Filed by Alerus Financial

Corporation

(Commission File No.: 001-39036)

Pursuant to Rule 425

of the Securities Act of 1933

and deemed filed pursuant

to Rule 14a-12

of the Securities Exchange

Act of 1934

Subject Company: HMNF

(Commission File No.: 0-24100)

Date: September 3,

2024

The following letter was mailed to certain

stockholders of Alerus Financial Corporation on September 3, 2024.

URGENT REMINDER FOR ALERUS FINANCIAL

CORPORATION STOCKHOLDERS

WE NEED YOUR VOTE

September 3, 2024

Dear Stockholder:

We recently sent you proxy materials, dated July 31, 2024 (the

“proxy statement”), in connection with the special meeting of stockholders of Alerus Financial Corporation (“Alerus”)

to be held at 11:00 a.m., local time on September 12, 2024 to vote on a proposal to approve and adopt the merger agreement

for the acquisition of HMN Financial, Inc. (“HMNF”). According to our latest records, we have not yet received your

vote. Time is running out to make your voice heard. Don’t wait. Please vote TODAY.

At the special meeting, our stockholders will be asked, among other

things, to consider and vote on a proposal to approve and adopt the merger agreement between Alerus and HMNF, pursuant to which HMNF will

merge with and into Alerus, and the transactions contemplated therein, including the issuance of Alerus common stock pursuant to the merger

agreement. If the merger agreement is adopted, at the effective time of the merger, each issued and outstanding share of HMNF common stock

will be cancelled and converted into the right to receive a number of shares of Alerus common stock equal to the exchange ratio (as defined

in the proxy statement).

Your

vote is extremely important, no matter how many shares you hold. The merger cannot be completed unless the Alerus merger proposal

set forth in the proxy statement is approved by the affirmative vote of a majority of the outstanding shares of Alerus common stock entitled

to vote. For the reasons set forth in the proxy statement, Alerus’ Board of Directors recommends that you vote “FOR”

the Alerus merger proposal.

The

meeting date is rapidly approaching. You are encouraged to vote via the internet or via the telephone by following the instructions on

the enclosed proxy form as soon as possible to ensure your vote is received on time. If you need assistance voting your shares,

please call D.F. King toll-free at (888) 605-1957.

Sincerely,

Katie Lorenson

President and Chief Executive Officer

Alerus Financial Corporation

401 DeMers Avenue

Grand Forks, ND 58201

Enclosure

Special Note Concerning Forward-Looking Statements

This message contains “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to

the anticipated future performance of Alerus Financial Corporation (“Alerus”) and HMN Financial Corporation, Inc. (“HMNF”)

and certain plans, expectations, goals, projections and benefits relating to the merger of HMN with and into Alerus (the “Merger”),

all of which are subject to numerous assumptions, risks and uncertainties. These statements are often, but not always, identified by words

such as “may,” “might,” “should,” “could,” “predict,” “potential,”

“believe,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would,” “annualized,”

“target” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking

nature. Examples of forward-looking statements include, among others, statements Alerus makes regarding the ability of Alerus and HMNF

to complete the transactions contemplated by the agreement and plan of merger (the “Merger Agreement”), including the parties’

ability to satisfy the conditions to the consummation of the Merger, statements about the expected timing for completing the Merger, the

potential effects of the proposed Merger on both Alerus and HMNF, and the possibility of any termination of the Merger Agreement, and

any potential downward adjustment in the exchange ratio.

Forward-looking statements

are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their

nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ,

possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. In addition to factors disclosed

in reports filed by Alerus and HMNF with the SEC, risks and uncertainties for Alerus, HMNF and the combined company that may cause actual

results or outcomes to differ materially from those anticipated include, but are not limited to: (1) the possibility that any of

the anticipated benefits of the proposed Merger will not be realized or will not be realized within the expected time period; (2) the

risk that integration of HMNF’s operations with those of Alerus will be materially delayed or will be more costly or difficult than

expected; (3) the parties’ inability to meet expectations regarding the timing of the proposed Merger; (4) changes to

tax legislation and their potential effects on the accounting for the Merger; (5) the inability to complete the proposed Merger due

to the failure of the Alerus’ or HMNF’s stockholders to adopt the Merger Agreement, or the failure of Alerus’ stockholders

to approve the issuance of Alerus’ common stock in connection with the Merger; (6) the failure to satisfy other conditions

to completion of the proposed Merger, including receipt of required regulatory and other approvals; (7) the failure of the proposed

