|

|

|

|

|

Filed by John Bean Technologies Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies: John Bean

Technologies Corporation (Commission File No. 001-34036)

Marel hf. |

Investor Presentation S e p t e m b e r 4 , 2 0 2 4

Forward-Looking and Non-GAAP Statements This presentation contains

forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are information of a non-historical nature and are subject to risks and uncertainties that are beyond JBT’s ability to

control. These forward-looking statements include, among others, statements relating to our business and our results of operations, a potential transaction with Marel, our strategic plans, our restructuring plans and expected cost savings from those

plans, and our liquidity. The factors that could cause our actual results to differ materially from expectations include, but are not limited to, the following factors: the occurrence of any event, change or other circumstances that could give rise

to the termination or abandonment of the voluntary takeover offer to acquire all issued and outstanding shares of Marel (the “Offer”); the expected timing and likelihood of completion of the proposed transaction with Marel, including the

timing, receipt and terms and conditions of any required governmental and regulatory approvals for the Offer that could reduce anticipated benefits or cause the parties to abandon the transaction; the risk that Marel and/or JBT may not be able to

satisfy the conditions to the Offer in a timely manner or at all; the risk that the Offer and its announcement could have an adverse effect on the ability of JBT and Marel to retain customers and retain and hire key personnel and maintain

relationships with their suppliers and customers, and on their operating results and businesses generally; the risk that problems may arise in successfully integrating the businesses of Marel and JBT, which may result in the combined company not

operating as effectively and efficiently as expected; the risk that the combined company may be unable to achieve cost-cutting synergies or that it may take longer than expected to achieve those synergies; fluctuations in our financial results;

unanticipated delays or accelerations in our sales cycles; deterioration of economic conditions, including impacts from supply chain delays and reduced material or component availability; inflationary pressures, including increases in energy, raw

material, freight and labor costs; disruptions in the political, regulatory, economic and social conditions of the countries in which we conduct business; changes to trade regulation, quotas, duties or tariffs; fluctuations in currency exchange

rates; changes in food consumption patterns; impacts of pandemic illnesses, food borne illnesses and diseases to various agricultural products; weather conditions and natural disasters; the impact of climate change and environmental protection

initiatives; acts of terrorism or war, including the ongoing conflicts in Ukraine and the Middle East; termination or loss of major customer contracts and risks associated with fixed-price contracts, particularly during periods of high inflation;

customer sourcing initiatives; competition and innovation in our industries; our ability to develop and introduce new or enhanced products and services and keep pace with technological developments; difficulty in developing, preserving and

protecting our intellectual property or defending claims of infringement; catastrophic loss at any of our facilities and business continuity of our information systems; cyber-security risks such as network intrusion or ransomware schemes; loss of

key management and other personnel; potential liability arising out of the installation or use of our systems; our ability to comply with U.S. and international laws governing our operations and industries; increases in tax liabilities; work

stoppages; fluctuations in interest rates and returns on pension assets; a systemic failure of the banking system in the United States or globally impacting our customers’ financial condition and their demand for our goods and services;

availability of and access to financial and other resources; the risk factors discussed in our proxy statement/prospectus filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”), on June 25, 2024

(the “Proxy Statement/Prospectus”), forming part of the Registration Statement on Form S-4 (File No. 333-279438) (the “Registration Statement”), initially filed by us on May 15, 2024 and declared effective on June 25, 2024;

and other factors described under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in JBT’s most recent Annual Report on Form 10-K filed with

the U.S. Securities and Exchange Commission (the “SEC”) and in any subsequently filed Quarterly Reports on Form 10-Q. JBT cautions shareholders and prospective investors that actual results may differ materially from those indicated by

the forward-looking statements. JBT undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future developments, subsequent events or changes in circumstances or otherwise. JBT

provides non-GAAP financial measures in order to increase transparency in our operating results and trends. These non-GAAP measures eliminate certain costs or benefits from, or change the calculation of, a measure as calculated under U.S. GAAP. By

eliminating these items, JBT provides a more meaningful comparison of our ongoing operating results, consistent with how management evaluates performance. Management uses these non-GAAP measures in financial and operational evaluation, planning and

forecasting. These calculations may differ from similarly-titled measures used by other companies. The non-GAAP financial measures disclosed are not intended to be used as a substitute for, nor should they be considered in isolation of, financial

measures prepared in accordance with U.S. GAAP. 2

Important Additional Information Important Notices This presentation is not

intended to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. In particular, this presentation is not an offer of securities for sale in the United States, Iceland, the Netherlands or Denmark. Note to U.S. Shareholders It is

important that U.S. shareholders understand that the Offer and any related offer documents are subject to disclosure and takeover laws and regulations in Iceland and other European jurisdictions, which may be different from those of the United

