UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission file number: 001-39278

Kingsoft Cloud Holdings Limited

(Exact Name of Registrant as Specified in Its

Charter)

Building D, Xiaomi Science and Technology Park,

No. 33 Xierqi Middle Road,

Haidian District

Beijing, 100085, the People’s Republic

of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Kingsoft Cloud Holdings Limited |

| |

|

|

| Date: November 19, 2024 |

By: |

/s/ Haijian He |

| |

|

Name: Haijian He |

| |

|

Title: Chief Financial Officer and Director |

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Kingsoft Cloud Holdings Limited

金 山 云 控 股 有 限 公 司

(Incorporated in the Cayman Islands with limited

liability)

(Stock Code: 3896)

(Nasdaq Stock Ticker: KC)

(1)

RENEWAL AND AMENDMENTS OF CONTINUING CONNECTED TRANSACTIONS IN RELATION TO 2022 KINGSOFT FRAMEWORK AGREEMENT; AND

(2)

RENEWAL AND AMENDMENTS OF CONTINUING CONNECTED TRANSACTIONS IN RELATION TO 2022 XIAOMI FRAMEWORK AGREEMENT

Independent Financial Adviser to the Independent

Board

Committee and the Independent Shareholders

RENEWAL

AND AMENDMENTS OF THE CONTINUING CONNECTED TRANSACTIONS

Reference

is made to the Listing Document. On December 20, 2022, the Company entered into (i) the 2022 Kingsoft Framework Agreement with

Kingsoft Corporation in relation to the provision of cloud services and the acceptance of comprehensive property management and administrative

services by the Group, for an initial term of three years commencing from the Listing Date and expiring on December 31, 2024; and

(ii) the 2022 Xiaomi Framework Agreement with Xiaomi in relation to the provision of cloud services, the purchase of customized

terminal devices and software, and the acceptance of finance lease by the Group, for an initial term of three years commencing from the

Listing Date and expiring on December 31, 2024.

The

Board is pleased to announce that, on November 19, 2024 (after trading hours), the Company entered into (1) the 2024 Kingsoft

Framework Agreement with Kingsoft Corporation in relation to the provision of cloud services, the acceptance of comprehensive property

services, the acceptance of comprehensive technology services, and the acceptance of property lease services by the Group; and (2) the

2024 Xiaomi Framework Agreement with Xiaomi in relation to the provision of cloud services and the acceptance of financing services (including

the sale-and-leaseback finance lease, the direct finance lease, the factoring and the secured loan) by the Group.

HONG

KONG LISTING RULES IMPLICATION

In respect of 2024 Kingsoft Framework

Agreement

As at the date of this announcement,

Kingsoft Corporation directly held approximately 37.40% of the Shares, thus is a connected person of the Company as defined under the

Hong Kong Listing Rules. Accordingly, the entering into of the 2024 Kingsoft Framework Agreement and the transactions contemplated thereunder

constitute continuing connected transactions of the Company under Chapter 14A of the Hong Kong Listing Rules.

As one or more of the applicable percentage

ratios in respect of the proposed annual caps for the cloud services contemplated under the 2024 Kingsoft Framework Agreement are more

than 5%, such agreement and cloud services contemplated thereunder (including the proposed annual caps) are subject to the reporting,

annual review, announcement and independent shareholders’ approval requirements under Chapter 14A of the Hong Kong Listing Rules.

As the highest applicable percentage

ratios in respect of the proposed annual caps for the purchase of each of (i) the comprehensive property services, and (ii) the

comprehensive technology services under the 2024 Kingsoft Framework Agreement are more than 0.1% but less than 5%, such transactions

contemplated thereunder (including the proposed annual caps) are subject to the reporting, announcement and annual review requirements,

but are exempt from the independent shareholders’ approval requirement under Chapter 14A of the Hong Kong Listing Rules.

As the highest applicable percentage

ratio in respect of the proposed annual caps for the acceptance of the property lease services under the 2024 Kingsoft Framework Agreement

is less than 0.1%, such transactions contemplated thereunder (including the proposed annual caps) are fully exempt from reporting, announcement,

annual review and independent shareholders’ approval requirements under Chapter 14A of the Hong Kong Listing Rules.

In respect of 2024 Xiaomi Framework

Agreement

As at the date of this announcement,

Xiaomi directly and indirectly held an aggregate of approximately 12.25% of the Shares, thus is a connected person of the Company as

defined under the Hong Kong Listing Rules. Accordingly, the entering into of the 2024 Xiaomi Framework Agreement and the transactions

contemplated thereunder constitute continuing connected transactions of the Company under Chapter 14A of the Hong Kong Listing Rules.

As one or more of the applicable percentage

ratios in respect of the proposed annual caps for each of (i) the provision of cloud services, (ii) the acceptance of finance

lease (including the sale-and-leaseback finance lease and the direct finance lease), (iii) the acceptance of factoring, and (iv) the

acceptance of secured loans contemplated under the 2024 Xiaomi Framework Agreement are more than 5%, such agreement and transactions

contemplated thereunder (including the proposed annual caps) are subject to the reporting, annual review, announcement and independent

shareholders’ approval requirements under Chapter 14A of the Hong Kong Listing Rules.

As

the highest applicable percentage ratios in respect of the proposed annual caps for each of (i) the finance lease (including sale-and-leaseback

finance lease and direct finance lease) and (ii) the factoring under the 2024 Xiaomi Framework Agreement are more than 5% but less than

25%, such transactions contemplated thereunder (including the proposed annual caps) are also subject to the reporting and announcement

requirements applicable to discloseable transaction under Chapter 14 of the Hong Kong Listing Rules.

Reference is made to the Listing Document.

On December 20, 2022, the Company entered into (i) the 2022 Kingsoft Framework Agreement with Kingsoft Corporation in relation

to the provision of cloud services and the acceptance of comprehensive property management and administrative services by the Group,

for an initial term of three years commencing from the Listing Date and expiring on December 31, 2024; and (ii) the 2022 Xiaomi

Framework Agreement with Xiaomi in relation to the provision of cloud services, the purchase of customized terminal devices and software,

and the acceptance of finance lease by the Group, for an initial term of three years commencing from the Listing Date and expiring on

December 31, 2024.

