false000107553100010755312024-10-302024-10-300001075531us-gaap:CommonStockMember2024-10-302024-10-300001075531bkng:A0100SeniorNotesDue2025Member2024-10-302024-10-300001075531bkng:A4000SeniorNotesDue2026Member2024-10-302024-10-300001075531bkng:A1.8SeniorNotesDueMarch2027Member2024-10-302024-10-300001075531bkng:A05SeniorNotesDueMarch2028Member2024-10-302024-10-300001075531bkng:A3625SeniorNotesDue2028Member2024-10-302024-10-300001075531bkng:A4250SeniorNotesDue2029Member2024-10-302024-10-300001075531bkng:A3.500SeniorNotesDueMarch2029Member2024-10-302024-10-300001075531bkng:A450SeniorNotesDue2031Member2024-10-302024-10-300001075531bkng:A3.625SeniorNotesDueMarch2032Member2024-10-302024-10-300001075531bkng:A4125SeniorNotesDue2033Member2024-10-302024-10-300001075531bkng:A4750SeniorNotesDue2034Member2024-10-302024-10-300001075531bkng:A3.750SeniorNotesDueMarch2036Member2024-10-302024-10-300001075531bkng:A4.000SeniorNotesDueMarch2044Member2024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 30, 2024

Booking Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-36691 | | 06-1528493 |

(State or other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 800 Connecticut Avenue | Norwalk | Connecticut | | 06854 |

| (Address of principal executive offices) | | (zip code) |

Registrant's telephone number, including area code: (203) 299-8000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class: | | Trading Symbol | | Name of Each Exchange on which Registered: |

| Common Stock par value $0.008 per share | | BKNG | | The NASDAQ Global Select Market |

| | | | |

| 0.100% Senior Notes Due 2025 | | BKNG 25 | | The NASDAQ Stock Market LLC |

| 4.000% Senior Notes Due 2026 | | BKNG 26 | | The NASDAQ Stock Market LLC |

| 1.800% Senior Notes Due 2027 | | BKNG 27 | | The NASDAQ Stock Market LLC |

| 0.500% Senior Notes Due 2028 | | BKNG 28 | | The NASDAQ Stock Market LLC |

| 3.625% Senior Notes Due 2028 | | BKNG 28A | | The NASDAQ Stock Market LLC |

| 4.250% Senior Notes Due 2029 | | BKNG 29 | | The NASDAQ Stock Market LLC |

| 3.500% Senior Notes Due 2029 | | BKNG 29A | | The NASDAQ Stock Market LLC |

| 4.500% Senior Notes Due 2031 | | BKNG 31 | | The NASDAQ Stock Market LLC |

| 3.625% Senior Notes Due 2032 | | BKNG 32 | | The NASDAQ Stock Market LLC |

| 4.125% Senior Notes Due 2033 | | BKNG 33 | | The NASDAQ Stock Market LLC |

| 4.750% Senior Notes Due 2034 | | BKNG 34 | | The NASDAQ Stock Market LLC |

| 3.750% Senior Notes Due 2036 | | BKNG 36 | | The NASDAQ Stock Market LLC |

| 4.000% Senior Notes Due 2044 | | BKNG 44 | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 30, 2024, Booking Holdings Inc. announced its financial results for the third quarter ended September 30, 2024. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Copies of Booking Holdings' consolidated balance sheet at September 30, 2024, consolidated statement of operations for the three and nine months ended September 30, 2024, and consolidated statement of cash flows for the nine months ended September 30, 2024, are included in the financial and statistical supplement attached to the press release.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | Description | | | |

| | | | |

| Press release (which includes a financial and statistical supplement and related information) issued by Booking Holdings Inc. on October 30, 2024 relating to, among other things, its third quarter 2024 earnings. | | | |

| 104 | Cover Page Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOOKING HOLDINGS INC. |

| | |

| | | |

| | By: | /s/ Ewout L. Steenbergen |

| | | Name: | Ewout L. Steenbergen |

| | | Title: | Executive Vice President and Chief Financial Officer |

Date: October 30, 2024

Exhibit 99.1

Booking Holdings Reports Financial Results for 3rd Quarter 2024

NORWALK, CT – October 30, 2024. . . Booking Holdings Inc. (NASDAQ: BKNG) (the "Company," "we," "our," or "us") today reported its third quarter 2024 financial results:

•Room nights booked increased 8% from the prior-year quarter.

•Gross travel bookings, which refers to the total dollar value, generally inclusive of taxes and fees, of all travel services booked by our customers, net of cancellations, were $43.4 billion, an increase of 9% from the prior-year quarter.

•Total revenues were $8.0 billion, an increase of 9% from the prior-year quarter.

•Net income was $2.5 billion, which was in line with the prior-year quarter.

