UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.__ )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

| |

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

|

☒

|

Definitive Proxy Statement

|

| |

|

|

☐

|

Definitive Additional Materials

|

| |

|

|

☐

|

Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12

|

FIRSTHAND TECHNOLOGY VALUE FUND, INC.

(Name of Registrant as Specified in Its Chart)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒

|

No fee required.

|

| |

|

|

☐

|

Fee paid previously with preliminary materials

|

| |

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

FIRSTHAND TECHNOLOGY VALUE FUND, INC.

150 Almaden Boulevard, Suite 1250

San Jose, CA 95113

April 3, 2024

Dear Fellow Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Firsthand Technology Value Fund, Inc., a Maryland corporation (the “Company” or “SVVC”), on May 21, 2024, at 2:00 p.m., Pacific Time. To provide all of our stockholders across the United States and abroad an opportunity to participate in the Annual Meeting, this year’s Annual Meeting will be held in a virtual meeting format only. You will be able to attend the Annual Meeting virtually and vote and submit questions during the virtual Annual Meeting by visiting www.meetnow.global/MMWJ2FV.

The matters for consideration at the Annual Meeting are:

| |

i. |

the election of two directors of the Company; |

| |

ii.

|

the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2024; and

|

| |

iii.

|

the transaction of such other business as may properly come before the meeting or any postponements or adjournments thereof.

|

The Company’s Board of Directors unanimously recommends that you vote FOR the election of its nominees for director and FOR the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm.

Enclosed with this letter are the formal notice of the meeting; the proxy statement, which gives detailed information about the Board nominees and why the Board of Directors unanimously recommends that you vote FOR the election of the director nominees and FOR the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm; a written proxy for you to sign and return; and a copy of the Company’s annual report to stockholders on Form 10-K.

Your vote is important. Please complete, sign, and date the enclosed proxy card and return it in the enclosed envelope. This will ensure that your vote is counted, even if you cannot attend the meeting in person.

If you have any questions about the enclosed proxy or need assistance in voting your shares, please call 800.976.8776.

Sincerely,

Kevin Landis

Chairman of the Board of Directors, CEO and President

Firsthand Technology Value Fund, Inc.

150 Almaden Boulevard, Suite 1250

San Jose, CA 95113

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Firsthand Technology Value Fund, Inc.:

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders of Firsthand Technology Value Fund, Inc., a Maryland corporation (the “Company”), will be held on May 21, 2024, at 2:00 p.m., Pacific Time, to consider and vote on the following matters as more fully described in the accompanying proxy statement:

| |

1.

|

the election of one Class I director of the Company to serve until the 2027 Annual Meeting of Stockholders and the election of one Class III director of the Company to serve until the 2026 Annual Meeting of Stockholders and in each case to serve until his successor is duly elected and qualifies;

|

| |

2.

|

the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2024; and

|

| |

3.

|

the transaction of such other business as may properly come before the meeting or any postponements or adjournments thereof.

|

Stockholders of record as of the close of business on March 15, 2024, are entitled to notice of and to vote at the meeting (or any postponement or adjournment of the meeting). Whether or not you plan to attend the meeting, we urge you to review these materials carefully and to authorize a proxy to vote your shares by submitting your proxy card as promptly as possible.

By Order of the Board of Directors of the Company,

Kelvin Leung Secretary

April 3, 2024

San Jose, California

TABLE OF CONTENTS

|

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

|

3

|

|

PROXY STATEMENT 2024 ANNUAL MEETING OF STOCKHOLDERS

|

6

|

|

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

|

7

|

|

PROPOSAL ONE

|

11

|

|

NOMINEES FOR DIRECTOR WHO ARE NOT AN INTERESTED PERSONS

|

12

|

| REMAINING DIRECTOR NOMINEE WHO IS AN INTERESTED PERSON |

12 |

|

DIRECTOR COMPENSATION

|

14

|

|

DIRECTOR DIVERSITY

|

14

|

|

COMMITTEES OF THE BOARD OF DIRECTORS

|

15

|

|

INFORMATION ABOUT EACH DIRECTOR’S QUALIFICATIONS, EXPERIENCE, ATTRIBUTES, OR SKILLS

|

16

|

|

BOARD RECOMMENDATION

|

18

|

|

PROPOSAL TWO

|

18

|

|

INDEPENDENT ACCOUNTING FEES AND POLICIES

|

18

|

|

AUDIT COMMITTEE REPORT

|

19

|

|

BOARD RECOMMENDATION

|

20

|

|

INFORMATION ABOUT EXECUTIVE OFFICERS

|

23

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

24

|

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

|

24

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

|

26

|

|

CORPORATE GOVERNANCE

|

26

|

|

COMPENSATION COMMITTEE REPORT

|

28

|

|

OTHER MATTERS

|

29

|

|

MORE INFORMATION ABOUT THE MEETING

|

29

|

|

INVESTMENT ADVISER

|

29

|

|

ADMINISTRATOR

|

29

|

|

HOUSEHOLDING OF PROXY MATERIALS

|

29

|

|

STOCKHOLDER PROPOSALS

|

30

|

Firsthand Technology Value Fund, Inc.

150 Almaden Boulevard, Suite 1250

San Jose, CA 95113

PROXY STATEMENT

2024 Annual Meeting of Stockholders

May 21, 2024

This proxy statement is being sent to you by the Board of Directors (the “Board” or the “Board of Directors”) of Firsthand Technology Value Fund, Inc., a Maryland corporation (the “Company,” “SVVC,” “Fund,” “we,” “us,” or “our”), that is regulated as a business development company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors is asking you to complete, sign, date, and return the enclosed proxy card, permitting your votes to be cast at the 2024 annual meeting (the “Annual Meeting”) of stockholders to be held on May 21, 2024, at 2:00 p.m., Pacific Time, via live webcast accessible at www.meetnow.global/MMWJ2FV. Stockholders of record at the close of business on March 15, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. You are entitled to one vote for each share of common stock you hold at the close of business on the Record Date on each matter on which holders of such shares are entitled to vote. This proxy statement and enclosed proxy card are first being mailed to stockholders on or about April 3, 2024. Any reference in this proxy statement to attending the Annual Meeting, including any reference to “virtual” or “in person” attendance, means attending by remote communication via live webcast on the Internet.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2024: You should have received, together with this proxy statement, our Annual Report to stockholders for the fiscal year ended December 31, 2023. If you would like another copy of the Annual Report, please write us at the address shown at the top of this page or call us at 800.976.8776. The report will be sent to you without charge. Our proxy statement and reports can be accessed on our website (www.firsthandtvf.com/proxy2024) or on the Securities and Exchange Commission’s (the “SEC”) website (www.sec.gov). (The Company’s website is not and should not be considered part of this proxy statement and is not incorporated as a result of these references.)

Firsthand Capital Management, Inc. (“FCM” or the “Investment Advisor”) externally manages and advises us pursuant to our investment management agreement. FCM is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. FCM provides investment advice to investment funds and other clients, focusing on the technology and alternative energy sectors. As of December 31, 2023, FCM managed approximately $86 million. FCM may be contacted at the address listed above.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

In this section of the proxy statement, we answer some common questions regarding the Annual Meeting and voting at the Annual Meeting.