The Board is pleased to announce that,

on November 19, 2024 (after trading hours), the Company entered into (1) the 2024 Kingsoft Framework Agreement with Kingsoft

Corporation in relation to the provision of cloud services, the acceptance of comprehensive property services, the acceptance of comprehensive

technology services, and the acceptance of property lease services by the Group; and (2) the 2024 Xiaomi Framework Agreement with

Xiaomi in relation to the provision of cloud services and the acceptance of financing services (including the sale-and-leaseback finance

lease, the direct finance lease, the factoring and the secured loan) by the Group.

| II. | RENEWAL AND AMENDMENTS OF THE CONTINUING CONNECTED TRANSACTIONS |

| A. | 2024 Kingsoft Framework Agreement |

As disclosed in the Listing Document,

on December 20, 2022, the Company entered into the 2022 Kingsoft Framework Agreement with Kingsoft Corporation in relation to the

provision of cloud services and the acceptance of comprehensive property management and administrative services by the Group. The initial

term of the 2022 Kingsoft Framework Agreement commenced from the Listing Date and will expire on December 31, 2024.

The Board is pleased to announce that,

on November 19, 2024 (after trading hours), the Company entered into the 2024 Kingsoft Framework Agreement with Kingsoft Corporation

in relation to the provision of cloud services, the acceptance of comprehensive property services, the acceptance of comprehensive technology

services, and the acceptance of property lease services by the Group, for a term of three years commencing from January 1, 2025.

| The principal terms of the 2024 Kingsoft Framework Agreement are summarized as below. |

| |

|

|

| Date: |

November 19, 2024 |

| |

|

|

| Parties: |

(i) |

the Company; and |

| |

|

|

| |

(ii) |

Kingsoft Corporation |

| |

|

|

| Term: |

The term will be three years from January 1, 2025 to December 31, 2027, subject to the approval by the Independent Shareholders. The parties agreed that the agreement will, subject to compliance with the relevant laws and regulations and the Hong Kong Listing Rules, be renewed with the consent of the parties. |

| |

|

|

| Nature of the Transactions: |

The scope of services under the 2024 Kingsoft Framework Agreement includes the followings, to be conducted from time to time: |

| |

|

|

| |

(i) |

Cloud services: the Group

has agreed to provide cloud services to the Kingsoft Group, including but not limited to cloud storage, cloud computing, computing

power services, comprehensive cloud solutions, and technical support, maintenance and upgrading services and other related or similar

services; |

| |

|

|

| |

(ii) |

Comprehensive property

services: Kingsoft Group has agreed to provide the comprehensive property management, administrative services, software, and system

support to the Group, including but not limited to property management services and other related administrative support for the

office space; |

| |

|

|

| |

(iii) |

Comprehensive technology

services: Kingsoft Group has agreed to provide comprehensive technology services to the Group, including but not limited to the WPS365

software licensing, document middleware, document center services, IT process system services such as KOA development and other

related software and technology services; and |

| |

|

|

| |

(iv) |

Property lease services:

Kingsoft Group has agreed to lease certain properties to the Group. |

| Principle of the Transactions: |

The transactions under the 2024 Kingsoft Framework Agreement shall follow the principle of fairness and reasonableness and shall be conducted on normal commercial terms or better. |

| |

|

|

| |

The Group may, from time to time, enter into specific agreements with the Kingsoft Group to specify the details such as scope of services, price and/or service fees, payment and settlement arrangements and other specifications, provided that the principles in the 2024 Kingsoft Framework Agreement must be followed. |

| |

|

|

| Pricing Basis: |

To ensure the pricing under the 2024 Kingsoft Framework Agreement is fair and reasonable and in the interests of the Company and the Shareholders as a whole, the price/service fees shall be no more favourable than those offered by the Group to independent third parties, or no less favourable than those offered by independent third parties to the Group and those offered by Kingsoft Group to independent third parties (as the case may be). |

| |

|

|

| |

The service fees for the cloud services payable by Kingsoft Group shall be determined on an arm’s-length basis between the parties with reference to, among others, the costs and expenses of such services, the transaction amount, the expected profit margin of the Group, and the prevailing market prices of services with similar technical specifications and quantities. |

| |

|

|

| |

The Company primarily charges public cloud service customers on a monthly basis based on utilization and duration, and the Company employs a pre-determined formula and procedures of pricing for all public cloud service customers (the “Cloud Services Pricing Policy”), including Kingsoft Group, Xiaomi Group and other independent-third-party customers. The Cloud Services Pricing Policy establishes a structured methodology for pricing public cloud services to ensure fair and commercially competitive terms. |

| |

Details of the Cloud Services Pricing Policy |

| |

|

|

| |

The Cloud Services Pricing Policy includes, among others, the publication of standard reference prices for the products and services at the Company’s official website, and evaluation of pricing proposals by the Company. For public cloud services, the Group generally charges its customers based on utilization and duration and offers them credit terms. Customers are typically charged a monthly service fee based on the actual consumption of cloud products. The Group also offers prepaid subscription packages over a fixed subscription period. |

| |

|

|

| |

Before entering into definitive sales agreements or orders, the Company will go through its internal pricing proposal procedure as follows: |

| |

|

|

| |

• |

Step 1: Publication

of standard reference prices. The Group maintains a centralized pricing framework for its products and services. The Company

publishes pricing policies and standard reference prices of various types of cloud-based products and services at its official website,

which are easily and publicly accessible. These standard prices are reviewed and updated by the Company from time to time, to reflect

market dynamics, cost fluctuations, and other relevant factors. |

| |

|

|

| |

• |

Step 2: Evaluation of

pricing proposals. When considering whether to offer competitive prices for a particular client, the sales and finance

teams of Company will prepare a pricing proposal by employing a comprehensive pricing module with a series of pre-set factors including,

among others, the standard reference price published at the Company’s website, customer’s procurement amount, length

of service, payment schedule (such as upfront payment), deposit requirements, and historical business relationship with the customer.

