false

0001145986

0001145986

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 16, 2024

________________________

Aspen Aerogels, Inc.

(Exact name of Registrant as Specified in Its Charter)

________________________

| Delaware |

001-36481 |

04-3559972 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

|

30 Forbes Road, Building B,

Northborough, MA |

|

01532 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (508) 691-1111

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol |

Name

of exchange on which registered |

| Common

Stock |

ASPN |

The New York Stock

Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 16, 2024, Aspen Aerogels, Inc. (the “Company”)

issued a press release containing certain preliminary financial information for the third quarter ended September 30, 2024. A copy of

the press release containing such announcement is attached hereto as Exhibit 99.1.

The information in the press release under the headings “Q3 2024

Preliminary Financial Results,” “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures”

together with the forward-looking disclaimer in the press release, is incorporated by reference into Item 2.02 of this Current Report

on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On October 16, 2024, the Company issued a press release containing recent developments with

its business and preliminary financial information for the third quarter ended September 30, 2024. A copy of the press release containing

such announcement is attached hereto as Exhibit 99.1.

Item 8.01 Other Events.

The Company today announced that it has received a conditional commitment from the U.S. Department

of Energy (“DOE”) for a proposed loan of up to $670.6 million under the Advanced Technology Vehicles Manufacturing loan program

within DOE’s Loan Programs Office for financing the construction of its planned second aerogel manufacturing facility in Register,

Georgia. Aspen Aerogels Georgia, LLC, a subsidiary of the Company, is the intended borrower of the loan. The loan would provide for repayment

commencing upon project commissioning. The interest rate will be the applicable U.S. Treasury Rate at the time of each cash draw. While

this conditional commitment indicates the DOE’s intent to finance the project, the DOE and the Company must satisfy certain technical,

legal, environmental, and financial conditions before the DOE enters into definitive financing documents and funds the loan.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The press release may contain hypertext links to information on the Company’s website.

The information on its website is not incorporated by reference into this Current Report on Form 8-K and does not constitute a part of

this Form 8-K.

The information contained in Item 2.02 and Item 7.01 of this Current Report on Form

8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that

Section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

Aspen Aerogels, Inc. |

| |

|

|

|

| Date: October 16, 2024 |

|

By: |

/s/ Ricardo C. Rodriguez |

| |

|

Name: |

Ricardo C. Rodriguez |

| |

|

Title: |

Chief Financial Officer and Treasurer |

Exhibit 99.1

For Immediate Release

Aspen Aerogels, Inc. Receives

Conditional Commitment for Proposed DOE Loan and Provides Q3 2024 Preliminary Financial Results

Proposed loan of up to $670.6 million would fund the remaining

CAPEX needed to complete Company’s second aerogel plant

Interest rate at applicable U.S. Treasury Rate at the time

of each cash draw

Plant is expected to provide ~$1.2B - $1.6B of incremental

PyroThin® thermal barrier revenue capacity

Project financing structure, with Aspen Aerogels, Inc.’s

subsidiary Aspen Georgia, LLC as the borrower

Q3 2024 revenue of $117 million drove $25 million of Adjusted

EBITDA

NORTHBOROUGH, Mass., October 16, 2024 — Aspen Aerogels, Inc. (NYSE: ASPN)

(“Aspen” or the “Company”), a technology leader in sustainability and electrification solutions, today announced

that it has received a conditional commitment from the U.S. Department of Energy (“DOE”) for a proposed loan of up to $670.6

million (the “Loan”) under the Advanced Technology Vehicles Manufacturing loan program within DOE’s Loan Programs Office

(“LPO”) for financing the construction of its planned second aerogel manufacturing facility (“Register Plant”)

in Register, Georgia. The Company also announced Q3 2024 preliminary financial results and details regarding its planned Q3 earnings conference

call.

Loan and Project Highlights:

| · | Aspen Aerogels Georgia, LLC, a subsidiary of Aspen Aerogels, Inc., is the intended borrower of the loan.

