1173 Coleman AvenueSan JoseCalifornia0001428439FALSE00014284392024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 23, 2024

ROKU, INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-38211 | 26-2087865 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

1173 Coleman Avenue San Jose, California | | 95110 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 556-9040

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class: | Trading Symbol(s): | Name of Exchange on Which Registered: |

| Class A Common Stock, $0.0001 par value | “ROKU” | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 23, 2024, the Compensation Committee of the Board of Directors of Roku, Inc. (“Roku”) approved changes to the terms of Roku’s Executive Supplemental Stock Option Program (as amended, the “Amended Program”). Pursuant to the Amended Program, employees at or above the level of Senior Vice President, including certain executive officers, other than Roku’s Chief Executive Officer (“Eligible Executives”), may elect on an annual basis to reduce their annual base salary for a given calendar year in exchange for a series of monthly grants of fully vested non-statutory stock options under Roku’s Amended and Restated 2017 Equity Incentive Plan (the “Plan”). The Amended Program will be effective commencing January 1, 2025, and will remain in effect until modified or revoked by the Board of Directors or the Compensation Committee.

An Eligible Executive may elect to participate in the Amended Program pursuant to an Executive Supplemental Stock Option Program Enrollment Form, which must be completed during the last open trading window in the calendar year immediately preceding the calendar year for which such election is made. An Eligible Executive may not change his or her annual election amount once the deadline for enrollment has passed. An Eligible Executive may not withdraw from the Amended Program, unless: (i) the withdrawal is during an open trading window, (ii) the Eligible Executive is not otherwise in possession of material, non-public information, and (iii) such withdrawal is due to an unforeseeable emergency. If an Eligible Executive withdraws, the Eligible Executive will not be able to re-enroll in the Amended Program for such calendar year, and must wait until the next enrollment period to enroll for the next calendar year.

The number of stock options granted under the Amended Program on a monthly basis will be determined based on the following formula: (i) the monthly dollar amount by which the Eligible Executive has elected to reduce their annual base salary divided by (ii) (a) the closing price of our Class A common stock as reported by The Nasdaq Global Select Market on the date of grant (the “Fair Market Value”) divided by (b) a factor intended to result in such quotient approximating a Black-Scholes value (the “Stock Option Ratio”), with the Stock Option Ratio in effect during a given calendar year as determined by the Board of Directors or the Compensation Committee from time to time, rounded down to the nearest whole share. For example, if an Eligible Executive elects to reduce his or her annual base salary by $20,000 per month and the Fair Market Value is $50.00, then the Eligible Executive will be granted an option to purchase the number of shares of our Class A common stock equal to: (i) $20,000 divided by (ii) (a) $50.00 divided by (b) the Stock Option Ratio, rounded down to the nearest whole share. The Compensation Committee reserves the right and intends to review and may adjust the Stock Option Ratio on an annual basis, prior to the annual acceptance of Executive Supplemental Stock Option Program Enrollment Form.

Each monthly stock option grant will be made on the first trading day of the month (contingent upon the Eligible Executive’s continued service as of the grant date); provided, however, if such date occurs within the period starting four business days before and ending one business day after Roku (i) files a periodic report on a Form 10-K or a Form 10-Q or (ii) files or furnishes a current report on a Form 8-K that discloses material nonpublic information (including earnings information), other than a current report on Form 8-K disclosing a material new stock option grant award under Item 5.02(e) (such period, the “Filing Period”), then the grant date will be the first trading day following expiration of the Filing Period in the applicable month. Each stock option will be fully vested on the grant date and will have an exercise price equal to the Fair Market Value. The stock options will be subject to the terms and conditions of the Plan and will be administered on a non-discretionary basis without further action by the Compensation Committee. The stock options will be exercisable for up to ten years following the grant date regardless of the employment status of the Eligible Executive.