For orders that involve customized services, the procurement team of the Company adopts an additional pricing enquiry process to

ensure the fair pricing of the costs of services/revenue. The management team reviews and assesses the pricing terms on an individual

basis to ensure alignment with broader strategic goals. |

| |

|

|

| |

The Company also implements robust internal control measures to ensure the Company’s conformity with the pricing policy, details of which have been set out in the section headed “IV. INTERNAL CONTROL MEASURES”. |

The table below sets forth the historical

amounts in respect of the relevant services contemplated under the 2024 Kingsoft Framework Agreement for the two years ended December 31,

2023 and the nine months ended September 30, 2024:

| | |

For the

year ended

December 31,

2022 | | |

For the

year ended

December 31,

2023 | | |

For the

nine months

ended

September 30,

2024 | |

| | |

(RMB in million) | |

| Fees payable by Kingsoft Group in respect of the cloud services | |

| 198.8 | | |

| 236.0 | | |

| 218.2 | |

| | |

| | | |

| | | |

| | |

| Fees payable by the Group in respect of the comprehensive property management and administrative services | |

| 13.9 | | |

| 9.2 | | |

| 7.2 | |

| | |

| | | |

| | | |

| | |

| Fees payable by the Group in respect of the comprehensive technology services | |

| Nil | | |

| Nil | | |

| 2.66 | |

For the fees payable by Kingsoft Group

in respect of the cloud services under the 2022 Kingsoft Framework Agreement, the annual caps previously set for the two years ended

December 31, 2022 and 2023, and the year ending December 31, 2024 were RMB213.1 million, RMB265.3 million, and RMB330.5 million,

respectively; and the corresponding utilization rates of the actual transaction amounts against such existing annual caps are 93.29%,

88.96% and 66.02%1, respectively.

For the fees payable by the Group in

respect of the comprehensive property management and administrative services under the 2022 Kingsoft Framework Agreement, the annual

caps previously set for the two years ended December 31, 2022 and 2023, and the year ending December 31, 2024 were RMB15.3

million, RMB16.1 million, and RMB16.4 million, respectively; and the corresponding utilization rates of the actual transaction amounts

against such existing annual caps are 90.85%, 57.14% and 43.90%1, respectively.

Other than the historical amount incurred

in respect of the comprehensive property management and administrative services under the 2022 Kingsoft Framework Agreement, there were

no historical transactions in relation to the property lease services provided by Kingsoft Group to the Group which shall be recognized

as the Group’s right-of-use assets in accordance with the applicable accounting standards.

| 1 | For the nine months ended September 30, 2024. |

| (2) | Proposed annual caps for the three years ending December 31,

2027 |

The Company proposes to set the annual

caps for the transactions contemplated under the 2024 Kingsoft Framework Agreement for the three years ending December 31, 2027

as follows:

| | |

Proposed annual cap for the year ending

December 31, | |

| | |

2025 | | |

2026 | | |

2027 | |

| | |

(RMB in million) | |

| Fees payable by Kingsoft Group in respect of the cloud services | |

| 469.1 | | |

| 597.0 | | |

| 775.5 | |

| | |

| | | |

| | | |

| | |

| Fees payable by the Group in respect of the comprehensive property services | |

| 16.9 | | |

| 17.9 | | |

| 18.9 | |

| | |

| | | |

| | | |

| | |

| Fees payable by the Group in respect of the comprehensive technology services | |

| 7.5 | | |

| 8.5 | | |

| 9.5 | |

| | |

| | | |

| | | |

| | |

| Maximum value of right-of-use asset in respect of the property lease | |

| 4.7 | | |

| 5.1 | | |

| 5.5 | |

| (3) | Basis of determination of the proposed annual caps |

Proposed annual caps for provision of cloud services

The proposed annual caps for the fees

payable by Kingsoft Group in respect of the cloud services for the three years ending December 31, 2027 are determined with reference

to, among others, the following factors, with an additional buffer of a certain percentage on top to provide for operational flexibility

and cater for potential increment in the transaction volume:

| (i) | Historical transaction amounts and recent growth rate |

As illustrated above, the utilization

rates of the existing annual caps for the cloud services were approximately 93.29% and 88.96% for the two years ended December 31,

2022 and 2023, respectively. In addition, the rising demand for cloud services from Kingsoft Group has led to significant growth in historical

transaction amounts payable by Kingsoft Group to the Group:

| • | The transaction amounts of the cloud services payable by Kingsoft

Group to the Group increased of approximatively 33% for the six months ended June 30, 2024, compared to the same period in 2023. |

| • | For the nine months ended September 30, 2024, the transaction

amount of the cloud services payable by Kingsoft Group has increased to RMB218.2 million from RMB144.6 million for the six months ended

June 30, 2024. |

| • | The transaction amounts of the cloud services payable by Kingsoft

Group to the Group represent year-on-year growth rates of approximatively 31%, 27%, and 19% for the years ended December 31, 2021,

2022, and 2023, respectively. |

| (ii) | Continuous growth of demand of cloud services of Kingsoft Group |

As disclosed by Kingsoft Group, it has

set the strategy of “multi-screen, cloud, content, collaboration, and AI” where cloud service is an integrate part. In line

with Kingsoft Group’s continuous product enhancements and user experience optimization in cloud services and AI-driven applications

of Kingsoft Group, the Group is committed to providing cloud services, which synergizes the core business segments of Kingsoft Group,

namely (a) office software and services; and (b) online games and others business.

| a. | Existing offerings – office software and services:

The Company provides public cloud services for the office software and services segment of Kingsoft Group, which represented majority

of the revenue from Kingsoft Group for the year ended December 31, 2023. For the three years ending December 31, 2027, the

Company considered that the Group and the Kingsoft Group may continue to collaborate in the following areas: |

| • | Domestic individual office subscription business: As disclosed

by Kingsoft Corporation in its 2024 interim report, it enhanced the end-to-cloud integration experience, increasing user stickiness to

WPS cloud services, which in turn boosted user engagement in the cloud. According to Kingsoft Corporation, in July 2024, Kingsoft

Group upgraded its AI strategy with the launch of WPS AI 2.0. For individuals, it introduced four new AI office assistants for writing,

reading, data and design. The accumulated paying active subscribers of Kingsoft Group increased from approximately 29.97 million subscribers

as at December 31, 2022 to approximately 35.49 million subscribers as at December 31, 2023, representing an increase of approximately

18%. |

| • | Institutional subscription business: As disclosed by Kingsoft

Corporation, it also continued to promote the adoption of cloud, collaboration, and artificial intelligence applications, enabling efficient

and intelligent management of enterprise digital assets and advancing digital office processes in government and enterprises. Kingsoft

Group expanded public cloud business into the private and state-owned enterprises, which aligns with the products portfolio of the Group,

and may bring sustained growth in cloud service demand from the Group. For enterprise users, Kingsoft Group has launched WPS AI Enterprise

Edition, which includes AI Hub (intelligent base), AI Docs (intelligent document library), and Copilot Pro (enterprise intelligent assistant).

