UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT

OF 1934

For the month of November

2024

Commission File Number: 001-38590

CANGO INC.

8F, New Bund Oriental Plaza II

556 West Haiyang Road, Pudong

New Area

Shanghai 200124

People’s Republic of China

(Address of principal executive

offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

EXHIBIT INDEX

Exhibit 99.1 — Cango Inc. Reports Third Quarter 2024 Unaudited Financial Results

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

CANGO INC. |

| |

|

| |

By: |

/s/ Yongyi Zhang |

| |

Name: |

Yongyi Zhang |

| |

Title: |

Chief Financial Officer |

Date: November 6, 2024

Exhibit 99.1

Cango Inc. Reports Third Quarter 2024 Unaudited

Financial Results

SHANGHAI, Nov. 4, 2024 /PRNewswire/ -- Cango

Inc. (NYSE: CANG) ("Cango" or the "Company"), a leading automotive transaction service platform in China, today announced

its unaudited financial results for the third quarter of 2024.

Third Quarter 2024 Financial and Operational

Highlights

| · | Total revenues were RMB27.0 million (US$3.8 million),

compared with RMB353.6 million in the same period of 2023. Income from operations was RMB35.2 million (US$5.0 million) for the three months

ended September 30, 2024, compared with a loss of RMB87.8 million in the same period last year. Net income was RMB67.9

million (US$9.7 million) for the three months ended September 30, 2024, compared with a loss of RMB49.1 million in the

same period last year. |

| · | The total outstanding balance of financing transactions

the Company facilitated was RMB4.8 billion (US$685.7 million) as of September 30, 2024. Our credit risk exposure has decreased to

a lower level, with only RMB1.7 billion (US$ 246.1 million) of outstanding loan balances where the Company bears credit risks

that have not been provided with full bad debt allowance or full risk assurance liabilities. M1+ and M3+ overdue ratios for all financing

transactions that remained outstanding and were facilitated by the Company were 3.17% and 1.76%, respectively, as of September 30,

2024, compared with 2.93% and 1.57%, respectively, as of June 30, 2024. |

| · | Total balance of cash and cash equivalents and

short-term investments increased by RMB89.3 million (US$12.7 million) compared with that as of June 30, 2024. |

Mr. Jiayuan Lin, Chief Executive Officer

of Cango, commented, “In the third quarter of 2024, our business was primarily focused on the Cango U-car app and AutoCango.com,

our international used car platform. We strengthened Cango U-car app’s competitive advantages in vehicle inventory during the quarter

by establishing strategic partnerships with numerous used car marketplaces, enabling real-time updates of vehicle listings and ensuring

a diverse and abundant supply of vehicles on the Cango U-car app. For AutoCango.com, we have been continuously refining content development

and search engine optimization to boost brand exposure and expand our market reach. Since its launch in March 2024, AutoCango.com

has grown rapidly, accumulating over 370,000 page views, nearly 60,000 registered users and offering more than 100,000 used car SKUs

covering over 65,000 models. Going forward, we will strengthen our data analysis capabilities to gain a deeper understanding of our target

markets and user demographics and implement data-based, scientific marketing strategies to propel our balanced global development.”

“While steadily advancing our existing business,

we are also actively pursuing forward-looking, strategic investment opportunities worldwide. By establishing an international cooperation

network, strengthening communication with leading global companies, and actively participating in the collaborative development of overseas

projects, we aim to showcase Cango’s strength and vision on a broader stage and create greater value for all of our stakeholders,”

concluded Mr. Lin.

Mr. Yongyi Zhang, Chief Financial Officer

of Cango, stated, “We are pleased to report another solid quarter thanks to our continued focus on rigorous cost control and robust

risk management. As we continue to develop our business and actively explore growth opportunities overseas, we maintain prudent cash management

to safeguard our balance sheet. Simultaneously, we remain committed to prudent financial strategies designed to generate long-term value

for our shareholders.”

Third Quarter 2024 Financial Results

REVENUES

Total revenues in

the third quarter of 2024 were RMB27.0 million (US$3.8 million) compared with RMB353.6 million in the same period of 2023. Guarantee

income, which represented the fee income earned on the non-contingent aspect of a guarantee, was RMB14.4 million (US$2.1 million)

in the third quarter of 2024. This was presented separately from the contingent aspect of a guarantee pursuant to the adoption of ASC

326 since January 1, 2023.

