FALSE0001941365877622-47823300 Enterprise Parkway, Suite 300BeachwoodOhio00019413652024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2024

________________________

MasterBrand, Inc.

(Exact name of registrant as specified in its Charter)

________________________

| | | | | | | | |

| Delaware | 001-41545 | 88-3479920 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

3300 Enterprise Parkway, Suite 300 Beachwood, Ohio | | 44122 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

877-622-4782 |

(Registrant’s telephone number, including area code) |

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | MBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

MasterBrand, Inc. (the “Company”) issued an earnings release on November 5, 2024, announcing certain financial and operational results for the fiscal quarter ended September 29, 2024. A copy of the press release is furnished as Exhibit 99.1 and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On November 5, 2024, the Company posted a slide presentation on its investor relations website. Company officers intend to use this slide presentation in connection with upcoming meetings with analysts and investors. Pursuant to Regulation FD, a copy of the slide presentation is furnished with this Current Report on Form 8-K as Exhibit 99.2 and incorporated by reference herein.

The information in Items 2.02 and 7.01, including the press release furnished as Exhibit 99.1 and the investor presentation furnished as Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| | | |

| 99.2 | | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MasterBrand, Inc. |

| (Registrant) |

| | | |

Date: November 5, 2024 | | By: | /s/ R. David Banyard, Jr. |

| | Name: | R. David Banyard, Jr. |

| | Title: | President & Chief Executive Officer |

MasterBrand Reports Third Quarter 2024 Financial Results

•Net sales increased 6.0% year-over-year to $718.1 million

•Net income was $29.1 million compared to $59.7 million in the prior year, with net income margin of 4.1% and 8.8%, respectively

•Adjusted EBITDA margin1 decreased 160 basis points year-over-year to 14.6%

•Diluted earnings per share was $0.22 compared to $0.46 in the prior year quarter; adjusted diluted earnings per share1 was $0.40 compared to $0.49 in the prior year quarter

•Operating cash flow for the thirty-nine weeks ended September 29, 2024 was $176.9 million with free cash flow1 of $142.3 million

•Reiterates 2024 financial outlook

BEACHWOOD, Ohio.--(BUSINESS WIRE)--November 5, 2024-- MasterBrand, Inc. (NYSE: MBC, the “Company,” or “MasterBrand”), the largest residential cabinet manufacturer in North America, today announced third quarter 2024 financial results.

“We are pleased to announce that our third quarter financial performance was in-line with our expectations, as we continued to navigate choppiness in our end markets,” said Dave Banyard, President and Chief Executive Officer. “Our associates performed at an exceptionally high level in the quarter, delivering on our core business objectives and making steady progress on the integration of our Supreme acquisition. We are encouraged to see our highly complementary products, dealer channel and operations coming together as planned.”

“As we look to close out 2024, we remain focused on positioning the Company for growth in any end market environment and delivering superior financial returns for our shareholders,” Banyard continued.

Third Quarter 2024

Net sales were $718.1 million, an increase of 6% compared to the third quarter of 2023, driven by the 9% of growth from our Supreme acquisition. This increase was partially offset by lower average selling price (ASP) of 3%, with volume and foreign exchange having no impact on year-over-year performance. Gross profit was $238.0 million, compared to $237.5 million in the prior year. Gross profit margin decreased 200 basis points to 33.1%, on lower ASP, personnel and freight inflation, and a one-time benefit in the prior year period attributable to medical insurance rebates and insurance proceeds related to tornado damage sustained at our Jackson, Georgia facility. This was partially offset by additional cost savings from strategic initiatives and continuous improvement efforts and favorable variable compensation.

Net income was $29.1 million, compared to $59.7 million in the third quarter of 2023, a decrease of 51.3%, primarily due to acquisition-related costs, lower gross profit margin as discussed above, restructuring charges and higher interest expense, partially offset by favorable variable compensation and positive net income contribution from Supreme. Net income margin was 4.1% compared to 8.8% in the prior year.

Adjusted EBITDA1 was $104.5 million, compared to $109.8 million in the third quarter of 2023. Adjusted EBITDA margin1 decreased 160 basis points to 14.6%, driven by a decrease in gross profit margin.

1 - See "Non-GAAP Financial Measures" and the corresponding financial tables at the end of this press release for definitions and reconciliations of non-GAAP measures.

1

Diluted earnings per share were $0.22 compared to $0.46 in the third quarter of 2023. Adjusted diluted earnings per share1 were $0.40 compared to $0.49 in the third quarter of 2023.

1 - See "Non-GAAP Financial Measures" and the corresponding financial tables at the end of this press release for definitions and reconciliations of non-GAAP measures.

2

Balance Sheet, Cash Flow and Capital Allocation

As of September 29, 2024, the Company had $108.4 million in cash and $350.4 million of availability under its revolving credit facility. Total debt was $1,062.3 million and our ratio of total debt to net income from the most recent trailing twelve months was 7.2x as of September 29, 2024. For the same period, net debt1 was $953.9 million and our ratio of net debt to adjusted EBITDA1 was 2.5x.

Operating cash flow was $176.9 million for the thirty-nine weeks ended September 29, 2024, compared to $336.5 million in the thirty-nine weeks ended September 24, 2023. This decline was due to a benefit in the prior year from a strategic inventory build release. Free cash flow1 was $142.3 million for the thirty-nine weeks ended September 29, 2024, compared to $315.1 million for the thirty-nine weeks ended September 24, 2023.

During the thirty-nine weeks ended September 29, 2024, the Company repurchased approximately 371 thousand shares of common stock for approximately $6.5 million. No shares were repurchased in the quarter ended September 29, 2024.

2024 Financial Outlook

For full year 2024, the Company reiterates prior expectations:

•Net sales year-over-year increase of low single-digit percentage

◦Organic decline of low single-digit percentage

◦Acquisition-related increase of mid single-digit percentage

•Adjusted EBITDA1,2 in the range of $385 million to $405 million, with related adjusted EBITDA margin1,2 of roughly 14.0% to 14.5%

•Adjusted Diluted EPS1,2 in the range of $1.50 to $1.62

The Company expects organic net sales performance to be in line with the underlying market demand, as new products, channel specific offerings, and previously implemented price actions gain traction.

“Our third quarter financial performance was driven by our continued operational excellence and our acquisition of Supreme, as we delivered year-over-year net sales growth in a softer end market environment,” said Andi Simon, Executive Vice President and Chief Financial Officer. “In-line with our prior expectations, we believe demand trends across our R&R and new construction end markets will remain mixed for the balance of the year. With these factors in mind, our 2024 outlook is unchanged; we anticipate year-over-year growth in net sales and profitability.”