Q. WHAT AM I BEING ASKED TO CONSIDER AND VOTE ON AT THE ANNUAL MEETING?

| |

A.

|

The matters to be considered and voted upon at the Annual Meeting are:

|

| |

●

|

the election of one Class I director of the Company to serve until the 2027 Annual Meeting of Stockholders and the election of one Class III director of the Company to serve until the 2026 Annual Meeting of Stockholders and in each case to serve until his successor is duly elected and qualifies; |

| |

●

|

the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2024; and |

| |

●

|

the transaction of such other business as may properly come before the meeting or any postponements or adjournments thereof. |

Q. HOW DOES THE BOARD OF DIRECTORS SUGGEST THAT I VOTE?

A. The Board of Directors unanimously recommends that you vote FOR the election of its nominees for director and FOR the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm.

Q. HOW CAN I VOTE?

A. If your shares are held in “street name” by a broker or bank, you will receive information regarding how to instruct your bank or broker to vote your shares. If you are a stockholder of record, you may authorize the persons named as proxies on the enclosed proxy card to cast the votes you are entitled to cast at the Annual Meeting by completing, signing, dating and returning the enclosed proxy card. You also have the option of authorizing a proxy to vote your shares by telephone or via internet, by following the instructions in the enclosed proxy card. Stockholders of record as of the close of business on the Record Date, or their duly authorized proxies, also may vote in person at the Annual Meeting. However, even if you plan to attend the Annual Meeting, we urge you to return your proxy card or authorize a proxy to vote your shares by telephone or via the internet. That will ensure that your vote is cast should your plans change.

Q. HOW PROXIES WILL BE VOTED?

A. All proxies solicited by the Board of Directors that are properly authorized at or prior to the Annual Meeting, and that are not revoked, will be voted at the Annual Meeting. Votes will be cast in accordance with the instructions specified. If no instructions are specified, the persons named as proxies will cast such votes FOR the election of the nominees for director and FOR the ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm. We know of no other matters to be properly presented at the Annual Meeting. However, if another proposal is properly presented at the Annual Meeting, the persons named as proxies on the enclosed proxy card will cast votes on each proposal in their sole discretion.

Q. CAN I REVOKE MY PROXY?

| |

A.

|

Yes. At any time before it has been exercised, you may revoke your proxy by:

|

| |

●

|

sending a letter revoking your proxy to the Secretary of the Company at our offices located at 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113;

|

| |

●

|

properly executing and sending a later-dated proxy; or

|

| |

●

|

attending the Annual Meeting, requesting return of any previously delivered proxy, and voting in person. Attendance in person at the Annual Meeting alone will not revoke your proxy.

|

Q. WHAT CONSTITUTES A QUORUM?

A. The presence, in person or by proxy, of holders of shares entitled to cast a majority of the votes entitled to be cast at the Annual Meeting constitutes a quorum for the purposes of the Annual Meeting. No business may be conducted at the Annual Meeting if a quorum is not present. Abstentions and broker “non-votes” will be counted as present for purposes of determining a quorum. A broker non-vote is a vote that is not cast on a non-routine matter because the shares entitled to cast the vote are held in “street name”, the broker lacks discretionary authority to vote the shares and the broker has not received voting instructions from the beneficial owner.

If a quorum is not present in person or by proxy at the Annual Meeting, the chairman of the Annual Meeting may adjourn the meeting to a date not more than 120 days after the original Record Date without notice other than announcement at the Annual Meeting.

Q. WHAT IS THE REQUIRED VOTE FOR APPROVAL OF EACH PROPOSAL PROPERLY PRESENTED AT THE ANNUAL MEETING?

A. Proposal One. The election of Greg Burglin as a Class I director, and Kevin Landis as a Class III director requires the affirmative vote of a plurality of the votes cast at the Annual Meeting. Each share of common stock is entitled to one vote for each director to be elected at the Annual Meeting. For the purposes of Proposal One, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the election of Messrs. Burglin and Landis. There is no cumulative voting in the election of directors.

Proposal Two. The ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the Annual Meeting. Each share of common stock is entitled to one vote. For purposes of the vote on Proposal Two, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. Because the ratification of the appointment of Tait, Weller & Baker LLP is a discretionary item, generally, brokers, banks, trusts or other nominees holding shares that do not receive voting instructions from beneficial owners may vote on this proposal in their discretion.

Q. WHAT IF OTHER MATTERS COME UP AT THE ANNUAL MEETING?

A. The Board of Directors does not know of any matters to be properly presented at the Annual Meeting other than those referred to in this proxy statement. If other matters are properly presented at the Annual Meeting (or any postponement or adjournment thereof) for consideration, and you properly authorize a proxy, the persons named as proxy holders will have the discretion to vote on those matters for you.

Q. WHO IS SOLICITING MY VOTE?

A. In this proxy statement, the Board of Directors is soliciting your vote for matters properly submitted for consideration by stockholders at the Annual Meeting.

Q: HOW DO I ATTEND AND VOTE AT THE ANNUAL MEETING?

A: Any stockholder as of the close of business on the Record Date or their duly authorized proxies may attend the Annual Meeting. If you are a record stockholder, you do not need to register to attend the Annual Meeting. You will be able to attend the Annual Meeting online and submit your questions during the Annual Meeting by visiting www.meetnow.global/MMWJ2FV. You also will be able to vote your shares electronically as part of the Annual Meeting webcast. Please follow the instructions on the proxy card that you received.

To participate in the Annual Meeting, you will need to review the information included on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank, broker or other nominee, you must register in advance to attend the Annual Meeting by remote communication via webcast. To register to attend the Annual Meeting by remote communication via webcast, you must submit a legal proxy from your bank, broker or other nominee as proof of your power to authorize your vote. Obtaining a legal proxy from your bank, broker or other nominee may take several days. Requests for registration must be labeled as “Legal Proxy” and should be received by shareholdermeetings@computershare.com via email using the instructions below by no later than 5:00 p.m., Eastern Time, on May 16, 2024, to ensure ample time to provide your confirmation of registration to be admitted to the meeting.

Requests for registration should be directed to the following:

By email: Forward the email from your bank, broker, or other nominee or attach an image of your legal proxy, to shareholdermeetings@computershare.com. Please provide your full name and address and include “Firsthand Technology Value Fund” in the subject line. Computershare will then email you the instructions for voting during the Annual Meeting after verifying your eligibility to vote on the matters to be presented at the Annual Meeting.

The Annual Meeting will convene at 2:00 p.m., Pacific Time, on May 21, 2024. We encourage you to access the Annual Meeting prior to the start time leaving ample time for the check-in process. Please follow the registration instructions as outlined in this proxy statement.

Q. WHO PAYS FOR THIS SOLICITATION OF PROXIES?

A. The expenses of preparing, printing and mailing the enclosed proxy card, the accompanying notice and this proxy statement, tabulation expenses, and all other costs, in connection with this solicitation of proxies will be borne by the Company. We will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of our shares. Additional solicitation may be made by mail, telephone, facsimile or personal interview by representatives of the Company, FCM, our transfer agent, Georgeson LLC, or by brokers or their representatives. We will not pay any of our representatives or FCM any additional compensation for their efforts to supplement proxy solicitation activities.