In addition, the enterprise cloud services provided by Camelot to Kingsoft Group after the Company acquired Camelot in 2021 is

expected to continue to grow in the next three years ending December 31, 2027. |

As such, as a result of the above

continuous efforts of Kingsoft Group to promote its cloud migration and enhance its products and services for cloud office scenarios,

the Company considered the increasing demand of cloud services of Kingsoft Group in determining the proposed annual caps of cloud services

payable by Kingsoft Group.

| b. | New offerings – online games and others: In addition

to the transactions in relation to Kingsoft Group’s office software and services, the Company may have opportunities to deepen

the collaboration with Kingsoft Group to offer cloud services for launching and operations of several games of Kingsoft Group. |

| (iii) | Long-term and stable cooperation relationships |

The Company has been providing cloud

services to Kingsoft Group for more than a decade. The strong and stable collaboration with Kingsoft Group enables the Company to tailor

its services to meet the evolving needs of Kingsoft Group effectively. Such long-term business cooperation relationship has also created

unique and strong synergies between Kingsoft Group and the Group, driven by mutual commercial benefits, and in turn, bring more business

cooperations in the near future.

| (iv) | The fair market rates for similar services. Over the past

five years from 2019 to 2023, according to Wind Financial Terminal, the market size of cloud services has demonstrated a compound annual

growth rate of approximately 26.96%. |

Proposed annual caps for other transactions

under the 2024 Kingsoft Framework Agreement

The proposed annual caps for the fees

payable by the Group in respect of the comprehensive property services for the three years ending December 31, 2027 are determined

with reference to, among others, (i) the historical transaction amounts and fee charged by Kingsoft Group; (ii) the current

and expected future office space demand of the Group in light of the Group’s expected business development, for example, the strategic

expansion plan in Wuhan, which requires more property management services and support; and (iii) the fair market rates for similar

services. It is estimated that such transaction amounts will generally remain stable for the next three years.

The proposed annual caps for the fees

payable by the Group in respect of the comprehensive technology services for the three years ending December 31, 2027 are determined

with reference to, among others, (i) the historical transaction amounts; (ii) the current and expected demand for the software

and documentation related services and support due to the development of the business of the Group; and (iii) the fair market rates

for similar services.

The proposed annual caps for the maximum

value of right-of-use asset in respect of the property lease for the three years ending December 31, 2027 are determined with reference

to, among others, (i) the business development plan of the Group and the potential future lease arrangements; and (ii) the

fair market rates for similar services.

| 4. | Reasons for and benefit of entering into the 2024 Kingsoft

Framework Agreement |

Leveraging the long-standing cooperation

between the Kingsoft Group and the Group as well as the familiarity of products and services of each party, the entering into 2024 Kingsoft

Framework Agreement is expected to mutually benefit both parties. The provision of cloud services by the Group to Kingsoft Group, in

particular the public cloud services with a high level of customer stickiness in nature and growth potential, will provide sources of

recurring revenues to the Group as Kingsoft Group’s business expands. The provision of comprehensive property services and property

lease services by Kingsoft Group to the Group will better leverage the mature infrastructure and services coverage already established

by Kingsoft Group to provide a more stable and undisrupted office environment to the Group with the costs that are in line with prevailing

market prices. The provision of comprehensive technology services by Kingsoft Group will offer diversified, flexible and customized services

for office automation (OA) system and communication system to enhance business growth and operational efficiency of the Group. In addition,

the Group can integrate advanced technology services from Kingsoft Group to provide customized private deployment solutions, further

optimizing product portfolios and meeting diverse needs of the clients.

In light of the above, the Company

considers that it is beneficial to enter into the 2024 Kingsoft Framework Agreement to regulate the continuing connected transactions

contemplated thereunder as such transactions will continue to facilitate the operation and growth of the Group’s business as a

whole.

| B. | 2024 Xiaomi Framework Agreement |

Reference is made to the Listing Document.

On December 20, 2022, the Company entered into the 2022 Xiaomi Framework Agreement with Xiaomi in relation to the provision of cloud

services, the purchase of customized terminal devices and software, and the acceptance of finance lease by the Group. The initial term

of the 2022 Xiaomi Framework Agreement commenced from the Listing Date and will expire on December 31, 2024.

The Board is pleased to announce that,

on November 19, 2024 (after trading hours), the Company entered into the 2024 Xiaomi Framework Agreement with Xiaomi in relation

to the provision of cloud services and the acceptance of financing services (including the sale-and-leaseback finance lease, the direct

finance lease, the factoring and the secured loan) by the Group, for a term of three years commencing from January 1, 2025.

The principal terms of the 2024 Xiaomi Framework Agreement

are summarized as below.

| Date: |

November 19, 2024 |

| |

|

|

| Parties: |

(i) |

the

Company; and |

| |

|

|

| |

(ii) |

Xiaomi |

| |

|

|

| Term: |

The term will be three years from January 1, 2025 to December 31, 2027, subject to the approval by the Independent Shareholders. The parties agreed that the agreement will, subject to compliance with the relevant laws and regulations and the Hong Kong Listing Rules, be renewed with the consent of the parties. |

| Nature

of the Transactions: |

The scope of services under the 2024 Xiaomi Framework Agreement includes the followings, to be conducted from time to time: |

| |

|

|

| |

(i) |

Cloud

services: the Group has agreed to provide cloud services to the Xiaomi Group, including but not limited to cloud storage, cloud computing,

computing power services, comprehensive cloud solutions, and technical support, maintenance and upgrading services and other related

or similar services. |

| |

|

|

| |

(ii) |

Financing

services: Xiaomi Group has agreed to provide financing services to the Group by way of sale-and-leaseback finance lease, direct finance

lease, factoring and secured loans. |

| |

|

|

| |

|

The

Company expects that, subject to parties’ further negotiation and the Group’s then actual needs and conditions, (x) the

factoring services to be provided by Xiaomi Group may include both recourse and non-recourse types; and (y) the target assets

of the finance lease service to be provided by Xiaomi Group may include servers, network devices and other ancillary facilities owned

by the Group. |

| |

|

|

| Principle

of the Transactions: |

The transactions under the 2024 Xiaomi Framework Agreement shall follow the principle of fairness and reasonableness and shall be conducted on normal commercial terms or better. |

