As filed with the Securities and Exchange Commission

on May 17, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bright Scholar Education Holdings Limited

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

No. 1, Country Garden Road

Beijiao Town, Shunde District, Foshan, Guangdong 528300

The People’s Republic of China

(86)-757-2991-6814

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

2024 Share Incentive Plan

(Full title of the Plan)

Cogency Global Inc.

122 East, 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Ruolei Niu

Chief Executive Officer

Suites 6-7, The Turvill Building Old Swiss,

149

Cherry Hinton Road

Cambridge, England, CB1 7BX, United Kingdom

+44 12-2334-1303 |

|

Dan Ouyang, Esq.

Wilson Sonsini Goodrich & Rosati

Professional Corporation

Unit 2901, 29F, Tower C, Beijing Yintai Centre

No. 2 Jianguomenwai Avenue

Chaoyang District, Beijing 100022

People’s Republic of China

(86) 10-6529-8300 |

Indicate by check mark whether the Registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information*

Item 2. Registrant

Information and Employee Plan Annual Information*

* Information required by Part I to be contained in the Section 10(a)

prospectus is omitted from this registration statement in accordance with Rule 428 under the Securities Act and the introductory note

to Part I of Form S-8. In accordance with the rules and regulations of the Securities and Exchange

Commission (the “Commission”) and the instructions to Form S-8, such documents are not being filed with the Commission either

as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. The documents containing

information specified in this Part I will be separately provided to the participants covered by the Plan, as specified by Rule 428(b)(1)

under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation

of Documents by Reference

The following documents previously filed by the

Registrant with the Commission are incorporated by reference herein:

| |

(a) |

The Registrant’s annual report on Form 20-F (File No. 001-38077) filed with the Commission on January 2, 2024, which includes audited financial statements for the fiscal year ended August 31, 2023; and |

| |

|

|

| |

(b) |

The description of the Registrant’s Class A ordinary shares, contained as Exhibit 2.5 in the Registrant’s annual report on Form 20-F (File No. 001-38077) filed with the Commission on June 21, 2023. |

All documents subsequently filed by the Registrant

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after

the date of this registration statement and prior to the filing of a post-effective amendment to this registration statement which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this registration statement and to be part hereof from the date of filing of such documents. Any statement in a document

incorporated or deemed to be incorporated by reference in this registration statement will be deemed to be modified or superseded to the

extent that a statement contained in this registration statement or in any other later filed document that also is or is deemed to be

incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except

as so modified or superseded, to be a part of this registration statement.

Item 4. Description

of Securities

Not applicable.

Item 5. Interests

of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and

Officers

Cayman Islands law does not limit the extent to

which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such

provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against fraud or

dishonesty. The Registrant’s amended and restated articles of association provide that the Registrant shall indemnify secure harmless

each of its directors and officers (but not including the Registrant’s auditors) out of the assets and profits of the Registrant

from and against all actions, costs, charges, losses, damages and expenses which they or any of them or their heirs, executors or administrators

may incur or sustain by or by reason of any act done, concurred in or omitted in or about the execution of duty, or supposed duty, in

their respective offices or trusts; any none of them shall be answerable to for the acts, receipts, neglects or defaults of the other

or others of them or for joining in any receipts for the sake of conformity, or for any bankers or other persons with whom any moneys

or effects belonging to the Registrant shall or may be lodged or deposited for the sake of safe custody, or for insufficiency or deficiency

of any security upon which moneys of or belonging to the Registrant shall be placed out on or invested, or for any other loss, misfortune,

or damage which may happen in the execution of their respective offices or trusts, or in relation thereto other than by reason of any

such person’s own fraud or dishonesty.

Pursuant to the indemnification agreements, the

form of which was filed as Exhibit 10.2 to the Registrant’s registration statement on Form F-1, as amended (File No. 333-217359),

the Registrant has agreed to indemnify its directors and executive officers against certain liabilities and expenses incurred by such

persons in connection with claims made by reason of their being such a director or officer.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions,

the Registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the

Securities Act and is therefore unenforceable.

The Registrant also maintains a directors and

officers liability insurance policy for its directors and officers.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

See the Index to Exhibits attached hereto.

Item 9. Undertakings

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being

made, a post-effective amendment to this registration statement: |

| (i) | to include any prospectus required by Section 10(a)(3) of

the Securities Act; |

| (ii) | to reflect in the prospectus any facts or events arising after

the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in this registration statement; and |

| (iii) | to include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any material change to that information in the registration

statement; |

provided, however, that paragraphs (a)(1)(i)

and (a)(1)(ii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that

are incorporated by reference in this registration statement;

| (2) | That, for the purpose of determining any liability under

the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a)

or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section

15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under

the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as

expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue. |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Act

of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Foshan, China,

on May 17, 2024.