The Executive Supplemental Stock Option Program Enrollment Form and the form of stock option grant notice and agreement substantially in the form of those to be used in connection with the Amended Program are filed as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The foregoing description does not purport to be complete and is qualified in its entirety by the terms of the exhibits.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | Exhibits. | |

| | | |

| Exhibit Number | Description | |

| | |

| 10.1 | |

| | |

| 10.2 | |

| | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Roku, Inc. |

| Dated: September 26, 2024 | |

| | By: | /s/ Dan Jedda |

| | | Dan Jedda |

| | | Chief Financial Officer |

«Employee_Name»

EXECUTIVE SUPPLEMENTAL STOCK OPTION PROGRAM

[____]1 ENROLLMENT FORM

Date: [_____]2

Roku, Inc. (“Roku”) believes in providing its employees at the stock level of Senior Vice President (“SVP”) (each, an “Executive”) with a choice as to how their compensation is structured. For calendar year [_____]3, Roku is offering you the opportunity to enroll in the Executive Supplemental Stock Option Program (the “Program”) pursuant to which you can elect to reduce your Eligible Cash Compensation (as noted below and as defined on Appendix A) in exchange for the grant of vested stock options under Roku’s Amended and Restated 2017 Equity Incentive Plan (the “2017 Plan”).

The terms and conditions of the Program are described in Appendix A to this Enrollment Form. A general summary of the terms of stock options is included in Appendix B. Such summary is meant to be general only. It is ultimately your responsibility to review the terms of your stock options as set forth in the 2017 Plan and the applicable stock option notice(s) and agreement(s). If there is a difference between the terms of this Enrollment Form, including its appendices, and the 2017 Plan or the applicable stock option notice(s) and agreement(s), the 2017 Plan and the applicable stock option notice(s) and agreement(s) will govern. It is ultimately your responsibility to consult your personal tax or financial planning advisor about the tax and financial consequences of your election.

To enroll in the Program, please check the applicable box below and enter a dollar value of your Eligible Cash Compensation that will be reduced in exchange for stock option grants.

Annual Cash Compensation: «Annual_Cash_Amount»

Eligible Cash Compensation: «Eligible_Cash_Comp_Amount»

☐ I hereby enroll in the Program and elect to reduce my Eligible Cash Compensation by $_____________ (the “Stock Option Allocation Amount”) in exchange for the grant of stock options pursuant to the terms of the Program.

☐ I hereby elect not to enroll in the Program.

Your election is irrevocable following the Deadline (as defined below), except as otherwise expressly provided in Appendix A to this Enrollment Form.

Please return the signed Enrollment Form to the Compensation Team at Roku by no later than 1:00 pm PST on [Day of the Week], [Month] [Day], [Year]4 (the “Deadline”). Your failure to return the signed Enrollment Form by the Deadline will be treated by Roku as your election not to enroll in the Program (i.e., your Annual Cash Compensation will not be reduced in exchange for the grant of stock options).

By signing below, I agree to the terms of the program as set forth in this enrollment form, including the terms in Appendix A and Appendix B to this enrollment form. I acknowledge and agree that my election is irrevocable following the Deadline, except as otherwise expressly provided in Appendix A to this Enrollment Form.

Accepted and Agreed:

_________________________

«Employee_Name»

_________________________

Date

1 Insert applicable Program year.

2 Insert distribution date (which will in any event be prior to the Deadline).

3 Insert applicable Program year.

4 Insert deadline to return Enrollment Form (generally late November of the calendar year immediately preceding the applicable Program year, but in no event later than December 31 of the calendar year immediately preceding the applicable Program year).

Appendix A

Terms and Conditions of the Executive Supplemental Stock Option Program

This Appendix A, which is part of the Enrollment Form, contains the terms and conditions of your participation in the Program. Capitalized terms used but not defined herein shall have the same meanings assigned to them in the 2017 Plan.

Eligible Cash Compensation and Impact of Enrollment

If you enroll in the Program, the dollar amount of your Eligible Cash Compensation will be reduced by an amount you elect (the “Stock Option Allocation Amount”) in exchange for the grant of vested stock options on a monthly basis. Your Eligible Cash Compensation is your gross annualized base salary expected to be paid in calendar year [_____]5 (your “Annual Cash Compensation”) less $[_____]6. In other words, you must take a minimum of $[_____]7 in annual base salary (payable in the amount of $[_____]8 each bi-weekly payroll period, less applicable taxes and deductions). Eligible Cash Compensation does not include any bonus payments, reimbursement for expenses or other one time and/or extraordinary cash or other compensatory payments.

Your enrollment in the Program will reduce the amount of your gross, before-tax, Annual Cash Compensation by the amount of your Stock Option Allocation Amount, resulting in an amount we refer to as your “Adjusted Annual Cash Compensation.” The bi-weekly pay period portion of the Stock Option Allocation Amount you select will not be deducted from each paycheck and will not appear as a line-item on your paystub.

