UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

October, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras informs about collective

action judgement in the Netherlands

—

Rio de Janeiro, October 30th

2024 - Petróleo Brasileiro S.A. - Petrobras, further to the Announcements to the Market of January 29th 2020, May

27th 2021 and July 26th 2023, hereby informs that the District Court of Rotterdam ("Court") today handed

down a favorable judgment on its main arguments in the collective action filed by the Stichting Petrobras Compensation Foundation ("Foundation")

against the Company, Petrobras Global Finance B.V. (“PGF”) and several defendants.

In the collective action, the Foundation

claims that it represents the interests of investors not included in the US class action settlement announced by Petrobras in 2018 and

is seeking a declaration that Petrobras acted illegally towards these investors.

In its judgement, the Court broadly accepted

Petrobras' arguments regarding the claims in the interest of Company’s shareholders and considered that:

- Under Brazilian law, all the damages

alleged by the Foundation qualify as indirect and cannot be compensated.

- Under Argentinian law, shareholders

cannot, in principle, claim compensation from the company for the damages alleged by the Foundation, and the Foundation has not demonstrated

that it represents a sufficient number of investors who could, in theory, make such a claim.

The Court therefore rejected the Foundation's

claims under Brazilian and Argentinian law, resulting in the rejection of all claims made in favour of shareholders.

With regard to certain bondholders,

the Court found that Petrobras and PGF acted illegally under Luxembourg law, while PGF acted illegally with regard to Dutch law.

In addition, the Court confirmed the following

points of the decision announced to the market on July 26th 2023:

- Rejection of the allegations against

Petrobras International Braspetro B.V. (PIBBV), Prime Oil & Gas BV (POG BV) and the former CEOs of Petrobras, Maria das Graças

Silva Foster and José Sérgio Gabrielli de Azevedo.

- Prescription of claims made under Spanish

law.

Even with regard to bondholders,

the Foundation will not be able to claim compensation for damages within the scope of the collective action. Any compensation can only

be claimed in new lawsuits to be filed by or on behalf of such investors, who would need to prove all the elements necessary for Petrobras

and PGF to be held liable. Should this happen, Petrobras will defend itself vigorously.

The decision is subject to appeal.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

E-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares 28 – 9th floor –

20031-030 – Rio de Janeiro, RJ.

Phone: 55 (21) 3224-1510/9947

This document may contain forecasts within the meaning

of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended

(Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects",

"predicts", "intends", "plans", "projects", "aims", "should," and similar

terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future

results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included

herein.

According to note 14.4.1 of the 2Q24 Financial

Statements, Petrobras has no information to project a reliable estimate of the potential loss resulting from this lawsuit, which will

depend on any subsequent legal actions. The company, based on the assessments of its advisors, considers that there are not enough indicative

elements to qualify the universe of potential beneficiaries, nor to quantify the supposedly indemnifiable damages. Therefore, it is not

possible to predict at this time whether the company will be responsible for the actual payment of compensation in any future individual

actions, as this analysis will depend on the outcome of complex procedures. Furthermore, it is not possible to know which investors will

be able to file subsequent individual actions related to this matter against Petrobras.

Petrobras continues to deny the Foundation's

allegations, for which it has been considered a victim by all Brazilian authorities, including the Supreme Court.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

E-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares 28 – 9th floor –

20031-030 – Rio de Janeiro, RJ.

Phone: 55 (21) 3224-1510/9947

This document may contain forecasts within the meaning

of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended

(Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects",

"predicts", "intends", "plans", "projects", "aims", "should," and similar

terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future

results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included

herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 30, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

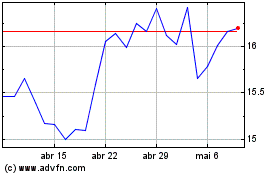

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024