| |

|

|

| |

The Group may, from time to time, enter into specific agreements with the Xiaomi Group to specify the details such as service fees, payment and settlement arrangements, leased assets, sale price, interest rate and other specifications, provided that the principles in the 2024 Xiaomi Framework Agreement must be followed. |

| Pricing

Basis: |

To ensure the pricing under the 2024 Xiaomi Framework Agreement is fair and reasonable and in the interests of the Company and the Shareholders as a whole, the price/service fees shall be no more favourable than those offered by the Group to independent third parties, or no less favourable than those offered by independent third parties to the Group and those offered by Xiaomi Group to independent third parties (as the case may be). Specifically: |

| |

|

|

| |

(i) |

Cloud

services: In provision of the cloud services to Xiaomi Group, the Company will also follow the Cloud Services Pricing Policy. For

more details please refer to page 6 of this announcement. |

| |

|

|

| |

|

The

service fees for the cloud services payable by Xiaomi Group shall be determined on an arm’s-length basis between the parties

with reference to, among others, the costs and expenses of such services, the transaction amount, the expected profit margin of the

Group, the service price offered by the Group to other independent third parties and the prevailing market prices of services with

similar technical specifications and quantities. |

| |

|

|

| |

(ii) |

Financing

services: The fees (including the interest rate and rent, if applicable) for the financing services shall be determined on an arm’s-length

basis between the parties with reference to, among others, the market price or book value of the leased assets (if applicable), the

then-current LPR published by the People’s Bank of China and the prevailing market financing cost for the similar financing

services. |

The table below sets forth the historical

amounts in respect of the relevant services contemplated under the 2024 Xiaomi Framework Agreement for the two years ended December 31,

2023 and the nine months ended September 30, 2024:

| | |

For the

year ended

December 31,

2022 | | |

For the

year ended

December 31,

2023 | | |

For the

nine months

ended

September 30,

2024 | |

| | |

(RMB in million) | |

| Fees payable by Xiaomi Group in respect of the cloud services | |

| 879.2 | | |

| 868.3 | | |

| 859.6 | |

| | |

| | | |

| | | |

| | |

| Maximum outstanding balance of finance lease and interest in respect of the finance lease provided by Xiaomi Group | |

| 753.6 | | |

| 814.9 | | |

| 724.5 | |

For the fees payable by Xiaomi Group

in respect of the cloud services under the 2022 Xiaomi Framework Agreement, the annual caps previously set for the two years ended December 31,

2022 and 2023, and the year ending December 31, 2024 were RMB1,111.8 million, RMB1,343.0 million, and RMB1,622.7 million, respectively;

and the corresponding utilization rates of the actual transaction amounts against such existing annual caps are 79.08%, 64.65% and 52.97%2,

respectively.

For the maximum outstanding balance

of finance lease and interest in respect of the finance lease provided by Xiaomi Group under the 2022 Xiaomi Framework Agreement, the

annual caps previously set for the two years ended December 31, 2022 and 2023, and the year ending December 31, 2024 were RMB1,400.0

million, RMB1,400.0 million, and RMB1,400.0 million, respectively; and the corresponding utilization rates of the actual transaction

amounts against such existing annual caps are 53.83%, 58.21% and 51.75%2, respectively.

There were no historical transactions

in relation to the factoring and secured loan provided by Xiaomi Group to the Group.

| 2 | For the nine months ended September 30, 2024. |

| (2) | Proposed annual caps for the three years ending December 31,

2027 |

The Company proposes to set the annual

caps for the transactions contemplated under the 2024 Xiaomi Framework Agreement for the three years ending December 31, 2027 as

follows:

| |

| |

Proposed annual cap for the year ending

December 31, | |

| |

| |

2025 | | |

2026 | | |

2027 | |

| |

| |

(RMB in million) | |

| Fees payable by Xiaomi Group in respect of the cloud services | |

| 2,309.8 | | |

| 3,138.3 | | |

| 4,035.1 | |

| |

| |

| | | |

| | | |

| | |

| In respect of financing services: | |

| | | |

| | | |

| | |

| a. |

Finance lease (including sale-and-leaseback finance lease and direct finance lease): | |

| | | |

| | | |

| | |

| |

Maximum outstanding balance | |

| 1,200 | | |

| 1,200 | | |

| 1,200 | |

| |

| |

| | | |

| | | |

| | |

| b. |

Factoring: | |

| | | |

| | | |

| | |

| |

Maximum outstanding balance | |

| 1,200 | | |

| 1,200 | | |

| 1,200 | |

| |

| |

| | | |

| | | |

| | |

| c. |

Secured loans: | |

| | | |

| | | |

| | |

| |

Maximum outstanding balance | |

| 2,000 | | |

| 2,000 | | |

| 2,000 | |

| (3) | Basis of determination of the proposed annual caps |

| A. | In respect of the cloud services |

The proposed annual caps for the fees

payable by Xiaomi Group in respect of the cloud services for the three years ending December 31, 2027 are determined with reference

to, among others, the following factors, with an additional buffer of a certain percentage on top to provide for operational flexibility

and cater for any potential increment in the transaction volume:

| (i) | Continuous growth of demand of cloud services of Xiaomi Group |

The Group is committed to

continuously improving its cloud-based services for its clients, including Xiaomi for its core business segments, namely

(a) smartphone × AIoT segment and (b) smart Electric Vehicle

(“EV”) and other new initiatives segment, which is also consistent with Xiaomi’s corporate strategy of

“Human × Car × Home”.

| a. | New business – smart EV and other new initiatives segment:

On March 28, 2024, Xiaomi officially launched its first smart EV product, Xiaomi SU7 Series, and

it launched its Xiaomi SU7 Ultra officially in October 2024, which represents a major

new source of cloud service demand. As disclosed by Xiaomi, the revenue from the smart EV business and other new initiatives increased

to RMB9.7 billion in the third quarter of 2024 from RMB6.4 billion in the second quarter of 2024. |

Having considered the above development

of Xiaomi’s smart EV business, the Group proposed the annual caps for the services fees payable by Xiaomi Group for the cloud services,

for the three years ending December 31, 2027, with a view to deepen the collaboration with Xiaomi Group in the following aspects:

| • | Cloud for R&D: During the EV development process, such as machine learning (ML) models, require

vast cloud services. |

| • | Storage Growth: Increases in data storage are anticipated, driven

by high-resolution image processing, sensor data from autonomous systems, and user data management for connected car ecosystems. |

| • | Beyond R&D, the production and operation of smart EVs will

require cloud services for managing logistics, monitoring performance, and delivering over-the-air (OTA) updates to vehicles. |

