein by reference. A copy of the equity commitment letter was filed as Exhibit (d)(4) to the Schedule TO and is incorporated

herein by reference. This summary does not purport to describe all of the terms of the Transaction Agreement and the certain other agreements

and you are encouraged to read the full text of the Transaction Agreement and the certain other agreements. The Transaction Agreement

and the certain other agreements may be examined and copies may be obtained at the places and in the manner set forth in Section 8— “Certain

Information Concerning the Company.” Capitalized terms used herein and not otherwise defined have the respective meanings set

forth in the Transaction Agreement or, as applicable, the certain other agreements. As used herein, the term “certain other agreements”

means the Governance Agreement, the Registration Rights Agreement, the Amended Articles, the Voting Agreement, the Equity Commitment

Letter, and the Limited Guarantee, each entered into or will be entered into in connection with the Transaction Agreement.

| 7. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the first

paragraph of Section 17—“Miscellaneous” on page 68 of the Offer

to Purchase in its entirety to read as follows: |

The

Offer is being made to all holders of Class A Shares. The Offerors are not aware of any jurisdiction in which the making of the

Offer or the acceptance thereof would be prohibited by securities, “blue sky” or other valid laws of such jurisdiction. If

the Offerors become aware of any U.S. state in which the making of the Offer or the acceptance of Class A Shares pursuant thereto

would not be in compliance with an administrative or judicial action taken pursuant to a U.S. state statute, the Offerors will make a

good faith effort to comply with any such law. If, after such good faith effort, the Offerors cannot comply with any such law, the Offer

will not be made to (nor will tenders be accepted from or on behalf of) the holders of Class A Shares in such state. In any jurisdictions

where applicable laws require the Offer to be made by a licensed broker or dealer, the Offer shall be deemed to be made on behalf of

the Offerors by one or more registered brokers or dealers licensed under the laws of such jurisdiction to be designated by the Offerors.

| 8. | The Offer

to Purchase is hereby amended and supplemented by amending and restating the second sub-bullet

of the first bullet under the caption “WHAT ARE THE MOST SIGNIFICANT CONDITIONS OF

THE OFFER?” in the Summary Term Sheet on page 4, paragraph number 2 under “The

Offer is subject to the conditions, among others, that:” on page 12 and the second

to last bullet on page 66 of the Offer to Purchase in its entirety to read as follows: |

(i)

the clearances, approvals and consents required to be obtained under competition, antitrust, merger control or investment laws (“Antitrust

Laws”) set forth in Schedule A to the Transaction Agreement will have been obtained and will be in full force and effect (which

have already been obtained and are in full force and effect), (ii) the PL Approval (as defined in the Transaction Agreement) will have

been obtained which has already been obtained and (iii) the Football Association Approval (as defined in the Transaction Agreement)

will have been obtained (the “Regulatory Condition”)

| 9. | The

Offer to Purchase is hereby amended and supplemented by amending and restating the sixth

paragraph (third bullet under “The respective obligations of Sellers, the Company and

Purchaser to consummate (i) the purchase and sale of the Sale Shares and (ii) the subscription,

issue and allotment of the Closing Subscription Shares, are in each case subject to the satisfaction

(or written waiver by all parties to the Transaction Agreement), if permissible under applicable

law at or prior to the Closing Date (as defined below) of each of the following conditions:”)

on page 33 in its entirety to read as follows: |

(i)

the clearances, approvals and consents required to be obtained under the Antitrust Laws set forth in Schedule A to the Transaction Agreement

will have been obtained and will be in full force and effect (which have already been obtained and are in full force and effect), (ii)

the PL Approval will have been obtained and will be in full force and effect which has already been obtained and is in full force and

effect and (iii) the Football Association Approval will have been obtained and will be in full force and effect. We refer herein to

this condition of the Transaction Agreement as the “Regulatory Condition”; and

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

February 12, 2024

| |

TRAWLERS

LIMITED |

| |

|

|

| |

|

|

| |

By: |

/s/

Tristan Head |

| |

Name: |

Tristan

Head |

| |

Title: |

Officer |

| |

JAMES

A. RATCLIFFE |

| |

|

|

| |

|

|

| |

By: |

/s/

James A. Ratcliffe |

| |

Name: |

James A.

Ratcliffe |

EXHIBIT

LIST

| Index

No. |

|

| (a)(1)(A)* |

Offer

to Purchase, dated January 17, 2024. |

| (a)(1)(B)* |

Form of

Letter of Transmittal. |

| (a)(1)(C)* |

Form of

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(D)* |

Form of

Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(E)* |

Form of

Summary Advertisement, published January 17, 2024, in the New York Times. |

| (a)(5)(A)** |

Press

Release, dated February 12, 2024. |

| (a)(5)(B)** |

Letter

to Shareholders, dated February 12, 2024. |

| (b) |

Not

applicable. |

| (d)(1) |

Transaction

Agreement, dated as of December 24, 2023, by and among Purchaser, Sellers and the Company (incorporated by reference to Exhibit 99.1

of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (d)(2) |

Governance

Agreement, dated as of December 24, 2023, by and among Purchaser, Sellers and the Company (incorporated by reference to Exhibit 99.2

of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (d)(3) |

Voting

Agreement, dated as of December 24, 2023, by and between Sellers and the Company (incorporated by reference to Exhibit 99.3

of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (d)(4)* |

Equity

Commitment Letter, dated as of December 24, 2023, by and between the Offerors. |

| (d)(5) |

Limited

Guarantee, dated as of December 24, 2023, entered into by and among James A. Ratcliffe, the Company and Sellers (incorporated

by reference to Exhibit 99.4 of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (g) |

Not

applicable. |

| (h) |

Not

applicable. |

| 107* |

Filing

Fee Table |

| * | Previously

filed. |

| | ** | Filed

herewith. |

Exhibit (a)(5)(A)

Sir Jim Ratcliffe and Trawlers Limited Extend

Tender Offer for Up To 25% of the Outstanding Class A Shares of Manchester United plc

February 12, 2024

FORT ANNE, Isle of Man --(BUSINESS WIRE)— Trawlers Limited

(“Purchaser”), a company limited by shares incorporated under the laws of the Isle of Man and wholly owned by James A. Ratcliffe,

a natural person (an “Offeror” and together with the Purchaser, the “Offerors”) today announced that the Offerors

have extended the expiration date of their previously announced tender offer (the “Offer”) to purchase up to 13,237,834

Class A ordinary shares, par value $0.0005 per share (“Class A Shares”), of Manchester United plc (NYSE: MANU) (the

“Company”). The Offer is being made pursuant to the transaction agreement, dated as of December 24, 2023, by and among

Purchaser, the sellers party thereto and the Company (together with any amendments or supplements thereto, the “Transaction Agreement”).