For example, if your annual base salary is $500,000 and you elect a Stock Option Allocation Amount of $[_____]9 ($500,000 - $[_____]10):

Annual Cash Compensation: $500,000

Eligible Cash Compensation: $[_____]11

Stock Option Allocation Amount: $[_____]12

Adjusted Annual Cash Compensation: $[_____]13

Any Roku benefits that are normally determined based on your Annual Cash Compensation and/or deducted from each pay period will now be determined based on your Adjusted Annual Cash Compensation. For example, if you participate in Roku’s 401(k) plan, the calculation of your percentage of annual salary deferred under the 401(k) plan will be based on your Adjusted Annual Cash Compensation paid out in bi-weekly salary payments (in the example above, the 401k contribution would be calculated on $[_____]14). If you then elect to have 5% of your gross, before-tax annual salary deferred under the 401(k) plan, the 5% contribution rate would be based on the Adjusted Annual Cash Compensation of $[_____]15. The result would be that $[_____]16 rather than $25,000 (or such lesser amount up to the applicable 401(k) maximum annual contribution) would be deferred on a pre-tax basis under the 401(k) plan for [_____]17.

5 Insert applicable Program year.

6 Insert applicable Program year minimum salary.

7 Insert applicable Program year minimum salary.

8 Insert applicable Program year minimum salary, divided into bi-weekly installments.

9 Insert the difference between (i) $500,000 and (ii) the applicable Program year minimum salary.

10 Insert applicable Program year minimum salary.

11 Insert the difference between (i) $500,000 and (ii) the applicable Program year minimum salary.

12 Insert the difference between (i) $500,000 and (ii) the applicable Program year minimum salary.

13 Insert applicable Program year minimum salary.

14 Insert applicable Program year minimum salary.

15 Insert applicable Program year minimum salary.

16 Insert the product of (i) the applicable Program year minimum salary times (ii) 5%.

17 Insert applicable Program year.

If you receive an Annual Cash Compensation increase during [_____]18, that increase will be paid to you in addition to your Adjusted Annual Cash Compensation; it will not be added to your Eligible Cash Compensation under the Program. The amount you are electing for your Stock Option Allocation Amount is a flat amount that will not change for the Program year, except as otherwise set forth herein.

In addition, you should be aware of the impact to your take home pay on any benefit plan premiums you pay from each paycheck. The amount of Eligible Cash Compensation you direct to the Program (your Stock Option Allocation Amount) also will not be considered when calculating your life insurance, short-term disability, long-term disability, and workers’ compensation benefits. So please be sure to take all of this into account when determining your Stock Option Allocation Amount.

For purposes of Roku’s Amended and Restated Severance Benefit Plan, the term “Monthly Base Salary” will be determined based on your Annual Cash Compensation before reduction for your election under the Program.

Option Grants

Nonstatutory Stock Options (“NSOs”) will be granted on the Grant Date (as defined below) that occurs during the month following the month of your salary reduction. “Grant Date” means the first trading day of the applicable month; provided, however, if such date occurs within the period starting four business days before and ending one business day after Roku (i) files a periodic report on a Form 10-K or a Form 10-Q or (ii) files or furnishes a current report on a Form 8-K that discloses material nonpublic information (including earnings information), other than a current report on Form 8-K disclosing a material new option grant award under Item 5.02(e) (such period, the “Filing Period”), then the Grant Date will be the first trading day following expiration of the Filing Period in the applicable month. At the end of each month, we will calculate the amount of the monthly portion of your Stock Option Allocation Amount and convert that into a number of NSOs determined under the formula set forth below. NSOs will be fully vested when granted.

Process for Converting Monthly Portion of Stock Option Allocation Amount to Options:

(Stock Option Allocation Amount ÷ 12) ÷ (Closing Price on Grant Date ÷ [_])19

| | | | | | | | |

| Example of Executive Supplemental Stock Option Program | Notes |

| Annual Cash Compensation Amount | $500,000 | Base salary before election |

| Annual Gross Cash Payroll Amount | $66,560 | Minimum annual cash (paycheck) |

| Annual Stock Option Allocation Amount | $433,440 | Employee Election to Annual Stock Option Allocation (stock options) |

| Monthly Stock Option Allocation Amount | $36,120 | ($435,520 ÷ 12) |

| Grant Date | February 1, 2024 | First trading day of the month following expiration of any Filing Period |

| Closing Price on Grant Date | $50.0000 | Hypothetical ROKU Fair Market Value on Grant Date |