As

disclosed by Xiaomi, it achieved the cumulative production of 100,000 vehicles on November 13, 2024, and will strive to achieve

the new target of delivering 130,000 vehicles of the Xiaomi SU7 Series for the

entire year of 2024. In addition, in the first half of 2024, its research and development (R&D) expenses were RMB10.7 billion, up

22.9% year-over-year, which was primarily due to the increase in research and development expenses related to its smart EV business and

other new initiatives. In the third quarter of 2024, its R&D expenses were RMB6.0 billion, up 19.9% year-over-year.

| b. | Existing business – smartphone × AIoT segment:

Notwithstanding the new revenue contributor of smart EV segment, in arriving the proposed annual cap, the Company has considered the

continuous development of Xiaomi’s smartphone × AIoT segment, including among others, (a) the cloud support for Xiaomi’s

ecosystem, for firmware updates delivered seamlessly to millions of devices and cloud-based features such as storage, photo backup, and

device synchronization, (b) the provision of scalable cloud storage and real-time computational capabilities to manage device data,

user interfaces, and analytics to Xiaomi’s AIoT platform, and (c) Xiaomi’s internet services, including content streaming

and cloud-based applications. According to Xiaomi’s 2024 interim report, in June 2024, Xiaomi’s global monthly active

users reached another record high at 675.8 million, increasing 11.5% year-over-year. As of June 30, 2024, the number of connected

IoT devices on Xiaomi AIoT platform (excluding smartphones, tablets and laptops) increased to 822.2 million, up 25.6% year-over-year.

As of September 30, 2024, the number of connected IoT devices on its AIoT platform (excluding smartphones, tablets and laptops)

increased to 861.4 million, up 23.2% year-over-year. |

| c. | As a result, driven by the expected growth rate of Xiaomi’s

smartphone × AIoT segment and smart EV and other new initiatives segment, and considering the current wallet share of the Company’s

services to Xiaomi, the Company proposed such annual caps for the cloud services payable by Xiaomi Group to embrace the collaboration

with Xiaomi Group, with an additional buffer of a certain percentage on top. |

| (ii) | Historical transaction amounts and recent growth rate |

As illustrated above, the utilization

rates of the existing annual caps for the cloud services provided by the Group to Xiaomi Group were approximately 79% and 64% for the

two years ended December 31, 2023, respectively. In addition, the transaction amounts for cloud services provided to Xiaomi Group

have shown significant growth since 2024, which reflected Xiaomi Group’s increasing demand on cloud services for its diverse and

expanding operations as detailed in below:

| • | For the six months ended June 30, 2024, the transaction amount

for the cloud services provided by the Group to Xiaomi Group was approximately RMB557.2 million, representing an increase of approximately

27%, from RMB379.9 million in the same period of 2023. |

| • | For the nine months ended September 30, 2024, the transaction

amount of the cloud services payable by Xiaomi Group has increased to RMB859.6 million from RMB557.3 million for the six months ended

June 30, 2024. |

| (iii) | Long-term and stable cooperation relationships |

The Group has maintained long-term

relationships with Xiaomi Group. The strong and stable collaboration enables the Group to tailor its services to meet the evolving needs

of Xiaomi Group effectively. Such long-term business cooperation relationship has created unique and strong synergies between Xiaomi

Group and the Group, driven by mutual commercial benefits, and in turn, core competence and competitive advantages of the Group in terms

of product and cloud service offerings.

| (iv) | the fair market rates for similar services. For more details,

please refer to page 10 of this announcement. |

Despite of the substantial increase

of the proposed annual caps for the cloud services to be provided by the Group to Xiaomi Group for the three years ending December 31,

2027 under the 2024 Xiaomi Framework Agreement, the Board is of the view that the Group will not place undue reliance on Xiaomi Group, considering among others, the Company’s diversified customer base and the Group’s

expected growth of total revenue.

| B. | In respect of the financing services |

In

determining the proposed annual caps for the financing services to be provided by Xiaomi Group, including the sub-caps of finance lease,

factoring and secured loans, the Group has taken into account the following factors, with an additional buffer of a certain percentage

on top to provide for operational flexibility and cater for potential increment in the transaction volume:

| (a) | Growing financing demand |

Given

the consistent need to fund infrastructure investment to meet its business expansion, the Group expects to maintain high demand of scalable,

stable and reliable funding support in the next three years.

| • | Future capital expenditure: To meet the increasing market

demand of cloud services, the Company has been actively investing and will continue to accelerate its investment into infrastructure.

The key priorities include (a) the procurement of new servers for AI-related services, to enhance the computing power and storage

capabilities with a view to delivering higher-quality cloud service to customers of the Group; and (b) investment in other fixed

assets. As of June 30, 2024, the Company owned around 100,000 servers. In 2023, the Company has reaffirmed its original aspiration

for sustainable high-quality development strategy and resolutely implemented cost reduction and efficiency initiatives. Adhering to its

business plan, the Company prudently manages its capital expenditure and focus on enhancing its provision of products and services. In

2023, the Company’s total capital expenditure was RMB1,964.7 million, which was mainly due to the procurement of new servers to

support AI-related services. |

As such, it is expected that the Company

will continue to have financing demand amounting to approximately RMB2 billion to RMB3 billion for each of the next three years, as a

result of the Company’s anticipated capital expenditure in fixed assets.

| • | Repayment of debts: To ensure financial stability and optimize

the overall capital structure of the Group, the Company has also taken into account its current level of short-term borrowings. It is

anticipated that the amount of debt repayment will amount to around RMB1 billion to RMB2 billion per annum for the years of 2025 to 2027,

which has been factored into when determining the proposed annual caps for financing services to be provided by Xiaomi Group. |

| (b) | Diversified financing channels |

The Group has historically utilized

a diversified mix of financing sources to meet its working capital and capital expenditure demands from time to time. These sources include

both (i) third-party commercial banks and financial institutions, including China Merchants Bank Financial Leasing Company Limited,

CITIC Financial Leasing Co., Ltd., and Cinda Financial Leasing Co., Ltd., etc. and (ii) connected persons, such as Xiaomi