Merger to close for any other reason; (8) diversion of management’s attention from ongoing business operations and opportunities

due to the proposed Merger; (9) the challenges of integrating and retaining key employees; (10) the effect of the announcement

of the proposed Merger on Alerus’, HMNF’s or the combined company’s respective customer and employee relationships and

operating results; (11) the possibility that the proposed Merger may be more expensive to complete than anticipated, including as a result

of unexpected factors or events; (12) the amount of HMNF’s stockholders’ equity as of the closing date of the merger and any

potential downward adjustment in the exchange ratio; (13) the dilution caused by Alerus’ issuance of additional shares of Alerus’

common stock in connection with the Merger; and (14) changes in the global economy and financial market conditions and the business, results

of operations and financial condition of Alerus, HMNF and the combined company. Please refer to each of Alerus’ and HMNF’s

Annual Report on Form 10-K for the year ended December 31, 2023, as well as both parties’ other filings with the SEC,

for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the

forward-looking statements.

Any forward-looking statement

included in this report is based only on information currently available to management and speaks only as of the date on which it is made.

Neither Alerus nor HMNF undertakes any obligation to publicly update any forward-looking statement, whether written or oral, that may

be made from time to time, whether as a result of new information, future developments or otherwise.

Additional Information and Where to Find It

Alerus has filed a

Registration Statement on Form S-4 (Registration Statement No. 333-280815) with the SEC on July 15, 2024, as amended

on July 29, 2024, in connection with a proposed transaction between Alerus and HMNF. The registration statement was declared

effective by the SEC on July 31, 2024. Alerus filed its definitive proxy statement/prospectus with the SEC on July 31, 2024, and it

was first mailed to Alerus' stockholders on August 5, 2024. HMNF filed its definitive proxy statement on August 1, 2024, and it was

first mailed to HMNF's stockholders on August 5, 2024. Alerus and HMNF have filed other relevant documents with the SEC regarding

the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, registration statement or any

other document that Alerus or HMNF has filed with the SEC. Before making any voting decision, the stockholders of Alerus and HMNF

are advised to read the joint proxy statement/prospectus, because it contains important information about Alerus, HMNF and the

proposed transaction. This document and other documents relating to the Merger filed by Alerus can be obtained free of charge from

the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing Alerus’ website at

www.alerus.com under the link “Investors Relations” and then under “SEC Filings” and HMNF’s website at

www.justcallhome.com/HMNFinancial under “SEC Filings.” Alternatively, these documents can be obtained free of charge

from Alerus upon written request to Alerus Financial Corporation, Corporate Secretary, 401 Demers Avenue, Grand Forks, North Dakota

58201 or by calling (701) 795-3200, or from HMNF upon written request to HMN Financial, Inc., Corporate Secretary, 1016

Civic Center Drive NW, Rochester, Minnesota 55901 or by calling (507) 535-1200. The contents of the websites referenced above

are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus.

Participants in the Solicitation

This report does not constitute

a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Alerus, HMNF, and certain of their

directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies

from the stockholders of Alerus and HMNF in connection with the proposed Merger under SEC rules. Information about the directors and executive

officers of Alerus and HMNF is included in the joint proxy statement/prospectus for the proposed transaction filed with the SEC. These

documents may be obtained free of charge in the manner described above under “Additional Information and Where to Find It.”

Security

holders may obtain information regarding the names, affiliations and interests of Alerus’ directors and executive officers in the

definitive proxy statement of Alerus relating to its 2024 Annual Meeting of Stockholders filed with the SEC on March 25, 2024 and

on Alerus’ Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 8, 2024. Security

holders may also obtain information regarding the names, affiliations and interests of HMNF’s directors and executive officers in

the definitive proxy statement of HMNF relating to its 2024 Annual Meeting of Stockholders filed with the SEC on March 21, 2024 and

HMNF’s Annual Report on Form 10-K/A for the year ended December 31, 2023 filed with the SEC on March 19, 2024. To

the extent the holdings of Alerus’ securities by Alerus’ directors and executive officers or the holdings of HMNF securities

by HMNF’s directors and executive officers have changed since the amounts set forth in Alerus’ or HMNF’s respective

proxy statement for its 2024 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. These documents can be obtained free of charge in the manner described above under “Additional

Information and Where to Find It.”

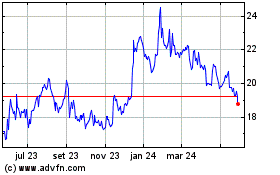

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

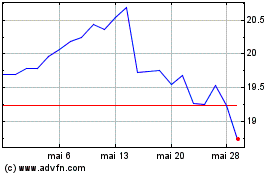

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024