Q. CAN I VIEW THE PROXY STATEMENT AND ANNUAL REPORT ON THE INTERNET?

A. Yes. The proxy statement and Annual Report are available on the Internet at www.firsthandtvf.com/proxy2024.

This information summarizes information that is included in more detail in the proxy statement. We urge you to

read the proxy statement carefully.

If you have questions, call 800.976.8776.

PROPOSAL ONE

ELECTION OF

DIRECTORS

Under our charter, our Board of Directors (the “Board”) is divided into three classes (Class I, Class II and Class III). We currently have three directors.

|

Class

|

Term*

|

Directors

|

|

I

|

to serve until the Annual Meeting of Stockholders in 2024

|

Greg Burglin

|

|

II

|

to serve until the Annual Meeting of Stockholders in 2025

|

Kimun Lee

|

|

III

|

to serve until the Annual Meeting of Stockholders in 2023 (holding over to 2024 Annual Meeting)

|

Kevin Landis

|

| |

|

|

* Each director serves until the Annual Meeting of Stockholders for the designated year and until his successor is duly elected and qualifies.

The director whose term is expiring at this year’s Annual Meeting is the Class I director, Greg Burglin. The Board has nominated him for election at the Annual Meeting, to serve until the 2027 Annual Meeting of Stockholders and until his successor has been duly elected and qualifies.

In addition, we did not hold our 2023 Annual Meeting of Stockholders due to a lack of quorum. In accordance with Maryland law, Kevin Landis, a Class III director who was up for election at the 2023 Annual Meeting of Stockholders, continues to serve as a “holdover” director. The Board has nominated Kevin Landis for election at the Annual Meeting as the Class III director, to serve until the 2026 Annual Meeting of Stockholders and until his successor has been duly elected and qualifies.

The Board knows of no reason why the nominees will be unable to serve, and the nominees consented to serve if re-elected. If any nominee is unable to serve or for good cause will not serve because of an event not now anticipated, the persons named as proxies may vote in their discretion for another nominee designated by the Board. The persons named as proxies on the accompanying proxy card intend to vote at the Annual Meeting (unless otherwise instructed) FOR the election of Mr. Burglin as the Class I director and Mr. Landis as the Class III director.

The following tables set forth each nominee's name and age; position(s) with us and length of time served; principal occupation during the past five years; and other directorships held during the past five years. The address for each nominee and all directors is 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113. Additional biographical information on each nominee follows the table.

The directors who are not “interested persons,” as defined in the 1940 Act, of FCM, or our underwriters in offerings of our securities from time to time, as defined in the 1940 Act, are referred to herein as “Independent Directors.” None of our Independent Directors, nor any of their immediate family members, has been a director, officer or employee of FCM or its affiliates within the last five years.

For information regarding the Fund’s executive officers and their compensation, please refer to “Information About Executive Officers” and “Compensation Discussion and Analysis” below.

NOMINEES FOR DIRECTOR WHO ARE NOT AN INTERESTED PERSONS

|

Name (Year Born)

|

Position(s) Held with

Registrant, Term

of Office/ Time of Service

|

|

Principal Occupations

During Past Five Years

|

Number of

Portfolios in Fund

Complex(1)

Overseen by

Director

|

Other Directorships

Held by Director During

Past Five Years

|

|

Greg Burglin

(born 1960)

|

Director (to serve until the 2024 Annual Meeting of

Stockholders). Served since

2010.

|

|

Tax consultant for more than 5 years.

|

3

|

Current: Firsthand Funds (2 portfolios) (since 2008).

|

|

Kimun Lee

(born 1946)

|

Director (to serve until the 2025 Annual Meeting of

Stockholders). Served since 2010.

|

|

Mr. Lee is a California-registered investment adviser. In addition, he has also conducted a consulting business under the name Resources Consolidated since January 1980.

|

3

|

Since September 2009, Mr. Lee has served as a director of iShares Delaware Trust Sponsor LLC. Since September 2010, Mr. Lee has served on the board of Firsthand Technology Value Fund Inc.Since April 2013, he has served on the board of Firsthand Funds. Since April 2014, Mr. Lee is a trustee of FundX Investment Trust.

|

(1) The 1940 Act requires the term “Fund Complex” to be defined to include registered investment companies advised by the Company’s investment adviser, FCM, and, as a result, the Fund Complex included, the Company and Firsthand Funds, a family of open-end funds registered under the 1940 Act that are managed by FCM.

REMAINING DIRECTOR NOMINEE WHO IS AN INTERESTED PERSON

|

Name (Year Born)

|

Position(s) Held with

Registrant, Term

of Office/ Time of Service

|

|

Principal Occupations

During Past Five Years

|

Number of

Portfolios in Fund

Complex(1)

Overseen by

Director

|

Other Directorships

Held by Director During

Past Five Years

|

|

Kevin Landis

(born 1961)

|

Chairman of the Board of Directors, President, Chief Executive Officer and Chief Financial Officer. Director (to serve until the 2023 Annual Meeting of Stockholders (holding over to 2024 Annual Meeting)), elected annually as an officer. Served since 2010.

|

|

President of FCM since 2009; President, Chairman and Founder of Firsthand Funds since 1994; Portfolio Manager of Firsthand Alternative Energy Fund, and Firsthand Technology Opportunities Fund, each a series of Firsthand Funds; Portfolio Manager of the Company since April, 2011. Chief Executive Officer of IntraOp Medical Corp. since 2023; Chief Executive Officer of Wrightspeed, Inc. since 2023.

|

3

|

Current:

Firsthand Funds (since 1994); EQX Capital, Inc.; Hera Systems, Inc.; IntraOp Medical Corp.; Revasum Inc.; and Wrightspeed, Inc.

Former:

Phumware Inc., (from March 2015 through May 2019); Pivotal Systems Corp. (from December 2014 through November 2023); QMAT, Inc. (from April 2016 through December 2019); Silicon Genesis Corp. (from September 2001 to5 through January 2023)

|

(1) The 1940 Act requires the term “Fund Complex” to be defined to include registered investment companies advised by the Company’s investment adviser, FCM, and, as a result, the Fund Complex included, the Company and Firsthand Funds, a family of open-end funds registered under the 1940 Act that are managed by FCM.

DIRECTOR COMPENSATION

The following table sets forth the compensation paid by us during the fiscal year ended December 31, 2023, to the Independent Directors. No compensation is paid to directors who are “interested persons.” We have no retirement or pension plans or any compensation plans under which our equity securities were authorized for issuance except for the Deferred Compensation Plan discussed below.

.

|

Name

|

Fees Earned or

Paid in Cash

(Total Compensation)

|

|

Independent Directors

|

|

|

Greg Burglin

|

$50,000

|

|

Kimun Lee

|

$50,000

|

|

Nicholas Petredis

|

$29,949.67

|

|

Rodney Yee

|

$0

|

| |

|

|

Interested Director

|

None

|

|

Kevin Landis

|

|

Our directors and officers who are “interested persons” because of their employment by FCM, including all our executive officers, serve without any compensation from us. The Independent Directors each receive $50,000 per annum plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each regularly-scheduled in-person board meeting. In addition, we purchase directors and officer’s liability insurance on behalf of our directors and officers, who are covered under the same joint policy that covers FCM and Firsthand Funds.

