false

0001893448

0001893448

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

May

14, 2024

Date

of Report (Date of earliest event reported)

STRONG

GLOBAL ENTERTAINMENT, INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

001-41688 |

|

N/A |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

No.) |

|

Identification

Number) |

108

Gateway Blvd,

Suite

204

Mooresville,

NC |

|

28117 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(704)

994-8279

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Class

A Common Voting Shares, without par value |

|

SGE |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition

Strong

Global Entertainment, Inc. (the “Company”) issued a press release on May 14, 2024, with earnings information for the Company’s

fiscal quarter ended March 31, 2024. The press release is furnished with this Current Report on Form 8-K (this “Current Report”)

as Exhibit 99.1.

Item

7.01 Regulation FD Disclosure

The

information set forth under Item 2.02 of this Current Report is incorporated herein by reference.

The

information contained in Items 2.02 and 7.01 to this Current Report, including in Exhibit 99.1, is being “furnished” and,

as such, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference

into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

Forward

Looking Statements

In

addition to the historical information in this Current Report and in the exhibits furnished with this Current Report, it includes forward-looking

statements which involve a number of risks and uncertainties, including but not limited to those discussed in the “Risk Factors”

section contained in Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange

Commission on May 14, 2024, and the following risks and uncertainties: the Company’s ability to maintain and expand its revenue

streams to compensate for the lower demand for the Company’s digital cinema products and installation services; potential interruptions

of supplier relationships or higher prices charged by suppliers; the Company’s ability to successfully compete and introduce enhancements

and new features that achieve market acceptance and that keep pace with technological developments; the Company’s ability to successfully

execute its capital allocation strategy or achieve the returns it expects from these holdings; the Company’s ability to maintain

its brand and reputation and retain or replace its significant customers; challenges associated with the Company’s long sales cycles;

the impact of a challenging global economic environment or a downturn in the markets; the effects of economic, public health, and political

conditions that impact business and consumer confidence and spending, including rising interest rates, periods of heightened inflation

and market instability, the outbreak of any highly infectious or contagious diseases, such as COVID-19 and its variants or other health

epidemics or pandemics, and armed conflicts, such as the ongoing military conflict in Ukraine and related sanctions; economic and political

risks of selling products in foreign countries (including tariffs); risks of non-compliance with U.S. and foreign laws and regulations,

potential sales tax collections and claims for uncollected amounts; cybersecurity risks and risks of damage and interruptions of information

technology systems; the Company’s ability to retain key members of management and successfully integrate new executives; the Company’s

ability to complete acquisitions, strategic investments, entry into new lines of business, divestitures, mergers or other transactions

on acceptable terms, or at all; the impact of economic, public health and political conditions on the companies in which the Company

holds equity stakes; the Company’s ability to utilize or assert its intellectual property rights, the impact of natural disasters

and other catastrophic events, whether natural, man-made, or otherwise (such as the outbreak of any highly infectious or contagious diseases,

or armed conflict); the adequacy of the Company’s insurance; the impact of having a controlling stockholder and vulnerability to

fluctuation in the Company’s stock price. Given the risks and uncertainties, readers should not place undue reliance on any forward-looking

statement and should recognize that the statements are predictions of future results which may not occur as anticipated. Many of the

risks listed above have been, and may further be, exacerbated by the impact of economic, public health (such as a resurgence of the COVID-19

pandemic) and political conditions (such as the military conflict in Ukraine) that impact consumer confidence and spending, particularly

in the cinema, entertainment, and other industries in which the Company and its subsidiaries operate, and the worsening economic environment.

Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the

risks and uncertainties described herein, as well as others not now anticipated. New risk factors emerge from time to time and it is

not possible for management to predict all such risk factors, nor can it assess the impact of all such factors on our business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements. Except where required by law, the Company assumes no obligation to update forward-looking statements to reflect actual results

or changes in factors or assumptions affecting such forward-looking statements.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

STRONG

GLOBAL ENTERTAINMENT, INC. |

| |

|

|

| Date:

May 14, 2024 |

By: |

/s/

Todd R. Major |

| |

|

Todd

R. Major |

| |

|

Chief

Financial Officer |

Exhibit

99-1

Strong

Global Entertainment Reports First Quarter 2024 Operating Results

Mooresville,

N.C., – May 14, 2024 – Strong Global Entertainment, Inc. (NYSE American: SGE) (the “Company” or “Strong

Global Entertainment”) today announced operating results for the first quarter ended March 31, 2024.

First

Quarter 2024 Highlights

| |

● |

Revenue

increased 11.2% to $11.1 million for the quarter - The acquisition of Innovative Cinema Solutions (“ICS”) and increased

product sales contributed favorably to revenue growth. |

| |

● |

Gross

profit improved to 24.0% of revenue for the quarter from 23.3% in the prior year with favorable product mix. |

| |

● |

In

April 2024, announced a transaction to merge Strong/MDI Screen Systems, Inc. “(Strong/MDI”) with FG Acquisition Corp.,

a Canadian special purpose acquisition company, which will be renamed Saltire, Inc. |

| |

○ |

Transaction

values Strong/MDI at $30 million. Strong Global Entertainment will retain a significant economic stake, participating in the future

growth and success of Strong/MDI and Saltire. |

| |

● |

Marketplace

momentum for laser upgrades and our international expansion continue to position the Company for growth. |

Mark

Roberson, Chief Executive Officer, commented, “The first quarter of 2024 continued the positive trends from 2023 as demand for

laser projection and customer upgrade initiatives favorably impact revenue and margins. The ICS acquisition continues to perform, and

we believe there are other opportunities in the market to accelerate scale in the services business. The Strong/MDI transaction represents

a compelling valuation, and we are very excited to participate in the future growth of Saltire.”

Select

Financial Highlights

| |

● |

Revenue

increased 11.2% to $11.1 million in the first quarter of 2024 from $10.0 million in the first quarter of 2023 due to increased sales

of projection screens and equipment, as well as increased demand for installation and maintenance services. The increase in demand

from cinema customers was due to a combination of increased sales efforts, expanded market share and a rebound in the rate of investment

by exhibitors for the upgrade of their auditoriums, particularly related to the pace of laser projection upgrades. Strong Global

Entertainment expects the upgrade activity to be a multi-year catalyst in the industry. |

| |

|

|

| |

● |

Gross

profit increased to $2.7 million or 24.0% of revenues in 2024 compared to $2.3 million or 23.3% in 2023. The increase resulted primarily

from increased demand for large format projection cinema screens and maintenance services, and this was the first full quarter of

contribution from the ICS acquisition. |

| |

|

|

| |

● |

Income

from operations was $0.2 million for the first quarter of 2024 compared to $0.5 million during 2023. We incurred higher general and

administrative expenses in connection with operating as an independent public company following the separation in May 2023, which

was partially offset by the increase in gross profit. |

| |

|

|

| |

● |

Net

income from continuing operations was $0.1 million as compared to $0.6 million in 2023. |

| |

|

|

| |

● |

Adjusted

EBITDA decreased to $0.4 million as compared to $0.8 million in the prior year, as increased profitability from products and services

from continuing operations was offset by the increased general and administrative costs primarily related to expenses associated

with operating as a stand-alone public company. |

| Strong Global Entertainment, Inc. – Fiscal Year 2024 | Page 2 of 7 |

| First Quarter 2024 Results | |

About

Strong Global Entertainment, Inc.