[*] Used for Calculation | TBD | ($50 ÷ [*]) * ratio is used to calculate stock option shares; approximately the black-scholes rate Roku applies to stock options |

| Monthly Grant Calculation | TBD | (Monthly + Carryover ÷ TBD) |

| Grant Details | | Fully vested on Grant Date |

| Grant Date | February 1, 2024 | First trading day of the month following expiration of any Filing Period |

Grant Price | $50.0000 | Hypothetical ROKU Fair Market Value on Grant Date |

| Fully Vested Shares Granted | TBD | Monthly grant of stock option |

| Fractional share | TBD | |

18 Insert applicable Program year.

19 The following table reflects 2024 Program year data. These tables will be updated for each Program year to reflect the applicable Program year minimum salary (and related sample calculations tied to the minimum salary), sample grant date, sample closing price and any ratio other than 1.8 that may be approved by the Compensation Committee from time to time.

| | | | | | | | |

| Carryover to next month | TBD | Dollar amount less than one full share |

| Stock Option Expiration | January 31, 2034 | 10 years minus one day |

Roku will not grant NSOs for a fractional share so the actual number of NSOs to be granted will be rounded down to the nearest whole share. The remaining dollar amount will be carried over to the next month and added to the amount of the monthly portion of Stock Option Allocation Amount for purposes of the option grant to be made for that month. Any Stock Option Allocation Amount not applied to the grant of an NSO due to the fractional share limitation by the end of [_____]20 will be refunded to you during the second regular payroll period in January [____]21.

Modifications and Withdrawal

Except as otherwise provided in this section, your election is irrevocable following the Deadline. After the Deadline, you will not be able to change your election amount. You will remain enrolled in the Program for all of calendar year [_____]22 unless (i) the withdrawal is during an open trading window, (ii) you are not otherwise in possession of material, non-public information, and (iii) such withdrawal is due to an “unforeseeable emergency,” as such term is used in Section 409A of the Internal Revenue Code of 1986, as amended, and the treasury regulations thereunder (“Section 409A”). In the case of an unforeseeable emergency, such withdrawal will take effect only to the extent necessary to satisfy the unforeseeable emergency, and any reference to a withdrawal in the Program will be deemed to mean a withdrawal only to such extent. If you withdraw from the Program, you will not be able to re-enroll in the Program for calendar year [_____]23. Your withdrawal from the Program will be effective beginning on the first payroll period in the month after you notify Roku of your withdrawal. For example, if you notify Roku of your intent to withdraw from the Program in June during the open trading window, the monthly portion of your Stock Option Allocation Amount will still apply for the month of June followed by a grant of NSOs on the Grant Date in July. Then, beginning with the first payroll period in July you will receive your prorated bi-weekly salary less applicable taxes and deductions (based on the reduced amount due to the unforeseeable emergency), plus any amount of cash from a fractional share carryover from a prior month.

If you elect to participate in the Program and, during the course of calendar year [_____]24 you: (i) move outside of the United States, (ii) are no longer on Roku’s payroll in the United States, or (iii) no longer have the stock level of SVP (clauses (i) through (iii), collectively, an “Employment Change”), you will no longer be eligible to participate in the Program and you will be automatically withdrawn from the Program. Your withdrawal will become effective as of the first payroll period in the month after the change in your status. For example, if you are no longer eligible to participate in the Program beginning in June, the monthly portion of your Stock Option Allocation Amount for June will still apply followed by a grant of NSOs on the Grant Date in July. Then, beginning with the first payroll period in July you will receive your full bi-weekly salary less applicable taxes and deductions, plus any amount of cash from a fractional share carryover from a prior month.

If your employment status with Roku changes from full-time to part-time or you take an unpaid leave of absence (an “Employment Reduction”), you will no longer be eligible to participate in the Program and you will be automatically withdrawn from the Program as of the effective date of the Employment Reduction. You will receive a cash salary payment, less applicable taxes and deductions, for the portion of your Stock Option Allocation Amount during the month of your Employment Reduction, to the extent such amount has already been deducted from your paycheck for such month, prorated for any partial month of active employment. You will not be eligible to receive a stock option grant for that month (other than a stock option grant previously made during such month in respect of your Stock Option Allocation Amount deducted from the prior month) or any subsequent month under the Program.