The Offer and withdrawal rights were initially scheduled to expire at one minute after 11:59 p.m. Eastern Time on February 13, 2024. The

Offer and withdrawal rights are now scheduled to expire at one minute after 11:59 p.m. Eastern Time on February 16, 2024, unless extended

or earlier terminated, in either case pursuant to the terms of the Transaction Agreement.

Computershare Trust Company, N.A., the depositary for the Offer, has

advised the Offerors that, as of 5:00 p.m. Eastern Time on February 9, 2024, the last business day prior to the announcement of the extension

of the Offer, 19,431,468 Class A Shares, representing approximately 36.7% of the outstanding Class A Shares, have been validly tendered (and

not validly withdrawn) pursuant to the Offer. Class A Shareholders who have already tendered their Class A Shares do not have to re-tender

their Class A Shares or take any other action as a result of the extension of the expiration date of the Offer.

Completion of the Offer remains subject to additional conditions described

in the tender offer statement on Schedule TO filed by the Offerors with the U.S. Securities and Exchange Commission on January 17, 2024,

as amended (the “Schedule TO”). The Offer will continue to be extended until all conditions are satisfied or waived, or until

the Offer is terminated, in either case pursuant to the terms of the Transaction Agreement and as described in the Schedule TO.

Georgeson LLC is acting as information agent for the Offerors in connection

with the Offer. Requests for documents and questions regarding the Offer may be directed to Georgeson LLC by telephone at (888) 275-7781

(domestic) or (781) 236-4943 (international) or by email at manchesterunited@georgeson.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements”

relating to the proposed acquisition of Class A Shares of the Company by the Offerors. Such forward-looking statements include, but are

not limited to, statements about the parties’ ability to satisfy the conditions to the consummation of the Offer, the expected

timetable for completing the Offer and the other transactions contemplated by the Transaction Agreement and the ancillary agreements

thereto (collectively, the “Transactions”), the Company’s and Offerors’ beliefs and expectations, the benefits

sought to be achieved by the Transactions, and the potential effects of the completed Transactions on both the Company and the Offerors.

In some cases, forward-looking statements may be identified by terminology such as “believe,” “may,” “will,”

“should,” “predict,” “goal,” “strategy,” “potentially,” “estimate,”

“continue,” “anticipate,” “intend,” “could,” “would,” “project,”

“plan,” “expect,” “seek” and similar expressions and variations thereof. These words are intended

to identify forward-looking statements. These forward-looking statements are based on current expectations and projections about future

events, but there can be no guarantee that such expectations and projections will prove accurate in the future. All statements other

than statements of historical fact are forward-looking statements. Actual results may differ materially from current expectations due

to a number of factors, including (but not limited to) risks associated with uncertainties as to the timing of the Transactions; uncertainties

as to how many of the Company’s shareholders will tender their shares in the Offer; the risk that competing offers will be made;

the possibility that various conditions to the Transactions may not be satisfied or waived; and the risk that shareholder litigation

in connection with the Transactions may result in significant costs of defense, indemnification and liability. Undue reliance should

not be placed on these forward-looking statements, which speak only as of the date they are made. Except as required by law, the Company

and the Offerors undertake no obligation to publicly release any revisions to the forward-looking statements after the date hereof to

conform these statements to actual results or revised expectations.

About the Offer and Additional Information

This press release is for informational purposes only, is not a recommendation

and is neither an offer to purchase nor a solicitation of an offer to sell Class A shares of the Company or any other securities. The

Offerors have filed a tender offer statement on Schedule TO (the “Tender Offer Statement”) with the United States Securities

and Exchange Commission (the “SEC”) and the Company has filed with the SEC a solicitation/recommendation statement on Schedule

14D-9 (the “Solicitation/Recommendation Statement”). THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE TENDER OFFER

STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION

/ RECOMMENDATION STATEMENT (AS FILED AND AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME), BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION THAT SHOULD BE READ AND CONSIDERED CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE OFFER. The Company’s shareholders

and other investors can obtain the Tender Offer Statement, the Solicitation/Recommendation Statement and other filed documents for free

at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of

charge on the Investors page of the Company’s website, https://ir.manutd.com/. In addition, the Company’s shareholders

may obtain free copies of the tender offer materials by contacting Georgeson LLC, the information agent for the Offer, by telephone at

(888) 275-7781 (domestic) or (781) 236-4943 (international) or by email at manchesterunited@georgeson.com.

Exhibit (a)(5)(B)

Trawlers Limited

Fort Anne

Douglas, IM1 5PD, Isle of Man

February 12, 2024

Dear Shareholder:

You have already received

in a separate mailing an offer to purchase dated, January 17, 2024 (the “Offer to Purchase”), and related letter of transmittal

in connection with the offer (the “Offer”) by Trawlers Limited (“Purchaser”), a company limited by shares incorporated

under the laws of the Isle of Man and wholly owned by James A. Ratcliffe, a natural person (an “Offeror” and together with

the Purchaser, the “Offerors”), to purchase up to 13,237,834 Class A ordinary shares, par value $0.0005 per share (the “Class

A Shares”), of Manchester United plc (the “Company”), a Cayman Islands exempted company, which, based on information

provided by the Company, represents 25.0% of the issued and outstanding Class A Shares as of the close of business on December 22, 2023,

rounded up to the nearest whole Class A Share, at a price of $33.00 per Class A Share, in cash (subject to certain adjustments as described

in Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements” of the Offer to Purchase),

without interest thereon, less any required tax withholding.