•Net income per diluted common share (EPS) was $74.34, an increase of 7% from the prior-year quarter.

•Adjusted Net income was $2.8 billion, an increase of 9% from the prior-year quarter.

•Adjusted Net income per diluted common share (Adjusted EPS) was $83.89, an increase of 16% from the prior-year quarter.

•Adjusted EBITDA was $3.7 billion, an increase of 12% from the prior-year quarter.

During the quarter, the Company recorded a $365 million accrual related to the proposed settlement of certain Italian indirect tax matters, which has been excluded from Adjusted Net income and Adjusted EBITDA. In addition, the Company recorded a reduction of $250 million to income tax expense based upon a recent U.S. Tax Court decision, which has been excluded from Adjusted Net income. For more information regarding these matters, see Notes 11 and 13 to the Unaudited Consolidated Financial Statements to be filed with the Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

The section below under the heading "Non-GAAP Financial Measures" provides definitions and information about the use of non-GAAP financial measures in this press release, including Adjusted Net income, Adjusted EPS, and Adjusted EBITDA, and the attached financial and statistical supplement reconciles non-GAAP financial results with Booking Holdings' financial results under GAAP.

"We are pleased to report third quarter room night growth of 8%, which exceeded our prior expectations, driven primarily by stronger performance in Europe," said Glenn Fogel, Chief Executive Officer of Booking Holdings. "We continue to make progress against our strategic initiatives while driving cost efficiency in our business, which I believe will position our company well for the long term."

Fourth Quarter Dividend

Our Board of Directors declared a cash dividend of $8.75 per share, payable on December 31, 2024, to stockholders of record as of the close of business on December 6, 2024.

Non-GAAP Financial Measures

The Unaudited Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") and include all normal and recurring adjustments that management of the Company considers necessary for a fair presentation of its financial position and operating results.

To supplement the Unaudited Consolidated Financial Statements, the Company uses the following non-GAAP financial measures: Adjusted Net income (loss), Adjusted EPS, Adjusted EBITDA, and Free cash flow (Net cash provided by (used in) operating activities less capital expenditures). The Company also uses information on (i) the impact of the adjustments required to compute Adjusted Net income (loss) and Adjusted EBITDA on Sales and other expenses, General and administrative expenses, Depreciation and amortization expenses, Interest and dividend income, Other income (expense), net, and Income tax expense, as reported in the Company's consolidated statements of operations, as applicable, and (ii) Adjusted fixed operating expenses, which is Total operating expenses, as reported in the Company's consolidated statements of operations, adjusted to exclude (a) certain operating expenses which are generally more likely to vary based on changes in business volumes and (b) amounts which are excluded in the computation of Adjusted EBITDA. The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

The Company uses non-GAAP financial measures for financial and operational decision-making and as a basis to evaluate performance and set targets for employee compensation programs. The Company believes that these non-GAAP financial measures are useful for analysts and investors to evaluate the Company's ongoing operating performance because they facilitate comparison of the Company's results for the current period and projected next-period results to those of prior periods and to those of its competitors (though other companies may calculate similar non-GAAP financial measures differently from those calculated by the Company). These non-GAAP financial measures, in particular Adjusted Net income (loss), Adjusted EBITDA and Free cash flow, are not intended to represent funds available for Booking Holdings' discretionary use and are not intended to represent or to be used as a substitute for Operating income (loss), Net income (loss) or Net cash provided by (used in) operating activities as measured under GAAP. The items excluded from these non-GAAP measures, but included in the calculation of their closest GAAP equivalent, are significant components of the Company's consolidated statements of operations and cash flows and must be considered in performing a comprehensive assessment of overall financial performance.

Adjusted Net income (loss) is Net income (loss) with the following adjustments:

•excludes accruals related to the Netherlands pension fund matter (recorded during the year ended December 31, 2023),

•excludes accruals related to the fine imposed by the Spanish competition authority,

•excludes accruals related to settlements of certain indirect tax matters,

•excludes the termination fee related to an acquisition agreement,

•excludes amortization expense of intangible assets,

•excludes gains and losses on equity securities with readily determinable fair values,

• excludes the impact, if any, of significant gains and losses on the sale of and impairment and credit losses on investments in available-for-sale debt securities and significant gains and losses on the sale of and impairment and other valuation adjustments on investments in equity securities without readily determinable fair values,

•excludes foreign currency transaction gains and losses on the remeasurement of Euro-denominated debt and accrued interest that are not designated as hedging instruments for accounting purposes and debt-related foreign currency derivative instruments used as economic hedges,

•excludes accruals related to the Canadian digital services taxes for the years ended December 31, 2022 and 2023 enacted in June 2024 with retrospective effect,

•excludes interest received on tax payments refunded pursuant to settlement with authorities,

•excludes adjustments to the one-time deemed repatriation income tax liability resulting from the U.S. Tax Cuts and Jobs Act ("Tax Act") enacted in December 2017,

•excludes the impact of net unrecognized tax benefits related to certain income tax matters, and

• the income tax impact of the non-GAAP adjustments mentioned above and changes in tax estimates, as applicable.