OPERATING COST AND EXPENSES

| · | Cost of revenue in the third quarter of 2024

decreased to RMB23.3 million (US$3.3 million) from RMB304.6 million in the same period of 2023. As a percentage of total revenues, cost

of revenue in the third quarter of 2024 was 86.3% compared with 86.1% in the same period of 2023. |

| · | Sales and marketing expenses in the third quarter

of 2024 decreased to RMB3.4 million (US$0.5 million) from RMB9.9 million in the same period of 2023. |

| · | General and administrative expenses in the third

quarter of 2024 were RMB45.2 million (US$6.4 million) compared with RMB34.7 million in the same period of 2023. |

| · | Research and development expenses in the third

quarter of 2024 decreased to RMB1.4 million (US$0.2 million) from RMB7.0 million in the same period of 2023. |

| · | Net gain on contingent risk assurance liabilities

in the third quarter of 2024 was RMB7.1 million (US$1.0 million) compared with a net loss of RMB3.5 million in the same period of 2023. |

| · | Net recovery on provision for credit losses in

the third quarter of 2024 was RMB74.4 million (US$10.6 million) compared with RMB66.9 million in the same period of 2023. |

INCOME FROM OPERATIONS

Income from operations

in the third quarter of 2024 was RMB35.2 million (US$5.0 million), compared with a loss of RMB87.8 million in the same period

of 2023.

NET INCOME

Net income in the

third quarter of 2024 was RMB67.9 million (US$9.7 million). Non-GAAP adjusted net income in the third quarter of 2024 was RMB71.3

million (US$10.2 million). Non-GAAP adjusted net income excludes the impact of share-based compensation expenses. For further information,

see "Use of Non-GAAP Financial Measure."

NET INCOME PER ADS

Basic and diluted

net income per American Depositary Share (the “ADS”) in the third quarter of 2024 were RMB0.66 (US$0.09) and RMB0.60

(US$0.09), respectively. Non-GAAP adjusted basic and diluted net income per ADS in the third quarter of 2024 were RMB0.69 (US$0.10) and

RMB0.63 (US$0.09), respectively. Each ADS represents two Class A ordinary shares of the Company.

BALANCE SHEET

| · | As of September 30, 2024, the Company had

cash and cash equivalents of RMB691.8 million (US$98.6 million), compared with RMB949.5 million as of June 30, 2024. |

| · | As of September 30, 2024, the Company had

short-term investments of RMB3.1 billion (US$439.3 million), compared with RMB2.7 billion as of June 30, 2024. |

Business Outlook

For the fourth quarter

of 2024, the Company expects total revenues to be between RMB15.0 million and RMB17.5 million. This forecast reflects the Company's

current and preliminary views on the market and operational conditions, which are subject to change.

Share Repurchase Program

Pursuant to the

share repurchase program announced on April 23, 2024 (the “New Share Repurchase Program”), the Company had repurchased

996,640 ADSs with cash in the aggregate amount of approximately US$1.7 million up to September 30, 2024.

Conference Call Information

The Company's management will hold a conference

call on Monday, November 4, 2024, at 8:00 P.M. Eastern Time or Tuesday, November 5, 2024, at 9:00 A.M. Beijing Time

to discuss the financial results. Listeners may access the call by dialing the following numbers:

| International: |

+1-412-902-4272 |

| United States Toll Free: |

+1-888-346-8982 |

| Mainland China Toll Free: |

4001-201-203 |

| Hong Kong, China Toll Free: |

800-905-945 |

| Conference ID: |

Cango Inc. |

The replay will be accessible through November 11,

2024 by dialing the following numbers:

| International: |

+1-412-317-0088 |

| United States Toll Free: |

+1-877-344-7529 |

| Access Code: |

8025630 |

A live and archived

webcast of the conference call will also be available at the Company's investor relations website at http://ir.cangoonline.com/.

About Cango Inc.

Cango Inc. (NYSE:

CANG) is a leading automotive transaction service platform in China, connecting car buyers, dealers, financial institutions, and other

industry participants. Founded in 2010 by a group of pioneers in China’s automotive finance industry, the Company is headquartered

in Shanghai and has a nationwide network. Leveraging its competitive advantages in technological innovation and big data, Cango has established

an automotive supply chain ecosystem, and developed a matrix of products centering on customer needs for auto transactions, auto financing

and after-market services. By working with platform participants, Cango endeavors to make car purchases simple and enjoyable, and make

itself customers’ car purchase service platform of choice. For more information, please visit: www.cangoonline.com.