On February 12, 2024, the

Offerors filed Amendment No. 1 to the Schedule TO filed with the United States Securities and Exchange Commission (the “SEC”)

on January 17, 2024, which:

| (i) | extended the expiration time of the Offer to one minute after 11:59 p.m. Eastern Time on February 16,

2024; and |

| (ii) | amended the Offer to Purchase according to the accompanying changed pages (the “Changed Pages”)

attached hereto as Annex A, marked to indicate changes from the Offer to Purchase filed as Exhibit (a)(1)(A) to the Schedule TO filed

with the SEC on January 17, 2024. |

The Schedule TO and Offer

to Purchase are also available free of charge on the SEC’s website at www.sec.gov. In addition, the Company’s shareholders

may obtain free copies of the tender offer materials by contacting Georgeson LLC, the information agent for the Offer, by telephone at

(888) 275-7781 (domestic) or (781) 236-4943 (international) or by email at manchesterunited@georgeson.com.

Yours sincerely,

Trawlers Limited

James A. Ratcliffe

Annex A – Changed Pages

DO THE OFFERORS HAVE FINANCIAL RESOURCES TO MAKE PAYMENTS IN THE

OFFER?

| · | Yes. We estimate that the total amount of funds required to purchase a number of Class A Shares equal to the Offer Cap will be

approximately $437 million at or prior to the closing of the Offer based on the Offer Price. The total

amount of funds required for Purchaser to complete the purchase of the Sale Shares, the Closing Share Subscription and the Subsequent

Share Subscription will be approximately $909 million, $200 million and $100 million, respectively, for an aggregate amount of approximately

$1.21 billion and, together with the amount of funds required to purchase the Class A Shares pursuant to the Offer, assuming a number

of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in Section 4

— “Withdrawal Rights”), an aggregate amount of approximately $1.65 billion. We expect that the purchase

of the Class A Shares in the Offer will be paid from cash available to (whether directly, or through entities controlled by) James

A. Ratcliffe, which would be sufficient to cover all amounts that may become payable pursuant to the Offer, the purchase of the Class B

Shares held by Sellers that are being sold pursuant to the Transaction Agreement (the “Sale Shares”) and,

the Closing Share Subscription (as defined below) and the Subsequent Share Subscription (as defined below),

in each case, including related transaction fees, costs and expenses. See Section 10 — “Source and Amount

of Funds” and Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements.” |

| · | As of [date], James A. Ratcliffe’s liquid assets were in excess of [$ amount]. James A. Ratcliffe’s net worth is significantly

in excess of those liquid assets and not subject to material guarantees or contingencies that would adversely affect his net worth. See

Section 10 — “Source and Amount of Funds.” |

SHOULD THE OFFERORS’ FINANCIAL CONDITION BE RELEVANT TO MY

DECISION TO TENDER IN THE OFFER?

| · | Purchaser has been organized solely in connection with the Offer and has not carried on any activities other than entering into the Transaction

Agreement or in connection with the Transaction Agreement and the Offer. As described above, we expect to have sufficient funds necessary

to purchase a number of Class A Shares equal to the Offer Cap. Because the and cover all amounts that may become payable pursuant to the

Offer, the purchase of the Sale Shares, and the completion of the Closing Share Subscription (as defined below) and the Subsequent Share

Subscription (as defined below). The form of payment consists of cash that will be provided by James A. Ratcliffe from cash available

to (whether directly, or through entities controlled by) James A. Ratcliffe and the Offer is not subject to any financing conditions,

our financial condition is not relevant to your decision to tender in the Offer. As of [date], James A. Ratcliffe’s liquid assets

were in excess of [$ amount]. James A. Ratcliffe’s net worth is significantly in excess of those liquid assets and not subject to

material guarantees or contingencies that would adversely affect his net worth. See Section 10 — “Source and Amount of Funds.” |

WHY ARE THE OFFERORS MAKING THE OFFER?

| · | Purchaser has entered into a Transaction Agreement and is making the Offer pursuant to the Transaction Agreement. We are making the

Offer because it is an opportunity for us to acquire an ownership stake in the Club (as defined in the Transaction Agreement) on the terms

of the Transaction Agreement and the other transaction documents related to the Offer, pursuant to which the Offerors will acquire certain

control rights of the business of the Company. James A. Ratcliffe intends to cause Purchaser to retain the Class A Shares acquired

in the Offer. See Section 1 — “Terms of the Offer; Expiration; Proration”, Section 12 — “Purpose

of the Offer and Plans for the Company” and Section 13 — “Summary of the Transaction Agreement and Certain

Other Agreements”). |

WHAT ARE THE MOST SIGNIFICANT CONDITIONS OF THE OFFER?

| · | The Offer is subject to, among others, the following conditions: |

| · | the consummation of any of the transactions contemplated by the Transaction Agreement and the ancillary agreements thereto (collectively,

the “Transactions”) will not then be enjoined or prohibited by any order, judgment, decree, injunction or ruling (whether

temporary, preliminary or permanent) of any Governmental Authority (as defined in the Transaction Agreement) (the “No Injunctions

Condition”); |

| · | (i) the clearances, approvals and consents required to be obtained under competition, antitrust, merger control or investment

laws (“Antitrust Laws”) set forth in Schedule A to the Transaction Agreement will have been obtained and will

be in full force and effect (which have already been obtained and are in full force and effect), (ii) the PL Approval (as defined

in the Transaction Agreement) will have been obtained (which has already been obtained) and (iii) the

