Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

15 Novembro 2024 - 6:59PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. )

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material under § 240.14a-12 |

AIM

ImmunoTech Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

November 15, 2024, AIM ImmunoTech Inc. (the “Company”) held a conference call in connection with the Company’s announcement

of its earnings for the third quarter of 2024. The excerpts from the script for the conference call that contain statements that may

be deemed proxy soliciting materials are attached hereto as Exhibit 1. In addition, on November 15, 2024, the Company issued the following

materials, copies of which are attached hereto as Exhibit 2.

Forward

Looking Statements

These

materials contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”).

Words such as “may,” “will,” “expect,” “plan,” “anticipate,” “continue,”

“believe,” “potential,” “upcoming” and other variations thereon and similar expressions (as well

as other words or expressions referencing future events or circumstances) are intended to identify forward-looking statements. Many of

these forward-looking statements involve a number of risks and uncertainties. Data, pre-clinical success and clinical success seen to

date does not guarantee that Ampligen will be approved as a therapy for endometriosis or ovarian cancer. The Company urges investors

to consider specifically the various risk factors identified in its most recent Annual Report on Form 10-K, and any risk factors or cautionary

statements included in any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, filed with the U.S. Securities and

Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of these materials. Among other things, for those statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the PSLRA. The Company does not undertake to update any of these forward-looking statements

to reflect events or circumstances that occur after the date hereof.

Important

Additional Information

The

Company, its directors and executive officers, Peter W. Rodino, III and Robert Dickey, IV, are deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s

stockholders in connection with the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Company

filed its definitive proxy statement (the “Definitive Proxy Statement”) and a WHITE universal proxy card with

the SEC on November 4, 2024 in connection with such solicitation of proxies from the Company’s stockholders. STOCKHOLDERS OF

THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH DEFINITIVE PROXY STATEMENT, ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND ALL OTHER

DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. The

Definitive Proxy Statement contains information regarding the identity of the participants, and their direct and indirect interests,

by security holdings or otherwise, in the Company’s securities and can be found in the section titled “Principal Stockholders”

of the Definitive Proxy Statement and available here. Information regarding subsequent changes to their holdings of the Company’s

securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website available here

or through the SEC’s website at www.sec.gov. Stockholders will be able to obtain the Definitive Proxy Statement, any amendments

or supplements thereto and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov.

Copies will also be available at no charge at the Company’s website at https://aimimmuno.com/sec-filings/.

Exhibit

1

I

would like to inform you that AIM ImmunoTech has filed a definitive proxy statement and related proxy materials with the SEC in connection

with the 2024 Annual Meeting of Shareholders. And in connection therewith, its directors, and executive officers, Peter W. Rodino III

and Robert Dickey, IV, are participants in the solicitation of proxies from our shareholders in connection with such annual meeting.

AIM shareholders are strongly encouraged to read such proxy statement and all other related materials filed with the SEC carefully and

in their entirety as they contain important information about the 2024 Annual Meeting.

As

you may know, a group of activist investors has nominated four individuals to replace our entire Board. We have issued a detailed public

letter on this, but I want to make a few points on this call.

For

the third year in a row, several individuals of this group are trying to take control of our Board. We have serious reservations about

this group’s members, which include individuals with checkered pasts and close ties to securities law felons. This, in our view,

indicates they would not be good stewards of stockholder resources. The group has also made clear in their proxy materials that they

personally will seek substantial monetary reimbursement for over $5 million for their 2023 failed attempt to take over the Board in addition

to whatever expenses they may incur in connection with this year’s annual meeting, each without giving shareholders a direct say.

Needless

to say, AIM’s cash is essential to funding our runway for ongoing research and clinical trials, keeping up the positive momentum

we’ve seen across high-value indications, which Chris and I have discussed earlier in this call, is what will allow us to unlock

long-term value for all shareholders. Each of our incumbent directors strongly believes that if the activist group gains control of the

Board, our progress and momentum would be put in jeopardy and the Company’s cash position could be severely depleted if and when

they reimburse themselves.

The

bottom line, in our view, the activist group is looking out for itself, not for all shareholders. and the election of their nominees—who

have not even put forth any serious plan for the future of the Company—would be detrimental to all stakeholders. That is all I’m

going to say on this subject on the call. So I ask that your questions be limited to our business and financial results from the quarter.

Exhibit

2

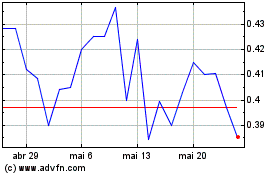

AIM ImmunoTech (AMEX:AIM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

AIM ImmunoTech (AMEX:AIM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024