1 - See "Non-GAAP Financial Measures" and the corresponding financial tables at the end of this press release for definitions and reconciliations of non-GAAP measures.

2 - We have not provided a reconciliation of our fiscal 2024 adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS guidance because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and which may be excluded from adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS. Additionally, estimating such GAAP measures and providing a meaningful reconciliation for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions used for historical non-GAAP measures.

3

Conference Call Details

The Company will hold a live conference call and webcast at 4:30 p.m. ET today, November 5, 2024, to discuss the financial results and business outlook. Telephone access to the live call will be available at (877) 407-4019 (U.S.) or by dialing (201) 689-8337 (international). The live audio webcast can be accessed on the “Investors” section of the MasterBrand website www.masterbrand.com.

A telephone replay will be available approximately one hour following completion of the call through November 19, 2024. To access the replay, please dial 877-660-6853 (U.S.) or 201-612-7415 (international). The replay passcode is 13749429. An archived webcast of the conference call will also be available on the "Investors" page of the Company's website.

Non-GAAP Financial Measures

To supplement the financial information presented in accordance with generally accepted accounting principles in the United States (“GAAP”) in this earnings release, certain non-GAAP financial measures as defined under SEC rules have been included. It is our intent to provide non-GAAP financial information to enhance understanding of our financial information as prepared in accordance with GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for, other financial measures prepared in accordance with GAAP. Our methods of determining these non-GAAP financial measures may differ from the methods used by other companies for these or similar non-GAAP financial measures. Accordingly, these non-GAAP financial measures may not be comparable to measures used by other companies.

We use EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income margin, adjusted diluted earnings per share (“adjusted diluted EPS”), free cash flow, net debt, and net debt to adjusted EBITDA, which are all non-GAAP financial measures. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. We evaluate the performance of our business based on income before income taxes, but also look to EBITDA as a performance evaluation measure because interest expense is related to corporate functions, as opposed to operations. For that reason, we believe EBITDA is a useful metric to investors in evaluating our operating results. Adjusted EBITDA is calculated by removing the impact of non-operational results and special items from EBITDA. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net sales. Adjusted net income is calculated by removing the impact of non-operational results, including non-cash amortization expense, which is not deemed to be indicative of the results of current or future operations, and special items from net income. Adjusted net income margin is calculated as adjusted net income divided by net sales. Adjusted diluted EPS is a measure of our diluted earnings per share excluding non-operational results and special items. We believe these non-GAAP measures are useful to investors as they are representative of our core operations and are used in the management of our business, including decisions concerning the allocation of resources and assessment of performance.

Free cash flow is defined as cash flow from operations less capital expenditures. We believe that free cash flow is a useful measure to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of our business strategy, and is used in the management of our business, including decisions concerning the allocation of resources and assessment of performance. Net debt is defined as total balance sheet debt less cash and cash equivalents. We believe this measure is useful to investors as it provides a measure to compare debt less cash and cash equivalents across periods on a consistent basis. Net debt to adjusted EBITDA is calculated by dividing net debt by the trailing twelve months adjusted EBITDA. Net debt to adjusted EBITDA is used by management to assess our financial leverage and ability to service our debt obligations.

As required by SEC rules, detailed reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure are included in the financial statement section of this earnings release. We have not provided a reconciliation of our fiscal 2024 adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS guidance because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred, including gains and losses associated with our defined benefit plans and restructuring and other charges, which are excluded from adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income margin, and adjusted diluted EPS. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions used for historical non-GAAP measures.

About MasterBrand:

MasterBrand, Inc. (NYSE: MBC) is the largest manufacturer of residential cabinets in North America and offers a comprehensive portfolio of leading residential cabinetry products for the kitchen, bathroom and other parts of the home. MasterBrand products are available in a wide variety of designs, finishes and styles and span the most attractive categories of the cabinets market: stock, semi-custom and premium cabinetry. These products are delivered through an industry-leading distribution network of over 6,000 dealers, major retailers and builders. MasterBrand employs over 13,000 associates across more than 20 manufacturing facilities and offices. Additional information can be found at www.masterbrand.com.

Forward-Looking Statements:

Certain statements contained in this Press Release, other than purely historical information, including, but not limited to estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are forward-looking statements. Statements preceded by, followed by or that otherwise include the word “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could,” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our management. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements. These factors include those listed under “Risk Factors” in Part I, Item 1A of our Form 10-K for the fiscal year ended December 31, 2023, Part II, Item 1A of our Form 10-Q for the quarterly period ended June 30, 2024, and other filings with the SEC.

The forward-looking statements included in this document are made as of the date of this Press Release and, except pursuant to any obligations to disclose material information under the federal securities laws, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date of this Press Release.

Some of the important factors that could cause our actual results to differ materially from those projected in any such forward-looking statements include:

◦Our ability to develop and expand our business;

◦Our ability to develop new products or respond to changing consumer preferences and purchasing practices;

◦Our anticipated financial resources and capital spending;

◦Our ability to manage costs;

◦Our ability to effectively manage manufacturing operations and capacity, or an inability to maintain the quality of our products;

◦The impact of our dependence on third parties to source raw materials and our ability to obtain raw materials in a timely manner or fluctuations in raw material costs;

◦Our ability to accurately price our products;

◦Our projections of future performance, including future revenues, capital expenditures, gross margins, and cash flows;

◦The effects of competition and consolidation of competitors in our industry;

◦Costs of complying with evolving tax and other regulatory requirements and the effect of actual or alleged violations of tax, environmental or other laws;

◦The effect of climate change and unpredictable seasonal and weather factors;

◦Conditions in the housing market in the United States and Canada;

◦The expected strength of our existing customers and consumers and any loss or reduction in business from one or more of our key customers or increased buying power of large customers;

◦Information systems interruptions or intrusions or the unauthorized release of confidential information concerning customers, employees, or other third parties;

◦Worldwide economic, geopolitical and business conditions and risks associated with doing business on a global basis;

◦The effects of a public health crisis or other unexpected event;

◦The inability to recognize, or delays in obtaining, anticipated benefits of the acquisition of Supreme Cabinetry Brands, Inc. (the “Acquisition”), including synergies, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain key employees;

◦The impact of our current and any additional future debt obligations on our business, current and future operations, profitability and our ability to meet other obligations;

◦Business disruption following the Acquisition;

◦Diversion of management time on Acquisition-related issues;

◦The reaction of customers and other persons to the Acquisition; and

◦Other statements contained in this Press Release regarding items that are not historical facts or that involve predictions.

