Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

01 Outubro 2024 - 6:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

October, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras reports on operations

in South Africa

—

Rio de Janeiro, October 1,

2024 – Petróleo Brasileiro S.A. – Petrobras informs that its Board of Directors has approved the company's operations

in South Africa, enabling the acquisition of a stake in the Deep Western Orange Basin (DWOB) block, through a competitive process conducted

by TotalEnergies.

The DWOB block is located in deep

waters in the Orange Basin, where there have recently been significant discoveries by TotalEnergies, Shell and Galp.

As a result, Petrobras will have

a 10% stake in the DWOB block, and the consortium will have the following composition: TotalEnergies, operator (40%), QatarEnergy (30%),

Sezigyn Pty. (20%) and Petrobras (10%).

The purpose of the operation will

be to diversify the exploration portfolio with value generation and is in line with the company's long-term strategy, which aims to oil

and gas reserves replacement by exploring new frontiers, both in Brazil and abroad, and acting in partnership.

The acquisition of the DWOB block

in South Africa complies with all the company's internal processes and governance procedures, in line with its Strategic Plan 2024-2028+

and is subject to approval by local regulatory bodies.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 1, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

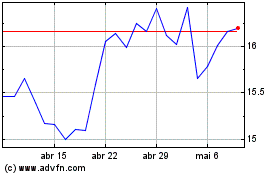

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024