States. The Offer will be made in compliance with the U.S. tender offer rules, including Regulation 14E under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and any exemption available to JBT in respect of

securities of foreign private issuers provided by Rule 14d-1(d) under the Exchange Act. Important Additional Information No offer of JBT securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act, or an exemption from registration, and applicable European regulations, including the Icelandic Prospectus Act no. 14/2020 and the Icelandic Takeover Act no. 108/2007 on takeovers. In connection with the Offer, JBT filed with the SEC

the Registration Statement that included the Proxy Statement/Prospectus. The Registration Statement was declared effective by the SEC on June 25, 2024. Additionally, JBT filed with the Financial Supervisory Authority of the Central Bank of Iceland

(“the FSA”) an offer document and a prospectus, which have been approved by the FSA and which have been published. SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE PROSPECTUS, AND THE OFFER DOCUMENT, AS APPLICABLE, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC OR THE FSA CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy

of the Proxy Statement/Prospectus, as well as other filings containing information about JBT, without charge, at the SEC’s website at www.sec.gov, and on JBT’s website at https://ir.jbtc.com/overview/default.aspx. You may obtain a free

copy of the prospectus on the FSA’s website at www.fme.is and on JBT’s website at https://www.jbtc.com/jbt-marel-offer-launch/ as well as a free copy of the offer document. 3

Introduction to JBT 4

Why Invest in JBT? Pure-play global food and beverage technology company

with broad participation 1 across attractive and resilient markets Compelling secular trends along with market leading technologies and 2 application knowledge support growth Large and growing installed base support resilient aftermarket, which is 3

enhanced by OmniBlu digital tools Strong operating platform with margin enhancement driven by continuous 4 improvement and supply chain initiatives Growth company with demonstrated track record of deploying capital and 5 quickly de-levering Strong

balance sheet and free cash flow generation support strategy 6 Complementary combination with Marel expected to generate meaningful value 7 5

JBT at a Glance: Leading Global Technology Solutions Provider to High-Value

Segments of the Food & Beverage Industry 1884 3,000+ 25+ ~$2.9B ~5,100 JBT (NYSE) (1) (1) (2) (1) Year Founded Customers Globally Countries Market Cap Employees Listed Since 2008 ~$1.65B 49% $268M 16.3% $151M 0.6x (3) (3) (4) TTM Revenue TTM

Recurring Revenue Mix TTM Adjusted EBITDA TTM Adj. EBITDA Margin TTM Free Cash Flow (FCF) Q2 2024 Net Leverage Broad application knowledge and food domain expertise Food safety experts Innovative solutions that solve problems – labor

automation, Why Customers yield, throughput, sustainability, uptime Choose JBT Global service and support with ability to scale and grow with customers and maintain uptime Versatile offerings and connected, digital solutions with OmniBlu –

“we are with you right down the line” Note: trailing twelve months (TTM) represents JBT as reported financial figures for the four quarters ended June 30, 2024. Figures may have immaterial differences due to rounding. (1) Statistics as

of June 30, 2024. (2) Market cap as of August 27, 2024. (3) Non-GAAP figure; please see appendix for reconciliations. (4) Net leverage ratio is net debt / TTM adj. EBITDA. 6

Broad Participation in Diverse Food & Beverage End Markets is a Strong

Differentiator JBT 2023 Equipment Orders by End Market 24% 15% 13% 12% Beverages, Poultry Fruit & Meat & Juices, Dairy & Vegetables Seafood Alternatives 9% 9% 11% 3% 4% Ready Meals, Warehouse Pharmaceuticals Other Pet Food, Plant

Automation & Nutraceuticals Convenience & Categories Based & Meat Specialty Foods Alternatives 7