Strong

Global Entertainment, Inc., a majority owned subsidiary of Fundamental Global Inc., is a leader in the entertainment industry, providing

mission critical products and services to cinema exhibitors and entertainment venues for over 90 years. The Company manufactures and

distributes premium large format projection screens, provides comprehensive managed services, technical support and related products

and services primarily to cinema exhibitors, theme parks, educational institutions, and similar venues. In addition to traditional projection

screens, the Company manufactures and distributes its Eclipse curvilinear screens, which are specially designed for theme parks, immersive

exhibitions, as well as simulation applications. It also provides maintenance, repair, installation, network support services and other

services to cinema operators, primarily in the United States.

About

Fundamental Global Inc.

Fundamental

Global Inc. (Nasdaq: FGF, FGFPP) and its subsidiaries engage in diverse business activities including reinsurance, asset management,

merchant banking, manufacturing and managed services.

The

FG® logo and Fundamental Global® are registered trademarks of Fundamental Global LLC.

Use

of Non-GAAP Measures

Strong

Global Entertainment, Inc. prepares its consolidated financial statements in accordance with United States generally accepted accounting

principles (“GAAP”). In addition to disclosing financial results prepared in accordance with GAAP, the Company discloses

information regarding Adjusted EBITDA (“Adjusted EBITDA”), which differs from the commonly used EBITDA (“EBITDA”).

Adjusted EBITDA both adjusts net income (loss) to exclude income taxes, interest, and depreciation and amortization, and excludes share-based

compensation, impairment charges, severance, foreign currency transaction gains (losses), transactional gains and expenses, gains on

insurance recoveries, and other cash and non-cash charges and gains.

EBITDA

and Adjusted EBITDA are not measures of performance defined in accordance with GAAP. However, Adjusted EBITDA is used internally in planning

and evaluating the Company’s operating performance. Accordingly, management believes that disclosure of these metrics offers investors,

bankers and other stakeholders an additional view of the Company’s operations that, when coupled with the GAAP results, provides

a more complete understanding of the Company’s financial results.

EBITDA

and Adjusted EBITDA should not be considered as an alternative to net income (loss) or to net cash from operating activities as measures

of operating results or liquidity. The Company’s calculation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled

measures used by other companies, and the measures exclude financial information that some may consider important in evaluating the Company’s

performance.

EBITDA

and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis

of the Company’s results as reported under GAAP. Some of these limitations are: (i) they do not reflect the Company’s cash

expenditures, or future requirements for capital expenditures or contractual commitments, (ii) they do not reflect changes in, or cash

requirements for, the Company’s working capital needs, (iii) EBITDA and Adjusted EBITDA do not reflect interest expense, or the

cash requirements necessary to service interest or principal payments, on the Company’s debt, (iv) although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted

EBITDA do not reflect any cash requirements for such replacements, (v) they do not adjust for all non-cash income or expense items that

are reflected in the Company’s statements of cash flows, (vi) they do not reflect the impact of earnings or charges resulting from

matters management considers not to be indicative of the Company’s ongoing operations, and (vii) other companies in the Company’s

industry may calculate these measures differently than the Company does, limiting their usefulness as comparative measures.

| Strong Global Entertainment, Inc. – Fiscal Year 2024 | Page 3 of 7 |

| First Quarter 2024 Results | |

Management

believes EBITDA and Adjusted EBITDA facilitate operating performance comparisons from period to period by isolating the effects of some

items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies.

These potential differences may be caused by variations in capital structures (affecting interest expense), tax positions (such as the

impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of facilities

and equipment (affecting relative depreciation expense). The Company also presents EBITDA and Adjusted EBITDA because (i) management

believes these measures are frequently used by securities analysts, investors and other interested parties to evaluate companies in the

Company’s industry, (ii) management believes investors will find these measures useful in assessing the Company’s ability

to service or incur indebtedness, and (iii) management uses EBITDA and Adjusted EBITDA internally as benchmarks to evaluate the Company’s

operating performance or compare the Company’s performance to that of its competitors.