In the event the Company reports a GAAP Net income but an Adjusted Net loss, dilutive shares that are included in the GAAP weighted-average number of diluted common shares outstanding are excluded from the non-GAAP weighted-average number of diluted common shares outstanding. In the event the Company reports a GAAP Net loss but an Adjusted Net income, anti-dilutive shares that are excluded from the GAAP weighted-average number of diluted common shares outstanding are included in the non-GAAP weighted-average number of diluted common shares outstanding.

In addition to the adjustments listed above regarding Adjusted Net income (loss), Adjusted EBITDA excludes depreciation expense, interest expense, and to the extent not included in the adjustments listed above, interest and dividend income, and income tax expense (benefit).

We evaluate certain operating and financial measures on both an as-reported and constant-currency basis. We calculate constant currency based on the predominant transactional currency in each country, converting our current-year period results in currencies other than U.S. Dollars using the corresponding prior-year period monthly average exchange rates.

The attached financial and statistical supplement includes reconciliations of our financial results under GAAP to non-GAAP financial information for the three and nine months ended September 30, 2024 and 2023. We are not able to provide a reconciliation between forward-looking Adjusted EBITDA and GAAP Net income (loss) because we cannot predict certain components of such reconciliation without unreasonable effort as they arise from events in future periods.

Information About Forward-Looking Statements

This press release contains forward-looking statements, which reflect the views of the Company's management regarding current expectations based on currently available information about future events. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, such as: adverse changes in market conditions for travel services; the effects of competition; the Company's ability to manage growth and expand; adverse changes in relationships with third parties on which the Company depends; success of the Company's marketing efforts; rapid technological and other market changes; the Company's ability to attract and retain qualified personnel; impacts of impairments and changes in accounting estimates; and other business and industry changes. Other risks and uncertainties relate to cyberattacks and information security; taxes; laws and regulations; the Company's facilitation of payments; foreign currency exchange rates; the Company's debt levels and stock price volatility; and the success of the Company's investments and acquisition strategy. For a detailed discussion of these and other risk factors that could cause the Company's actual results to differ materially from those described in the forward-looking statements included in this press release, refer to the Company's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any subsequently filed Quarterly Reports on Form 10-Q. Unless required by law, the Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

We will be posting our prepared remarks and a summary earnings presentation to the Booking Holdings investor relations website after the conclusion of the earnings call.

About Booking Holdings Inc.

Booking Holdings (NASDAQ: BKNG) is the world's leading provider of online travel and related services, provided to consumers and local partners in more than 220 countries and territories through five primary consumer-facing brands: Booking.com, Priceline, Agoda, KAYAK and OpenTable. The mission of Booking Holdings is to make it easier for everyone to experience the world. For more information, visit BookingHoldings.com and follow us on X @BookingHoldings.

###

For Press Information: Leslie Cafferty communications@bookingholdings.com

For Investor Relations: John Longstreet ir@bookingholdings.com

#BKNG_Earnings

Booking Holdings Inc.

CONSOLIDATED BALANCE SHEETS

(In millions, except share and per share data)

| | | | | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| | (Unaudited) | | |

| | |

| | | | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 15,775 | | | $ | 12,107 | |

Short-term investments (Available-for-sale debt securities:

Amortized cost of $580 at December 31, 2023) | | — | | | 576 | |

| Accounts receivable, net (Allowance for expected credit losses of $131 and $137, respectively) | | 3,649 | | | 3,253 | |

| Prepaid expenses, net | | 490 | | | 644 | |

| Other current assets | | 615 | | | 454 | |

| Total current assets | | 20,529 | | | 17,034 | |

| Property and equipment, net | | 882 | | | 784 | |

| Operating lease assets | | 600 | | | 705 | |

| Intangible assets, net | | 1,450 | | | 1,613 | |

| Goodwill | | 2,838 | | | 2,826 | |

| Long-term investments | | 500 | | | 440 | |

| Other assets, net | | 1,179 | | | 940 | |

| Total assets | | $ | 27,978 | | | $ | 24,342 | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 4,065 | | | $ | 3,480 | |

| Accrued expenses and other current liabilities | | 5,287 | | | 4,635 | |

| Deferred merchant bookings | | 4,907 | | | 3,254 | |

| Short-term debt | | 2,419 | | | 1,961 | |

| Total current liabilities | | 16,678 | | | 13,330 | |

| Deferred income taxes | | 191 | | | 258 | |

| Operating lease liabilities | | 508 | | | 599 | |

| Long-term U.S. transition tax liability | | 257 | | | 515 | |

| Other long-term liabilities | | 204 | | | 161 | |

| Long-term debt | | 13,793 | | | 12,223 | |

| Total liabilities | | 31,631 | | | 27,086 | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders' deficit: | | | | |