More Stable and Resilient Investment by Food & Beverage Producers

Supports JBT (1) Indexed Capex Comparison Benefits of Stable Demand for Food and Beverage Products More moderated growth expected in 2024 given larger capacity expansions ▪ Continued growth in food and beverage Quick capex recovery in prior

years for food & beverage consumption creates a less cyclical environment producers after pandemic recession ▪ During economic recessions, capex for food and Capex was essentially flat for ~40 food & beverage producers was not as

severely impacted beverage producers when compared to major industrial companies in during great recession 2007 – 2023 food & vs. significant declines Flatter investment by food the XLI for XLI companies beverage producer & beverage

producers in 2016 - 2018 capex CAGR of ~4.8% ▪ JBT benefits as food and beverage producers vs. XLI of ~2.3% continue to invest in equipment solutions to serve the end consumer Source: Capital IQ. (1) XLI represents the companies in the

Industrial Select Sector SPDR Fund. Global food and beverage producers represents approximately 40 top global producers. 8

Demonstrated Resiliency Through the Cycle with Recurring Revenue Model

Leveraging Large Global Installed Base JBT Recurring Revenue ($ millions) Recurring Revenue Driven by Sales and Service Network $846 $751 ▪ ~600 field service technicians globally support equipment and leases $662 Parts & Consumables $611

▪ Cross-training for increased regional support and 60% $587 utilization $518 $486 ▪ Increased selling of aftermarket support contracts with equipment sales – developing more parts kits Refurbishments vs. single-part sales 14%

Service ▪ Generating new opportunities through 14% Leases increased focus on outbound aftermarket sales 12% ▪ Over 50,000 global install base of machinery 2017 2018 2019 2020 2021 2022 2023 Recurring (1) 41.5% 38.1% 44.1% 49.5% 47.2%

47.2% 50.8% Revenue % Note: Figures may have immaterial differences due to rounding. (1) 2018 revenue was positively impacted by the adoption of ASC 606 revenue recognition policy, impacting total revenue by approximately $114 million. 9

We are Executing on our Elevate 2.0 Strategy Organic Growth 1 ▪ New

product development – automation, sustainability, efficiency/yield ▪ End market penetration 2 ▪ Cross-selling opportunities ▪ Continued penetration into attractive geographies DIGITAL TRANSFORMATION DigitaI Transformation 2

▪ Roll out digital offering 1 ▪ Enable growth in aftermarket, new equipment, and new recurring revenue streams ORGANIC 3 GROWTH Margin Enhancement 3 IMPROVE ▪ Strategic sourcing / direct materials MARGINS ▪ Relentless

continuous improvement ▪ Price/cost discipline ▪ Recurring revenue mix 4 Acquisitions 4 ACQUISITIONS ▪ Re-deploy proceeds from AeroTech sale to both accretive “bolt-on” and larger M&A, including the Marel

transaction ▪ Disciplined strategic M&A program to generate double-digit ROIC while maintaining appropriate leverage 10

Driving Organic Growth at JBT Growing above durable Providing solutions in

Serving customers Need for automation, market demand diverse markets with through holistic digital, and sustainable durable demand partnership model solutions Enabled by broad participation in attractive More consistent consumption Increased

cross-selling Deep engineering and markets, recurring of food and beverage creates capabilities, aftermarket application knowledge aftermarket capabilities, and a less cyclical market penetration, and geographic provide innovation and secular trends

environment expansion solution capabilities in these focus areas 11

t n e m e g a n a A M R o o y c D o l i t t a P D r o b l e m S Continued

Operational Enhancement Opportunities JBT Business System Supply Chain & Strategic Sourcing Initiatives Supply Base Consolidation Make vs. Buy Decisions Business System + Relentless Continuous Value Engineering & Improvement (Lean) Component

Standardization Best Cost Country Sourcing ~200+ bps medium-term margin enhancement opportunity 12 o l v i n g P s l r o C o o c n h e T s a e n s l a c P e k L d n a n e z i a K

OmniBlu’s Holistic Approach and JBT’s Application Expertise

Provide Differentiated Results Customer Machine Performance Proactively monitor real-time Benefits performance along with application expertise to improve efficiency/output, anticipate failures & predict maintenance Improved Profitability

Frictionless Increased Parts & Service Uptime Easily execute on-schedule or event- driven parts/service ordering via e- Maintenance Manager commerce interface Ease of Doing Comprehensive, one-stop view to understand and plan events Business