Deferred Compensation Plan

We maintain our Deferred Compensation Plan (the “Deferred Compensation Plan”), pursuant to which our non-employee directors and our non-employee directors may defer some or all of their directors’ cash fees compensation. The Deferred Compensation Plan was approved by our Board on December 23, 2022, and will expire on December 29, 2031.

Under the Deferred Compensation Plan an Independent Director may elect to defer all or a portion of that person’s cash compensation for a particular year. The amounts deferred are booked as a liability on the Company’s balance sheet, and the value of that liability will track the net asset value of the Company’s common stock, as if it were invested in that common stock.

Each of Mr. Burglin and Mr. Lee elected to defer under the Deferred Compensation Plan 50% of his compensation amounts for 2023 shown above.

DIRECTOR DIVERSITY

|

Demographic Background

|

|

|

|

|

| |

Female

|

Male

|

Non-Binary

|

Did not

Disclose Gender

|

|

African American or Black

|

|

|

|

|

|

Alaskan Native or Native American

|

|

|

|

|

|

Asian

|

|

1

|

|

|

|

Hispanic or Latinx

|

|

|

|

|

|

Native Hawaiian or Pacific Islander

|

|

|

|

|

|

White

|

|

1

|

|

|

|

Two or More Races or Ethnicities

|

|

|

|

|

|

LGBTQ+

|

|

|

|

|

|

Did Not Disclose Demographic Background

|

|

|

|

1

|

COMMITTEES OF THE BOARD OF DIRECTORS

Our Board has four standing committees: (1) the Audit Committee, (2) the Valuation Committee, (3) the Nominating Committee and (4) the Compensation Committee.

AUDIT COMMITTEE

The members of the Audit Committee are Greg Burglin and Kimun Lee, each of whom is independent for purposes of the Nasdaq Stock Market corporate governance regulations, is not an “interested person” as defined in Section 2(a)(19) of the 1940 Act, and is able to read and understand financial statements as required by the NASDAQ Stock Market Corporate governance regulations. Mr. Burglin serves as chairman of the Audit Committee. Our Board of Directors has determined that no member of the Audit Committee qualifies as “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K, as promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”). Mr. Burglin meets the current independence and experience requirements of Rule 10A-3 of the Exchange Act. The Audit Committee is responsible for approving our independent registered public accounting firm, reviewing with our independent accountants the plans and results of the audit engagement, approving professional services provided by our independent accountants, reviewing the independence of our independent accountants, and reviewing the adequacy of our internal accounting controls. For the fiscal year ended December 31, 2023, the Audit Committee met four times. The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the Audit Committee Charter is available on the Company’s website at www.firsthandtvf.com.

VALUATION COMMITTEE

The members of the Valuation Committee are Greg Burglin and Kimun Lee, each of whom is independent for purposes of the NASDAQ Stock Market corporate governance regulations and is not an “interested person” as defined in Section 2(a)(19) of the 1940 Act. Mr. Burglin serves as chairman of the Valuation Committee. The Valuation Committee is responsible for aiding our Board of Directors in fair value pricing debt and equity securities that are not publicly traded or for which current market values are not readily available. The Board of Directors and Valuation Committee may use the services of nationally recognized independent valuation firms or the advice of FCM to help them determine the fair value of these securities. For the fiscal year ended December 31, 2023, the Valuation Committee met four times. The Valuation Committee operates under a written charter adopted by the Board of Directors. A copy of the Valuation Committee Charter is available on the Company’s website at www.firsthandtvf.com.

NOMINATING COMMITTEE

The members of the Nominating Committee are Kimun Lee and Greg Burglin, each of whom is independent for purposes of the NASDAQ Global Market corporate governance regulations and is not an “interested person” as defined in Section 2(a)(19) of the 1940 Act. Mr. Lee serves as chairman of the Nominating Committee. The Nominating Committee is responsible for nominating and corporate governance matters. This includes the responsibilities of selecting, researching, and nominating directors for election by our stockholders, selecting nominees to fill vacancies on the Board or a committee of the Board, developing and recommending to the Board a set of corporate governance principles, and overseeing the evaluation of the Board and our management. For the fiscal year ended December 31, 2023, the Nominating Committee met one time. The Nominating Committee operates under a written charter adopted by the Board of Directors. A copy of the Nominating Committee Charter is available on the Company’s website at www.firsthandtvf.com.

COMPENSATION COMMITTEE

The members of the compensation committee are Kimun Lee and Greg Burglin each of whom is independent for purposes of the NASDAQ Stock Market corporate governance regulations and is not an “interested person” as defined in Section 2(a)(19) of the 1940 Act. Mr. Lee serves as the Chairman of the Compensation Committee. The compensation committee is responsible for overseeing the discharge of, or assisting the Board in discharging, the Board’s responsibilities relating to the Company’s executive officers as well as the compensation of the independent directors. During the fiscal year ended December 31, 2023, the compensation committee met one time. The Compensation Committee operates under a written charter adopted by the Board of Directors. A copy of the Compensation Committee Charter is available on the Company’s website at www.firsthandtvf.com.

BOARD OF DIRECTOR AND COMMITTEE MEETINGS HELD

The following table shows the number of meetings held for the Company during the fiscal year ended December 31, 2023:

|

Board of Directors

|

6 |

|

Audit Committee

|

4

|

|

Valuation Committee

|

4

|

|

Nominating Committee

|

1

|

|

Compensation Committee

|

1

|

All directors attended at least 75% of the aggregate of (1) the total number of meetings of the Board and (2) the total number of meetings held by all committees of the Board on which they served. The Company does not currently have a policy with respect to Board member attendance at annual meetings of stockholders.

Please refer to “Corporate Governance” on page 16 below for a review of the Board’s leadership structure, role in risk oversight, and other matters.

INFORMATION ABOUT EACH DIRECTOR’S QUALIFICATIONS, EXPERIENCE, ATTRIBUTES, OR SKILLS

The Board believes that each of its directors has the qualifications, experience, attributes, and skills (“Director Attributes”) appropriate to his continued service as a director of the Company in light of the Company’s business and structure. Each of the directors has a demonstrated record of business and/or professional accomplishment that indicates that he has the ability to critically review, evaluate, and access information provided. Certain of these business and professional experiences are set forth in detail in the charts above. Messrs. Landis, Burglin, and Lee have served on boards for organizations other than the Company and each has served on the Board of the Company since its inception. In addition, each of the directors has substantial boardroom experience and/or, in his service to the Company, has gained substantial insight into the operation of the Company and has demonstrated a commitment to discharging his duties as a director.

In addition to the information provided in the charts above, certain additional information regarding the directors and their Director Attributes is provided below. The information provided below, and in the charts above, is not all-inclusive. Many Director Attributes involve intangible elements, such as intelligence, integrity and work ethic, along with the ability to work together, to communicate effectively, to exercise judgment and ask incisive questions, and commitment to stockholder interests. The Board annually conducts a self-assessment wherein the effectiveness of the Board and individual directors is reviewed. In conducting its annual self-assessment, the Board has determined that the directors have the appropriate attributes and experience to continue to serve effectively as directors of the Company.