Group and Kingsoft Group. When considering terms of financing sources, the Group takes into account multiple factors, including but not

limited to, urgency of funding needs, flexibility, costs, availability of credit enhancements (such as assets portfolio) and repayment

abilities,

| • | The total amounts of the Group’s borrowings from both third

parties financial institutions and related parties were approximately RMB2.1 billion, RMB3.7 billion and RMB4.1 billion, as at December 31,

2023, June 30, 2024 and September 30, 2024, respectively. |

| • | As of September 30, 2024, the amount of financing obtained

from independent third-party banks and financial institutions was approximately RMB2.7 billion, representing approximately 66% of the

total amount of financing of the Group. |

| (c) | Flexibility and availability of financing sources – advantages

of Xiaomi Group’s financial services |

Despite that the Group has diversified

sources of third-party financing, the Group would like to deepen the collaboration with Xiaomi Group. Notwithstanding the terms of the

finance services agreements are fair and reasonable, Xiaomi Group’s financing services are customized to meet the Group’s

operational and investment needs, offering a high degree of alignment with its business strategy. Services include finance leases, factoring,

and secured loans, structured to provide both long-term and short-term liquidity support to the Group’s operations. The pre-existing

business relationship with Xiaomi Group simplifies negotiations and reduces lead times for accessing funds, which is crucial for addressing

urgent liquidity needs from time to time.

The actual finance lease amount incurred

between the Group and Xiaomi Group for the past two years demonstrated a year-over-year growth rate of approximately 8.13%, and the transaction

amount for the nine months ended September 30, 2024 also shows the ongoing trend, further supporting the Group’s growing financing

needs. Furthermore, the historical utilization rates of the annual caps for the past two years of approximately 50% to 60% for finance

leasing services provided by Xiaomi Group to the Group were mainly because the Group also obtained finance leasing services from some

other independent-third-party providers. As such, a downward adjustment is made to the proposed annual caps in relation to the finance

lease with Xiaomi Group for the three years ending December 31, 2027.

The Group will closely monitor the

market conditions, in particular, the prevailing market financing costs offered by other independent-third-party institutions, such as

the rates quoted by major independent commercial banks, to compare with the financing terms offered by Xiaomi Group, adjust its financing

arrangement as necessary and ensure the overall funding costs remain favourable to the Group.

| (d) | Different nature of the finance services |

The Group’s financing needs

vary in nature, reflecting the specific characteristics of finance leases, factoring, and secured loans. Based on these differences and

considering the liquidity status of the Group, the proposed annual sub-caps are tailored to address both long-term and short-term funding

requirements of the Group.

| • | Finance lease will generally provide long term liquidity support

to the Group as compared to factoring and secured loans. |

| • | Factoring provides short-term funding by leveraging accounts receivable,

offering operational flexibility. |

| • | Secured loans allow additional liquidity through asset-backed

financing, addressing both medium- and short-term funding needs. |

After considering the Group’s

assets portfolio, borrowing repayment schedules, and projected liquidity requirements, the Company has proposed the annual caps for each

financing type for the three years ending December 31, 2027.

| 4. | Reasons for and benefit of entering into the 2024 Xiaomi

Framework Agreement |

The Group has been in business cooperation

with Xiaomi Group for more than a decade. The provision of cloud services to Xiaomi Group, in particular the public cloud services with

a high level of customer stickiness in nature and growth potential, will provide sources of recurring revenues to the Group as Xiaomi

Group’s business expands. Besides, leveraging on Xiaomi’s latest development in innovative businesses, including the rapid

growth in smart assisted driving services, the Group will be able to maintain and achieve stable income stream from the growing demand

in computing power services of Xiaomi Group, further improving the financial performance of the Group and broadening return to the Shareholders

as a whole. Additionally, the obtaining of financial resources by way of sale-and-leaseback finance lease, direct finance lease, factoring

and secured loan from Xiaomi Group will strengthen the liquidity position, diversify the funding sources in view of the Group’s

rapid business growth and increasing expenditure as well as address the increasing capital need of the Group in connection with the business

operation and development in the field of cloud services and artificial intelligence infrastructure without equity dilution to existing

Shareholders.

In light of the above, the Company

considers that it is beneficial to enter into the 2024 Xiaomi Framework Agreement to regulate the continuing connected transactions contemplated

thereunder as such transactions will continue to facilitate the operation and growth of the Group’s business as a whole.

| III. | INFORMATION OF THE PARTIES |

| A. | Information of the Company |

The Company was incorporated under the

laws of the Cayman Islands on January 3, 2012 as an exempted company with limited liability, the ADSs of which are listed on Nasdaq

under the symbol of “KC” on May 8, 2020 and the shares of which are listed on the main board of the Hong Kong Stock

Exchange under the stock code “3896” and stock short name “KINGSOFT CLOUD” on December 30, 2022.

The Company is a leading independent

cloud service provider in China. With its full commitment to cloud service, it is dedicated to mobilizing resources to enable its customers

to successfully embrace the benefits of cloud solutions, to pursue their digital transformation strategies, and to create business value.

| B. | Information of Kingsoft Corporation |

Kingsoft Corporation, the controlling

shareholder of the Company, is a company continued in the Cayman Islands with limited liability, whose shares are listed on the Hong

Kong Stock Exchange (Stock Code: 3888).

Kingsoft Corporation is principally engaged

in the design, research and development, and sales and marketing of the office software products and services of WPS Office; and research

and development of games, and the provision of PC games and mobile games services.

Xiaomi, the substantial shareholder of

the Company, is a company incorporated with limited liability in the Cayman Islands on January 5, 2010, whose class B shares are

listed on the Hong Kong Stock Exchange (Stock Codes: 1810 (HKD counter) and 81810 (RMB counter)).