13

Disciplined Capital Allocation Strategy Supports Growth (1) JBT Capital

Deployment Priorities JBT Net Leverage Ratio 2.8x Return generating Complementary capital expenditures M&A 0.6x 0.6x 0.6x 0.5x Target leverage of Return capital to Q2 Q3 Q4 Q1 Q2 2.0 – 3.0x shareholders 2023 2023 2023 2024 2024 ▪

M&A criteria: double-digit cash ROIC by year three ▪ Approximately $650M of debt at low-cost, fixed rates DISCIPLINED AMPLE for “bolt-on” & years four/five for larger deals ACQUISITION ▪ In connection with Marel

combination, expect to LIQUIDITY ▪ Dynamic economic environment drives risk-adjusted maintain flexible capital structure and appropriate METRICS return approach level of liquidity Note: Figures may have immaterial differences due to rounding.

(1) Net leverage ratio is net debt / TTM adjusted EBITDA. 14

Proven Ability to Execute and Integrate M&A JBT M&A Framework for

Strategic and Financial Criterion / Returns Key M&A Focus Areas: Targets With: ROIC Target: Primary, further processing, end of Strong intellectual property in key Double-digit by year three for line packaging, and technologies that can be

bolt-ons and year four/five for complementary software, globalized and added to the larger deals services, and consumables broader JBT portfolio Integrated 20 acquisitions with ~$1.3 billion capital deployed since 2014 2014 2015 2016 2017 2018 2019

2020 2021 2022 15

JBT’s Responsibility and Sustainability Framework RESPONSIBLE

OPERATIONS PEOPLE AND COMMUNITIES CUSTOMER SOLUTIONS ▪ Water, steam, energy and utility ▪ Manufacturing and office operations ▪ Safety for all, first and foremost optimization ▪ Consumables reduction/reuse ▪ Employee

satisfaction, development, and ▪ Optimal food safety and quality retention ▪ Waste reduction/recycling ▪ Food waste reduction ▪ Diversity, equity, inclusion, and belonging ▪ Reduced water/energy consumption ▪

Packaging waste reduction ▪ Employee Network Communities ▪ Alternative/renewable energy sourcing ▪ Extended equipment life ▪ Continuing education programs ▪ Sustainable supply chain initiatives ▪

Development/advancement in ▪ Multilevel local community support ▪ Relentless continuous improvement sustainable foods 16

JBT’s Prioritization and Focus on ESG Customer Solutions Responsible

Operations People and Communities JBT empowers customers to optimize energy and JBT takes every opportunity to reduce our carbon JBT strives to engage our employees to foster a diverse, water consumption, prioritize food safety and quality,

footprint, optimize our resources, and give new life equitable, and inclusive culture, creating an environment reduce waste, extend equipment life, and develop to what otherwise would go to waste. where people feel they belong and are inspired to

succeed. sustainable foods. (1) (2) Scope 1 and 2 GHG Emissions Lost Workday Incident Rate Board Diversity (Metric Tons CO2e) % Product Revenue by Environmental Benefit Scope 1 Scope 2 0.20 0.20 63% 57% <1% 4% 50% 0.09 9,148 71% 9% 8,338 8,464

2021 2022 2023 9% 7,871 potential incidents proactively 2021 2022 2023 6,837 14,000 6,365 identified and resolved 60% 17% 29% 2021 2022 2023 Increasing Diversity Among Our Leadership 2021 2022 2023 2023 30% 26% 27% %Women 25% 17% Revenue from

Products 21% 20% Food Waste Reduction Reduction in total Scope 1 and 2 12% 11% Leaders 5% and Services with GHG emissions since 2022 Equipment Refurbishment & Retrofits (Global) Beneficial ELT & Direct Reports General Managers Business Unit

Leadership Environmental Impact Packaging Waste Reduction Landfill diversion rate 69% Emission Reduction Revenue Outside of 32% %Minority 26% 29% 29% 29% 19% 26% Environmental Impact Water Optimization 22% 20% Leader Areas Emerging Food &

Nutrition (U.S.) ELT & Direct Reports General Managers Business Unit Leadership Please visit our JBT ESG website to download the entire 2023 ESG report. (1) Prior-year metrics have been restated due to the divestiture of our AeroTech business in