Common stock, $0.008 par value, Authorized shares: 1,000,000,000 Issued shares: 64,265,798 and 64,048,000, respectively | | — | | | — | |

Treasury stock: 31,089,462 and 29,650,351 shares, respectively | | (46,734) | | | (41,426) | |

| Additional paid-in capital | | 7,635 | | | 7,175 | |

| Retained earnings | | 35,749 | | | 31,830 | |

| Accumulated other comprehensive loss | | (303) | | | (323) | |

| Total stockholders' deficit | | (3,653) | | | (2,744) | |

| Total liabilities and stockholders' deficit | | $ | 27,978 | | | $ | 24,342 | |

Booking Holdings Inc.

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | |

| Merchant revenues | | $ | 4,972 | | | $ | 3,945 | | | $ | 10,806 | | | $ | 8,467 | |

| Agency revenues | | 2,753 | | | 3,135 | | | 6,660 | | | 7,346 | |

| Advertising and other revenues | | 269 | | | 261 | | | 802 | | | 768 | |

| Total revenues | | 7,994 | | | 7,341 | | | 18,268 | | | 16,581 | |

| Operating expenses: | | | | | | | | |

| Marketing expenses | | 2,151 | | | 2,022 | | | 5,700 | | | 5,340 | |

| Sales and other expenses | | 872 | | | 807 | | | 2,370 | | | 2,094 | |

Personnel, including stock-based compensation of $148, $128, $432, and $369, respectively | | 868 | | | 788 | | | 2,501 | | | 2,262 | |

| General and administrative | | 575 | | | 305 | | | 873 | | | 821 | |

| Information technology | | 194 | | | 187 | | | 564 | | | 468 | |

| Depreciation and amortization | | 155 | | | 129 | | | 434 | | | 370 | |

| | | | | | | | |

| | | | | | | | |

| Total operating expenses | | 4,815 | | | 4,238 | | | 12,442 | | | 11,355 | |

| Operating income | | 3,179 | | | 3,103 | | | 5,826 | | | 5,226 | |

| | | | | | | | |

| Interest expense | | (305) | | | (254) | | | (788) | | | (689) | |

| Interest and dividend income | | 327 | | | 289 | | | 863 | | | 783 | |

| Other income (expense), net | | (332) | | | 11 | | | (173) | | | (250) | |

| | | | | | | | |

| Income before income taxes | | 2,869 | | | 3,149 | | | 5,728 | | | 5,070 | |

| Income tax expense | | 352 | | | 638 | | | 914 | | | 1,003 | |

| Net income | | $ | 2,517 | | | $ | 2,511 | | | $ | 4,814 | | | $ | 4,067 | |

| Net income applicable to common stockholders per basic common share | | $ | 75.37 | | | $ | 70.62 | | | $ | 142.38 | | | $ | 111.09 | |

| Weighted-average number of basic common shares outstanding (in 000's) | | 33,401 | | | 35,570 | | | 33,814 | | | 36,615 | |

| Net income applicable to common stockholders per diluted common share | | $ | 74.34 | | | $ | 69.80 | | | $ | 140.45 | | | $ | 110.02 | |

| Weighted-average number of diluted common shares outstanding (in 000's) | | 33,864 | | | 35,987 | | | 34,278 | | | 36,971 | |

Booking Holdings Inc.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

| | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, | | |

| | 2024 | | 2023 | | |

| OPERATING ACTIVITIES: | | | | | | |

| Net income | | $ | 4,814 | | | $ | 4,067 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | | 434 | | | 370 | | | |

| Provision for expected credit losses and chargebacks | | 292 | | | 224 | | | |

| Deferred income tax benefit | | (75) | | | (409) | | | |

| Net (gains) losses on equity securities | | (27) | | | 151 | | | |

| Stock-based compensation expense | | 432 | | | 369 | | | |

| Operating lease amortization | | 114 | | | 120 | | | |

| | | | | | |

| Unrealized foreign currency transaction losses (gains) related to Euro-denominated debt | | 108 | | | (2) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Other | | — | | | 3 | | | |

| Changes in assets and liabilities: | | | | | | |

| Accounts receivable | | (651) | | | (1,506) | | | |

| Prepaid expenses and other current assets | | 12 | | | 96 | | | |

| Deferred merchant bookings and other current liabilities | | 2,308 | | | 2,644 | | | |