Investor Relations:

Investorrelations@masterbrand.com

Media Contact:

Media@masterbrand.com

Source: MasterBrand, Inc.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Unaudited) |

| | | | | | | | |

| | 13 Weeks Ended | | 39 Weeks Ended |

| (U.S. Dollars presented in millions, except per share amounts) | | September 29,

2024 | | September 24,

2023 | | September 29,

2024 | | September 24,

2023 |

| NET SALES | | $ | 718.1 | | | $ | 677.3 | | | $ | 2,032.7 | | | $ | 2,049.1 | |

| Cost of products sold | | 480.1 | | | 439.8 | | | 1,359.0 | | | 1,370.8 | |

| GROSS PROFIT | | 238.0 | | | 237.5 | | | 673.7 | | | 678.3 | |

| Gross Profit Margin | | 33.1 | % | | 35.1 | % | | 33.1 | % | | 33.1 | % |

| Selling, general and administrative expenses | | 166.3 | | | 140.3 | | | 450.8 | | | 417.3 | |

| Amortization of intangible assets | | 6.3 | | | 3.6 | | | 13.7 | | | 11.6 | |

| | | | | | | | |

| Restructuring charges | | 7.8 | | | 1.4 | | | 11.0 | | | 4.1 | |

| OPERATING INCOME | | 57.6 | | | 92.2 | | | 198.2 | | | 245.3 | |

| | | | | | | | |

| Interest expense | | 20.0 | | | 15.3 | | | 54.7 | | | 49.9 | |

| Other income, net | | (1.8) | | | (1.0) | | | (5.0) | | | (0.1) | |

| INCOME BEFORE TAXES | | 39.4 | | | 77.9 | | | 148.5 | | | 195.5 | |

| Income tax expense | | 10.3 | | | 18.2 | | | 36.6 | | | 49.6 | |

| NET INCOME | | $ | 29.1 | | | $ | 59.7 | | | $ | 111.9 | | | $ | 145.9 | |

| Average Number of Shares of Common Stock Outstanding | | | | | | | | |

| Basic | | 127.1 | | | 127.6 | | | 127.0 | | | 128.1 | |

| Diluted | | 130.8 | | | 130.3 | | | 130.8 | | | 129.9 | |

| Earnings Per Common Share | | | | | | | | |

| Basic | | $ | 0.23 | | | $ | 0.47 | | | $ | 0.88 | | | $ | 1.14 | |

| Diluted | | $ | 0.22 | | | $ | 0.46 | | | $ | 0.86 | | | $ | 1.12 | |

| | | | | | | | | | | | | | |

| SUPPLEMENTAL INFORMATION - Quarter-to-date |

| (Unaudited) |

|

| 13 Weeks Ended |

| September 29, | | September 24, |

| (U.S. Dollars presented in millions, except per share amounts and percentages) | 2024 | | 2023 |

1. Reconciliation of Net Income to EBITDA to ADJUSTED EBITDA | | | |

| Net income (GAAP) | $ | 29.1 | | | $ | 59.7 | |

| | | |

| Interest expense | 20.0 | | | 15.3 | |

| Income tax expense | 10.3 | | | 18.2 | |

| Depreciation expense | 13.8 | | | 11.9 | |

| Amortization expense | 6.3 | | | 3.6 | |

| EBITDA (Non-GAAP Measure) | $ | 79.5 | | | $ | 108.7 | |

| | | |

| [1] Separation costs | — | | | 0.1 | |

| [2] Restructuring charges | 7.8 | | | 1.4 | |

| [3] Restructuring-related adjustments | — | | | (0.4) | |

| [4] Acquisition-related costs | 15.0 | | | — | |

| [5] Purchase accounting cost of products sold | 2.2 | | | — | |

| | | |

| | | |

| Adjusted EBITDA (Non-GAAP Measure) | $ | 104.5 | | | $ | 109.8 | |

|

2. Reconciliation of Net Income to Adjusted Net Income | | | |

| Net Income (GAAP) | $ | 29.1 | | | $ | 59.7 | |

| | | |

| [1] Separation costs | — | | | 0.1 | |

| [2] Restructuring charges | 7.8 | | | 1.4 | |

| [3] Restructuring-related adjustments | — | | | (0.4) | |

| [4] Acquisition-related costs | 15.0 | | | — | |

| [5] Purchase accounting cost of products sold | 2.2 | | | — | |

| | | |

| | | |

| | | |

| [7] Amortization expense | 6.3 | | | 3.6 | |

| [8] Income tax impact of adjustments | (7.8) | | | (1.2) | |

| Adjusted Net Income (Non-GAAP Measure) | $ | 52.6 | | | $ | 63.2 | |

|

3. Earnings per Share Summary | | | |

| Diluted EPS (GAAP) | $ | 0.22 | | | $ | 0.46 | |

| Impact of adjustments | $ | 0.18 | | | $ | 0.03 | |

| Adjusted Diluted EPS (Non-GAAP Measure) | $ | 0.40 | | | $ | 0.49 | |

|

| Weighted average diluted shares outstanding | 130.8 | | | 130.3 | |

| | | |

4. Profit Margins | | | |

| Net Sales (GAAP) | $ | 718.1 | | | $ | 677.3 | |

| Net Income Margin % (GAAP) | 4.1 | % | | 8.8 | % |

| Adjusted Net Income Margin % (Non-GAAP Measure) | 7.3 | % | | 9.3 | % |

| Adjusted EBITDA Margin % (Non-GAAP Measure) | 14.6 | % | | 16.2 | % |

| | | | | | | | | | | | | | |

| SUPPLEMENTAL INFORMATION - Year-to-date |

| (Unaudited) |

|

| 39 Weeks Ended |

| September 29, | | September 24, |

| (U.S. Dollars presented in millions, except per share amounts and percentages) | 2024 | | 2023 |