Football Association Approval (as defined in the Transaction Agreement) will have been obtained (the “Regulatory Condition”); |

| · | the resolution for the Company to adopt the amended and restated memorandum and articles of association for the Company set forth

in Exhibit A to the Transaction Agreement (the “Amended Articles”) will have been approved by the Company’s

shareholders and the Amended Articles (x) will be in full force and effect as of immediately prior to the Closing (as defined in

Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”) or (y) will

automatically come into full force and effect simultaneously with the occurrence of the Closing (the “Amended Articles Condition”);

and |

| · | If the Offer is subject to proration, Purchaser will announce the final results of any proration prior to making payment for your

Class A Shares. Because of the difficulty of determining the number of Class A Shares validly tendered (and not validly withdrawn

as described in Section 4 — “Withdrawal Rights”) prior to the Expiration Time, Purchaser does

not expect to be able to announce the final results of the proration or pay for any Class A Shares until up to five NYSE trading

days after the Expiration Time. Purchaser will not pay for any Class A Shares tendered until after the final proration factor has

been determined. Preliminary results of the proration will be announced by press release as promptly as practicable after the Expiration

Time. After the preliminary results have been made publicly available, you will be able to obtain them from the Information Agent, which

has been appointed as information agent for the Offer, and may be able to obtain them from your broker, dealer, bank, trust company or

other nominee. All Class A Shares not accepted for payment and purchase will be returned to the shareholder or, in the case of tendered

Class A Shares delivered by book-entry transfer, credited to the account at The Depository Trust Company (“DTC”)

from which the transfer had previously been made, promptly after the expiration or termination of the Offer. See Section 1 — “Terms

of the Offer; Expiration; Proration” and Section 2 — “Acceptance for Payment and Purchase

for Class A Shares.” |

IF I DECIDE NOT TO TENDER, HOW WILL THE OFFER AFFECT ME?

| · | If you decide not to tender your Class A Shares, you will still own the same number of Class A Shares, and we expect that

the Company will remain a public company listed on the NYSE. Purchaser’s purchase of Class A Shares pursuant to the Offer will

reduce the number of Class A Shares that might otherwise trade publicly. Under the terms of the Transaction Agreement, Purchaser

has also agreed to (a) purchase the Sale Shares and (b) subscribe for (i) an additional

1,966,899.062 Class A Shares and 4,093,706.998 Class B Shares, at the Offer Price, for an aggregate subscription price of $200 million,

at the Closing (as defined in Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”)

(the “Closing Share Subscription”) and (ii) an additional 983,449.531 Class A Shares and 2,046,853.499 Class B

Shares, at the Offer Price, for an aggregate subscription price of $100 million, at the Subsequent Closing (as defined in Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements”) (the “Subsequent Share Subscription”), each of

which will occur following the Expiration Time. Upon (i) consummation of the Offer, assuming a number

of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in Section 4 — “Withdrawal

Rights”), the purchase of the Sale Shares and the completion of the Closing Share Subscription, each Class A Share will retain

approximately 96% of the voting power that it held in the Company as of December 22, 2023 and (ii) consummation of the Offer,

assuming a number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described

in Section 4 — “Withdrawal Rights”), the purchase of the Sale Shares, and the completion of the Closing

Share Subscription and the Subsequent Share Subscription, each Class A Share will retain approximately 95% of the voting power that

it held in the Company as of December 22, 2023, in each case, as Purchaser will acquire newly issued and outstanding Class A

Shares and Class B Shares in such transactions. We cannot predict whether such transactionsthe

purchase of the Sale Shares or the completion of the Closing Share Subscription or the Subsequent Share Subscription would

have an adverse or beneficial effect on the market price for, or marketability of, the Class A Shares or whether it would cause future

market prices to be greater or less than the offer price of $33.00 per Class A Share. See Section 7 — “Possible

Effects of the Offer on the Market for the Class A Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations.” |

WHAT ARE THE PLANS FOR THE FUTURE COMPOSITION OF THE COMPANY’S

BOARD OF DIRECTORS?

| · | Under the terms of the Transaction Agreement, immediately following the Closing, John Reece and Rob Nevin shall become directors of

the Company. |

WILL I HAVE THE RIGHT TO HAVE MY CLASS A SHARES APPRAISED?

| · | No appraisal or dissenter’s rights are available in connection with the Offer. |

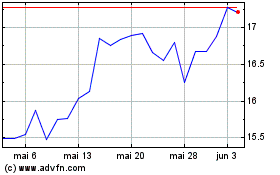

WHAT ARE THE RECENT TRADING PRICES FOR THE CLASS A SHARES?

| · | On December 22, 2023, the last full trading day before the public announcement of the Offer, the closing price of the Class A

Shares reported on the NYSE was $19.84 per Class A Share. On January 16, 2024, the last full trading day before the commencement

of the Offer, the closing price of the Class A Shares reported on the NYSE was $21.20 per Class A Share. You should obtain current

market quotations for Class A Shares before deciding whether to tender your Class A Shares. |

INTRODUCTION

Purchaser has agreed to purchase 25.0% of the

issued and outstanding Class B Shares from the Sellers at the Offer Price pursuant to the Transaction Agreement. The purchase of

Class B Shares will be consummated on the business day immediately following the Expiration Time. See “Introduction,”

Section 1 — “Terms of the Offer; Expiration; Proration” and Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements.” Purchaser has also agreed to subscribe for (i) an additional

1,966,899.062 Class A Shares and 4,093,706.998 Class B Shares, at the Offer Price, for an aggregate subscription price of $200 million,

at the Closing (as defined in Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”)

(the “Closing Share Subscription”) and (ii) an additional 983,449.531 Class A Shares and 2,046,853.499 Class B

Shares, at the Offer Price, for an aggregate subscription price of $100 million, at the Subsequent Closing (as defined in Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements”) (the “Subsequent Share Subscription”), each of

which will occur following the Expiration Time.