Forward-Looking

Statements

In

addition to the historical information included herein, this press release contains “forward-looking statements” that are

subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release

are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such

as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,”

“intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “target,” “aim,” “should,” “will” “would,” or the

negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that

are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove

to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in

the final prospectus related to the public offering filed with the SEC. Forward-looking statements contained in this announcement are

made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor

Relations Contacts:

IR@strong-entertainment.com

| Strong Global Entertainment, Inc. – Fiscal Year 2024 | Page 4 of 7 |

| First Quarter 2024 Results | |

Strong

Global Entertainment, Inc. and Subsidiaries

Consolidated Balance Sheets

(In

thousands)

(Unaudited)

| | |

March

31, 2024 | | |

December

31, 2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 5,111 | | |

$ | 5,470 | |

| Accounts receivable, net | |

| 6,299 | | |

| 6,476 | |

| Inventories, net | |

| 4,446 | | |

| 4,079 | |

| Assets of discontinued

operations | |

| - | | |

| 940 | |

| Other

current assets | |

| 1,264 | | |

| 1,062 | |

| Total current assets | |

| 17,120 | | |

| 18,027 | |

| Property, plant and equipment,

net | |

| 1,488 | | |

| 1,592 | |

| Operating lease right-of-use

assets | |

| 4,697 | | |

| 4,793 | |

| Finance lease right-of-use

asset | |

| 1,136 | | |

| 1,201 | |

| Goodwill | |

| 881 | | |

| 903 | |

| Other

long-term assets | |

| 26 | | |

| 10 | |

| Total

assets | |

$ | 25,348 | | |

$ | 26,526 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’

Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,642 | | |

$ | 3,544 | |

| Accrued expenses | |

| 2,975 | | |

| 3,112 | |

| Payable to FG Group Holdings

Inc. | |

| 119 | | |

| 129 | |

| Short-term debt | |

| 2,453 | | |

| 2,456 | |

| Current portion of long-term

debt | |

| 271 | | |

| 270 | |

| Current portion of operating

lease obligations | |

| 403 | | |

| 397 | |

| Current portion of finance

lease obligations | |

| 258 | | |

| 253 | |

| Deferred revenue and customer

deposits | |

| 1,867 | | |

| 1,318 | |

| Liabilities

of discontinued operations | |

| 161 | | |

| 1,392 | |

| Total current liabilities | |

| 12,149 | | |

| 12,871 | |

| Operating lease obligations,

net of current portion | |

| 4,361 | | |

| 4,460 | |

| Finance lease obligations,

net of current portion | |

| 904 | | |

| 971 | |

| Long-term debt, net of

current portion | |

| 234 | | |

| 301 | |

| Deferred income tax liabilities,

net | |

| 135 | | |

| 125 | |

| Other

long-term liabilities | |

| 4 | | |

| 4 | |

| Total

liabilities | |

| 17,787 | | |

| 18,732 | |

| | |

| | | |

| | |

| Commitments, contingencies and concentrations | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | |

| Paid-in-capital related

to Class A and Class B common stock | |

| 15,814 | | |

| 15,740 | |

| Accumulated deficit | |

| (2,785 | ) | |

| (2,712 | ) |

| Accumulated

other comprehensive loss | |

| (5,468 | ) | |

| (5,234 | ) |

| Total

stockholders’ equity | |

| 7,561 | | |

| 7,794 | |

| Total

liabilities and stockholders’ equity | |

$ | 25,348 | | |

$ | 26,526 | |

| Strong Global Entertainment, Inc. – Fiscal Year 2024 | Page 5 of 7 |

| First Quarter 2024 Results | |

Strong

Global Entertainment, Inc. and Subsidiaries

Consolidated Statements of Operations

(In

thousands, except per share data)