| 1. Reconciliation of Net Income to EBITDA to Adjusted EBITDA | | | |

| Net income (GAAP) | $ | 111.9 | | | $ | 145.9 | |

| | | |

| Interest expense | 54.7 | | | 49.9 | |

| Income tax expense | 36.6 | | | 49.6 | |

| Depreciation expense | 39.5 | | | 34.9 | |

| Amortization expense | 13.7 | | | 11.6 | |

| EBITDA (Non-GAAP Measure) | $ | 256.4 | | | $ | 291.9 | |

| | | |

| [1] Separation costs | — | | | 2.3 | |

| [2] Restructuring charges | 11.0 | | | 4.1 | |

| [3] Restructuring-related adjustments | — | | | (0.7) | |

| [4] Acquisition-related costs | | 19.4 | | | — | |

| [5] Purchase accounting cost of products sold | 2.2 | | | — | |

| | | |

| | | |

| Adjusted EBITDA (Non-GAAP Measure) | $ | 289.0 | | | $ | 297.6 | |

|

| 2. Reconciliation of Net Income to Adjusted Net Income | | | |

| Net Income (GAAP) | $ | 111.9 | | | $ | 145.9 | |

| | | |

| [1] Separation costs | — | | | 2.3 | |

| [2] Restructuring charges | 11.0 | | | 4.1 | |

| [3] Restructuring-related adjustments | — | | | (0.7) | |

| [4] Acquisition-related costs | 19.4 | | | — | |

| [5] Purchase accounting cost of products sold | 2.2 | | | — | |

| [6] Non-recurring components of interest expense | 6.5 | | | — | |

| | | |

| | | |

| [7] Amortization expense | | 13.7 | | | 11.6 | |

| [8] Income tax impact of adjustments | (13.2) | | | (4.3) | |

| Adjusted Net Income (Non-GAAP Measure) | $ | 151.5 | | | $ | 158.9 | |

|

3. Earnings per Share Summary | | | |

| Diluted EPS (GAAP) | $ | 0.86 | | | $ | 1.12 | |

| Impact of adjustments | $ | 0.30 | | | $ | 0.10 | |

| Adjusted Diluted EPS (Non-GAAP Measure) | $ | 1.16 | | | $ | 1.22 | |

|

| Weighted average diluted shares outstanding | 130.8 | | | 129.9 | |

| | | |

4. Profit Margins | | | |

Net Sales (GAAP) | $ | 2,032.7 | | | $ | 2,049.1 | |

| Net Income Margin % (GAAP) | 5.5 | % | | 7.1 | % |

| Adjusted Net Income Margin % (Non-GAAP Measure) | 7.5 | % | | 7.8 | % |

| Adjusted EBITDA Margin % (Non-GAAP Measure) | 14.2 | % | | 14.5 | % |

TICK LEGEND:

[1] Separation costs represent one-time costs incurred directly by MasterBrand related to the separation from Fortune Brands.

[2] Restructuring charges are nonrecurring costs incurred to implement significant cost reduction initiatives and may consist of workforce reduction costs, facility closure costs, and other costs to maintain certain facilities where operations have ceased, but which we are still responsible for. The restructuring charges for all periods presented are mainly comprised of workforce reduction costs and other costs to maintain facilities that have been closed, but not yet sold.

[3] Restructuring-related charges are expenses directly related to restructuring initiatives that do not represent normal, recurring expenses necessary to operate the business, but cannot be reported as restructuring under GAAP. Such costs may include losses on disposal of inventories from exiting product lines, and gains/losses on the sale of facilities closed as a result of restructuring actions. Restructuring-related adjustments are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods. The restructuring-related adjustments in fiscal 2023 are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods.

[4] Acquisition-related costs are transaction and integration costs, including legal, accounting and other professional fees, severance, stock-based compensation, and other integration related costs. These charges are primarily recorded within selling, general and administrative expenses within the Condensed Consolidated Statements of Income. Acquisition-related costs are significantly impacted by the timing and complexity of the underlying acquisition related activities and are not indicative of the Company’s ongoing operating performance. The acquisition-related costs in fiscal 2024 are associated with the acquisition of Supreme Cabinetry Brands, Inc., which was announced in the second quarter of fiscal 2024 and closed early in the third quarter of fiscal 2024, and are comprised primarily of professional fees.

[5] Purchase accounting cost of products sold relates to the fair market value adjustment required under GAAP for inventory obtained in the acquisition of Supreme Cabinetry Brands, Inc. All inventory obtained was sold in the third quarter of 2024.

[6] Non-recurring components of interest expense are one-time costs associated with the refinancing of debt facilities and usage of temporary debt facilities. The non-recurring components of interest expense were incurred in the second quarter of fiscal 2024 related primarily to non-recurring write-offs of deferred financing costs resulting from the debt restructuring transaction. These charges are classified as interest expense within the Condensed Consolidated Statements of Income and are not indicative of the Company’s ongoing operating performance.

[7] Beginning in the second quarter of fiscal 2024 reporting, management began adding back amortization of intangible assets in calculating adjusted net income and adjusted diluted EPS for all periods presented. Non-cash amortization expenses are not indicative of the Company’s ongoing operations. Prior period information has been recast to reflect the updated presentation.

[8] In order to calculate Adjusted Net Income, each of the items described in Items [1] - [7] above reflect tax effects based upon an estimated annual effective income tax rate of 25.0 percent, inclusive of recurring permanent differences and the net effect of state income taxes and excluding the impact of discrete income tax items. Discrete items are recorded in the relevant period identified and include, but are not limited to, changes in judgment or estimates of uncertain tax positions related to prior periods, return-to-provision adjustments, the tax effect of relevant stock-based compensation items, certain changes in the valuation allowance for the realizability of deferred tax assets, or enacted changes in tax law. Management believes this approach assists investors in understanding the income tax provision and the estimated annual effective income tax rate related to ongoing operations.

| | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| | | | |

| | September 29, | | September 24, |

| (U.S. Dollars presented in millions) | | 2024 | | 2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 108.4 | | | $ | 122.5 | |

| Accounts receivable, net | | 216.1 | | | 233.6 | |

| Inventories | | 299.4 | | | 269.4 | |

| Other current assets | | 63.0 | | | 58.5 | |

| TOTAL CURRENT ASSETS | | 686.9 | | | 684.0 | |

| Property, plant and equipment, net | | 456.7 | | | 341.5 | |

| Operating lease right-of-use assets, net | | 71.3 | | | 61.6 | |

| Goodwill | | 1,129.4 | | | 924.6 | |

| Other intangible assets, net | | 577.9 | | | 338.5 | |

| | | | |

| Other assets | | 38.0 | | | 28.1 | |

| TOTAL ASSETS | | $ | 2,960.2 | | | $ | 2,378.3 | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 175.3 | | | $ | 179.7 | |