| | | | | | |

| Other | | (159) | | | (129) | | | |

| Net cash provided by operating activities | | 7,602 | | | 5,998 | | | |

| INVESTING ACTIVITIES: | | | | | | |

| | | | | | |

| Proceeds from sale and maturity of investments | | 590 | | | 1,785 | | | |

| Additions to property and equipment | | (353) | | | (251) | | | |

| | | | | | |

| | | | | | |

| Other investing activities | | (33) | | | (9) | | | |

| Net cash provided by investing activities | | 204 | | | 1,525 | | | |

| FINANCING ACTIVITIES: | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Proceeds from the issuance of long-term debt | | 2,959 | | | 1,893 | | | |

| | | | | | |

| Payment on maturity of debt | | (1,114) | | | (500) | | | |

| Payments for repurchase of common stock | | (5,282) | | | (7,889) | | | |

| | | | | | |

| Dividends paid | | (885) | | | — | | | |

| Proceeds from exercise of stock options | | 11 | | | 122 | | | |

| Other financing activities | | (36) | | | (45) | | | |

| Net cash used in financing activities | | (4,347) | | | (6,419) | | | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash and cash equivalents | | 214 | | | (29) | | | |

| Net increase in cash and cash equivalents and restricted cash and cash equivalents | | 3,673 | | | 1,075 | | | |

| Total cash and cash equivalents and restricted cash and cash equivalents, beginning of period | | 12,135 | | | 12,251 | | | |

| Total cash and cash equivalents and restricted cash and cash equivalents, end of period | | $ | 15,808 | | | $ | 13,326 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Booking Holdings Inc.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In millions, except share and per share data) (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME AND ADJUSTED EPS | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 2,517 | | | $ | 2,511 | | | $ | 4,814 | | | $ | 4,067 | |

| | | | | | | | | |

| | | | | | | | | |

| (a) | Adjustment to accruals related to the fine imposed by the Spanish competition authority | | — | | | — | | | (78) | | | — | |

| | | | | | | | | |

| (b) | Accruals related to settlements of indirect tax matters | | 365 | | | — | | | 365 | | | 62 | |

| (c) | Termination fee related to an acquisition agreement | | — | | | 90 | | | — | | | 90 | |

| | | | | | | | | |

| | | | | | | | | |

| (d) | Amortization of intangible assets | | 55 | | | 55 | | | 166 | | | 166 | |

| (e) | Net (gains) losses on equity securities | | (32) | | | (16) | | | (27) | | | 151 | |

| | | | | | | | | |

| (f) | Foreign currency transaction losses (gains) on the remeasurement of certain Euro-denominated debt and accrued interest and debt-related foreign currency derivative instruments | | 329 | | | (36) | | | 94 | | | (2) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| (g) | Adjustment to one-time deemed repatriation income tax liability resulting from the Tax Act and related net unrecognized tax benefit | | (250) | | | — | | | (250) | | | — | |

| (h) | Other | | — | | | — | | | 17 | | | (31) | |

| (i) | Tax impact of Non-GAAP adjustments | | (144) | | | (4) | | | (117) | | | (71) | |

| Adjusted Net income | | $ | 2,841 | | | $ | 2,602 | | | $ | 4,985 | | | $ | 4,433 | |

| GAAP and Non-GAAP weighted-average number of diluted common shares outstanding (in 000's) | | 33,864 | | | 35,987 | | | 34,278 | | | 36,971 | |

| Net income applicable to common stockholders per diluted common share (EPS) | | $ | 74.34 | | | $ | 69.80 | | | $ | 140.45 | | | $ | 110.02 | |

| | | | | | | | | |

| Adjusted Net income applicable to common stockholders per diluted common share (Adjusted EPS) | | $ | 83.89 | | | $ | 72.32 | | | $ | 145.42 | | | $ | 119.92 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 2,517 | | | $ | 2,511 | | | $ | 4,814 | | | $ | 4,067 | |

| | | | | | | | | |

| | | | | | | | | |

| (a) | Adjustment to accruals related to the fine imposed by the Spanish competition authority | | — | | | — | | | (78) | | | — | |

| | | | | | | | | |

| (b) | Accruals related to settlements of indirect tax matters | | 365 | | | — | | | 365 | | | 62 | |

| (c) | Termination fee related to an acquisition agreement | | — | | | 90 | | | — | | | 90 | |

| (j) | Depreciation and amortization | | 155 | | | 129 | | | 434 | | | 370 | |

| | | | | | | | | |

| | | | | | | | | |

| (j) | Interest and dividend income | | (327) | | | (289) | | | (863) | | | (783) | |

| (j) | Interest expense | | 305 | | | 254 | | | 788 | | | 689 | |

| (e) | Net (gains) losses on equity securities | | (32) | | | (16) | | | (27) | | | 151 | |