The loan would be structured as project financing, providing for repayment commencing upon project commissioning. |

| · | The interest rate will be the applicable U.S. Treasury Rate at the time of each cash draw. |

| · | The Register Plant is designed to manufacture PyroThin® aerogel blankets. Aspen’s PyroThin

platform offers ultrathin and lightweight thermal barriers designed to help prevent thermal runaway propagation - an event in which a

battery cell overheats and triggers neighboring cells, possibly resulting in a sudden fire - in batteries. Aspen’s PyroThin is designed

to offer a unique combination of thermal management, mechanical performance, and fire protection properties. Aerogel thermal barriers

have the potential to increase energy density of EV battery systems when compared to alternative thermal barrier products. |

| · | The Register Plant has an initial estimated revenue capacity of $1.2B - $1.6B, depending on product mix. |

| · | The Register Plant project is expected to create up to 550 construction jobs and 255 permanent, full-time

operations jobs. |

| · | The project aligns with the LPO’s mission of supporting U.S. manufacturing that will help enable

the growth of zero-emissions vehicles. |

“With this Conditional Commitment, we are pleased to announce that the proposed

loan would fully fund the required CAPEX for our second aerogel manufacturing facility, which is expected to play a key role in scaling

our PyroThin supply for our rapidly growing Thermal Barrier business,” noted Donald R. Young, Aspen's President and CEO. “We

believe that PyroThin, which can enable increased battery safety and performance, is a unique and differentiated product that solves an

important and challenging problem. The past 12 months have further validated these beliefs; we have increased our revenues to $232 million

in this segment, a 277% year-over-year increase1; secured additional EV production contracts, bringing us to a total of six

major OEMs in the United States and Europe; and, won a prestigious Automotive News Pace Award. We are also excited to further DOE’s

mission to onshore and re-shore domestic manufacturing technologies that are critical to meeting the current federal goal of having half

of all new vehicles sold in 2030 be zero-emissions vehicles. We want to thank the DOE Loan Programs Office for its continued support and

partnership throughout this process.”

Ricardo C. Rodriguez, Aspen’s Chief Financial Officer and Treasurer added, “Securing

the lowest cost of capital has been the top priority of our financing strategy. This proposed loan, and its terms, will provide us, if

finalized, with the opportunity to optimize our capital structure and capture the long-term opportunity that is in front of us. In the

meantime, we’ll continue maximizing our existing assets and resources to drive profitability."

While this conditional commitment indicates the DOE’s intent to finance

the project, the DOE and the Company must satisfy certain technical, legal, environmental, and financial conditions before the DOE enters

into definitive financing documents and funds the loan.

Learn more about Aspen’s thermal barrier solutions here (https://www.aerogel.com/industries/battery-thermal-barriers/).

1. 277% year-over-year revenue increase in Thermal Barrier revenue compares segment revenues

from the trailing twelve months ended June 30, 2024 to the trailing twelve months ended June 30, 2023.

Q3 2024 Preliminary Financial Results

The Company today announced the following select preliminary

results for the quarter ended September 30, 2024:

| · | Quarterly revenue of approximately $117 million. |

| · | Quarterly net loss of approximately $13 million, including a $27.5 million one-time

charge from the extinguishment of the Company’s convertible note on August 19, 2024. |

| · | Quarterly Adjusted EBITDA of approximately $25 million. |

Cash and cash equivalents were approximately $113 million as

of September 30, 2024.

A reconciliation of net income (loss) to Adjusted EBITDA is provided

in the financial schedules that are part of this press release. An explanation of this non-GAAP financial measure is also included below

under the heading "Non-GAAP Financial Measures."

Aspen's preliminary Q3 2024 financial results are based solely

on information currently available to management and are unaudited. This financial information does not represent a comprehensive statement

of Aspen's financial results for the quarter ended September 30, 2024 and remains subject to the completion of Aspen's financial closing

procedures and internal reviews. As a result, Aspen's actual results for the quarter ended September 30, 2024 may vary materially from

these preliminary estimates.