| Current portion of long-term debt | | — | | | 8.2 | |

| Current operating lease liabilities | | 16.8 | | | 15.4 | |

| Other current liabilities | | 186.3 | | | 164.6 | |

| TOTAL CURRENT LIABILITIES | | 378.4 | | | 367.9 | |

| Long-term debt | | 1,062.3 | | | 699.3 | |

| Deferred income taxes | | 154.0 | | | 84.2 | |

| Pension and other postretirement plan liabilities | | 7.5 | | | 12.1 | |

| Operating lease liabilities | | 56.7 | | | 48.4 | |

| Other non-current liabilities | | 13.7 | | | 9.9 | |

| TOTAL LIABILITIES | | 1,672.6 | | | 1,221.8 | |

| Stockholders' equity | | 1,287.6 | | | 1,156.5 | |

| TOTAL EQUITY | | 1,287.6 | | | 1,156.5 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 2,960.2 | | | $ | 2,378.3 | |

| | | | |

| Reconciliation of Net Debt | | | | |

| Current portion of long-term debt | | $ | — | | | $ | 8.2 | |

| Long-term debt | | 1,062.3 | | | 699.3 | |

| Less: Cash and cash equivalents | | (108.4) | | | (122.5) | |

| Net Debt | | $ | 953.9 | | | $ | 585.0 | |

| Adjusted EBITDA for Prior Fiscal Year | | 383.4 | | | 411.4 | |

Less: Adjusted EBITDA for 39 weeks ended September 24, 2023 | | (297.6) | | | (313.6) | |

Plus: Adjusted EBITDA for 39 weeks ended September 29, 2024 | | 289.0 | | | 297.6 | |

| Adjusted EBITDA (trailing twelve months) | | $ | 374.8 | | | $ | 395.4 | |

| Net Debt to Adjusted EBITDA | | 2.5x | | 1.5x |

| | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| | 39 Weeks Ended |

| | September 29, | | September 24, |

| (U.S. Dollars presented in millions) | | 2024 | | 2023 |

| OPERATING ACTIVITIES | | | | |

| Net income | | $ | 111.9 | | | $ | 145.9 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation | | 39.5 | | | 34.9 | |

| Amortization of intangibles | | 13.7 | | | 11.6 | |

| Restructuring charges, net of cash payments | | 4.3 | | | (13.9) | |

| Write-off and amortization of finance fees | | 8.2 | | | 1.7 | |

| Stock-based compensation | | 16.8 | | | 13.2 | |

| | | | |

| | | | |

| | | | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable | | (2.3) | | | 60.1 | |

| Inventories | | (32.5) | | | 103.9 | |

| Other current assets | | (1.8) | | | 6.9 | |

| Accounts payable | | 18.0 | | | (42.8) | |

| Accrued expenses and other current liabilities | | (3.5) | | | 9.2 | |

| Other items | | 4.6 | | | 5.8 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | 176.9 | | | 336.5 | |

| INVESTING ACTIVITIES | | | | |

| Capital expenditures | | (34.6) | | | (21.4) | |

| Proceeds from the disposition of assets | | 8.4 | | | 0.3 | |

| Acquisition of business, net of cash acquired | | (515.7) | | | — | |

| NET CASH USED IN INVESTING ACTIVITIES | | (541.9) | | | (21.1) | |

| FINANCING ACTIVITIES | | | | |

| Issuance of long-term and short-term debt | | 1,130.0 | | | 55.0 | |

| Repayments of long-term and short-term debt | | (767.5) | | | (327.5) | |

| Payment of financing fees | | (17.8) | | | — | |

| Repurchase of common stock | | (6.5) | | | (15.6) | |

| Payments of employee taxes withheld from share-based awards | | (5.3) | | | (3.0) | |

| | | | |

| | | | |

| Other items | | (1.6) | | | (1.0) | |

| | | | |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | | 331.3 | | | (292.1) | |

| Effect of foreign exchange rate changes on cash and cash equivalents | | (5.6) | | | (1.9) | |

| NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | | $ | (39.3) | | | $ | 21.4 | |

| Cash, cash equivalents, and restricted cash at beginning of period | | $ | 148.7 | | | $ | 101.1 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 109.4 | | | $ | 122.5 | |

| | | | |

| Cash and cash equivalents | | $ | 108.4 | | | $ | 122.5 | |

| Restricted cash included in other assets | | 1.0 | | | — | |

| Total cash, cash equivalents and restricted cash | | $ | 109.4 | | | $ | 122.5 | |

| | | | |

| Reconciliation of Free Cash Flow | | | | |

| Net cash provided by operating activities | | $ | 176.9 | | | $ | 336.5 | |

| Less: Capital expenditures | | (34.6) | | | (21.4) | |

| Free cash flow | | $ | 142.3 | | | $ | 315.1 | |

Q3 2024 Investor Presentation November 5, 2024

Forward-Looking Statements Certain statements contained in this presentation, other than purely historical information, including, but not limited to estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are forward-looking statements. Statements preceded by, followed by or that otherwise include the word “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could,” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our management. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements. These factors include those listed under “Risk Factors” in Part I, Item 1A of our Form 10-K for the fiscal year ended December 31, 2023, Part II, Item 1A of our Form 10-Q for the quarterly period ended June 30, 2024, and other filings with the SEC. The forward-looking statements included in this document are made as of the date of this presentation and, except pursuant to any obligations to disclose material information under the federal securities laws, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date of this presentation. 2

MasterBrand Overview #1 North American residential cabinet manufacturer Key brands 1 Includes Supreme acquisition 2 Excludes Supreme acquisition 3 Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP metrics. Please see Appendix for definitions and corresponding reconciliations to historical GAAP measures MasterBrand at a glance 1 ~65% Net sales to R&R 6,000+ Dealer network $383 million 2023 Adjusted EBITDA3 13,000+ Employees 20+ Manufacturing facilities MasterBrand key financial metrics 2 3 $2.4 $2.5 $2.9 $3.3 $2.7 10% 11% 11% 11% 14% -1% 1% 3% 5% 7% 9% 11% 13% 15% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 2019 2020 2021 2022 2023 Net Sales ($B) Adjusted EBITDA Margin 1 $2.7 billion 2023 Net sales 3

The MasterBrand Story Building great experiences together O U R P U R P O S E How? Tools that enable us to: Lead through Lean Engage teams and foster problem-solving Align to Grow Deliver on the unique needs of each customer Tech Enabled Drive profitable growth and transform the way we work through digital, data, and analytics D E L I V E R E D T H R O U G H T H E M A S T E R B R A N D W A Y Build on our rich history by innovating how we work and what we offer to delight our customers O U R V I S I O N Make the team better Be bold Champion improvement O U R C U L T U R E 4 PRE-SPIN-OFF TODAY Industry Leader Largest distribution network Product & Brand Portfolio Leader amongst peers Operational Excellence At Scale