2023. We have also made improvements in data collection methods and added additional locations to our reporting footprint. Estimates are used for a small percent of missing data to ensure completeness. 2021/2022 scope 2 was location-based; 2023

market-based. (2) Represents Gender, Racial, and Ethnic Diversity. 17

Complementary Combination with Marel 18

S c O a p l e e r a a n t d i o R n i g a o l r d e t h n c e t l a a E m

T n n h U a n c G e r d o JBT and Marel: Aligned to Transform Food Processing and Fortify the Future of Food Customer Benefits Improved Increased Ease of Doing Aligned to Transform Outcomes Uptime Business the Way Food is Processed and Fortify the

Future Enabled by Purpose-Driven Talent Organization of Food Broad application Global service Innovating to solve Continuously knowledge and support customer pain points improving 19 P w t r h o f r i s t e p a m i b h o l t e s s n u o C i t p a S

e l e e u D R s t F a o i c n u a s b i l i t y

Creating a Leading Global Food & Beverage Technology Solutions Company

Markets: Greater end market participation in resilient and growing food & beverage markets 1 Solutions: Compelling platform to accelerate growth by offering broader solutions, utilizing 2 holistic application knowledge, and leveraging R&D

capabilities Service: Increased customer focus and aftermarket revenue opportunities as scale of global 3 sales and service network will improve customer care reach and service levels Digital: Complementary leading digital tools provide insights to

optimize and improve 4 customers’ operational efficiency, leading to reduced downtime events Sustainability: Greater collective impact on sustainability with innovative customer 5 solutions rooted in reducing waste, energy efficiency, and

improved food traceability Talent: Tremendous combined talent representing the best in the industry, with deep 6 knowledge in technology, markets, and applications across various end markets Scale: Enhanced operational scale expected to generate

meaningful value creation through operational efficiencies and cost synergies together with revenue synergies from cross- 7 selling, enhanced service, and an overall improved value proposition 20

Combined Company is Expected to Benefit from Resilient Growth Trends

Across Select Diverse End Markets Global Protein Global Convenience Global Ready-To-Drink Global Pet Food Consumption Food Market Beverage Market Market Mid-Single Mid-Single Mid-Single Low-to-Mid-Single Digits Digits+ Digits Digits 2023 –

2027 CAGR 2022– 2027 CAGR 2024 – 2029 CAGR 2023 – 2027 CAGR Forecast 5-year CAGR for global Estimated 5-year CAGR for the Expected 4-year CAGR of the Estimated 4-year CAGR of global convenience / ready-to-eat food global

ready-to-drink beverage global pet food market size, with protein consumption with durable market size with growth fueled by market size driven by constantly outsized growth expected in demand expected in a high-volume (1) (1) consumer lifestyles

and desire evolving flavor preferences and APAC and LATAM markets industry (1) (1) for time-saving solutions convenience (1) Euromonitor, Technavio, as well as JBT and Marel individual research. 21

Combined Company is Strategically Positioned to Capture Customer

Investment Trends, Enabling Growth Above GDP Company Vision ▪ Constantly changing demand driven by Ever Evolving preferences for various flavors, diets, sustainability, etc. Consumer ▪ Requires continuous new product Preferences

introductions ▪ Greater focus on processing efficiency Targeting Efficient and and lowering total cost of ownership Food and beverage mid-single-digit Sustainable ▪ Desire for technology that improves consumption drives Customer multiple

areas including yield, organic growth base level of automation, digital connectivity, and Operations through cycle sustainability investment ▪ Customers rely on partners who can Holistic provide integrated solutions for Solution equipment,

digital, and leading Requirements customer care 22

Complementary Core Technologies in Protein and Pet Food Processing Support

Broader Portfolio Offering for Customers Benefits of Fuller Solutions Primary processing Secondary Further End of line Cut-up, de-boning, Forming, coating, Handling, Killing, stunning, eviscerating, cooking, freezing, etc. packaging, etc. skinning,

portioning, etc. chilling, etc. ✓ Deeper portfolio of market leading Poultry technology, with advanced application (Illustrative) and process knowledge ✓ Ability to better address customer needs with line solutions that offer seamless

flow and efficiency ✓ Allows similar customer base to access Primary processing Further End of line Secondary broader solution set globally Food safety, inspection, Mixing, extrusion, filling, Cooking, Tray sealing, clipping & raw

material handling, etc. forming, etc. freezing, etc. packaging, etc. ✓ Utilize scaled combined service and Pet aftermarket support organization to Food improve performance and customer (Illustrative) uptime JBT equipment offering Marel

equipment offering JBT and Marel offerings 23

Greater Ability to Provide Leading Customer Care and Service Significant

Benefits for Customers ✓ ~1,700 service technicians globally to support aftermarket care for equipment and leases Enhanced ✓ Greater scale and density of resources enables increased capacity to service customers more Customer Care

frequently Capabilities ✓ Expanded aftermarket solutions provide ability to monitor and improve equipment maintenance and uptime for customers ✓ Newly built regional distribution centers improve lead times for key parts and services