(Unaudited)

| | |

Three Months

Ended March 31, | |

| | |

2024 | | |

2023 | |

| Net product sales | |

$ | 8,022 | | |

$ | 7,204 | |

| Net service revenues | |

| 3,048 | | |

| 2,747 | |

| Total net revenues | |

| 11,070 | | |

| 9,951 | |

| Cost of products | |

| 5,938 | | |

| 5,465 | |

| Cost of services | |

| 2,475 | | |

| 2,166 | |

| Total cost of revenues | |

| 8,413 | | |

| 7,631 | |

| Gross profit | |

| 2,657 | | |

| 2,320 | |

| Selling and administrative expenses: | |

| | | |

| | |

| Selling | |

| 518 | | |

| 534 | |

| Administrative | |

| 1,959 | | |

| 1,240 | |

| Total selling and administrative expenses | |

| 2,477 | | |

| 1,774 | |

| Income from operations | |

| 180 | | |

| 546 | |

| Other income (expense): | |

| | | |

| | |

| Interest expense, net | |

| (115 | ) | |

| (56 | ) |

| Foreign currency transaction gain | |

| 162 | | |

| 117 | |

| Other income, net | |

| 25 | | |

| 12 | |

| Total other income | |

| 72 | | |

| 73 | |

| Income from continuing operations before income taxes | |

| 252 | | |

| 619 | |

| Income tax expense | |

| (133 | ) | |

| (55 | ) |

| Net income from continuing operations | |

| 119 | | |

| 564 | |

| Net loss from discontinued operations | |

| (192 | ) | |

| (191 | ) |

| Net (loss) income | |

$ | (73 | ) | |

$ | 373 | |

| | |

| | | |

| | |

| Basic net (loss) income per share: | |

| | | |

| | |

| Continuing operations | |

$ | 0.01 | | |

$ | 0.09 | |

| Discontinued operations | |

| (0.02 | ) | |

| (0.03 | ) |

| Basic net (loss) income per share | |

$ | (0.01 | ) | |

$ | 0.06 | |

| | |

| | | |

| | |

| Diluted net (loss) income per share: | |

| | | |

| | |

| Continuing operations | |

$ | 0.01 | | |

$ | 0.09 | |

| Discontinued operations | |

| (0.02 | ) | |

| (0.03 | ) |

| Diluted net (loss) income per share | |

$ | (0.01 | ) | |

$ | 0.06 | |

| | |

| | | |

| | |

| Weighted-average shares used in computing net (loss) income per share: | |

| | | |

| | |

| Basic | |

| 7,877 | | |

| 6,000 | |

| Diluted | |

| 7,883 | | |

| 6,000 | |

| Strong Global Entertainment, Inc. – Fiscal Year 2024 | Page 6 of 7 |

| First Quarter 2024 Results | |

Strong

Global Entertainment, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In

thousands)

(Unaudited)

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income from continuing operations | |

$ | 119 | | |

$ | 564 | |

| Adjustments to reconcile net income to net cash (used in) provided by operating

activities: | |

| | | |

| | |

| Provision for (recovery of) doubtful accounts | |

| 18 | | |

| (18 | ) |

| Provision for obsolete inventory | |

| 14 | | |

| 14 | |

| Provision for warranty | |

| 10 | | |

| 44 | |

| Depreciation and amortization | |

| 153 | | |

| 179 | |

| Gain on acquisition of ICS assets | |

| (23 | ) | |

| - | |

| Amortization and accretion of operating leases | |

| 158 | | |

| 16 | |

| Deferred income taxes | |

| 10 | | |

| (19 | ) |

| Stock-based compensation expense | |

| 74 | | |

| 18 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 527 | | |

| 593 | |

| Inventories | |

| (419 | ) | |

| (284 | ) |

| Current income taxes | |

| 102 | | |

| 130 | |

| Other assets | |

| (216 | ) | |

| (418 | ) |

| Accounts payable and accrued expenses | |

| (693 | ) | |

| (135 | ) |

| Deferred revenue and customer deposits | |

| 555 | | |

| 618 | |

| Operating lease obligations | |

| (154 | ) | |

| (19 | ) |

| Net cash provided by operating activities from continuing operations | |

| 235 | | |

| 1,283 | |

| Net cash used in operating activities from discontinued operations | |

| (492 | ) | |

| (513 | ) |

| Net cash (used in) provided by operating activities | |

| (257 | ) | |

| 770 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Capital expenditures | |