Definition of Overdue Ratios

The Company defines "M1+ overdue ratio"

as (i) exposure at risk relating to financing transactions for which any installment payment is 30 to 179 calendar days past due

as of a specified date, divided by (ii) exposure at risk relating to all financing transactions which remain outstanding as of such

date, excluding amounts of outstanding principal that are 180 calendar days or more past due.

The Company defines "M3+ overdue ratio"

as (i) exposure at risk relating to financing transactions for which any installment payment is 90 to 179 calendar days past due

as of a specified date, divided by (ii) exposure at risk relating to all financing transactions which remain outstanding as of such

date, excluding amounts of outstanding principal that are 180 calendar days or more past due.

Use of Non-GAAP Financial Measure

In evaluating the business, the Company considers

and uses Non-GAAP adjusted net income (loss), a Non-GAAP measure, as a supplemental measure to review and assess its operating performance.

The presentation of the Non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial

information prepared and presented in accordance with U.S. GAAP. The Company defines Non-GAAP adjusted net income (loss) as net income

(loss) excluding share-based compensation expenses. The Company presents the Non-GAAP financial measure because it is used by the management

to evaluate the operating performance and formulate business plans. Non-GAAP adjusted net income (loss) enables the management to assess

the Company's operating results without considering the impact of share-based compensation expenses, which are non-cash charges. The Company

also believes that the use of the Non-GAAP measure facilitates investors' assessment of its operating performance.

Non-GAAP adjusted net income (loss) is not defined

under U.S. GAAP and is not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as an analytical tool.

One of the key limitations of using Non-GAAP adjusted net income (loss) is that it does not reflect all items of expense that affect the

Company's operations. Share-based compensation expenses have been and may continue to be incurred in the business and are not reflected

in the presentation of Non-GAAP adjusted net income (loss). Further, the Non-GAAP measure may differ from the Non-GAAP information used

by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations

by reconciling the Non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating

the Company's performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial

measure.

Reconciliations of Cango's Non-GAAP financial

measure to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange Rate Information

This announcement

contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the

reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.0176 to US$1.00, the noon buying

rate in effect on September 30, 2024, in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation

that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates,"

"future," "intends," "plans," "believes," "estimates" and similar statements. Among

other things, the "Business Outlook" section and quotations from management in this announcement, contain forward-looking statements.

Cango may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Cango's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained

in any forward-looking statement, including but not limited to the following: Cango's goal and strategies; Cango's expansion plans; Cango's

future business development, financial condition and results of operations; Cango's expectations regarding demand for, and market acceptance

of, its solutions and services; Cango's expectations regarding keeping and strengthening its relationships with dealers, financial institutions,

car buyers and other platform participants; general economic and business conditions; and assumptions underlying or related to any of

the foregoing. Further information regarding these and other risks is included in Cango's filings with the SEC. All information provided

in this press release and in the attachments is as of the date of this press release, and Cango does not undertake any obligation to update

any forward-looking statement, except as required under applicable law.

Investor Relations Contact

Yihe Liu

Cango Inc.

Tel: +86 21 3183 5088 ext.5581

Email: ir@cangoonline.com

Helen Wu

Piacente Financial Communications

Tel: +86 10 6508 0677

Email: ir@cangoonline.com

CANGO INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEET

(Amounts in Renminbi ("RMB") and US dollar ("US$"), except for number of shares and per share data)

| | |

As of December 31, 2023 | | |

As of September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS: | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,020,604,191 | | |

| 691,818,800 | | |

| 98,583,390 | |

| | |

| | | |

| | | |

| | |

| Restricted cash - current - bank deposits held for short-term investments | |

| 1,670,006,785 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Restricted cash - current - others | |

| 14,334,937 | | |

| 12,816,134 | | |

| 1,826,284 | |

| Short-term investments | |

| 635,070,394 | | |

| 3,082,865,458 | | |

| 439,304,813 | |

| Accounts receivable, net | |

| 64,791,709 | | |

| 25,529,710 | | |

| 3,637,955 | |

| Finance lease receivables - current, net | |

| 200,459,435 | | |

| 47,126,581 | | |

| 6,715,484 | |

| Financing receivables, net | |

| 29,522,035 | | |

| 8,535,562 | | |

| 1,216,308 | |

| Short-term contract asset | |

| 170,623,200 | | |

| 55,923,363 | | |

| 7,969,015 | |

| Prepayments and other current assets | |

| 78,606,808 | | |

| 29,955,505 | | |

| 4,268,625 | |

| Total current assets | |

| 3,884,019,494 | | |

| 3,954,571,113 | | |

| 563,521,874 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Restricted cash - non-current | |