| Bright Scholar Education Holdings Limited |

|

| |

|

| By: |

/s/ Ruolei Niu |

|

| |

Name: Ruolei Niu |

|

| |

Title: Chief Executive Officer |

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature

appears below does hereby constitute and appoint Ruolei Niu, as his or her true and lawful attorney-in-fact and agent, each with full

power of substitution and re-substitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign

any and all amendments (including post-effective amendments) to this registration statement and to file the same, with all exhibits thereto,

and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent,

full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith and

about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all

that said attorney-in-fact and agent, or her substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration

statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Hongru Zhou |

|

Chairman |

|

May 17, 2024 |

| Hongru Zhou |

|

|

|

|

| |

|

|

|

|

| /s/ Ruolei Niu |

|

Chief Executive Officer |

|

May 17, 2024 |

| Ruolei Niu |

|

(principal executive officer) |

|

|

| |

|

|

|

|

|

/s/ Hui Zhang |

|

Chief Financial Officer |

|

May 17, 2024 |

| Hui Zhang |

|

(principal financial and accounting officer) |

|

|

| |

|

|

|

|

| /s/

Shuting Zhou |

|

Director |

|

May 17, 2024 |

| Shuting Zhou |

|

|

|

|

| |

|

|

| /s/ Jun Zhao |

|

Independent Director |

|

May 17, 2024 |

| Jun Zhao |

|

|

|

|

| |

|

|

|

|

| /s/ Meng Rui |

|

Independent Director |

|

May 17, 2024 |

| Meng Rui |

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant to the Securities Act of 1933, the undersigned,

the duly authorized representative in the United States of Bright Scholar Education Holdings Limited has signed this registration statement

or amendment thereto in New York on May 17, 2024.

Authorized U.S. Representative

Cogency Global Inc. |

|

| |

|

|

| By: |

/s/ Colleen A. De Vries |

|

| |

Name: Colleen A. De Vries |

|

| |

Title: Senior Vice-President on behalf of Cogency Global Inc. |

|

Exhibit 5.1

17 May 2024

Matter No.:838241

Doc Ref: PL/BXC/jm/19965952

(852) 2842 9551

Paul.lim@conyers.com

(852) 2842 9403

Beverly.Cheung@conyers.com

Bright Scholar Education Holdings Limited

No. 1 Country Garden Road

Beijiao Town, Shunde District

Foshan

Guangdong 528300

The People’s Republic of China

Dear Sirs,

Re: Bright Scholar Education Holdings Limited (the “Company”)

We have acted as special Cayman Islands legal

counsel to the Company in connection with a registration statement on Form S-8, (the “Registration Statement”, which

term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule

thereto) relating to the registration under the U.S. Securities Act of 1933, as amended, (the “Securities Act”) of

17,835,723 Class A ordinary shares of par value US$0.00001 per share of the Company (the “Class A Ordinary Shares”)

issuable pursuant to the 2024 share incentive plan (the “Share Incentive Plan”).

For the purposes of giving this opinion, we have

examined copies of the following documents:

| 1.1 | the Registration Statement; and |

| 1.2 | the Share Incentive Plan. |

We have also reviewed copies of:

| 1.3 | the amended and restated memorandum and articles of association of the Company (the “Amended

M&A”); |

| 1.4 | the written resolutions of the directors of the Company dated 18 January 2024 and

the minutes of a meeting of all the directors of the Company held on 19 April 2024 (collectively, the “Board Resolutions”); |

| 1.5 | a

Certificate of Good Standing issued by the Registrar of Companies in relation to the Company on 14 May 2024 (the “Certificate

Date”); and |

| 1.6 | such other documents and made such enquiries as to questions of law as we have deemed necessary in order

to render the opinion set forth below. |

We have assumed:

| 2.1 | the genuineness and authenticity of all signatures and the conformity to the originals of all copies (whether

or not certified) examined by us and the authenticity and completeness of the originals from which such copies were taken; |

| 2.2 | that where a document has been examined by us in draft form, it will be or has been executed and/or filed

in the form of that draft, and where a number of drafts of a document have been examined by us all changes thereto have been marked or

otherwise drawn to our attention; |

| 2.3 | the accuracy and completeness of all factual representations made in the Registration Statement and the

Share Incentive Plan and other documents reviewed by us; |

| 2.4 | that

the Board Resolutions were passed at one or more duly convened, constituted and quorate meetings or by unanimous written resolutions,

remain in full force and effect and have not been rescinded or amended; |

| 2.5 | that there is no provision of the law of any jurisdiction, other than the Cayman Islands, which would

have any implication in relation to the opinions expressed herein; |

| 2.6 | that there is no provision of any award agreement, incentive share option, restricted shares, share appreciation

rights or restricted share units or otherwise granted pursuant to the Share Incentive Plan which would have any implication in relation

to the opinions expressed herein; |

| 2.7 | that upon issue of any Class A Ordinary Shares, the Company will receive consideration for the full issue

price thereof which shall be equal to at least the par value thereof; |

| 2.8 | that on the date of issuance of any of the Class A Ordinary Shares, the Company will have sufficient authorised

but unissued Class A Ordinary Shares; |

| 2.9 | that on the date of issuing of any Class A Ordinary Shares, the Company is able to pay its liabilities

as they become due; and |

| 2.10 | the issue of the Class A Ordinary Shares are made in accordance with the terms and conditions of the Share

Incentive Plan. |

We have made no investigation of and express no

opinion in relation to the laws of any jurisdiction other than the Cayman Islands. This opinion is to be governed by and construed in

accordance with the laws of the Cayman Islands and is limited to and is given on the basis of the current law and practice in the Cayman

Islands. This opinion is issued solely for the purposes of the filing of the Registration Statement and the issuance of the Class A Ordinary

Shares by the Company pursuant to the Share Incentive Plan and is not to be relied upon in respect of any other matter.

