Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 Novembro 2024 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of November,

2024

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: Letter dated November 6, 2024 entitled “Operations with Sociedad Argentina de Construcción y Desarrollo Estratégico

S.A.”

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: November 6, 2024

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

Buenos Aires, November 6, 2024

COMISIÓN NACIONAL

DE VALORES

BOLSAS Y MERCADOS

ARGENTINOS S.A.

Ref.: Operations with Sociedad Argentina de

Construcción y Desarrollo Estratégico S.A.

Dear Sirs,

I am writing to the National Securities

Commission (“Comisión Nacional de Valores”) and Bolsas y Mercados Argentinos S.A. in my capacity as Head of Market

Relations of Pampa Energía S.A. (the “Company”), to inform that on the date hereof, the Board of the Directors of the

Company approved a new general framework containing the terms and conditions for acquiring the services of Sociedad Argentina de Construcción

y Desarrollo Estratégico S.A. related to the construction and engineering of the Company projects to be carried out in the next

year. This new framework’s terms and conditions are the same as those contained in the frameworks approved in the previous years,

and that were informed as Relevant Event on November 9, 8, 11, 10, 7 ans 8 2018, 2019, 2020, 2021, 2022 and 2023 respectively.

Before the approval mentioned

above, it is worth noting that it was required the opinion of the Company’s Audit Committee regarding the adjustment of those operations

to arm’s length conditions, following art. 72 of the Capital Markets Law. The rendered opinion concluded that, as long as those

operations are made under the pre-established and approved conditions, they can be reasonably considered arm’s length market transaction.

It is informed that the Audit

Committee’s opinion is available at the CNV’s “Autopista de la Información Financiera” and upon

shareholders’ request at the Company’s headquarters.

Sincerely,

María Agustina Montes

Head of Market Relations

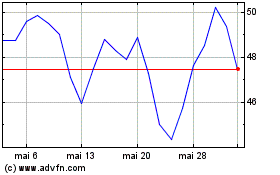

Pampa Energia (NYSE:PAM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

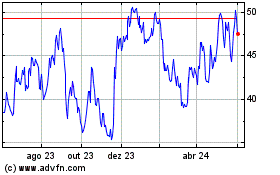

Pampa Energia (NYSE:PAM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024