Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Outubro 2024 - 12:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

October, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

FPSO Marechal

Duque de Caxias initiates pre-salt production

—

Rio de Janeiro, October 30, 2024 –

Petróleo Brasileiro S.A. - Petrobras communicates that FPSO Marechal Duque de Caxias (Mero 3) has initiated today production

operations in the Mero field, located in the pre-salt Santos Basin. The unit has the capacity to produce up to 180,000 barrels of oil

per day and compress up to 12 million cubic meters of gas daily. The FPSO unit will increase Mero’s installed production capacity

from 410,000 to 590,000 barrels of oil per day.

The unit is part of Mero’s fourth

production system and was chartered from MISC. Altogether, there will be 15 wells – 8 producer wells and 7 water and gas injection

wells – interconnected to the platform through an undersea infrastructure. The FPSO Pioneiro de Libra and two definitive systems

- FPSO Guanabara (Mero 1) and FPSO Sepetiba (Mero 2) - are already operating in the field.

The Marechal Duque de Caxias platform

will utilize innovative technologies to decarbonize and increase production, such as HISEP®, expected to be operational as of 2028.

This equipment will separate oil from the gas right at the bottom of the ocean, reinjecting the CO2-rich gas into the reservoir. As a

result, it will be possible to free up space in the surface gas processing plant and reduce greenhouse gases released into the atmosphere.

The operations of the unitized Mero field

are conducted by the consortium members of the Libra Production Sharing Contract - operated by Petrobras (38.6%), in partnership with

Shell Brasil (19.3%), TotalEnergies (19.3%), CNOOC (9.65%), CNPC (9.65%) and Pré-Sal Petróleo S.A (PPSA), which in addition

to managing the contract, acts as the Federal Government's representative in the non-contracted area (3.5%).

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valladares 28 – 9º andar –

20031-030 – Rio de Janeiro, RJ

Phone: 55 (21) 3224-1510/9947

This document may contain forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Exchange Act of 1934, as amended (Exchange Act), which only reflect the expectations of the Company's management. The terms “anticipates,”

“believes,” “expects,” “foresees,” “intends,” “plans,” “projects,”

“aims,” “should,” as well as other similar terms, are intended to identify such forward-looking statements, which

inherently involve risks or uncertainties, whether foreseen or not by the Company. Therefore, the future results of the Company's operations

may differ from current expectations, and the reader should not rely solely on the information contained herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 30, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

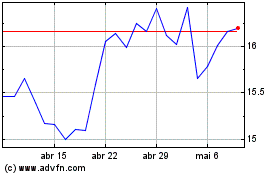

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024