If your Class A Shares are registered in

your name and you tender your Class A Shares directly to Computershare Trust Company, N.A., the depositary for the Offer (the “Depositary”),

you will not be obligated to pay brokerage fees or commissions or similar expenses or, except as otherwise provided in Instruction 6 of

the Letter of Transmittal, transfer taxes on the purchase of Class A Shares by Purchaser pursuant to the Offer. If you hold your

Class A Shares through a broker, dealer, commercial bank, trust company or other nominee and your broker, dealer, commercial bank,

trust company or other nominee tenders your Class A Shares on your behalf, your broker, dealer, commercial bank, trust company or

other nominee may charge a fee for doing so. You should consult your broker, dealer, commercial bank, trust company or other nominee to

determine whether any charges will apply. If you do not complete and sign the Substitute Form W-9 that is included in the Letter

of Transmittal (or an alternative applicable form including Form W-8, if applicable), you may be subject to U.S. federal backup withholding

on the gross proceeds payable to you. See Section 5 — “Certain Income Tax Considerations” —

“Information Reporting and Withholding.”

We will pay all charges and expenses of the Depositary

and Georgeson LLC, the information agent for the Offer (the “Information Agent”).

The Offer is not subject to any financing condition. The Offer is

subject to the conditions, among others, that:

| 1. | the consummation of any of the transactions contemplated by the Transaction Agreement and the ancillary agreements thereto (collectively,

the “Transactions”) will not then be enjoined or prohibited by any order, judgment, decree, injunction or ruling (whether

temporary, preliminary or permanent) of any Governmental Authority (as defined in the Transaction Agreement) (the “No Injunctions

Condition”); |

| 2. | (i) the clearances, approvals and consents required to be obtained under competition, antitrust, merger control or investment

laws (“Antitrust Laws”) set forth in Schedule A to the Transaction Agreement will have been obtained and will

be in full force and effect (which have already been obtained and are in full force and effect.), (ii) the PL Approval (as defined

in the Transaction Agreement) will have been obtained (which has already been obtained) and (iii) the

Football Association Approval (as defined in the Transaction Agreement) will have been obtained (the “Regulatory Condition”); |

| 3. | the resolution for the Company to adopt the amended and restated memorandum and articles of association for the Company set forth

in Exhibit A to the Transaction Agreement (the “Amended Articles”) will have been approved by the Company’s

shareholders and the Amended Articles (x) will be in full force and effect as of immediately prior to the Closing (as defined in

Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”) or (y) will

automatically come into full force and effect simultaneously with the occurrence of the Closing (the “Amended Articles Condition”);

and |

| 4. | the Transaction Agreement will not have been terminated in accordance with its terms (the “Termination Condition”). |

The Offer is subject to other conditions in

addition to those set forth above. A more detailed discussion of the conditions to consummation of the Offer is contained in the Introduction,

Section 1 — “Terms of the Offer; Expiration; Proration” and Section 14 — “Conditions

of the Offer.”

Purchaser expressly reserves the right to waive

certain of the conditions to the Offer, provided that Purchaser may not waive the Termination Condition, the Regulatory Condition or the

No Injunctions Condition. See Section 14 — “Conditions of the Offer.”

The

Offer will expire at one minute after 11:59 p.m. Eastern Time on February 1316,

2024, unless the Purchaser extends the Offer or earlier terminates. See Section 1 — “Terms of the Offer; Expiration;

Proration”, Section 14 — “Conditions of the Offer” and Section 15 — “Certain Legal Matters;

Regulatory Approvals.”

The Company’s board of directors (the

“Company Board”) has (a) determined that it is in the best interests of the Company for the Company to execute, deliver

and perform the Transaction Agreement, the Governance Agreement, the Equity Commitment Letter, the Limited Guarantee, the Voting Agreement

and the Transactions (other than the sale and purchase of the Sale Shares), (b) approved the execution, delivery and performance

by the Company of the Transaction Agreement, the Governance Agreement, the Equity Commitment Letter, the Limited Guarantee and the Voting

Agreement, (c) determined to direct that the Amendment Proposal be submitted to the shareholders of the Company for their approval,

and (d) resolved to recommend that the Company’s shareholders (i) approve the adoption of the Amended Articles by the

Company and (ii) tender their Class A Shares to Purchaser pursuant to the Offer.

| Current Fiscal Year | |

High | | |

Low | |

| First Quarter | |

$ | 24.46 | | |

$ | 18.27 | |

| Second Quarter | |

$ | 20.57 | | |

$ | 17.50 | |

| Third Quarter (through January 16, 2024) | |

$ | 21.22 | | |

$ | 19.94 | |

On December 22, 2023, the last full trading

day before the public announcement of the Offer, the closing price of the Class A Shares reported on the NYSE was $19.84 per Class A

Share. On January 16, 2024, the last full trading day before the commencement of the Offer, the closing price of the Class A

Shares reported on the NYSE was $21.20 per Class A Share. Before deciding whether to tender your Class A Shares in the Offer,

you should obtain a current market quotation for the Class A Shares.

The Company has historically paid semi-annual

cash dividends on its ordinary shares. The following table sets forth the semi-annual dividend payments made by the Company over the past

5 years.

| Fiscal Year Ended June 30, | |

First Half | | |

Second Half | |

| 2023 | |

$ | 0.00 | | |

$ | 0.00 | |

| 2022 | |

$ | 0.09 | | |

$ | 0.09 | |

| 2021 | |

$ | 0.09 | | |

$ | 0.09 | |

| 2020 | |

$ | 0.09 | | |

$ | 0.09 | |

| 2019 | |

$ | 0.09 | | |

$ | 0.09 | |

In the Company’s Annual Report on Form 20-F

for the fiscal year ended June 30, 2023, the Company indicated that it had not paid any dividends for fiscal year 2023. It was further

indicated that the declaration and payment of any future dividends will be at the sole discretion of the Company Board or a committee

thereof and will depend upon the Company’s results of operations, financial condition, distributable reserves, contractual restrictions,

restrictions imposed by applicable law, capital requirements and other factors the Company Board (or such committee thereof) deems relevant.

| 7. | Possible Effects of the Offer on the Market for the Class A

Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations. |

Possible

Effects of the Offer on the Market for the Class A Shares. The purchase of Class A Shares pursuant to the

Offer will reduce the number of holders of Class A Shares and the number of Class A Shares that might otherwise trade publicly,

which could adversely affect the liquidity and market value of the remaining Class A Shares. We cannot predict whether the reduction

in the number of Class A Shares that might otherwise trade publicly would have an adverse or beneficial effect on the market price

for, or marketability of, the Class A Shares or whether such reduction would cause future market prices to be greater or less than

the Offer Price.