Q3 2024 Financial Results Conference Call and Webcast Notification

The Company has announced that Don Young, President & Chief

Executive Officer, and Ricardo C. Rodriguez, Chief Financial Officer & Treasurer, expect to discuss the Company's financial results

for the third quarter ended September 30, 2024, during a conference call scheduled for Thursday, November 7, 2024, at 8:30 a.m. ET. The

Company also expects to release financial results for the third quarter on Wednesday, November 6, 2024, after the market close.

Shareholders and other interested parties may participate in

the conference call by dialing +1 (833) 470-1428 (domestic) or +1 (929) 526-1599 (international) and referencing conference ID "921873”

a few minutes before 8:30 a.m. ET on Thursday, November 7, 2024. In addition, the conference call and an accompanying slide presentation

will be available live as a listen-only webcast hosted on the Investors section of Aspen’s website, www.aerogel.com.

A replay of the webcast will be available on the Investor Relations

section of the Aspen Aerogels website at www.aerogel.com, where it will remain available for approximately one year after the conference

call.

About Aspen Aerogels, Inc.

Aspen is a technology leader in sustainability and electrification

solutions. The Company's aerogel technology enables its customers and partners to achieve their own objectives around the global megatrends

of resource efficiency, e-mobility, and clean energy. Aspen's PyroThin® products enable solutions to thermal runaway challenges within

the electric vehicle ("EV") market. Aspen Battery Materials, the Company's carbon aerogel initiative, seeks to increase the

performance of lithium-ion battery cells to enable EV manufacturers to extend the driving range and reduce the cost of EVs. The Company's

Cryogel® and Pyrogel® products are valued by the world's largest energy infrastructure companies. Aspen's strategy is to partner

with world-class industry leaders to leverage its Aerogel Technology Platform® into additional high-value markets. Aspen is headquartered

in Northborough, Mass. For more information, please visit www.aerogel.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally

accepted accounting principles in the United States of America ("GAAP"), Aspen provides an additional financial metric that

is not prepared in accordance with GAAP ("non-GAAP"). The non-GAAP financial measure included in this press release is Adjusted

EBITDA. Management uses this non-GAAP financial measure, in addition to GAAP financial measures, as a measure of operating performance

because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Aspen's core

operating performance. In addition, management uses Adjusted EBITDA (i) for planning purposes, including the preparation of Aspen's annual

operating budget, (ii) to allocate resources to enhance the financial performance of its business, and (iii) as a performance measure

under its bonus plan.

Management believes that this non-GAAP financial measure reflects

Aspen's ongoing business in a manner that allows for meaningful comparisons and analysis of trends in its business, as it excludes expenses

and gains not reflective of Aspen's ongoing operating results or that may be infrequent and/or unusual in nature. Management also believes

that this non-GAAP financial measures provides useful information to investors in understanding and evaluating Aspen's operating results

and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer

companies. This non-GAAP measure may not be comparable to similarly titled measures presented by other companies.

The non-GAAP financial measure does not replace the presentation

of Aspen's GAAP financial results and should only be used as a supplement to, not as a substitute for, Aspen's financial results presented

in accordance with GAAP. In this press release, Aspen has provided a reconciliation of Adjusted EBITDA to net income (loss), the most

directly comparable GAAP financial measure. Management strongly encourages investors to review Aspen's financial statements and publicly

filed reports in their entirety and not rely on any single financial measure.

Special Note Regarding Forward-Looking and Cautionary Statements

This press release and any related discussion contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties that

could cause actual results to be materially different from historical results or from any future results expressed or implied by such

forward-looking statements. These statements are not historical facts but rather are based on Aspen’s current expectations, estimates

and projections regarding Aspen's business, operations and other factors relating thereto. Words such as "may," "will,"

"could," "would," "should," "anticipate," "predict," "potential," "continue,"

"expects," "intends," "plans," "projects," "believes," "estimates," "outlook,"

“assumes,” “targets,” “opportunity,” and similar expressions are used to identify these forward-looking

statements. Such forward-looking statements include statements regarding, among other things, Aspen’s expectation with respect to

the receipt and funding of the DOE loan, including satisfaction of certain technical, legal, environmental, and financial conditions before

the DOE enters into definitive financing documents and funds the loan; Aspen’s expectation with respect to the ability of the DOE

loan to fully fund Aspen’s remaining CAPEX needed to complete the Register Plant; Aspen’s beliefs and expectations about the