INFORMATION ABOUT INDEPENDENT DIRECTORS

Greg Burglin, 64, is an accounting and tax specialist and has been a tax consultant for more than 5 years. Mr. Burglin’s tax and accounting expertise enables him to provide valuable counsel to the Company, and he currently chairs our Valuation Committee, which is responsible for aiding our Board of Directors in fair value pricing our illiquid securities. Mr. Burglin has also served as Trustee to Firsthand Funds, a Delaware statutory trust, since November 2008. In determining Mr. Burglin’s qualifications to serve on the Board, the Board considered Mr. Burglin’s familiarity with FCM and service on the board of a registered investment company. Mr. Burglin holds a Bachelor’s Degree in Business Administration from University of California at Berkeley and a Master’s Degree in Taxation from Golden Gate University.

Kimun Lee, 78, is a registered investment advisor and a principal of Resources Consolidated, a consulting firm he founded in 1980. Since September 2009, Mr. Lee has served as a director of iShares Delaware Trust Sponsor LLC. Since September 2010, Mr. Lee has served on the board of Firsthand Technology Value Fund Inc. and since April 2013, he has served on the board of Firsthand Funds. Since April 2014, Mr. Lee is a trustee of FundX Investment Trust. Until January 2005, Mr. Lee served on the board of Fremont Mutual Funds, Inc., a mutual fund company. He holds a bachelor’s degree from University of the Pacific and master’s degree in business administration from University of Nevada, Reno. He has also completed the Stanford University Executive Education program in Corporate Governance for Directors.

INFORMATION ABOUT INTERESTED DIRECTORS

Kevin Landis, 63, in addition to being President and Chief Investment Officer of FCM, is also the President and Chief Executive Officer of Firsthand Funds, which he co- founded in 1994. Mr. Landis is a well-known technology investor who serves as portfolio manager for Firsthand Alternative Energy Fund and Firsthand Technology Opportunities Fund, each a series of Firsthand Funds. Mr. Landis is currently also the Chief Executive Officer of IntraOp Medical Corp. and Wrightspeed, Inc., two of the Company’s portfolio companies. He currently serves on the boards of directors at a number of private technology portfolio companies: EQX Capital, Inc., Hera Systems, Inc., IntraOp Medical Corporation, Revasum Inc., and Wrightspeed, Inc.. other than Firsthand Funds, all private technology portfolio companies Mr. Landis served as a director of Phunware, Inc., from March 2015 through May 2019, Pivotal System Corp., from December 2014 through November 2023, Mr. Landis served as a director of QMAT, Inc., from April 2016 to December 2019. Mr. Landis served as a director of Silicon Genesis Corporation from September 2001 through January 2023. In determining Mr. Landis’ qualifications to serve on the Board, the Board considered Mr. Landis’s over two decades of experience in engineering, market research, product management, and investing in the technology sector. Mr. Landis appears regularly on CNBC, CNBC Asia, and Bloomberg News, and has been featured in Forbes, Fortune, Time, and Money magazines. Mr. Landis holds a Bachelor’s Degree in Electrical Engineering and Computer Science from the University of California at Berkeley and an MBA from Santa Clara University.

BOARD RECOMMENDATION

THE BOARD OF DIRECTORS OF THE COMPANY, INCLUDING ALL OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES AS A DIRECTOR.

PROPOSAL TWO

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee and the Board of Directors of the Company, including all of the Company’s Independent Directors, have selected Tait, Weller & Baker LLP as the independent registered public accounting firm for the Company for the year ending December 31, 2024, and are submitting the selection of Tait, Weller & Baker LLP to the stockholders for ratification.

Tait, Weller & Baker LLP has audited the financial statements of the Company since inception and has informed us that it has no direct or indirect material financial interest in the Company or in FCM.

A representative of Tait, Weller & Baker LLP will be present at the Annual Meeting to make a statement, if such representative so desires, and to respond to stockholders’ questions.

The Audit Committee normally meets two times each year with representatives of Tait, Weller & Baker LLP to discuss the scope of its engagement, and review the financial statements of the Company and the results of its examination.

INDEPENDENT ACCOUNTING FEES AND POLICIES

AUDIT AND RELATED FEES

Audit Fees. The aggregate fees billed to us by Tait, Weller & Baker LLP during fiscal years 2022 and 2023 for professional services rendered with respect to the audit of our financial statements were $33,600 and $34,000, respectively.

Audit-Related Fees. For professional services for assurance and related services reasonably related to the performance of the audits of our annual financial statements for fiscal years 2022 and 2023, we were billed by Tait, Weller & Baker LLP for fees in the amounts of $13,575 and $12,750, respectively.

Tax Fees. For professional services for tax compliance, tax advice and tax planning for fiscal years 2022 and 2023, we were billed by Tait, Weller & Baker LLP for fees in the amounts of 11,200 and $11,750 respectively.

All Other Fees. For professional services for anti-money laundering audit, we were billed for fiscal year 2023 by Tait, Weller & Baker LLP for fees in the amount of $1,650.

Aggregate Non-Audit Fees. We were not billed by Tait, Weller & Baker LLP for any amounts for any non-audit services during either of the past two fiscal years. In addition, neither FCM nor any entity controlling, controlled by, or under common control with FCM that provides ongoing services to us, was billed by Tait, Weller & Baker LLP for any non-audit services during either of the last two fiscal years.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

Before the auditor is engaged (i) by us to render audit, audit related or permissible non-audit services to us or (ii) with respect to non-audit services to be provided by the auditor to FCM or any entity in the investment company complex, if the nature of the services provided relate directly to our operations or financial reporting, either: (a) the Audit Committee shall pre-approve such engagement; or (b) such engagement shall be entered into pursuant to pre-approval policies and procedures established by the Audit Committee. Any such policies and procedures must be detailed as to the particular service and not involve any delegation of the Audit Committee’s responsibilities to FCM. The Audit Committee may delegate to one or more of its members the authority to grant pre-approvals. The pre-approval policies and procedures shall include the requirement that the decisions of any member to whom authority is delegated under this provision shall be presented to the full Audit Committee at its next scheduled meeting. Under certain limited circumstances, pre-approvals are not required if certain de minimis thresholds are not exceeded, as such thresholds are set forth by the Audit Committee and in accordance with applicable SEC rules and regulations.

For engagements with Tait, Weller & Baker LLP, the Audit Committee approved in advance all audit services and non-audit services that Tait, Weller & Baker LLP provided to us (with respect to our operations and financial reporting). None of the services rendered by Tait, Weller & Baker LLP to us or FCM were pre-approved by the Audit Committee pursuant to the pre-approval exception under Rule 2.01(c)(7)(i)(C) or Rule 2.01(c)(7)(ii) of Regulation S-X. The Audit Committee has considered whether the provision of non-audit services rendered by Tait, Weller & Baker LLP to FCM and any entity controlling, controlled by, or under common control with FCM that were not required to be pre-approved by the Audit Committee is compatible with maintaining Tait, Weller & Baker LLP's independence.