Shareholders that do not tender their Class A

Shares in the Offer or that do not have all of their Class A Shares accepted because of proration will continue to be owners of Class A

Shares. As a result, such shareholders will continue to participate in the future performance of the Company and to bear the attendant

risks associated with owning Class A Shares.

Possible

Effects of the Purchase of the Sale Shares and the Completion of the Share Subscriptions on

the Market for the Class A Shares. Under the terms of the Transaction Agreement, Purchaser has agreed to (a) purchase

the Sale Shares and (b) subscribe for (i) the Closing Share Subscription and (ii) the Subsequent Share

Subscription, each of which will occur following the Expiration Time. Upon (i) consummation of the

Offer, assuming a number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly

withdrawn as described in Section 4 — “Withdrawal Rights”), the purchase of the Sale Shares and

the completion of the Closing Share Subscription, each Class A Share will retain approximately 96% of the voting power that it

held in the Company as of December 22, 2023 and (ii) consummation of the Offer, assuming a number of Class A Shares

greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in

Section 4 — “Withdrawal Rights”), the purchase of the Sale Shares, and the completion of the

Closing Share Subscription and the Subsequent Share Subscription, each Class A Share will retain approximately 95% of the

voting power that it held in the Company as of December 22, 2023, in each case, as Purchaser will acquire newly issued and

outstanding Class A Shares and Class B Shares in such transactions. We cannot predict whether eitherthe purchase of the Sale Shares or the completion of the Closing Share Subscription or the Subsequent Share Subscription

would have an adverse or beneficial effect on the market price for, or marketability of, the Class A Shares or whether such

subscription would cause future market prices to be greater or less than the Offer Price.

Stock

Exchange Listing. The Class A Shares are listed on the NYSE. We expect that the Company will still be a public

company listed on the NYSE following the Offer. If, as a result of the purchase of Class A Shares pursuant to the Offer, the Class A

Shares no longer meet the criteria for continued listing on the NYSE, the market for the Class A Shares could be adversely affected.

According to the NYSE’s published guidelines, the NYSE would normally give consideration to the prompt initiation of suspension

and delisting procedures with respect to the Class A Shares if, among other things:

| · | the total number of holders of Class A Shares (including both record holders and beneficial holders of Class A Shares held

in the name of NYSE member organizations) fell below 400; |

| · | (i) the total number of holders of Class A Shares (including both record holders and beneficial holders of Class A

Shares held in the name of NYSE member organizations) fell below 1,200 and (ii) the average monthly trading volume for the most recent

12 months is less than 100,000 Shares; or |

| · | the number of publicly-held Class A Shares (excluding for this purpose shares held by directors, officers or their immediate

families and other concentrated holdings of 10.0% or more) fell below 600,000. |

If, following the purchase of Class A Shares

in the Offer, the Company no longer meets these standards, the listing of the Class A Shares on the NYSE could be discontinued. If

the Class A Shares cease to be listed on the NYSE, it is possible that the Class A Shares would continue to trade on another

market or securities exchange or in the over-the-counter market and that price or other quotations would be reported by other sources.

The extent of the public market for the Class A Shares and the availability of such quotations would depend, however, upon such factors

as the number of holders and/or the aggregate market value of the publicly-held Class A Shares at such time, the interest in maintaining

a market in the Class A Shares on the part of securities firms, the possible termination of registration of the Class A Shares

under the Exchange Act, and other factors.

Registration

under the Exchange Act. The Class A Shares are currently registered under the Exchange Act, and we do not expect

that the consummation of the Offer will affect the registration of the Class A Shares.

Margin

Regulations. The Class A Shares are currently “margin securities” under the regulations of the Board

of Governors of the Federal Reserve System (the “Federal Reserve Board”), which regulations have the effect, among

other things, of allowing brokers to extend credit on the collateral of Class A Shares for the purpose of buying, carrying or trading

in securities. Depending upon factors similar to those described above regarding listing and market quotations, it is possible that, following

the Offer, the Class A Shares would no longer constitute “margin securities” for the purpose of the Federal Reserve Board’s

margin regulations and, therefore, could no longer be used as collateral for loans made by brokers.

| 8. | Certain Information Concerning the Company |

The following description of the Company and its

business has been taken from the Company’s Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed with

the SEC on October 27, 2023, and is qualified in its entirety by reference to such Form 20-F.

The Company operates one of the most popular football

teams in the world. The Company leverages its global platform to generate revenues from multiple sources, including sponsorship, merchandising,

product licensing, broadcasting and football match day activities from all domestic and European football match day activities. Since

2013, the Company has wholly owned an in-house television network (“MUTV”), providing a greater degree of control over

the production, distribution and quality of the Company’s proprietary content. In May 2022, the Company expanded the reach

of MUTV by incorporating it into the Company’s main global application.

The Company was incorporated under the laws of

the Cayman Islands on April 30, 2012, under the name “Manchester United Ltd.” and subsequently changed its name to “Manchester

United plc” on August 8, 2012. The Company’s principal executive offices are located at Sir Matt Busby Way, Old Trafford,

Manchester, England, M16 0RA. The Company’s telephone number is +44 (0) 161 868 8000. The Company’s Internet website

is https://www.manutd.com. The Company’s website address is not intended to function as a hyperlink, and the information contained

in the Company’s website is not incorporated by reference in this Offer to Purchase and you should not consider it as part of the

Offer to Purchase.