CSR HIGHLIGHTS 5

57% 33% 10% Industry Leading Customer Base 6 MasterBrand channel mix 1 Dealer: provide customer education, service and design consultation 57% Retail: common box products that offer some customization along with in-stock standardized products 33% Builder: sold directly and highly correlated to single-family housing starts 10% Dealer Retail Builder MasterBrand has a leadership position across channels… Overview of primary sales channels in the US and Canada: Builder ChannelRetailers / Home Center ChannelDealer Channel $1.3bn ~11% $3.4bn ~28% $7.3bn ~61% Industry Channel Size % of total New Home Construction R&R R&R / New Home Construction Primary End Market Exposure Medium (Growing trend of National Homebuilder Consolidation) High (Top 3 represent ~90%) Low (25,000+) Customer Concentration Fragmented network: Requires broad products and regional presence to address and allows for a variety of consumer touch points Multi-brand strategy: Dealers offer multiple brands, enabling trade up and down to drive sales High retention rate: Physical showroom investments and sales training drive retention …and why it matters 1 Channel mix for fiscal year 2023, including pro forma impact of Supreme acquisition

7 Multi-Branded Strategy Across Price Points and Products ~51% ~40% ~100% ~30% ~60% ~19% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% MasterBrand Competitor A Competitor B Stock / In-Stock Semi-Custom Custom / Premium Price point (per cabinet) <$350 >$750 MasterBrand portfolio by type and key brands Stock /In-Stock Semi-Custom Custom/Premium MasterBrandoffers the most diverse product portfolio and covers the price spectrum 1 1 Includes pro forma impact of Supreme acquisition

+ + + Integrated Manufacturing Network & Strong Track Record of Continuous Improvement Footprint optimization Proven tools of our business system, enable product portfolio simplification Continuous improvement culture Efficient capital spending profile 8 MasterBrand’s strategic transformation initiatives have created >$90 million of cumulative annual savings since 2019, with another $50 million of incremental savings anticipated in 2024 O L D M O D E L : 10+ product platform / plant silos N E W M O D E L : 4 construction-specific product platforms Assets Capabilities Product Specs Networked manufactured footprint Capability duplication aligned to demand Aligned product continuum Note: Excludes Supreme acquisition

Stock MANUFACTURING FLEXIBILITY 1 Quarter facility transition from Made-to-Order to Stock 1 Facility absorbed FACILITY RATIONALIZATION 2 Facilities closed Plant A Plant B Consolidated manufacturing sites Plant C Plant D Plant E Plant F 5 Networks PLANT NETWORKS 20 Independent Plants COMMON CONSTRUCTION 10+ Platforms 4 Platforms Stock MTO Framed Frameless Vanities A ch ie ve d In -p ro ce ss ~55% Reduction in Doors ~85% Reduction in Paints and Stains ~40% Reduction in Species Align to Grow 9 Simplified manufacturing to fulfill market needs Reduce complexity, without limiting customer selection MTO t Note: Excludes Supreme acquisition

Lead Through Lean 10 2021 2022 - 2024 2025 and beyond Best Place to Work Rewards & Recognition Talent Strategy Associate Engagement Lean Foundational Tools Four years into our journey, we’re progressing toward our vision of being a best place to work ASSOCIATE ENGAGEMENT REWARDS & RECOGNITION LEAN FOUNDATION TOOLS TALENT STRATEGY BEST PLACE TO WORK Consistent opportunities to strengthen lean skills with 266 formal kaizen events in 2023 Continued evolution of Best Place to Work, supported by three robust processes Lead Through Lean further improved engagement scores in 2023 Since inception over 400K peer-to-peer recognition awards given Talent Philosophy & Success Model provides consistent lexicon and code for all associates around talent processes

Simplify and Automate Backoffice Processes Enhance Customer Experience Digitize our Plants Leveraging Data and Analytics to Unlock Shareholder Value 11

Supreme Cabinetry Brands Acquisition Completed July 2024 12 Enhances MasterBrand’s Portfolio with Complementary Products in Resilient and Attractive Categories Extends Diversity of Channel Distribution to Reach More Consumers Drives Augmented Financial Profile and Value Creation via Highly Achievable Cost Synergies Reinforces Opportunity for Capital Flexibility Through Strong Balance Sheet and Cash Flow 1 2 4 5 Combines Best-in-Class Competencies to Win Today and Tomorrow, Enriching Consumer Value, Product Access, and Service3

Q3 2024 Highlights • Net sales increased 6% driven by 9% growth from our Supreme acquisition, partially offset by a 3% decline in organic net sales due to lower net average selling price (ASP). The impact of volume and foreign exchange were roughly flat year-on-year. • Net income decreased 51%, primarily due to acquisition costs, lower gross profit margin, restructuring charges and higher interest expense, partially offset by favorable variable compensation and positive net income contribution from Supreme. Net income margin contracted 470 bps. • Adjusted EBITDA margin1 declined 160 bps primarily due to the timing of price realization relative to inflationary pressures, continued investments in strategic initiatives, and approximately $6 million in non- repeating insurance proceeds and medical rebates in the same period last year. • Operating cash flow (YTD) and Free Cash Flow1 (YTD) declined primarily due to a benefit in the prior year from the release of a strategic inventory build meant to mitigate various supply chain constraints. 13 Financial Results ($ in millions, except per share amounts) Q3 2024 Q3 2023 B/(W) Net Sales $718.1 $677.3 6.0% Gross Profit $238.0 $237.5 0.2% Gross Profit Margin 33.1% 35.1% (200 bps) SG&A $166.3 $140.3 18.5% Net Income $29.1 $59.7 (51.3%) Net Income Margin 4.1% 8.8% (470 bps) Adjusted EBITDA1 $104.5 $109.8 (4.8%) Adjusted EBITDA Margin 1 14.6% 16.2% (160 bps) Diluted EPS (GAAP) $0.22 $0.46 (52.2%) Adjusted Diluted EPS1 $0.40 $0.49 (18.4%) Net Cash Provided By Operating Activities (YTD) $176.9 $336.5 (47.4%) Free Cash Flow1 (YTD) $142.3 $315.1 (54.8%)

Near-Term Expectations Full Year 2024 Outlook1 • Organic net sales decline of low single-digit % and acquisition-related increase of mid single-digit % • Promotional activity and trade downs to continue at a similar pace, but impact to moderate from a y-o-y perspective • Continued growth in new construction, but expected to moderate y-o-y and sequentially; R&R demand to be at the lower end of mid-single digit % declines • Q4 net sales to outperform normal seasonality due to previously implemented price and traction from new products and channel specific offerings • Ability to flex manufacturing, ongoing continuous improvement efforts, and price actions will support adj. EBITDA2, and reduce the impact of recent cost inflation. Anticipating seasonally higher than normal adj. EBITDA margin2 in Q4. • Free Cash Flow2 is expected to be in excess of Net Income in 2024. Drivers Market Growth Low Single-Digit % Decline North American Cabinets Market MasterBrand Increase of low single-digit % Net Sales $385-$405 million Adjusted EBITDA2 ~14.0%-14.5% Adjusted EBITDA Margin2 $1.50-$1.62 Adjusted Diluted EPS2 S T R O N G B A L A N C E S H E E T W I T H F I N A N C I A L F L E X I B I L I T Y 14 1 This outlook information was presented by the Company on its third quarter 2024 Earnings Conference Call on November 5, 2024, and it speaks only as of that date. Its inclusion in this presentation does not constitute a reaffirmation or update of such information as of the date hereof or any other date. 2 Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Diluted EPS, and Free Cash Flow are non-GAAP metrics. Please see Appendix for definitions.