AUDIT COMMITTEE REPORT

The Audit Committee (the “Audit Committee”) of the Board of Directors (the “Board”) of Firsthand Technology Value Fund, Inc. (the “Company”) is responsible for assisting the Board in monitoring (1) the accounting and reporting policies and procedures of the Company, (2) the quality and integrity of the Company’s financial statements, (3) the Company’s compliance with regulatory requirements, and (4) the independence and performance of the Company’s independent auditors. Among other responsibilities, the Audit Committee reviews, in its oversight capacity, the Company’s annual financial statements with both management and the independent auditors and the Audit Committee meets periodically with the independent auditors to consider their evaluation of the Company’s financial and internal controls. The Audit Committee also selects, retains, evaluates and may replace the Company’s independent auditors and determines their compensation, subject to ratification of the Board, if required. The Audit Committee is currently composed of three directors. The Audit Committee operates under a written charter (the “Audit Committee Charter”) adopted and approved by the Board. Each committee member is “independent” in accordance with Nasdaq Stock Market corporate governance regulations.

The Audit Committee, in discharging its responsibilities, has met with and held discussions with management and the Company’s independent auditors. The Audit Committee has reviewed and discussed the Company’s audited financial statements with management. Management has represented to the independent auditors that the Company’s financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees). The Audit Committee has received the written disclosures and the letter from the Company’s independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the Audit Committee concerning independence, and has discussed with the independent auditors the independent auditors’ independence. As provided in the Audit Committee Charter, it is not the Audit Committee’s responsibility to determine, and the considerations and discussions referenced above do not ensure, that the Company’s financial statements are complete and accurate and presented in accordance with generally accepted accounting principles.

Based on the Audit Committee’s review and discussions with management and the independent auditors, the representations of management and the report of the independent auditors to the Audit Committee, the committee has recommended that the Board include the audited financial statements in the Company’s Annual Report on Form 10-K.

Submitted by the Audit Committee

Greg Burglin

Kimun Lee

BOARD RECOMMENDATION

THE BOARD OF DIRECTORS OF THE COMPANY, INCLUDING ALL OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF TAIT, WELLER & BAKER LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

INFORMATION ABOUT EXECUTIVE OFFICERS

The following table sets forth each of our officer’s name; position(s) with us and length of time served; principal occupation during the past five years; and other directorships. The address for all of our officers is 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113.

|

Name (Year Born)

|

|

Position(s) Held with

Registrant, Proposed Term

of Office/ Time of Service

|

|

Principal Occupations

During Past Five Years

|

Number of

Portfolios in Fund

Complex(1)

Overseen by

Director

|

Other Directorships

Held by Director During

Past Five Years

|

|

Kevin Landis

(born 1961)

|

|

Chairman of the Board of Directors, President, Chief Executive Officer and Chief Financial Officer. Director (to serve until the 2023 Annual Meeting of Stockholders), elected annually as an officer.

Served since 2010.

|

|

President of FCM since 2009; President, Chairman and Founder of Firsthand Funds since 1994; Portfolio Manager of Firsthand Alternative Energy Fund and Firsthand Technology Opportunities Fund each a series of Firsthand Funds; Portfolio Manager of the Company since April, 2011. Chief Executive Officer of IntraOp Medical Corp. since 2023; Chief Executive Officer of Wrightspeed, Inc. since 2023.

|

3

|

Current:

Firsthand Funds (since 1994); EQX Capital, Inc.; Hera Systems, Inc.; IntraOp Medical Corp.; Revasum Inc.; and Wrightspeed, Inc.

Former:

Phumware Inc., (from March 2015 through May 2019); Pivotal Systems Corp. (from December 2014 through November 2023); QMAT, Inc. (from April 2016 through December 2019); Silicon Genesis Corp. (from September 2001 to5 through January 2023)

|

|

Nichole Mileski

(born 1971)

|

|

Chief Compliance Officer.

Served since 2013.

|

|

Corporate counsel of FCM since 2013; corporate paralegal of FCM from 2011 to 2013.

|

N/A

|

N/A

|

(1) The 1940 Act requires the term “Fund Complex” to be defined to include registered investment companies advised by the Company’s investment adviser, FCM, and, as a result, the Fund Complex included, the Company and Firsthand Funds, a family of open-end funds registered under the 1940 Act that are managed by FCM.

COMPENSATION DISCUSSION AND ANALYSIS

Pursuant to an investment management agreement between FCM (our external manager) and us, our external manager is responsible for supervising the investments and reinvestments of the Company’s assets. Our external manager, at its own expense, maintains staff and employs personnel as it determines is necessary to perform its obligations under the investment management agreement. We pay management fees to our external manager for its advisory and other services performed under the investment management agreement.

Our executive officers who manage our regular business are employees of our external manager or its affiliates. Accordingly, we do not directly pay any salaries, bonuses, or other compensation to our executive officers. We do not have employment agreements with our executive officers. We do not provide pension or retirement benefits, perquisites, or other personal benefits to our executive officers. We do not maintain any compensation plans under which our equity securities are authorized for issuance, other than our 2023 Director Plan. We do not have arrangements to make payments to our executive officers upon their termination or in the event of a change in control of the Company.

The investment management agreement does not require our external manager to dedicate specific personnel to fulfilling its obligation to us under the investment management agreement, or require personnel to dedicate a specific amount of time. In their capacities as executive officers or employees of our external manager or its affiliates, they devote a portion of their time to our affairs as required for the performance of the duties of our external manager under the investment management agreement.

Our executive officers are compensated by our external manager. We understand that our external manager takes into account the performance of the Company as a factor in determining the compensation of certain of its senior managers, and such compensation may be increased depending on the Company’s performance. In addition to compensation for services performed for the Company, certain of our executive officers receive compensation for services performed for various investment funds of our external manager. However, our external manager cannot segregate and identify that portion of the compensation awarded to, earned by, or paid to our executive officers that relates exclusively to their services to us. Our external manager compensates our Chief Compliance Officer, subject to reimbursement by us of a portion of the related costs of that Officer’s services to us, all based on terms and in amounts determined and approved by our Board of Directors.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth as of February 28, 2024, the number of shares of our common stock beneficially owned by each of our current directors and executive officers as a group, and certain beneficial owners, according to information furnished to us by such persons. Based on statements publicly filed with the SEC, as of February 28, 2024, we are aware of no person who beneficially owns more than 5% of our outstanding common stock except as disclosed below. Beneficial ownership is determined in accordance with Rule 13d-3 under the Exchange Act, and, unless indicated otherwise, includes voting or investment power with respect to the securities. Unless otherwise indicated, the address of each individual listed below is c/o 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113.

|

Name of Beneficial Owner of Common Stock

|

Number of Shares

|

Percent of Class (1)

|

|

Independent Directors

|

|

|

|

Greg Burglin

|

2,250

|

*

|

|

Kimun Lee

|

700

|

*

|

|

Interested Director

|

|

Kevin Landis

|

637,929

|

4.48%

|

|

Executive Officers

|

|

|

|

Nichole Mileski

|

0

|

*

|

|

Other Beneficial Owners

|

|

|

|

Star Equity Fund, LP

53 Forest Avenue, Suite 101

Old Greenwich, Connecticut 06870

|

1,985,724

|

28.81%

|

* Less than 1% of class.