| | | | | | | | | |

| (f) | Foreign currency transaction losses (gains) on the remeasurement of certain Euro-denominated debt and accrued interest and debt-related foreign currency derivative instruments | | 329 | | | (36) | | | 94 | | | (2) | |

| | | | | | | | | |

| (h) | Other | | — | | | — | | | 17 | | | — | |

| (j) | Income tax expense | | 352 | | | 638 | | | 914 | | | 1,003 | |

| Adjusted EBITDA | | $ | 3,665 | | | $ | 3,284 | | | $ | 6,458 | | | $ | 5,648 | |

| Net income as a % of Total Revenues | | 31.5 | % | | 34.2 | % | | 26.4 | % | | 24.5 | % |

| Adjusted EBITDA as a % of Total Revenues | | 45.8 | % | | 44.7 | % | | 35.4 | % | | 34.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW | | | | Nine Months Ended

September 30, |

| | | | | | | 2024 | | 2023 |

| Net cash provided by operating activities | | | | | | $ | 7,602 | | | $ | 5,998 | |

| (k) | Additions to property and equipment | | | | | | (353) | | | (251) | |

| | | | | | | | | |

| Free cash flow | | | | | | $ | 7,249 | | | $ | 5,746 | |

| Net cash provided by operating activities as a % of Total Revenues | | | | | | 41.6 | % | | 36.2 | % |

| Free cash flow as a % of Total Revenues | | | | | | 39.7 | % | | 34.7 | % |

(1) Amounts may not total due to rounding.

| | | | | |

| Notes: |

| |

| |

| |

| |

| |

| (a) | Adjustment to accruals related to the fine imposed by the Spanish competition authority are recorded in General and administrative expenses and excluded from Net income to calculate Adjusted Net income and Adjusted EBITDA. |

| |

| (b) | Accruals related to settlements of certain indirect tax matters are recorded in General and administrative expenses and excluded from Net income to calculate Adjusted Net income and Adjusted EBITDA. During the quarter, the Company recorded a $365 million accrual related to the proposed settlement of certain Italian indirect tax matters. |

| (c) | Termination fee related to the acquisition agreement for the Etraveli Group is recorded in General and administrative expenses and excluded from Net income to calculate Adjusted Net income and Adjusted EBITDA. |

| |

| |

| |

| |

| (d) | Amortization of intangible assets is recorded in Depreciation and amortization expenses and excluded from Net income to calculate Adjusted Net income. |

| (e) | Net (gains) losses on equity securities with readily determinable fair values and impairments of investments in equity securities are recorded in Other income (expense), net and excluded from Net income to calculate Adjusted Net income and Adjusted EBITDA. |

| |

| (f) | Foreign currency transaction losses (gains) on the remeasurement of Euro-denominated debt and accrued interest that are not designated as hedging instruments for accounting purposes and debt-related foreign currency derivative instruments used as economic hedges are recorded in Other income (expense), net and excluded from Net income to calculate Adjusted Net income and Adjusted EBITDA. |

| (g) | Adjustment to one-time deemed repatriation income tax liability resulting from the Tax Act and related net unrecognized tax benefit are recorded in Income tax expense and excluded from Net income to calculate Adjusted Net income. During the quarter, the Company recorded a reduction of $250 million to income tax expense based upon a recent U.S. Tax Court decision. |

| |

| |

| |

| |

| |

| (h) | For the nine months ended September 30, 2024, includes an accrual related to the Canadian digital services taxes for the years ended December 31, 2022 and 2023 enacted in June 2024 with retrospective effect, which is recorded in Sales and other expenses. For the nine months ended September 30, 2023, includes interest received on tax payments refunded pursuant to a settlement with authorities, which is recorded in Interest and dividend income and Income tax expense, as applicable. |

| |

| |

| (i) | Reflects the tax impact of Non-GAAP adjustments above and changes in tax estimates which are excluded from Net income to calculate Adjusted Net income. |

| |

| (j) | Amounts are excluded from Net income to calculate Adjusted EBITDA. |

| (k) | Cash used for additions to property and equipment is included in the calculation of Free cash flow. |

| |

| |

| |

| |

| |

| |

| |

| For a more detailed discussion of the adjustments described above, please see the section in this press release under the heading "Non-GAAP Financial Measures" which provides definitions and information about the use of non-GAAP financial measures. Additional information on the impact of the adjustments above on Sales and other expenses, General and administrative expenses, Depreciation and amortization expenses, Interest and dividend income, Other income (expense), net, and Income tax expense, as applicable, are presented in the following pages. The reconciliation of Total operating expenses to Adjusted fixed operating expenses is also provided. |