Long-Term Financial Targets Long Term Outlook1 1. Business and portfolio aligned with the customer 2. Operational Excellence will fuel margin growth 3. Flexible platform allows us to navigate any market condition Clear Path to Achieving Results 1 This outlook information was presented by the Company at its Investor Day 2022 presentation on December 6, 2022, and it speaks only as of that date. Its inclusion in this presentation does not constitute a reaffirmation or update of such information as of the date hereof or any other date. 2 Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP metrics. Please see Appendix for definitions. Market Growth 3-5% CAGR North American Cabinets Market MasterBrand 4-6% CAGR Net Sales ~16%-18% FY Adjusted EBITDA Margin2 15 S T R O N G F O C U S O N M A R G I N E X P A N S I O N

MasterBrand: Investor Day 2022 Appendix

Non-GAAP Financial Measures To supplement the financial information presented in accordance with generally accepted accounting principles in the United States (“GAAP”) in this presentation, certain non-GAAP financial measures as defined under SEC rules have been included. It is our intent to provide non-GAAP financial information to enhance understanding of our financial information as prepared in accordance with GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for, other financial measures prepared in accordance with GAAP. Our methods of determining these non-GAAP financial measures may differ from the methods used by other companies for these or similar non-GAAP financial measures. Accordingly, these non-GAAP financial measures may not be comparable to measures used by other companies. We use EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income margin, adjusted diluted earnings per share (“adjusted diluted EPS”), free cash flow, net debt, and net debt to adjusted EBITDA, which are all non-GAAP financial measures. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. We evaluate the performance of our business based on income before income taxes, but also look to EBITDA as a performance evaluation measure because interest expense is related to corporate functions, as opposed to operations. For that reason, we believe EBITDA is a useful metric to investors in evaluating our operating results. Adjusted EBITDA is calculated by removing the impact of non-operational results and special items from EBITDA. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net sales. Adjusted net income is calculated by removing the impact of non-operational results, including non-cash amortization expense, which is not deemed to be indicative of the results of current or future operations, and special items from net income. Adjusted net income margin is calculated as adjusted net income divided by net sales. Adjusted diluted EPS is a measure of our diluted earnings per share excluding non- operational results and special items. We believe these non-GAAP measures are useful to investors as they are representative of our core operations and are used in the management of our business, including decisions concerning the allocation of resources and assessment of performance. Free cash flow is defined as cash flow from operations less capital expenditures. We believe that free cash flow is a useful measure to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of our business strategy, and is used in the management of our business, including decisions concerning the allocation of resources and assessment of performance. Net debt is defined as total balance sheet debt less cash and cash equivalents. We believe this measure is useful to investors as it provides a measure to compare debt less cash and cash equivalents across periods on a consistent basis. Net debt to adjusted EBITDA is calculated by dividing net debt by the trailing twelve months adjusted EBITDA. Net debt to adjusted EBITDA is used by management to assess our financial leverage and ability to service our debt obligations. As required by SEC rules, see the appendix of this presentation for detailed reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure. We have not provided a reconciliation of our fiscal 2024 adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS guidance because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred, including gains and losses associated with our defined benefit plans and restructuring and other charges, which are excluded from adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income margin, and adjusted diluted EPS. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions used for historical non-GAAP measures. 16

Full Year Non-GAAP Reconciliations 17Note: See tick legend on following page December 29, December 27, December 26, December 25, December 31, (In millions, except percentages) 2019 2020 2021 2022 2023 Reconciliation of Net Income to EBITDA to ADJUSTED Net income (GAAP) 100.7$ 145.7$ 182.6$ 155.4$ 182.0$ Related party interest income, net (0.1) (2.4) (4.6) (12.9) - Interest expense - - - 2.2 65.2 Income tax expense 34.5 50.5 55.7 58.0 56.7 Depreciation expense 44.3 48.0 44.4 47.3 49.0 Amortization expense 17.8 17.8 17.8 17.2 15.3 EBITDA (Non-GAAP Measure) 197.2$ 259.6$ 295.9$ 267.2$ 368.2$ [1] Separation costs - - - 15.4 2.4 [2] Restructuring charges 10.2 6.1 4.2 25.1 10.1 [3] Restructuring-related items 0.5 5.3 3.7 12.7 (0.2) [4] Asset impairment charges 41.5 9.5 - 46.4 - [5] Recognition of actuarial gains - - - 0.2 2.9 Adjusted EBITDA (Non-GAAP Measure) 249.4$ 280.5$ 303.8$ 367.0$ 383.4$ NET SALES 2,388.7$ 2,469.3$ 2,855.3$ 3,275.5$ 2,726.2$ Net Income Margin 4% 6% 6% 5% 7% Adjusted EBITDA Margin % 10% 11% 11% 11% 14% Fiscal Year Ended

Full Year Non-GAAP Reconciliations Tick Legend 18 [1] Separation costs represent one-time costs incurred directly by MasterBrand related to the separation from Fortune Brands. [2] Restructuring charges are nonrecurring costs incurred to implement significant cost reduction initiatives and may consist of workforce reduction costs, facility closure costs, and other costs to maintain certain facilities where operations have ceased, but which we are still responsible for. The restructuring charges for the periods presented are comprised primarily of workforce reduction costs and facility closure costs. [3] Restructuring-related charges are expenses directly related to restructuring initiatives that do not represent normal, recurring expenses necessary to operate the business, but cannot be reported as restructuring under GAAP. Such costs may include losses on disposal of inventories from exiting product lines, accelerated depreciation expense, and gains/losses on the sale of facilities closed as a result of restructuring actions. Restructuring-related adjustments are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods. Restructuring-related charges/(adjustments) for the periods presented are related primarily to the reserves for losses on disposal of inventories. [4] The year-ended December 25, 2022 included $46.4 million of pre-tax impairment charges related to impairments of indefinite-lived tradenames. [5] We exclude the impact of actuarial gains and losses related to our U.S. defined benefit pension plan as they are not deemed indicative of future operations.