20 Insert applicable Program year.

21 Insert the year immediately following the applicable Program year.

22 Insert applicable Program year.

23 Insert applicable Program year.

24 Insert applicable Program year.

In the event your Annual Cash Compensation is reduced other than pursuant to an Employment Change or an Employment Reduction (a “Cash Reduction”) while you are a participant in the Program, a corresponding proportionate reduction to your Eligible Cash Compensation, Stock Option Allocation Amount and Adjusted Annual Cash Compensation under the Program (collectively with the Annual Cash Compensation, the “Program Compensation”) will be made automatically as of the effective date of the Cash Reduction; provided, however, in no event will your Adjusted Annual Cash Compensation be reduced below $[____]25. In the event of any such reduction, you will have no right with respect to any portion of the Program Compensation that is reduced in connection with such reduction, subject to applicable law; provided, however, that you will receive a cash salary payment, less applicable taxes and deductions, for the portion of your Stock Option Allocation Amount that will not be applied to stock options pursuant to the Program due to the Cash Reduction, to the extent such amount has already been deducted from your paycheck for such month.

Stock options previously granted to you under the Program (and otherwise) will remain exercisable for their remaining term as set forth in the applicable stock option grant documents, subject to Roku’s ability to take any of the actions set forth in the applicable stock option grant documents, including without limitation pursuant to Section 9(b) and/or Section 9(c) of the 2017 Plan.

Termination of Continuous Service

If your Continuous Service with Roku terminates for any reason during calendar year [_____]26, your enrollment in the Program will automatically terminate and you will receive a cash salary payment, less applicable taxes and deductions, for the portion of your Stock Option Allocation Amount during the month of your termination (prorated for any partial month). You will not be eligible to receive a stock option grant for that month (other than a stock option grant previously made during such month in respect of your Stock Option Allocation Amount deducted from the prior month) or any subsequent month under the Program. Stock options previously granted to you under the Program (and otherwise) will remain exercisable for their remaining term as set forth in the applicable stock option grant documents, subject to Roku’s ability to take any of the actions set forth in the applicable stock option grant documents, including without limitation pursuant to Section 9(b) and/or Section 9(c) of the 2017 Plan.

Additional Terms

You should be aware that Roku, in its discretion, may change or end the operation of the Program and/or the 2017 Plan at any time. If Roku decides to change or terminate the Program and/or the 2017 Plan, you will not have any claim against Roku to receive additional option grants or any other equity benefits equivalent to the option grant. You acknowledge that Roku is not obligated to continue to grant options, restricted stock units or any other equity awards to you. You also acknowledge that Roku is not obligated to offer the Program in any subsequent years.

Roku will administer the Program and will have discretionary authority to interpret and construe the terms and conditions of the Program and to adopt rules and regulations for administration of the Program. All determinations, interpretations and constructions made by Roku pursuant to such authority will be final and binding. The foregoing authority does not in any way supersede, diminish, replace or otherwise modify the authority of the Board, the Committee or an Officer, as applicable (each as defined in the 2017 Plan) to administer the 2017 Plan (and options granted pursuant to the Program) in accordance with the terms of the 2017 Plan.

Roku’s obligation under the Program shall be merely that of an unfunded and unsecured promise of Roku to issue NSOs in the future, and your rights will be no greater than those of unsecured general creditors. You and your heirs, successors, and assigns will have no legal or equitable rights, claims, or interest in any specific property or assets of Roku. No assets of Roku will be held under any trust or held in any way as collateral security for the fulfilling of the obligations of Roku under the Program. Any and all of Roku’s assets will be, and remain, the general unpledged, unrestricted assets of Roku.

25 Insert applicable Program year minimum salary.

26 Insert applicable Program year.

You have no right to commute, sell, assign, transfer, pledge, anticipate, mortgage or otherwise encumber, transfer, hypothecate, alienate or convey in advance of actual receipt, the amounts or NSOs, if any, payable or issuable hereunder, or any part thereof, which are, and all rights to which are expressly declared to be, unassignable and non-transferable. No part of the amounts payable or issuable will, prior to actual payment or issuance, be subject to seizure, attachment, garnishment (except to the extent Roku may be required to garnish amounts from payments due under the Program pursuant to applicable law) or sequestration for the payment of any debts, judgments, alimony or separate maintenance owed by you or any other person, be transferable by operation of law in the event of your or any other person’s bankruptcy or insolvency or be transferable to a spouse as a result of a property settlement or otherwise.