ADDITIONAL INFORMATION ON THE IMPACT OF NON-GAAP ADJUSTMENTS

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

|

| Sales and other expenses: | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Sales and other expenses | | $ | 872 | | | $ | 807 | | | $ | 2,370 | | | $ | 2,094 | |

| Accruals related to prior-period Canadian digital services taxes | | — | | | — | | | (17) | | | — | |

| Adjusted Sales and other expenses | | $ | 872 | | | $ | 807 | | | $ | 2,353 | | | $ | 2,094 | |

| | | | | | | | | |

|

| General and administrative expenses: | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| General and administrative expenses | | $ | 575 | | | $ | 305 | | | $ | 873 | | | $ | 821 | |

| Adjustment to accruals related to the fine imposed by the Spanish competition authority | | — | | | — | | | 78 | | | — | |

| Accruals related to settlements of indirect tax matters | | (365) | | | — | | | (365) | | | (62) | |

| Termination fee related to an acquisition agreement | | — | | | (90) | | | — | | | (90) | |

| Adjusted General and administrative expenses | | $ | 210 | | | $ | 215 | | | $ | 586 | | | $ | 669 | |

| | | | | | | | | |

|

| Depreciation and amortization expenses: | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Depreciation and amortization expenses | | $ | 155 | | | $ | 129 | | | $ | 434 | | | $ | 370 | |

| Amortization of intangible assets | | (55) | | | (55) | | | (166) | | | (166) | |

| Depreciation expenses | | $ | 100 | | | $ | 74 | | | $ | 268 | | | $ | 204 | |

| | | | | | | | | |

| Interest and dividend income: | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Interest and dividend income | | $ | 327 | | | $ | 289 | | | $ | 863 | | | $ | 783 | |

| Interest received on refunded tax payments | | — | | | — | | | — | | | (24) | |

| Adjusted Interest and dividend income | | $ | 327 | | | $ | 289 | | | $ | 863 | | | $ | 759 | |

| | | | | | | | | |

|

| Other income (expense), net: | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Other income (expense), net | | $ | (332) | | | $ | 11 | | | $ | (173) | | | $ | (250) | |

| Net (gains) losses on equity securities | | (32) | | | (16) | | | (27) | | | 151 | |

| Foreign currency transaction losses (gains) on the remeasurement of certain Euro-denominated debt and accrued interest and debt-related foreign currency derivative instruments | | 329 | | | (36) | | | 94 | | | (2) | |

| Adjusted Other income (expense), net | | $ | (35) | | | $ | (41) | | | $ | (106) | | | $ | (101) | |

ADDITIONAL INFORMATION ON THE IMPACT OF NON-GAAP ADJUSTMENTS

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

|

| Income tax expense: | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Income tax expense | | $ | 352 | | | $ | 638 | | | $ | 914 | | | $ | 1,003 | |

| Adjustment to one-time deemed repatriation income tax liability resulting from the Tax Act and related net unrecognized tax benefit | | 250 | | | — | | | 250 | | | — | |

| Interest received on refunded tax payments | | — | | | — | | | — | | | 7 | |

| Tax impact of Non-GAAP adjustments | | 144 | | | 4 | | | 117 | | | 71 | |

| Adjusted Income tax expense | | $ | 746 | | | $ | 642 | | | $ | 1,281 | | | $ | 1,081 | |

| | | | | | | | | |

| | | | | | | | |

|

| | | | | | | | | |

| | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

|

|

| | | | | | | | | |

| RECONCILIATION OF TOTAL OPERATING EXPENSES TO ADJUSTED FIXED OPERATING EXPENSES | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Total operating expenses | | $ | 4,815 | | | $ | 4,238 | | | $ | 12,442 | | | $ | 11,355 | |

| Marketing expenses | | (2,151) | | | (2,022) | | | (5,700) | | | (5,340) | |

| Sales and other expenses | | (872) | | | (807) | | | (2,370) | | | (2,094) | |

| Depreciation and amortization | | (155) | | | (129) | | | (434) | | | (370) | |

| | | | | | | | |

| Adjustment to accruals related to the fine imposed by the Spanish competition authority | | — | | | — | | | 78 | | | — | |

| Accruals related to settlements of indirect tax matters | | (365) | | | — | | | (365) | | | (62) | |

| Termination fee related to an acquisition agreement | | — | | | (90) | | | — | | | (90) | |

| Other | | — | | | (2) | | | — | | | (4) | |

| Adjusted fixed operating expenses | | $ | 1,272 | | | $ | 1,188 | | | $ | 3,651 | | | $ | 3,395 | |

Booking Holdings Inc.