24

Combined Software and Digital Ecosystems Optimize Customer Processing and

Profitability and Enhance Combined Company’s Aftermarket Opportunity Marel Software + OmniBlu : Complementary Paths to Digital Solutions That Meet Customer Needs Manufacturing Execution Process Machine Machine Health / System / Line Control

Control Performance Uptime Traceability Order & Food Safety Process Yield / Machine Predictive Aftermarket and Value Inventory & Quality Control & Throughput Vision / AI Maintenance e-commerce ✓ Expanded suite of solutions Chain

Management Assurance Optimization Monitoring Optimization Platform to meet customer needs Integration (OEE) Marel Software ✓ Streamlined development Manufacturing execution priorities from system (MES) for whole lines & facilities

complementary features JBT OmniBlu ✓ Increased scale to support Product-specific solutions to platform development and optimize asset maintenance maintenance & performance 25

Combination Will Provide Enhanced Scale & Profitable Growth (1) $

millions Pro Forma Combined Company 2025 Full Year 2023 (4) Expected Profile (Per S-4 Filing) Revenue $1,664 $1,876 $3,540 Diverse End Markets: Poultry 24% Poultry Poultry 48% 37% Top Order Categories ~$4 billion Beverages Meat 15% Meat 22% 16% (2)

(select top categories only) In estimated revenue Fruit & Veg 13% Seafood Seafood 12% 8% Ready Meals 11% Pet Food Beverages 9% 7% (3) Nearly 50% AGV Fruit & Veg 9% 0% 6% In expected recurring revenue Meat Pet Food 9% 0% 6% Pet Food 0% 3%

Seafood 0% ~16%+ 3% In expected adjusted EBITDA margin Revenue by Geography >100% 9% 10% 10% (5) Americas Estimated free cash flow (FCF) conversion 40% 25% EMEA 52% 38% 2 – 3x 66% 50% APAC (6) Expect to be within target leverage range by

year-end 2025 driven by strong expected FCF and expected improvement in adjusted EBITDA Figures may have immaterial difference due to rounding. (1) Marel figures are translated to U.S. dollars based on an average exchange rate of approximately 1.09

USD / EUR for the twelve months ended December 31, 2023. (2) Top order categories based on 2023 equipment orders by end market. Note that this list is not exhaustive and only represents select, top end markets. (3) AGV represents warehouse

automation category. (4) These projections were prepared by JBT management in connection with JBT's consideration of the transaction with Marel. Such projections are not necessarily predictive of actual future events and should not be relied upon as

such. For further information on these projections, please see the S-4. (5) Free cash flow conversion is defined as pro forma net income / pro forma free cash flow. (6) Pro forma leverage is estimated pro forma net debt / estimated pro forma TTM

adjusted 26 EBITDA and includes cost synergies during this timeframe.

Expect to Deliver Compelling Cost Synergies Direct Materials: ~$25 - $35M

▪ Supplier consolidation Anticipated Cost Synergies ▪ Best cost country sourcing ▪ Value add / value engineering >$125M Indirect: ~$15 - $25M Cost of Goods Sold: ▪ Logistics efficiencies (1) >$55M ▪ Spend

reduction ▪ Supplier consolidation and center-led programs ~$70M Plant & Other: ~$10M ▪ Operating footprint ▪ Factory flow optimization Sales and Marketing: ~$10 - $20M ▪ Streamline organizational structure ▪

Optimize consolidated spend Annual Run-Rate Savings Total Annual Run-Rate Savings Operating Expense: General & Administrative: ~$55 - $65M 12-Months Post-Close by End of Year 3 Post-Close (1) ▪ Certain back-office resource rationalization