EV market and how it may enable a path to profitability; Aspen’s expectations with respect to the construction of the planned Register

Plant; Aspen’s expectation and beliefs about thermal barrier revenue capacity, revenue creation from the Register Plant and creation

of jobs from the construction and operation of the Register Plant; and Aspen’s expectations and beliefs regarding the use of proceeds

from the DOE loan facility, the flexibility and efficiency of the facility, the future cost of capital and availability of liquidity,

and potential future sources of capital. All such forward-looking statements are based on management’s present expectations and

are subject to certain factors, risks and uncertainties that may cause actual results, outcome of events, timing and performance to differ

materially from those expressed or implied by such statements. These risks and uncertainties include, but are not limited to, the following:

inability to close on the DOE loan facility and/or receive funding from the DOE loan, inability to execute Aspen’s growth plan,

including with respect to construction of the Register Plant, creation of revenue capacity, revenue and jobs resulting from the construction

and operation of the Register Plant, inability to construct the Register Plant and to do so at a cost consistent with Aspen’s estimates

and aligned with Aspen’s expectations of demand from our EV customers; the right of EV thermal barrier customers to cancel contracts

with Aspen at any time and without penalty; any costs, expenses, or investments incurred by Aspen in excess of projections used to develop

pricing under the contracts with EV thermal barrier customers; Aspen’s inability to create customer or market opportunities for

its products; any disruption or inability to achieve expected capacity levels in any of its manufacturing or assembly facilities; any

failure to enforce any of Aspen’s patents; the general economic conditions and cyclical demands in the markets that Aspen serves;

and the other risk factors discussed under the heading “Risk Factors” in Aspen’s Annual Report on Form 10-K for the

year ended December 31, 2023 and filed with the Securities and Exchange Commission (“SEC”) on March 7, 2024, as well as any

updates to those risk factors filed from time to time in Aspen’s subsequent periodic and current reports filed with the SEC. All

statements contained in this press release are made only as of the date of this press release. Aspen does not intend to update this information

unless required by law.

Investor Relations Contacts:

Neal Baranosky

ir@aerogel.com

Phone: (508) 691-1111 x 8

Georg Venturatos / Ralf Esper

Gateway Group

ASPN@gateway-grp.com

Phone: (949) 574-3860

Media Contacts:

Hugh Burns / Pamela Greene

Reevemark

AspenAerogelsTeam@Reevemark.com

Phone: (212) 433-4600

Reconciliation of Non-GAAP Financial Measures

The following tables present a reconciliation of the non-GAAP financial measure included in

this press release to the most directly comparable GAAP measure:

Reconciliation of Adjusted EBITDA to Net income (loss)

We define Adjusted EBITDA as net income (loss) before interest expense, taxes, depreciation,

amortization, stock-based compensation expense and other items, which occur from time to time and which we do not believe are indicative

of our core operating performance.

For the three months ended September 30, 2024 and 2023:

| | |

Three Months Ended |

| | |

September

30, |

| | |

2024 | |

2023 |

| | |

(In millions) |

| Net income (loss) | |

$ | (13 | ) | |

$ | (13 | ) |

| Depreciation and amortization | |

| 5 | | |

| 5 | |

| Stock-based compensation | |

| 3 | | |

| 3 | |

| Other expense (income) | |

| 3 | | |

| (2 | ) |

| Loss on extinguishment of debt | |

| 27 | | |

| - | |

| Adjusted EBITDA | |

$ | 25 | | |

$ | (7 | ) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

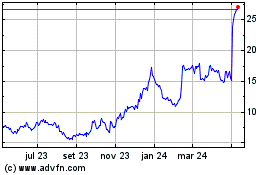

Aspen Aerogels (NYSE:ASPN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

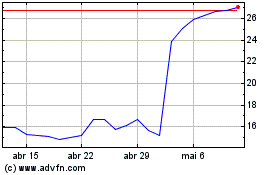

Aspen Aerogels (NYSE:ASPN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024