Statistical Data

Units Sold in millions and Gross Bookings and Total Revenues in billions(1)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Units Sold | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3Q22 | | 4Q22 | | 1Q23 | | 2Q23 | | 3Q23 | | 4Q23 | | 1Q24 | | 2Q24 | | 3Q24 | | | | |

| Room Nights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 240 | | | 211 | | | 274 | | | 268 | | | 276 | | | 231 | | | 297 | | | 287 | | | 299 | | | | | |

| Year/Year Growth | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 31.5 | % | | 39.5 | % | | 38.3 | % | | 8.8 | % | | 14.9 | % | | 9.2 | % | | 8.5 | % | | 7.1 | % | | 8.1 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rental Car Days | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 16 | | | 14 | | | 19 | | | 20 | | | 20 | | | 15 | | | 21 | | | 22 | | | 23 | | | | | |

| Year/Year Growth | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 24.9 | % | | 27.6 | % | | 22.7 | % | | 24.0 | % | | 20.0 | % | | 10.7 | % | | 10.7 | % | | 10.0 | % | | 16.2 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Airline Tickets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 6 | | | 6 | | | 8 | | | 9 | | | 9 | | | 9 | | | 11 | | | 11 | | | 13 | | | | | |

| Year/Year Growth | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 45.1 | % | | 61.5 | % | | 73.3 | % | | 58.3 | % | | 56.6 | % | | 45.8 | % | | 33.1 | % | | 27.7 | % | | 38.7 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Bookings(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3Q22 | | 4Q22 | | 1Q23 | | 2Q23 | | 3Q23 | | 4Q23 | | 1Q24 | | 2Q24 | | 3Q24 | | | | |

| Merchant | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 14.5 | | | $ | 13.3 | | | $ | 19.9 | | | $ | 21.1 | | | $ | 22.3 | | | $ | 18.4 | | | $ | 25.8 | | | $ | 25.8 | | | $ | 28.4 | | | | | |

| Agency | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 17.6 | | | 14.0 | | | 19.5 | | | 18.6 | | | 17.5 | | | 13.3 | | | 17.8 | | | 15.6 | | | 15.1 | | | | | |

| Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 32.1 | | | $ | 27.3 | | | $ | 39.4 | | | $ | 39.7 | | | $ | 39.8 | | | $ | 31.7 | | | $ | 43.5 | | | $ | 41.4 | | | $ | 43.4 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Bookings Year/Year Growth (Decline) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Merchant | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 64.6 | % | | 85.9 | % | | 81.0 | % | | 39.9 | % | | 53.5 | % | | 38.7 | % | | 29.3 | % | | 22.3 | % | | 27.3 | % | | | | |

| Agency | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 18.4 | % | | 18.2 | % | | 19.7 | % | | (4.5) | % | | (0.4) | % | | (5.3) | % | | (8.9) | % | | (16.0) | % | | (14.0) | % | | | | |

| Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 35.6 | % | | 43.6 | % | | 44.5 | % | | 14.9 | % | | 24.0 | % | | 16.1 | % | | 10.4 | % | | 4.4 | % | | 9.1 | % | | | | |

| Constant-currency Basis | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 50 | % | | 56 | % | | 51 | % | | 15 | % | | 20 | % | | 13 | % | | 10 | % | | 6 | % | | 9 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3Q22 | | 4Q22 | | 1Q23 | | 2Q23 | | 3Q23 | | 4Q23 | | 1Q24 | | 2Q24 | | 3Q24 | | | | |

| Total Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 6.1 | | | $ | 4.0 | | | $ | 3.8 | | | $ | 5.5 | | | $ | 7.3 | | | $ | 4.8 | | | $ | 4.4 | | | $ | 5.9 | | | $ | 8.0 | | | | | |

| Year/Year Growth | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 29.4 | % | | 35.8 | % | | 40.2 | % | | 27.2 | % | | 21.3 | % | | 18.1 | % | | 16.9 | % | | 7.3 | % | | 8.9 | % | | | | |

| Constant-currency Basis | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 44 | % | | 47 | % | | 46 | % | | 27 | % | | 16 | % | | 15 | % | | 17 | % | | 9 | % | | 9 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)Amounts may not total due to rounding.

(2) Gross bookings is an operating and statistical metric that captures the total dollar value, generally inclusive of taxes and fees, of all travel services booked by our customers, net of cancellations.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A0100SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4000SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A1.8SeniorNotesDueMarch2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A05SeniorNotesDueMarch2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3625SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4250SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.500SeniorNotesDueMarch2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A450SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.625SeniorNotesDueMarch2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4125SeniorNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4750SeniorNotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.750SeniorNotesDueMarch2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4.000SeniorNotesDueMarch2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

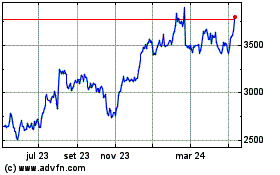

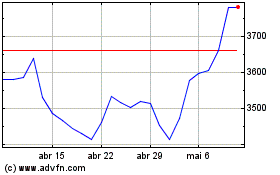

Booking (NASDAQ:BKNG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Booking (NASDAQ:BKNG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024