Except as otherwise described in this Offer to

Purchase, none of the Offerors or, to the best knowledge of the Offerors, any of the Purchaser D&Os, has had any business relationship

or transaction with the Company or any of its executive officers, directors or affiliates that is required to be reported under the rules and

regulations of the SEC applicable to the Offer. Except as provided in the Transaction Agreement or as otherwise described in this Offer

to Purchase, there have been no contacts, negotiations or transactions between any of the Offerors or any of their subsidiaries or, to

the best knowledge of the Offerors, any of the Purchaser D&Os, on the one hand, and the Company or its affiliates, on the other hand,

concerning a merger, consolidation or acquisition, tender offer or other acquisition of securities, an election of directors or a sale

or other transfer of a material amount of assets during the past two years.

Available

Information. Pursuant to Rule 14d-3 under the Exchange Act, Purchaser filed with the SEC a Tender Offer Statement

on Schedule TO (together with the exhibits thereto, as it may be amended or supplemented from time to time, the “Schedule TO”),

of which this Offer to Purchase forms a part, and exhibits to the Schedule TO. The Schedule TO and any amendments thereto, including

exhibits, and reports, proxy statements and other information may be obtained by mail, upon payment of the SEC’s customary charges,

by writing to its principal office at 100 F Street, NE, Washington, DC 20549. The Schedule TO and the exhibits thereto are available

at the SEC’s website on the Internet at www.sec.gov.

| 10. | Source and Amount of Funds |

The Offer is not conditioned upon Purchaser’s

ability to finance the purchase of Class A Shares pursuant to the Offer. Purchaser estimates that the total amount of funds required

to purchase a number of Class A Shares equal to the Offer Cap will be approximately $437 million at or prior to the closing

of the Offer. The total amount of funds required for Purchaser to complete the purchase of the Sale Shares,

the Closing Share Subscription and the Subsequent Share Subscription will be approximately $909 million, $200 million and $100 million,

respectively, for an aggregate amount of approximately $1.21 billion and, together with the amount of funds required to purchase the Class A

Shares pursuant to the Offer, assuming a number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and

not validly withdrawn as described in Section 4 — “Withdrawal Rights”), an aggregate amount of approximately

$1.65 billion. Purchaser expects that the purchase of the Class A Shares in the Offer will be paid from cash available

to (whether directly, or through entities controlled by) James A. Ratcliffe, which would be sufficient to cover all amounts that may become

payable pursuant to the Offer, the purchase of the Sale Shares (as defined in Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements”) and,

the Closing Share Subscription and the Subsequent Share Subscription, in each case, including

related transaction fees, costs and expenses.

As

of [date], James A. Ratcliffe’s liquid assets were in excess of [$ amount]. James A. Ratcliffe’s net worth is significantly

in excess of those liquid assets and not subject to material guarantees or contingencies that would adversely affect his net worth.

The Offer is not conditioned on Purchaser’s ability to

finance the purchase of Class A Shares pursuant to the Offer.

| 11. | Background of the Offer |

The following chronology summarizes the key

meetings and other events between the Offerors and the Company that led to the signing of the Transaction Agreement and the other transaction

documents related to the Offer (collectively, the “Transaction Documents”). The following chronology does not purport

to catalogue every conversation between the Offerors and the Company and their respective representatives. For a summary of additional

activities of the Company relating to the signing of the Transaction Documents, please refer to the Schedule 14D-9 being mailed to

shareholders with this Offer to Purchase.

On November 22, 2022, the Company publicly

announced its decision to commence a process to explore strategic alternatives for the Company (the “Strategic Alternatives Review

Process”).

On January 15, 2023, an entity acting on

behalf of James A. Ratcliffe (for purposes of this Section 11, James A. Ratcliffe and any entity or entities acting on behalf of

James A. Ratcliffe is referred to as “Offeror”) reached out to Raine Securities LLC (“Raine”), acting

as financial advisor to the Company, to express its interest in a potential strategic transaction with the Company. As a result of this

outreach, Raine provided a draft nondisclosure agreement the same day and a final version was entered between Offeror and the Company

on January 17, 2023. The nondisclosure agreement contained customary provisions (but did not contain a standstill).

On January 17, 2023, representatives of Offeror

were given access to a virtual data room established by the Company. Offeror and its advisors began their business and legal due diligence

of the Company to assess potential risks in connection with a potential strategic transaction.

On January 30, 2023, Raine delivered a first

round process letter to Offeror. Following receipt of the process letter and prior to February 17, 2023, Raine addressed process-related

questions with Offeror.

The Offerors intend to communicate with the Company’s

management and the Company Board about, and may enter into negotiations and agreements with them regarding the foregoing and may communicate

with other shareholders and third parties in respect of the same. The Offerors may exchange information with any such persons pursuant

to appropriate confidentiality or similar agreements. The Offerors may change their intentions with respect to any and all matters referred

to in this Item 12. They may also take steps to explore and prepare for various plans and actions, and propose transactions, before

forming an intention to engage in such plans, proposals or other actions or proceed with such transactions.