| (22 | ) | |

| (75 | ) |

| Net cash used in investing activities from continuing operations | |

| (22 | ) | |

| (75 | ) |

| Net cash used in investing activities from discontinued operations | |

| - | | |

| (83 | ) |

| Net cash used in investing activities | |

| (22 | ) | |

| (158 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Principal payments on short-term debt | |

| (21 | ) | |

| (250 | ) |

| Principal payments on long-term debt | |

| (67 | ) | |

| (9 | ) |

| Borrowings under credit facility | |

| 2,839 | | |

| 1,596 | |

| Repayments under credit facility | |

| (2,765 | ) | |

| (225 | ) |

| Payments on finance lease obligations | |

| (61 | ) | |

| (25 | ) |

| Net cash transferred to parent | |

| - | | |

| (1,217 | ) |

| Net cash used in financing activities from continuing operations | |

| (75 | ) | |

| (130 | ) |

| Net cash provided by financing activities from discontinued

operations | |

| - | | |

| - | |

| Net cash used in financing activities | |

| (75 | ) | |

| (130 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (5 | ) | |

| (20 | ) |

| Net increase in cash and cash equivalents from continuing operations | |

| 133 | | |

| 1,058 | |

| Net decrease in cash and cash equivalents from discontinued operations | |

| (492 | ) | |

| (596 | ) |

| Net (decrease) increase in cash and cash equivalents | |

| (359 | ) | |

| 462 | |

| Cash and cash equivalents at beginning of period | |

| 5,470 | | |

| 3,615 | |

| Cash and cash equivalents at end of period | |

$ | 5,111 | | |

$ | 4,077 | |

| Strong Global Entertainment, Inc. – Fiscal Year 2024 | Page 7 of 7 |

| First Quarter 2024 Results | |

Strong

Global Entertainment, Inc. and Subsidiaries

Reconciliation of Net

Income (Loss) to Adjusted EBITDA

(In

thousands)

(Unaudited)

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net (loss) income | |

$ | (73 | ) | |

$ | 373 | |

| Net loss from discontinued operations | |

| 192 | | |

| 191 | |

| Net income from continuing operations | |

| 119 | | |

| 564 | |

| Interest expense, net | |

| 115 | | |

| 56 | |

| Income tax expense | |

| 133 | | |

| 55 | |

| Depreciation and amortization | |

| 153 | | |

| 179 | |

| EBITDA | |

| 520 | | |

| 854 | |

| Stock-based compensation expense | |

| 74 | | |

| 18 | |

| Adjust gain on purchase of ICS | |

| (23 | ) | |

| - | |

| Foreign currency transaction loss (gain) | |

| (162 | ) | |

| (117 | ) |

| Adjusted EBITDA | |

$ | 409 | | |

$ | 755 | |

v3.24.1.1.u2

Cover

|

May 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 14, 2024

|

| Entity File Number |

001-41688

|

| Entity Registrant Name |

STRONG

GLOBAL ENTERTAINMENT, INC.

|

| Entity Central Index Key |

0001893448

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

108

Gateway Blvd

|

| Entity Address, Address Line Two |

Suite

204

|

| Entity Address, City or Town |

Mooresville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28117

|

| City Area Code |

(704)

|

| Local Phone Number |

994-8279

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Voting Shares, without par value

|

| Trading Symbol |

SGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

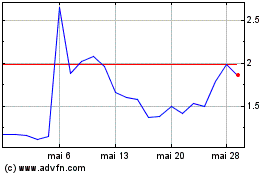

Strong Global Entertainm... (AMEX:SGE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Strong Global Entertainm... (AMEX:SGE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024