>$70M Estimating ~65% in one-time costs to achieve ▪ Redundant systems, public company costs, and third-party contracts total expected annual run-rate cost synergies ▪ Optimize overlapping R&D programs (1) These estimated

synergies are based on mid-point of the expected ranges. 27

Opportunity to Generate Meaningful Revenue Synergies Potential Revenue

Uplift Serve as better partner for protein customers, offering integrated solutions and enhanced line coverage to drive our customer overall equipment effectiveness Leverage customer base with improved cross-selling through broader portfolio of

>$75M complementary equipment to deliver fuller solutions and reduce customer complexity by end of third year Utilize scale of combined company to create a platform to drive local growth, efficiency, and post-close at service density in LATAM

& APAC normal contribution Combining dry pet food and wet pet food processing expertise offers complete set of solutions margins and capabilities to customers Illustrative Equipment Opportunity: Target ~300 Protein Customers in the U.S. for

Secondary/Further Processing Cross-Selling Coating / Check Grinding Mixing Forming Cooking Freezing Inspection Packaging Frying Weighing CombiGrind SoftMix RevoPortioner S Stei tein n Stein Self GYRo X-Ray C Check heck ProSeal Tray Seal C Co oat

atiing ng L Liine ne Stacking Oven Compact W Weigher eigher Packaging Marel product JBT product 28

Formal Integration Office to Ensure Successful Execution and Synergy

Capture ▪ Thoughtful about creating a shared vision, purpose, and culture that respects both organizations Clearly Articulated ▪ Ensuring growth and customer-focused planning efforts are designed to strengthen the combined portfolio,

prioritize North Star long-term investments, and bolster innovation ▪ Joint leadership and decision-making through steering committee comprised of senior leaders from both organizations Senior Leadership and Board ▪ Steering committee

reports directly to the combined company’s Board of Directors to ensure alignment Involvement ▪ Expect to have a go-forward leadership team in place for day one readiness that will be responsible for implementing the integration plan

post-close ▪ Utilizing proven third-party advisors with a record of successful industrial integrations to provide processes, tools, Strong Support resources, and leadership support throughout the process Resources ▪ Dedicated internal

staff and external support to provide integration planning and execution ▪ Integration Management Office includes full-time representation of top executives from each company with track record of delivering results Best-In-Class Processes

▪ Integration design process based on best-in-class structures for synergy capture, organization and management, culture and purpose, and communications and change management 29

Marel Transaction Update JBT Shareholder ▪ On August 8, more than

99% of the shares voted at the special meeting were voted in favor of the issuance of JBT shares for the Marel transaction Vote ▪ Clearances obtained in the majority of jurisdictions Regulatory ▪ E.U. process remains ongoing with

clearance expected this year (no significant concerns identified to-date, Workstreams regulatory process is proceeding on customary E.U. timeline) ▪ Received FSA approval to extend the voluntary takeover offer as JBT and Marel continue to

pursue the required regulatory approvals to close the transaction Voluntary Takeover ▪ The voluntary takeover offer will expire on the earliest date to occur of either November 11, 2024, or three weeks Offer after the date all required

regulatory clearances are secured (unless such offer period is further extended in accordance with applicable laws and the terms of the definitive agreement between JBT and Marel) Nasdaq Iceland ▪ Submitted formal request in August to begin

the secondary listing process on Nasdaq Iceland Listing 30

Target Timeline for Marel Transaction May June July August September

October November December Q1 2025 Ongoing: Year-end 2024: Preparation and Regulatory review Target regulatory Regulatory submission of required approvals filings May 15: June 25: Filed preliminary S-4 went S-4 S-4 effective August 8: JBT JBT

stockholders Stockholder approved Marel transaction Vote Voluntary June 24: Year-end 2024: (1) Launched Acceptance period Takeover Target VTO closing VTO Offer (VTO) Nasdaq August: Year-end 2024: Submitted request Preparation and review of Nasdaq

Iceland application Target secondary Iceland to begin secondary listing approval listing process Listing Targeting to close transaction by year-end 2024, subject to receiving the remaining regulatory approvals, at least 90% of the outstanding Marel

shares being tendered by Marel shareholders, and satisfaction or waiver of other closing conditions (1) The voluntary takeover offer will expire on the earliest date to occur of either November 11, 2024, or three weeks after the date on which all

required regulatory clearances are secured, unless such offer period is further extended in accordance with applicable laws and the terms of the definitive agreement between JBT and Marel. 31