| 583,380,417 | | |

| 461,367,450 | | |

| 65,744,336 | |

| Property and equipment, net | |

| 8,239,037 | | |

| 6,586,202 | | |

| 938,526 | |

| Intangible assets | |

| 48,373,192 | | |

| 47,634,678 | | |

| 6,787,887 | |

| Long-term contract asset | |

| 36,310,769 | | |

| 448,353 | | |

| 63,890 | |

| Finance lease receivables - non-current, net | |

| 36,426,617 | | |

| 9,761,388 | | |

| 1,390,987 | |

| Operating lease right-of-use assets | |

| 47,154,944 | | |

| 42,815,154 | | |

| 6,101,111 | |

| Other non-current assets | |

| 4,705,544 | | |

| 4,104,803 | | |

| 584,930 | |

| Total non-current assets | |

| 764,590,520 | | |

| 572,718,028 | | |

| 81,611,667 | |

| TOTAL ASSETS | |

| 4,648,610,014 | | |

| 4,527,289,141 | | |

| 645,133,541 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term debts | |

| 39,071,500 | | |

| - | | |

| - | |

| Long-term debts—current | |

| 926,237 | | |

| 649,300 | | |

| 92,525 | |

| Accrued expenses and other current liabilities | |

| 206,877,626 | | |

| 130,806,077 | | |

| 18,639,717 | |

| Deferred guarantee income | |

| 86,218,888 | | |

| 20,638,251 | | |

| 2,940,927 | |

| Contingent risk assurance liabilities | |

| 125,140,991 | | |

| 33,692,222 | | |

| 4,801,103 | |

| Income tax payable | |

| 311,904,279 | | |

| 311,235,998 | | |

| 44,350,775 | |

| Short-term lease liabilities | |

| 7,603,380 | | |

| 8,015,363 | | |

| 1,142,180 | |

| Total current liabilities | |

| 777,742,901 | | |

| 505,037,211 | | |

| 71,967,227 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Long-term debts | |

| 712,023 | | |

| 470,216 | | |

| 67,005 | |

| Deferred tax liability | |

| 10,724,133 | | |

| 10,724,133 | | |

| 1,528,177 | |

| Long-term operating lease liabilities | |

| 42,228,435 | | |

| 39,375,249 | | |

| 5,610,928 | |

| Other non-current liabilities | |

| 226,035 | | |

| 140,038 | | |

| 19,955 | |

| Total non-current liabilities | |

| 53,890,626 | | |

| 50,709,636 | | |

| 7,226,065 | |

| Total liabilities | |

| 831,633,527 | | |

| 555,746,847 | | |

| 79,193,292 | |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 204,260 | | |

| 204,260 | | |

| 29,107 | |

| Treasury shares | |

| (773,130,748 | ) | |

| (782,800,080 | ) | |

| (111,548,119 | ) |

| Additional paid-in capital | |

| 4,813,679,585 | | |

| 4,747,032,306 | | |

| 676,446,692 | |

| Accumulated other comprehensive income | |

| 111,849,166 | | |

| 98,802,836 | | |

| 14,079,291 | |

| Accumulated deficit | |

| (335,625,776 | ) | |

| (91,697,028 | ) | |

| (13,066,722 | ) |

| Total Cango Inc.’s equity | |

| 3,816,976,487 | | |

| 3,971,542,294 | | |

| 565,940,249 | |

| Total shareholders' equity | |

| 3,816,976,487 | | |

| 3,971,542,294 | | |

| 565,940,249 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| 4,648,610,014 | | |

| 4,527,289,141 | | |

| 645,133,541 | |

CANGO INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

(Amounts in Renminbi (“RMB”) and US dollar (“US$”), except for number of shares and per share data)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| 353,638,119 | | |