|

1.

|

Based on 6,893,056 shares of common stock outstanding as of February 28, 2024.

|

The following table sets forth as of February 28, 2024, the dollar range of our equity securities beneficially owned by each of our directors. We are part of a “family of investment companies,” as that term is defined in the 1940 Act.

|

Director

|

Dollar Range(1) of Our

Equity Securities

|

Aggregate Dollar Range(1) of Equity Securities in All Registered Investment Companies(2) Overseen by Director in

Fund Complex(3)

|

|

Independent Directors

|

|

|

|

Greg Burglin(3)

|

$1 - $10,000

|

$1 - $10,000 |

|

Kimun Lee(3)

|

$1 - $10,000

|

$1 - $10,000 |

| |

|

|

| Interested Director |

|

|

| Kevin Landis(3) |

Over $100,000 |

Over $100,000 |

| |

(1) |

Dollar ranges are as follows: none; $1-$10,000; $10,001-$50,000; $50,001-$100,000 or over $100,000. |

| |

(2)

|

The Company is incorporated in Maryland.

|

| |

(3)

|

Each of Greg Burglin, Kimun Lee and Kevin Landis is a member of the board of trustees of Firsthand Funds, which has two series, Firsthand Alternative Energy Fund and Firsthand Technology Opportunities Fund. FCM serves as investment advisor for each of these funds.

|

None of the independent directors or any of their immediate family members own beneficially or of record any securities in the Investment Adviser or our underwriters in the offering of our securities from time to time, as defined in the 1940 Act, or any person directly or indirectly controlling, controlled by, or under common control with the Investment Adviser or such underwriters.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

We have entered into the Investment Management Agreement with FCM, in which the chairman of our Board of Directors and our Chief Executive Officer and Chief Financial Officer have ownership and financial interests. The other investment professionals of the Investment Adviser may also serve as principals of other investment managers affiliated with FCM that may currently and also in the future manage investment funds with investment objectives similar to ours. In addition, our current executive officers and directors, the Chief Financial Officer and Chief Compliance Officer, and the other senior investment professionals whom FCM currently retains, serve or may serve as officers, directors, or principals of entities that operate or may operate in the same or related line of business as we do or of investment funds managed by our affiliates. Accordingly, we may not be given the opportunity to participate in certain investments made by investment funds managed by advisers affiliated with FCM. However, FCM intends to allocate investment opportunities in a fair and equitable manner consistent with our investment objectives and strategies so that we are not disadvantaged in relation to any other client of the Investment Adviser.

CORPORATE GOVERNANCE

BOARD LEADERSHIP STRUCTURE

The Company’s business and affairs are managed under the direction of its Board of Directors, including the responsibilities performed for us pursuant to our investment management agreement. Among other things, the Board of Directors sets broad policies for the Company; approves the appointment of the Company’s investment adviser, administrator, and officers; and approves the engagement, and reviews the performance of, the Company’s independent registered accounting firm. The role of the Board and of any individual director is one of oversight and not of management of the day-to-day affairs of the Company.

The Board of Directors currently consists of three directors, two of whom are not “interested persons,” as defined in the 1940 Act. We refer to these individuals as our “Independent Directors.” As part of each regular Board meeting, the Independent Directors meet separately from management and, as part of at least one Board meeting each year, with the Company’s Chief Compliance Officer. The Board reviews its leadership structure periodically as part of its annual self-assessment process and believes that its structure is appropriate to enable the Board to exercise its oversight of the Company.

Under the Company’s Bylaws, the Chairman of the Board presides over meetings of the Board of Directors and the Board of Directors may designate a chairman to preside over meetings of stockholders, and to perform such other duties as may be assigned to him or her by the Board. The Company does not have an established policy as to whether the Chairman of the Board shall be an Independent Director and believes that its flexibility to determine its Chairman and reorganize its leadership structure from time to time is in the best interests of the Company and its stockholders.

Presently, Mr. Landis serves as Chairman of the Board of Directors. Mr. Landis is an “interested person” of the Company, as defined in the 1940 Act, by virtue of his employment relationship with FCM. The Company believes that Mr. Landis’s history with the Company, familiarity with FCM’s investment platform and extensive experience in the field of technology-related investments qualifies him to serve as the Chairman of the Board. The Board has determined that the compositions of the Audit, Valuation, Compensation, and Nominating Committees are appropriate means to address any potential conflicts of interest that may arise from the Chairman’s status as an interested person of the Company. The Board of Directors believes that this Board leadership structure—a combined Chairman of the Board and Chief Executive Officer and committees led by Independent Directors—is the optimal structure for the Company at this time. Since the Chief Executive Officer has the most extensive knowledge of the various aspects of the Company’s business and is directly involved in managing both the day-to-day operations and long-term strategy of the Company, the Board has determined that Mr. Landis is the most qualified individual to lead the Board and serve in the key position as Chairman. The Board has also concluded that this structure allows for efficient and effective communication with the Board.

The Board of Directors does not currently have a designated lead independent director. Instead, all of the Independent Directors play an active role on the Board of Directors. The Independent Directors compose a majority of the Board of Directors, and are closely involved in all material deliberations related to the Company. The Board of Directors believes that, with these practices, each Independent Director has an equal stake in the Board’s actions and oversight role and equal accountability to the Company and its stockholders.

ANTI-HEDGING POLICY

The Company has an anti-hedging policy applicable to directors and officers. The policy prohibits directors and officers

from engaging in, among other things, short sales, hedging transactions, or trading in put and call options with respect to the

Company’s securities. The Company believes that prohibiting these types of transactions will help ensure that the economic interests

of all directors, officers, and employees will not differ from the economic interests of the Company’s stockholders.

BOARD ROLE IN RISK OVERSIGHT

The Board oversees the services provided by FCM, including certain risk management functions. Risk management is a broad concept composed of many disparate elements (such as, for example, investment risk, issuer and counterparty risk, compliance risk, operational risk, and business continuity risk). Consequently, Board oversight of different types of risks is handled in different ways, and the Board implements its risk oversight function both as a whole and through Board committees. In the course of providing oversight, the Board and its committees receive reports on the Company’s activities, including regarding the Company’s investment portfolio and its financial accounting and reporting. The Board also reviews reports at least quarterly, and meets at least once annually with the Company’s Chief Compliance Officer, who reports on the compliance of the Company with the federal securities laws and the Company’s internal compliance policies and procedures. The Audit Committee’s meetings with the Company’s independent public accounting firm also contribute to its oversight of certain internal control risks. In addition, the Board meets periodically with representatives of the Company and FCM to receive reports regarding the management of the Company, including certain investment and operational risks, and the Independent Directors are encouraged to communicate directly with senior management.

The Company believes that the Board’s roles in risk oversight must be evaluated on a case-by-case basis and that its existing role in risk oversight is appropriate. Management believes that the Company has robust internal processes in place and a strong internal control environment to identify and manage risks. However, not all risks that may affect the Company can be identified or processes and controls developed to eliminate or mitigate their occurrence or effects, and some risks are beyond any control of the Company or FCM, its affiliates, or other service providers.

