Form 6-K/A - Report of foreign issuer [Rules 13a-16 and 15d-16]: [Amend]

18 Junho 2024 - 6:08PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2024

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Announcement of Transaction

with Related Party

Rio de Janeiro, June 17,

2024, Centrais Elétricas Brasileiras S/A – Eletrobras informs the following transaction with a related party transaction:

| Related Party Names |

Company: Centrais Elétricas Brasileiras S/A

- Eletrobras;

Related Party: Chapada do Piauí I Holding

S/A Specific Purpose Company.

|

| Issuer Relationships |

Eletrobras is a shareholder in SPE Chapada do Piauí I, holding a relevant stake in its capital stock (49%). |

| Date of the transaction |

Contractual instrument signed on 06/07/2024.

|

| Object of the Agreement |

Issuance of a bank guarantee by a market financial

institution (BTG Pactual Bank) as a guarantee to be provided in favor of the creditors of the debt contracts of SPE Chapada do Piauí

I, in accordance with an obligation previously established within the scope of such agreements.

Eletrobras will provide a corporate counter-guarantee

(personal guarantee) to the guarantor in the amount equivalent to its shareholding interest in SPE Chapada do Piauí I, guaranteeing

the SPE's obligations in the event of default, enabling the issuance of the bank guarantee.

|

| Main Terms and Conditions |

The corporate counter-guarantee to be provided by

Eletrobras is equivalent to the amount of the bank guarantee corresponding to the Company's 49% shareholding interest in SPE Chapada do

Piauí I, thus comprising a total of approximately R$ 63 million, in accordance with the contract concluded.

The contractual instrument and the respective personal

guarantee provided will last for 24 (twenty-four) months.

It is observed that, due to the characteristic of

the

transaction portrayed (provision of personal guarantee),

there is no direct financial flow to be established

between

the SPE described in this press release.

Furthermore, only in the event of contractual default

by the

aforementioned SPE, Eletrobras, as counter-guarantor

of

part of its obligations, may be called upon to honor

such

obligations vis-à-vis the Guarantor. |

| Detailed reasons why the Company's Management considers that the transaction has commutative conditions or provides for adequate compensatory payment. |

The conditions of the proposed bank guarantee were

defined based on parameters and quotations usually practiced by the market.

In addition, the provision of the counter-guarantee

by the shareholders (including Eletrobras) allows the issuance of a bank guarantee, contributing to the maintenance of the performance

with the contractual condition of the SPE vis-à-

vis its creditors. |

|

Eventual participation of the counterparty, its partners

or administrators in the decision process

of the issuer's subsidiary regarding

the transaction or the negotiation of

the transaction as representatives of

the Company, describing these

interests. |

The request for the provision of a counter-guarantee

by Eletrobras comes from the financial institution selected by SPE Chapada do Piauí to structure the operation to obtain the bank

guarantee.

Eletrobras' decision to effectively provide the guarantee,

was approved by the Eletrobras Governance Bodies,

and therefore does not have the participation of the SPE.

|

Eduardo Haiama

Vice President of Finance and Investor Relations

This

document may contain estimates and projections that are not statements of fact that have occurred in the past, but reflect the beliefs

and expectations of our management and may constitute estimates and projections about future events within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934,

as amended. The words "believes", "may", "may", "estimates", "continues", "anticipates", "intends", "expects" and the like are intended

to identify estimates that necessarily involve risks and uncertainties, whether known or not. Known risks and uncertainties include, but

are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, variations in interest rates,

inflation and the value of the Brazilian Real, changes in volumes and patterns of consumer use of electricity, competitive conditions,

our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the

reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations,

and other risks described in our annual report and other documents filed with the SEC. Estimates and projections speak only as of the

date on which they were expressed and we undertake no obligation to update any such estimates or projections due to the occurrence of

new information or upcoming events. The future results of the Companies' operations and initiatives may differ from current expectations

and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect

accurate results due to rounding performed.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: June 18, 2024

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Eduardo Haiama

|

|

| |

Eduardo Haiama

Vice-President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

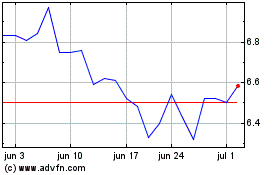

Centrais Eletricas Brasi... (NYSE:EBR)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

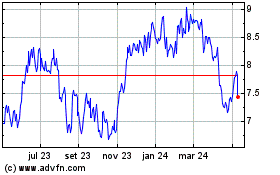

Centrais Eletricas Brasi... (NYSE:EBR)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024