Appendix 32

Non-GAAP Financial Measures The non-GAAP financial measures presented in

this report may differ from similarly-titled measures used by other companies. The non-GAAP financial measures are not intended to be used as a substitute for, nor should they be considered in isolation of, financial measures prepared in accordance

with U.S. GAAP. ▪ EBITDA and Adjusted EBITDA: We define EBITDA as earnings before income taxes, interest expense and depreciation and amortization. We define Adjusted EBITDA as EBITDA before restructuring, pension expense other than service

cost, and M&A related costs. ▪ Adjusted income from continuing operations and Adjusted diluted earnings per share from continuing operations: We adjust earnings for restructuring expense, M&A related costs, which include integration

costs and the amortization of inventory step-up from business combinations, advisory and transaction costs for both potential and completed M&A transactions and strategy (“M&A related costs”), amortization of debt issuance costs

related to bridge financing for potential M&A transactions, and impact on tax provision from remeasurement of deferred taxes for material tax rate changes and internal reorganizations. ▪ Free cash flow: We define free cash flow as cash

provided by continuing operating activities, less capital expenditures, plus proceeds from sale of fixed assets and pension contributions. For free cash flow purposes, we consider contributions to pension plans to be more comparable to the payment

of debt, and therefore exclude these contributions from the calculation of free cash flow. 33

Reconciliation of JBT Income from Continuing Operations to Adjusted EBITDA

(In millions) TTM as of 6/30/24 Full Year 2023 Q2 2024 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Income from continuing operations $ 137.2 $ 129.3 $ 30.7 $ 22.7 $ 52.7 $ 31.1 $ 28.4 Income tax provision 15.1 23.5 (3.3) 8.1 5.7 4.6 8.6 Interest expense, net

(7.1) 10.9 (1.6) (2.8) (3.6) 0.9 7.1 Depreciation and amortization 89.4 91.3 22.2 22.1 22.0 23.1 23.5 EBITDA from continuing operations 234.6 255.0 48.0 50.1 76.8 59.7 67.6 (1) 9.4 11.4 0.2 1.1 1.7 6.4 2.5 Restructuring related costs (2) 2.3 0.7 1.0

1.0 0.1 0.2 0.2 Pension expense, other than service cost (3) 22.1 6.0 14.5 5.2 2.4 - 1.1 M&A related costs Adjusted EBITDA from continuing operations $ 268.4 $ 273.1 $ 63.7 $ 57.4 $ 81.0 $ 66.3 $ 71.4 Total revenue $ 1,642.8 $ 1,664.4 $ 402.3 $

392.3 $ 444.6 $ 403.6 $ 427.7 Adjusted EBITDA % 16.3% 16.4% 15.8% 14.6% 18.2% 16.4% 16.7% (1) Costs incurred as a direct result of the restructuring program are excluded because they are not part of the ongoing operations of the underyling business.

(2) Pension expense, other than service cost is excluded as it represents all non service-related pension expense, which consists of non-cash interestcost, expected return on plan assets and amortization of actuarial gains and losses. (3) M&A

related costs include integration costs, amortization of inventory step-up from business combinations, earn out adjustments to fair value, advisory and transaction costs for both potential and completed M&A transactions and strategy.

34

Reconciliation of JBT Cash Provided by Operating Activities to Free Cash

Flow Q2 2024 (In millions) YTD TTM Cash provided by operating activities $ 32.0 $ 43.6 Less: Capital expenditures 21.0 40.8 Plus: Proceeds from disposal of assets 0.9 2.5 Plus: Pension contributions 1.6 12.2 Plus: income taxes on gain from sale of

AeroTech - 133.2 Free cash flow $ 13.5 $ 150.7 Income from continuing operations $ 53.4 $ 137.2 Free cash flow % 25% 110% 35

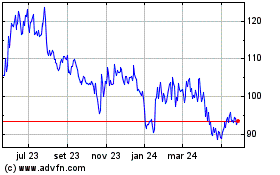

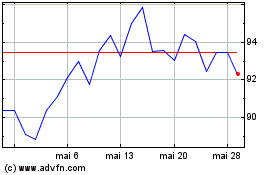

John Bean Technologies (NYSE:JBT)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

John Bean Technologies (NYSE:JBT)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024