Q3 2024 Non-GAAP Reconciliations 19 Note: See tick legend on following page

Q3 2024 Non-GAAP Reconciliations Tick Legend 20 [1] Separation costs represent one-time costs incurred directly by MasterBrand related to the separation from Fortune Brands. [2] Restructuring charges are nonrecurring costs incurred to implement significant cost reduction initiatives and may consist of workforce reduction costs, facility closure costs, and other costs to maintain certain facilities where operations have ceased, but which we are still responsible for. The restructuring charges for all periods presented are mainly comprised of workforce reduction costs and other costs to maintain facilities that have been closed, but not yet sold. [3] Restructuring-related charges are expenses directly related to restructuring initiatives that do not represent normal, recurring expenses necessary to operate the business, but cannot be reported as restructuring under GAAP. Such costs may include losses on disposal of inventories from exiting product lines, and gains/losses on the sale of facilities closed as a result of restructuring actions. Restructuring-related adjustments are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods. The restructuring-related adjustments in fiscal 2023 are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods. [4] Acquisition-related costs are transaction and integration costs, including legal, accounting and other professional fees, severance, stock-based compensation, and other integration related costs. These charges are primarily recorded within selling, general and administrative expenses within the Condensed Consolidated Statements of Income. Acquisition-related costs are significantly impacted by the timing and complexity of the underlying acquisition related activities and are not indicative of the Company’s ongoing operating performance. The acquisition-related costs in fiscal 2024 are associated with the acquisition of Supreme Cabinetry Brands, Inc., which was announced in the second quarter of fiscal 2024 and closed early in the third quarter of fiscal 2024, and are comprised primarily of professional fees. [5] Purchase accounting cost of products sold relates to the fair market value adjustment required under GAAP for inventory obtained in the acquisition of Supreme Cabinetry Brands, Inc. All inventory obtained was sold in the third quarter of 2024. [6] Beginning in the second quarter of fiscal 2024 reporting, management began adding back amortization of intangible assets in calculating adjusted net income and adjusted diluted EPS for all periods presented. Non-cash amortization expenses is not indicative of the Company’s ongoing operations. Prior period information has been recast to reflect the updated presentation. [7] In order to calculate Adjusted Net Income, each of the items described in Items [1] - [6] above reflect tax effects based upon an estimated annual effective income tax rate of 25.0 percent, inclusive of recurring permanent differences and the net effect of state income taxes and excluding the impact of discrete income tax items. Discrete items are recorded in the relevant period identified and include, but are not limited to, changes in judgment or estimates of uncertain tax positions related to prior periods, return-to-provision adjustments, the tax effect of relevant stock-based compensation items, certain changes in the valuation allowance for the realizability of deferred tax assets, or enacted changes in tax law. Management believes this approach assists investors in understanding the income tax provision and the estimated annual effective income tax rate related to ongoing operations.

Q3 2024 Non-GAAP Reconciliations 21 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) 39 Weeks Ended September 29, September 24, (U.S. Dollars presented in millions) 2024 2023 OPERATING ACTIVITIES Net income .............................................................................................................................. $ 111.9 $ 145.9 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation .................................................................................................................. 39.5 34.9 Amortization of intangibles ........................................................................................... 13.7 11.6 Restructuring charges, net of cash payments ................................................................. 4.3 (13.9) Write-off and amortization of finance fees .................................................................... 8.2 1.7 Stock-based compensation ............................................................................................ 16.8 13.2 Changes in operating assets and liabilities: Accounts receivable ...................................................................................................... (2.3) 60.1 Inventories ..................................................................................................................... (32.5) 103.9 Other current assets ....................................................................................................... (1.8) 6.9 Accounts payable .......................................................................................................... 18.0 (42.8) Accrued expenses and other current liabilities .............................................................. (3.5) 9.2 Other items .................................................................................................................... 4.6 5.8 NET CASH PROVIDED BY OPERATING ACTIVITIES ............................................... 176.9 336.5 INVESTING ACTIVITIES Capital expenditures ...................................................................................................... (34.6) (21.4) Proceeds from the disposition of assets ......................................................................... 8.4 0.3 Acquisition of business, net of cash acquired ................................................................ (515.7) — NET CASH USED IN INVESTING ACTIVITIES ............................................................ (541.9) (21.1) FINANCING ACTIVITIES Issuance of long-term and short-term debt .................................................................... 1,130.0 55.0 Repayments of long-term and short-term debt .............................................................. (767.5) (327.5) Payment of financing fees ............................................................................................. (17.8) — Repurchase of common stock ........................................................................................ (6.5) (15.6) Payments of employee taxes withheld from share-based awards .................................. (5.3) (3.0) Other items .................................................................................................................... (1.6) (1.0) NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES ............................ 331.3 (292.1) Effect of foreign exchange rate changes on cash and cash equivalents .................................. (5.6) (1.9) NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH ....................................................................................................... $ (39.3) $ 21.4 Cash, cash equivalents, and restricted cash at beginning of period......................................... $ 148.7 $ 101.1 Cash, cash equivalents, and restricted cash at end of period ................................................... $ 109.4 $ 122.5 Cash and cash equivalents ...................................................................................................... $ 108.4 $ 122.5 Restricted cash included in other assets .................................................................................. 1.0 — Total cash, cash equivalents and restricted cash ..................................................................... $ 109.4 $ 122.5 Reconciliation of Free Cash Flow Net cash provided by operating activities ............................................................................... $ 176.9 $ 336.5 Less: Capital expenditures ...................................................................................................... (34.6) (21.4) Free cash flow ......................................................................................................................... $ 142.3 $ 315.1

Prior Year to Current Year Net Sales Walk 22

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

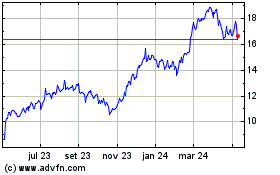

Masterbrand (NYSE:MBC)

Gráfico Histórico do Ativo

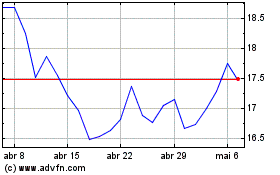

De Out 2024 até Nov 2024

Masterbrand (NYSE:MBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024