| 26,953,433 | | |

| 3,840,833 | | |

| 1,571,681,558 | | |

| 136,455,663 | | |

| 19,444,776 | |

| Loan facilitation income and other related income | |

| 11,345,343 | | |

| 819,779 | | |

| 116,818 | | |

| 27,618,224 | | |

| 16,310,549 | | |

| 2,324,235 | |

| Guarantee income | |

| 50,006,711 | | |

| 14,414,947 | | |

| 2,054,114 | | |

| 170,010,917 | | |

| 65,581,347 | | |

| 9,345,267 | |

| Leasing income | |

| 11,298,293 | | |

| 2,057,631 | | |

| 293,210 | | |

| 50,157,926 | | |

| 10,338,904 | | |

| 1,473,282 | |

| After-market services income | |

| 14,116,184 | | |

| 7,956,088 | | |

| 1,133,733 | | |

| 41,364,974 | | |

| 36,110,901 | | |

| 5,145,762 | |

| Automobile trading income | |

| 263,821,645 | | |

| 1,202,198 | | |

| 171,312 | | |

| 1,256,429,781 | | |

| 6,116,392 | | |

| 871,579 | |

| Others | |

| 3,049,943 | | |

| 502,790 | | |

| 71,646 | | |

| 26,099,736 | | |

| 1,997,570 | | |

| 284,651 | |

| Operating cost and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 304,638,147 | | |

| 23,260,308 | | |

| 3,314,567 | | |

| 1,400,985,230 | | |

| 78,844,658 | | |

| 11,235,274 | |

| Sales and marketing | |

| 9,854,441 | | |

| 3,375,602 | | |

| 481,019 | | |

| 34,546,132 | | |

| 10,909,363 | | |

| 1,554,572 | |

| General and administrative | |

| 34,682,695 | | |

| 45,196,454 | | |

| 6,440,443 | | |

| 111,319,960 | | |

| 122,290,803 | | |

| 17,426,300 | |

| Research and development | |

| 6,990,685 | | |

| 1,424,250 | | |

| 202,954 | | |

| 22,841,206 | | |

| 4,192,881 | | |

| 597,481 | |

| Net loss (gain) on contingent risk assurance liabilities | |

| 3,541,506 | | |

| (7,110,545 | ) | |

| (1,013,245 | ) | |

| 3,475,114 | | |

| (32,385,904 | ) | |

| (4,614,954 | ) |

| Net recovery on provision for credit losses | |

| (66,945,232 | ) | |

| (74,429,953 | ) | |

| (10,606,183 | ) | |

| (105,260,489 | ) | |

| (203,759,529 | ) | |

| (29,035,501 | ) |

| Impairment loss from goodwill | |

| 148,657,971 | | |

| - | | |

| - | | |

| 148,657,971 | | |

| - | | |

| - | |

| Total operation cost and expense | |

| 441,420,213 | | |

| (8,283,884 | ) | |

| (1,180,445 | ) | |

| 1,616,565,124 | | |

| (19,907,728 | ) | |

| (2,836,828 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Loss) income from operations | |

| (87,782,094 | ) | |

| 35,237,317 | | |

| 5,021,278 | | |

| (44,883,566 | ) | |

| 156,363,391 | | |

| 22,281,604 | |

| Interest income | |

| 19,481,911 | | |

| 25,742,760 | | |

| 3,668,314 | | |

| 58,981,302 | | |

| 76,001,320 | | |

| 10,830,101 | |

| Net gain on equity securities | |

| 7,038,386 | | |

| 2,237,825 | | |

| 318,888 | | |

| 15,439,734 | | |

| 7,217,751 | | |

| 1,028,521 | |

| Interest expense | |

| (153,088 | ) | |

| - | | |

| - | | |

| (4,099,783 | ) | |

| - | | |

| - | |

| Foreign exchange (loss) gain, net | |

| (489,215 | ) | |

| (1,414,569 | ) | |

| (201,574 | ) | |

| 2,346,525 | | |

| (921,077 | ) | |

| (131,252 | ) |

| Other income | |

| 21,806,106 | | |

| 3,053,224 | | |

| 435,081 | | |

| 29,404,718 | | |

| 8,470,829 | | |

| 1,207,083 | |

| Other expenses | |

| (141,358 | ) | |

| (216,395 | ) | |

| (30,836 | ) | |

| (368,492 | ) | |

| (2,051,858 | ) | |

| (292,387 | ) |

| Net (loss) income before income taxes | |

| (40,239,352 | ) | |

| 64,640,162 | | |

| 9,211,151 | | |

| 56,820,438 | | |

| 245,080,356 | | |

| 34,923,670 | |

| Income tax (expenses) benefits | |

| (8,847,190 | ) | |

| 3,238,963 | | |

| 461,549 | | |

| 9,084,706 | | |

| (1,151,608 | ) | |

| (164,103 | ) |

| Net (loss) income | |

| (49,086,542 | ) | |

| 67,879,125 | | |

| 9,672,700 | | |

| 65,905,144 | | |

| 243,928,748 | | |

| 34,759,567 | |

| Net (loss) income attributable to Cango Inc.’s shareholders | |

| (49,086,542 | ) | |

| 67,879,125 | | |

| 9,672,700 | | |

| 65,905,144 | | |

| 243,928,748 | | |

| 34,759,567 | |

| (Losses) earnings per ADS attributable to ordinary shareholders: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.45 | ) | |