The Offerors also intend to review their investment

in the Company on a continuing basis and depending upon various factors, including without limitation, the Company’s financial position

and strategic direction, the outcome of any discussions referenced above, overall market conditions, other investment opportunities available

to Purchaser, and the availability of securities of the Company at prices that would make the purchase or sale of such securities desirable,

Purchaser may endeavor (i) to increase or decrease its position in the Company through, among other things, the purchase or sale

of securities of the Company, including through transactions involving the Ordinary Shares and/or other equity, debt, notes, other securities,

or derivative or other instruments that are based upon or relate to the value of securities of the Company in the open market or in private

transactions, including through a trading plan created under Rule 10b5-1(c) or otherwise, on such terms and at such times as

the Purchaser may deem advisable and/or (ii) to enter into transactions that increase or hedge their economic exposure to the Ordinary

Shares without affecting their beneficial ownership of the Ordinary Shares. In addition, the Offerors may, at any time and from time to

time, (i) review or reconsider its position and/or change its purpose and/or formulate plans or proposals with respect thereto and

(ii) consider or propose one or more of the actions described in subsections (1) through (7) of Item 1006(c) of

Regulation M-A.

| 13. | Summary of the Transaction Agreement and Certain Other Agreements. |

The following summary of the material provisions of the

Transaction Agreement and the certain other agreements (as defined below) and all other provisions of the Transaction Agreement and

the certain other agreements discussed herein are qualified in their entirety by reference to the Transaction Agreement and the

certain other agreements, copies of which, excluding the equity commitment letter, are filed as Exhibit 99.1 to the Current Report

on Form 6-K filed by the Company with the SEC on December 26, 2023, and are incorporated herein by reference. A copy of the equity

commitment letter was filed as Exhibit (d)(4) to the Schedule TO and is incorporated herein by reference. This summary is

not intended to be complete and may not contain all of the information aboutdoes not purport to describe all of the terms of the

Transaction Agreement and the certain other agreements that is important to you. For a complete understanding of the Transaction

Agreement and the certain other agreements, and you are encouraged to read the full text of the Transaction Agreement and the certain

other agreements. The Transaction Agreement and the certain other agreements may be examined and copies may be obtained at the

places and in the manner set forth in Section 8 — “Certain Information Concerning the Company.” Capitalized terms

used herein and not otherwise defined have the respective meanings set forth in the Transaction Agreement or, as applicable, the

certain other agreements. As used herein, the term “certain other agreements” means the Governance Agreement, the

Registration Rights Agreement, the Amended Articles, the Voting Agreement, the Equity Commitment Letter, and the Limited Guarantee,

each entered into or will be entered into in connection with the Transaction Agreement.

Transaction Agreement

The summary description has been included in this

Offer to Purchase to provide you with information regarding the terms of the Transaction Agreement and is not intended to modify or supplement

any rights or obligations of the parties under the Transaction Agreement or any factual information about Purchaser, Sellers, the Company

or the Transactions contained in public reports filed by Purchaser or the Company with the SEC. Such information can be found elsewhere

in, or incorporated by reference into, the Schedule TO and related exhibits, including this Offer to Purchase, and the Schedule 14D-9,

as well as in the Company’s other public filings. The Transaction Agreement and the summary of its terms contained in the Current

Report on Form 6-K filed by the Company with the SEC on December 26, 2023, are incorporated herein by reference as required

by applicable SEC regulations and solely to inform investors of its terms. The Transaction Agreement contains representations, warranties

and covenants, which were made only for the purposes of such agreement and as of specific dates, were made solely for the benefit of Purchaser,

Sellers and the Company, and are intended not as statements of fact, but rather as a way of allocating risk to one of the parties if those

statements prove to be inaccurate. In addition, such representations, warranties and covenants may have been qualified by certain disclosures

in confidential disclosure letters delivered by Sellers to Purchaser and by Purchaser to Sellers, in connection with the signing of the

Transaction Agreement, and may apply standards of materiality in a way that is different from what may be viewed as material by shareholders

of, or other investors in, the Company. Moreover, information concerning the subject matter of the representations and warranties, which

do not purport to be accurate as of the date of this Offer to Purchase, may have changed since the date of the Transaction Agreement.

The respective obligations of Sellers, the Company

and Purchaser to consummate (i) the purchase and sale of the Sale Shares and (ii) the subscription, issue and allotment of the

Closing Subscription Shares, are in each case subject to the satisfaction (or written waiver by all parties to the Transaction Agreement),

if permissible under applicable law at or prior to the Closing Date (as defined below) of each of the following conditions:

| · | the consummation of (i) the sale and purchase of the Sale Shares and (ii) the subscription, issue and allotment of the Closing

Subscription Shares will in each case not then be enjoined or prohibited by any order, judgment, decree, injunction or ruling (whether

temporary, preliminary or permanent) of any Governmental Authority. We refer herein to this condition of the Transaction Agreement as

the “No Injunctions Condition”; |

| · | the Expiration Time shall have occurred at a time when Purchaser shall be obligated to accept the Class A Shares validly tendered

(and not validly withdrawn) pursuant to the Offer. We refer herein to this condition of the Transaction Agreement as the “Expiration

Condition”; |

| · | (i) the clearances, approvals and consents required to be obtained under the Antitrust Laws set forth in Schedule A to the

Transaction Agreement will have been obtained and will be in full force and effect (which have already been obtained and are in full force

and effect), (ii) the PL Approval will have been obtained and will be in full force and effect (which

has already been obtained and is in full force and effect) and (iii) the Football Association Approval will have been

obtained and will be in full force and effect. We refer herein to this condition of the Transaction Agreement as the “Regulatory

Condition”; and |

| · | the Amendment Proposal shall have been approved by the Company’s shareholders and the Amended Articles (x) will be in full

force and effect as of immediately prior to the Closing or (y) will automatically come into full force and effect simultaneously

with the occurrence of the Closing. We refer herein to this condition of the Transaction Agreement as the “Amended Articles Condition”. |

The obligation of Purchaser to consummate (i) the

purchase and sale of the Sale Shares and (ii) the subscription, issue and allotment of the Closing Subscription Shares is subject

to the satisfaction (or written waiver by Purchaser, if permissible under applicable law) at or prior to the Closing Date, of each of

the following conditions:

| · | certain of the representations and warranties, as set forth in the Transaction Agreement, made by the Company relating to corporate

existence and power, corporate authorization to execute the Transaction Agreement, authorized share capital and outstanding shares, a

Company Material Adverse Effect (as defined below) having not occurred, and no brokers, as well as the Seller Fundamental Representations

will be true and correct in all material respects as of the Closing Date as if made at the Closing Date, except for those representations