The terms and conditions of the Program will not be deemed to constitute a contract of employment or continued engagement between Roku or any of its affiliates and you. Nothing in the Program will be deemed to give you the right to be retained in the service of Roku or any of its affiliates or to interfere with the right of Roku or any of its affiliates to discipline or discharge you at any time for any or no reason, with or without notice (subject to applicable law). Your employment with Roku or any of its affiliates remains at will (subject to applicable law). In the event your compensation or regular level of employment with Roku is reduced (other than pursuant to an Employment Change, an Employment Reduction, or a Cash Reduction) while you are a participant in the Program, Roku has the right in its discretion to make a corresponding adjustment to your Program Compensation; provided, however, in no event will your Adjusted Annual Cash Compensation be reduced below $[_____]27.27In the event of any such adjustment, you will have no right with respect to any portion of the Program Compensation that is reduced in connection with such adjustment, subject to applicable law.

The Program is intended to be exempt from Section 409A to the maximum extent an exemption is available; provided, however, that to the extent an exemption under Section 409A is unavailable, the Program is intended to comply with the requirements of Section 409A. To the extent that any provision of the Program is ambiguous as to its exemption from or compliance with Section 409A, the provision will be read in such a manner that the applicable payments or issuances hereunder are exempt from Section 409A to the maximum permissible extent, and for any payments or issuances where such construction is not tenable, that those payments or issuances comply with Section 409A to the maximum permissible extent. You acknowledge and agree that Roku and its affiliates make no representations with respect to the application of Section 409A to any payment or issuance under the Program and other tax consequences to any payments under the Program.

You understand and agree that any option grant made pursuant to your participation in the Program will be subject to the terms of the 2017 Plan and your applicable award agreement and that this Enrollment Form is governed by the internal substantive laws of the State of Delaware, without regard to that state’s conflicts of laws rules. For purposes of any action, lawsuit or other proceedings brought to enforce this election, relating to it, or arising from it, the parties hereby submit to and consent to the sole and exclusive jurisdiction of the courts within Santa Clara County, State of California, and no other courts, where this election is made and/or to be performed.

The provisions of this Enrollment Form are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions shall nevertheless be binding and enforceable.

27 Insert applicable Program year minimum salary.

Appendix B

General Information About Nonstatutory Stock Options

This is general information only.

Roku does not give tax or financial advice; you must speak to your own tax or financial advisor

What is an Option?

An option is a right to buy Roku common stock at a specified price (exercise price). The exercise price will be the fair market value of a share of Roku common stock (equal to the closing Nasdaq price of Roku stock) on the Grant Date. As detailed below, upon exercise of the option, you become the owner of the shares of Roku common stock.

General requirements and restrictions

•Vesting - Options granted to you under the Program will be fully vested at grant.

•Exercise - You do not own shares of Roku common stock upon the grant of your vested options. To own such shares of Roku common stock, you must exercise the vested options.

•Expiration and Forfeiture - Options granted under the Program will have a maximum 10-year term and will be exercisable at any time during the option term even if you have terminated employment with Roku, subject to Roku’s ability to take any of the actions set forth in the applicable stock option grant documents, including without limitation pursuant to Section 9(b) and/or Section 9(c) of the 2017 Plan. Options not exercised during the term will automatically expire and will be automatically cancelled.

Taxes

If you enroll in the Program, you will not be subject to tax on the date the options are granted. Instead, you will be subject to ordinary income and withholding taxes on the date you exercise your options. The taxable income amount will be the excess of the fair market value of Roku common stock on the date of exercise over the option exercise price (i.e., the “spread”).

You may also be subject to capital gains tax at the time you sell any shares of Roku common stock acquired upon the exercise of the options, provided you sell the shares at a gain (i.e., the sale price is greater than the fair market value of the shares at the time of acquisition).

Please note that that you are solely responsible for all taxes associated with your stock options, even if Roku has an obligation to withhold (and does or does not withhold) applicable taxes at the time of exercise. Therefore, you should consult your personal accountant or tax advisor regarding the tax implications of any stock options granted to you. You should also refer to the tax sections of the prospectus for the 2017 Plan.

Tax obligations are complex and differ from state to state. Roku is not in a position to give tax advice to you and you should not rely on the above as anything else but general information.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

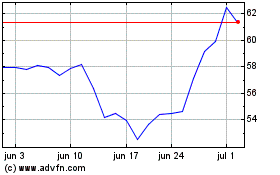

Roku (NASDAQ:ROKU)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

Roku (NASDAQ:ROKU)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024