| 0.66 | | |

| 0.09 | | |

| 0.52 | | |

| 2.34 | | |

| 0.33 | |

| Diluted | |

| (0.45 | ) | |

| 0.60 | | |

| 0.09 | | |

| 0.50 | | |

| 2.16 | | |

| 0.31 | |

| Weighted average ADS used to compute earnings per ADS attributable to ordinary shareholders: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 109,587,726 | | |

| 103,486,998 | | |

| 103,486,998 | | |

| 125,710,975 | | |

| 104,346,709 | | |

| 104,346,709 | |

| Diluted | |

| 109,587,726 | | |

| 113,911,629 | | |

| 113,911,629 | | |

| 131,630,583 | | |

| 112,853,015 | | |

| 112,853,015 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss), net of tax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 7,806,144 | | |

| (41,774,075 | ) | |

| (5,952,758 | ) | |

| 79,837,076 | | |

| (13,046,330 | ) | |

| (1,859,087 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive (loss) income | |

| (41,280,398 | ) | |

| 26,105,050 | | |

| 3,719,942 | | |

| 145,742,220 | | |

| 230,882,418 | | |

| 32,900,480 | |

| Total comprehensive (loss) income attributable to Cango Inc.’s shareholders | |

| (41,280,398 | ) | |

| 26,105,050 | | |

| 3,719,942 | | |

| 145,742,220 | | |

| 230,882,418 | | |

| 32,900,480 | |

CANGO INC.

RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(Amounts in Renminbi ("RMB") and US dollar ("US$"), except for number of shares and per share data

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net (loss) income | |

| (49,086,542 | ) | |

| 67,879,125 | | |

| 9,672,700 | | |

| 65,905,144 | | |

| 243,928,748 | | |

| 34,759,567 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Add: Share-based compensation expenses | |

| 7,857,905 | | |

| 3,407,729 | | |

| 485,597 | | |

| 33,897,580 | | |

| 13,814,122 | | |

| 1,968,497 | |

| Cost of revenue | |

| 444,748 | | |

| 170,312 | | |

| 24,269 | | |

| 1,920,626 | | |

| 637,320 | | |

| 90,817 | |

| Sales and marketing | |

| 1,608,169 | | |

| 635,874 | | |

| 90,611 | | |

| 6,747,135 | | |

| 2,551,010 | | |

| 363,517 | |

| General and administrative | |

| 5,427,332 | | |

| 2,569,932 | | |

| 366,212 | | |

| 23,710,996 | | |

| 10,369,108 | | |

| 1,477,586 | |

| Research and development | |

| 377,656 | | |

| 31,611 | | |

| 4,505 | | |

| 1,518,823 | | |

| 256,684 | | |

| 36,577 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net (loss) income | |

| (41,228,637 | ) | |

| 71,286,854 | | |

| 10,158,297 | | |

| 99,802,724 | | |

| 257,742,870 | | |

| 36,728,064 | |

| Net (loss) income attributable to Cango Inc.’s shareholders | |

| (41,228,637 | ) | |

| 71,286,854 | | |

| 10,158,297 | | |

| 99,802,724 | | |

| 257,742,870 | | |

| 36,728,064 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net (loss) income per ADS-basic | |

| (0.38 | ) | |

| 0.69 | | |

| 0.10 | | |

| 0.79 | | |

| 2.47 | | |

| 0.35 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net (loss) income per ADS-diluted | |

| (0.38 | ) | |

| 0.63 | | |

| 0.09 | | |

| 0.76 | | |

| 2.28 | | |

| 0.33 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average ADS outstanding—basic | |

| 109,587,726 | | |

| 103,486,998 | | |

| 103,486,998 | | |

| 125,710,975 | | |

| 104,346,709 | | |

| 104,346,709 | |

| Weighted average ADS outstanding—diluted | |

| 109,587,726 | | |

| 113,911,629 | | |

| 113,911,629 | | |

| 131,630,583 | | |

| 112,853,015 | | |

| 112,853,015 | |

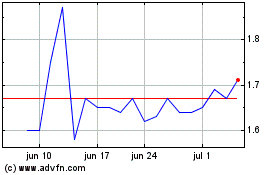

Cango (NYSE:CANG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Cango (NYSE:CANG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024