On the basis of and subject to the foregoing,

we are of the opinion that:

| 4.1 | The Company is duly incorporated and existing under the law of the Cayman Islands and, based on the Certificate

of Good Standing, is in good standing as at the Certificate Date. Pursuant to the Companies Act (the “Act”), a company

is deemed to be in good standing if all fees and penalties under the Act have been paid and the Registrar of Companies has no knowledge

that the Company is in default under the Act. |

| 4.2 | When

issued and paid for as contemplated by the Share Incentive Plan and the Form 6-K/A as filed with the U.S. Securities and Exchange Commission

on 22 February 2024 and in accordance with the Amended M&A, the Class A Ordinary Shares will be validly issued, fully paid and non-assessable

(which term when used herein means that no further sums are required to be paid by the holders thereof in connection with the issue thereof). |

We hereby consent to the filing

of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not hereby admit that we are experts within

the meaning of Section 11 of the Securities Act or that we are within the category of persons whose consent is required under Section

7 of the Securities Act or the Rules and Regulations of the Commission promulgated thereunder.

Yours faithfully,

| /s/ Conyers Dill & Pearman |

|

| |

|

| Conyers Dill & Pearman | |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

We consent to the incorporation by reference

in this Registration Statement on Form S-8 of our report dated January 2, 2024, relating to the financial statements of Bright Scholar

Education Holdings Limited appearing in the annual report on Form 20-F for the year ended August 31, 2023.

| /s/ Deloitte Touche Tohmatsu Certified Public Accountants LLP |

| Deloitte Touche Tohmatsu Certified Public Accountants LLP |

| Shenzhen, China |

| May 17, 2024 |

Exhibit 107

Calculation of Filing

Fee Tables

FORM S-8

(Form Type)

Bright Scholar Education

Holdings Limited

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered

Securities

Security

Type | |

Security

Class

Title(1) | |

Fee

Calculation

Rule | |

Amount

Registered(2)(4) | | |

Proposed

Maximum

Offering

Price

Per Unit | | |

Maximum

Aggregate

Offering Price | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Class A ordinary shares, par value $0.00001 per share | |

Rules 457(c)

and (h) | |

| 17,835,723 | (3) | |

$ | 0.48875 | | |

$ | 8,717,209.62 | | |

$ | 0.0001476 | | |

$ | 1,286.66 | |

| Total Offering Amounts | |

| |

| | | |

| | | |

$ | 8,717,209.62 | | |

| | | |

$ | 1,286.66 | |

| Total Fees Previously Paid | |

| |

| | | |

| | | |

| | | |

| | | |

$ | - | |

| Total Fee Offsets | |

| |

| | | |

| | | |

| | | |

| | | |

$ | - | |

| Net Fee Due | |

| |

| | | |

| | | |

| | | |

| | | |

$ | 1,286.66 | |

| (1) | The Class A ordinary shares of Bright Scholar Education Holdings

Limited (the “Registrant”) registered hereunder are represented by the Registrant’s American depositary shares (“ADSs”),

each representing four Class A ordinary shares, par value $0.00001 per share. The Registrant’s ADSs issuable upon deposit of the

Class A ordinary shares have been registered under a separate registration statement on Form F-6 (333-217525). |

| (2) | Represents Class A ordinary shares which are issuable under

the 2024 Share Incentive Plan of the Registrant. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities

Act”), this registration statement is deemed to cover an indeterminate number of Class A ordinary shares which may be offered and

issued to prevent dilution resulting from reorganization, recapitalization, share dividend, share split or any similar equity restructuring

transaction as provided in the 2024 Share Incentive Plan. |

| (3) | Represents Class A ordinary shares to be issued pursuant to the 2024 Share Incentive Plan. The proposed

maximum offering price per share, which is estimated solely for the purposes of calculating the registration fee under Rule 457(h)

and Rule 457(c) under the Securities Act, is based on US$1.955 per ADS, the average of the high and low prices for the

Registrant’s ADSs as quoted on the New York Stock Exchange on May 14, 2024. |

| (4) | Any Class A ordinary share covered by an award granted under

the 2024 Share Incentive Plan (or portion of an award) that is forfeited, cancelled or otherwise expired for any reason without having

been exercised shall be deemed not to have been issued for purposes of determining the maximum aggregate number of Class A ordinary shares

which may be issued under the 2024 Share Incentive Plan. |

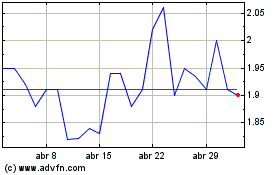

Bright Scholar Education (NYSE:BEDU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bright Scholar Education (NYSE:BEDU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024