NOMINEES FOR DIRECTOR

The Nominating Committee evaluates candidates’ qualifications for Board membership. The Nominating Committee takes diversity of a particular candidate and overall diversity of the Board into account when considering and evaluating candidates for director. While the Nominating Committee has not adopted a particular definition of diversity or a particular policy with regard to the consideration of diversity in identifying candidates, when considering a candidate’s and the Board’s diversity, the Nominating Committee generally considers the manner in which each candidate’s leadership, independence, interpersonal skills, financial acumen, integrity and professional ethics, educational and professional background, prior director or executive experience, industry knowledge, business judgment and specific experiences or expertise would complement or benefit the Board and, as a whole, contribute to the ability of the Board to oversee the Company. The Nominating Committee may also consider other factors or attributes as it may determine appropriate in its judgment. The Nominating Committee believes that the significance of each candidate’s background, experience, qualifications, attributes or skills must be considered in the context of the Board as a whole. As a result, the Nominating Committee has not established any litmus test or quota relating to these matters that must be satisfied before an individual may be nominated to serve as a director. The Board believes that Board effectiveness is best evaluated at a group level, through its annual self-assessment process. Through this process, the Board considers whether the Board as a whole has an appropriate level of sophistication, skill and business acumen and the appropriate range of experience and background.

Stockholders may recommend candidates to our Board. Any recommendation should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. All recommendations for nomination received by the Secretary will be presented to the Nominating Committee for its consideration.

COMMUNICATIONS BETWEEN STOCKHOLDERS AND THE BOARD OF DIRECTORS

Stockholders may send communications to the Board of Directors. Communications should be addressed to the Secretary of the Company at our principal offices at 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113. The sender should indicate in the address whether it is intended for the entire Board, the independent directors as a group or an individual director. The Secretary will forward any communications received directly to the intended recipient in accordance with the instructions.

CODE OF ETHICS

We have adopted a supplemental antifraud code of ethics which applies to, among others, our principal and senior financial officers, including our principal executive officer and principal financial officer. Our supplemental antifraud code of ethics is filed as Exhibit 14.1 of our Annual Report on Form 10-K, filed with the SEC on March 21, 2012, and can be accessed via the SEC’s Internet site at www.sec.gov. We intend to disclose any amendments to or waivers of required provisions of this code on Form 8-K.

We have also adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act that establishes personal trading procedures for employees designated as access persons. Access persons may engage in personal securities transactions, including transactions involving securities that are currently held by us or, in limited circumstances, that are being considered for purchase or sale by us, subject to certain general restrictions and procedures set forth in our code of ethics. Our code of ethics is filed as Exhibit 14.2 of our Annual Report on Form 10-K, filed with the SEC on March 18, 2019, and can be accessed via the SEC’s Internet site. We also have a code of business conduct, which is available on our website and in print to any stockholder who requests it.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Because our executive officers did not receive any direct compensation from us, none of the Board, the Compensation Committee, or any present or former officers or employees of the Company participated in any deliberations concerning executive officer compensation.

COMPENSATION COMMITTEE REPORT

The Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of Firsthand Technology Value Fund, Inc. (“the Company”) (which was responsible for compensation matters for the fiscal year ended December 31, 2023) has reviewed and discussed with management the Company’s Compensation Discussion and Analysis required by Item 402(b) of Securities and Exchange Commission Regulation S-K. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement and incorporated into our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Submitted by the Compensation Committee

Kimun Lee

Greg Burglin

OTHER MATTERS

The Board of Directors knows of no other matters that are intended to be brought before the Annual Meeting. If other matters are properly presented at the Annual Meeting or any postponement or adjournment thereof, the proxies named in the enclosed proxy card will vote on those matters in their sole discretion.

MORE INFORMATION ABOUT THE MEETING

As of the close of business on February 28, 2024, we had 6,893,056 shares of stock issued and outstanding and entitled to vote at the Annual Meeting. To the knowledge of our management:

| |

a.

|

As of February 28, 2024, Star Equity Fund, LP held beneficially more than 28% of our outstanding common stock.

|

| |

b.

|

As of February 28, 2024, none of our independent directors owned 1% or more of our outstanding common stock. Kevin Landis held, as of that date, approximately 9.9% of our outstanding common stock.

|

| |

c.

|

As of February 28, 2024, our officers and directors owned, as a group, approximately 9.9% of our outstanding common stock.

|

INVESTMENT ADVISER

Firsthand Capital Management, Inc., is our investment adviser. Its principal office is located at 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113.

ADMINISTRATOR

BNY Mellon Servicing (U.S.) Inc. (“BNY”) provides certain administrative services for us, including but not limited to preparing and maintaining books, records, and tax and financial reports, and monitoring compliance with regulatory requirements. The Administrator is located at 301 Bellevue Parkway, Wilmington, Delaware 19809.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year a number of brokers with account holders who are the Company’s stockholders will be “householding” its proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. If you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker. Stockholders who currently receive multiple copies of the proxy statement and annual report at their addresses and would like to request “householding” of their communications should contact their brokers.

STOCKHOLDER PROPOSALS

Our Bylaws provide that in order for a stockholder to nominate a candidate for election as a director at an annual meeting of stockholders or propose business for consideration at such meeting, written notice containing the information required by the Bylaws must be delivered to the Secretary of the Company at 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113 not earlier than the 150th day nor later than 5:00 p.m., Pacific Time, on the 120th day prior to the first anniversary of the date our proxy statement was released to stockholders for the preceding year’s annual meeting; provided, however that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year’s annual meeting, notice by the stockholder to be timely must be so delivered not earlier than the 150th day prior to the date of such annual meeting and not later than 5:00 p.m., Pacific Time, on the later of the 120th day prior to the date of such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made. Accordingly, a stockholder nomination or proposal intended to be considered at the 2025 Annual Meeting of Stockholders must be received by the Secretary of the Company on or after November 4, 2024, and prior to 5:00 p.m. Pacific Time on December 4, 2024. However, under the rules of the SEC, if a stockholder wishes to submit a proposal for possible inclusion in our proxy statement pursuant to Rule 14a-8 of the 1934 Act, we must receive it not less than 120 calendar days before the anniversary of the date our proxy statement was released to stockholders for the previous year’s annual meeting. Accordingly, a stockholder’s proposal under Rule 14a-8(e) must be received by us on or before December 4, 2024 in order to be included in our proxy statement and proxy card for the 2025 Annual Meeting of Stockholders. All nominations and proposals must be in writing.

By Order of the Board of Directors

Kelvin Leung Secretary April 3, 2024

We urge you to read the proxy statement carefully.

If you have questions, call 800.976.8776.

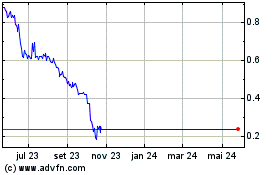

Firsthand Technology Value (NASDAQ:SVVC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

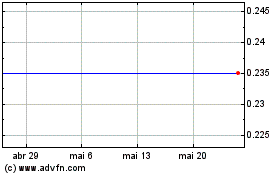

Firsthand Technology Value (NASDAQ:SVVC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024