Xiaomi is a consumer electronics and

smart manufacturing company with smartphones and smart hardware connected by an IoT platform at its core.

| IV. | INTERNAL CONTROL MEASURES |

In order to ensure the terms and conditions

of the continuing connected transactions contemplated under the 2024 Kingsoft Framework Agreement and the 2024 Xiaomi Framework Agreement

are on normal commercial terms and fair and reasonable to the Company and Shareholders and are no more favourable than terms offered

available to or no less favourable from independent third parties, the Company has adopted the following internal control procedures:

| (i) | For each type of continuing connected transactions to be conducted

with Kingsoft Group and Xiaomi Group, the Group will ensure that the terms and conditions (including the pricing policy) of the transactions

are fair and reasonable by following the below procedures: |

| • | With respect to the cloud services to be provided by the Group

under the 2024 Kingsoft Framework Agreement and 2024 Xiaomi Framework Agreement, the relevant personnel of the business department of

the Company will conduct quarterly checks on the standard price published on the website of the Company, the prevailing market conditions

and practices of cloud services (including the market fee rates, where available) and the pricing and terms provided by the Group to

independent third parties for the purpose of considering if the service fee charged for a specific type of transaction is no more favourable

to that offered to independent third parties and fair and reasonable, and will review, adjust and approve the pricing policies regularly

when it deems necessary. |

| • | With respect to the comprehensive property services, the comprehensive

technology services, and the property lease services to be provided by Kingsoft Group to the Group under the 2024 Kingsoft Framework

Agreement, the relevant personnel of the business department of the Company will continuously monitor the terms and conditions under

each specific agreement for the purpose of considering if the they are no less favourable to the Group than the terms available from

independent third parties for similar type of services. In particular, the business department of the Company will generally inquire

the quotations offered by at least two independent third parties in respect of the similar services before entering into specific agreements. |

| • | With respect to the respective financing services to be provided

by Xiaomi Group under 2024 Xiaomi Framework Agreement, the finance department of the Company will, before entering into each specific

agreement: (a) check the then-current LPR published by People’s Bank of China; and (b) compare the interest rate with

that for similar type of financing services offered by at least two major commercial banks or financial institutions to confirm the interest

rate or rent charged by Xiaomi Group is in line with the market rates and the specific agreements are entered into on normal or better

commercial terms. |

| (ii) | The designated staff of the finance department of the Company

will closely monitor the actual amounts incurred for each type of continuing connected transactions for the purpose of ensuring the relevant

annual caps are not exceeded. They will closely monitor the continuing connected transactions and report the latest status to the finance

department of the Company on a monthly basis. The finance department of the Company will report to the senior management on a monthly

basis and the Directors (including the independent non-executive Directors) on a half-yearly basis in relation to the transaction status. |

| • | If the actual transaction amounts reach approximately 80% of the

respective annual caps at any given time of the year, the finance department of the Company shall immediately report to the senior management. |

| • | If the remaining cap for that year is expected to be insufficient

to meet the Group’s future business needs, the senior management will report to the Board, and the Board will seek advice from

its professional advisers and consider taking appropriate measures to revise the relevant annual caps in accordance with the applicable

requirements under the Hong Kong Listing Rules. |

| (iii) | The independent non-executive Directors conduct annual review

of continuing connected transactions and provide annual confirmations in the Company’s annual report on whether the continuing

connected transactions are conducted: (1) in the ordinary course of business; (2) in accordance with normal commercial terms

or better and on terms that are fair and reasonable; (3) in accordance with the terms of the relevant agreements; and (4) in

the interests of the Company and the Shareholders as a whole. |

| (iv) | The Company’s external auditors will also conduct an annual

review of the continuing connected transactions of the Group and provide annual confirmation to ensure that the transactions are conducted

in accordance with the terms of the framework agreements (including the pricing policies and the annual caps thereof), on normal commercial

terms and aligned with the pricing policy. |

Mr. Lei Jun and Mr. Zou Tao

are considered to have material interests by virtue of their respective directorships and shareholdings in Kingsoft Corporation. Accordingly,

both Mr. Lei Jun and Mr. Zou Tao have abstained from voting on the relevant Board resolution to approve the 2024 Kingsoft Framework

Agreement (including the proposed annual caps). Mr. Lei Jun is considered to have material interests by virtue of his directorship

and shareholding in Xiaomi. Accordingly, Mr. Lei Jun has abstained from voting on the relevant Board resolution to approve the 2024

Xiaomi Framework Agreement (including the proposed annual caps). Save as mentioned above, none of other Directors has a material interest

in such transactions and is required to abstain from voting on the relevant resolutions at the Board meeting.

The Directors (excluding the Directors

who shall abstain from voting on the relevant resolutions and the independent non-executive Directors whose views will be given after

taking into account the advice from Gram Capital) are of the view that the transactions under the 2024 Kingsoft Framework Agreement and

the 2024 Xiaomi Framework Agreement were entered into after arm’s length negotiation between the parties thereto and in the ordinary

and usual course of business of the Group and on normal commercial terms, and the terms and conditions thereof as well as the proposed

annual caps for such transactions are fair and reasonable and in the interests of the Company and the Shareholders as a whole.

The Independent Board Committee (comprising

all the independent non-executive Directors) has been formed to advise and provide recommendation to the Independent Shareholders on

the renewal and amendments of the 2024 Kingsoft Framework Agreement and the 2024 Xiaomi Framework Agreement and the transactions thereunder

(where applicable), including the respective proposed annual caps thereunder for the three years ending 31 December 2027.

Gram Capital has been appointed as

the Independent Financial Adviser to advise the Independent Board Committee and the Independent Shareholders in the same respect.

| VI. | HONG KONG LISTING RULES IMPLICATIONS |

In respect of 2024 Kingsoft Framework

Agreement

As at the date of this announcement,

Kingsoft Corporation directly held approximately 37.40% of the Shares, thus is a connected person of the Company as defined under the

Hong Kong Listing Rules. Accordingly, the entering into of the 2024 Kingsoft Framework Agreement and the transactions contemplated thereunder

constitute continuing connected transactions of the Company under Chapter 14A of the Hong Kong Listing Rules.

As one or more applicable percentage

ratios in respect of the proposed annual caps for the cloud services contemplated under the 2024 Kingsoft Framework Agreement are more

than 5%, such agreement and cloud services contemplated thereunder (including the proposed annual caps) are subject to the reporting,

annual review, announcement and independent shareholders’ approval requirements under Chapter 14A of the Hong Kong Listing Rules.

As the highest applicable percentage

ratios in respect of the proposed annual caps for each of the purchase of (i) the comprehensive property services, and (ii) the

comprehensive technology services under the 2024 Kingsoft Framework Agreement are more than 0.1% but less than 5%, such transactions

contemplated thereunder (including the proposed annual caps) are subject to the reporting, announcement and annual review requirements,

but are exempt from the independent shareholders’ approval requirement under Chapter 14A of the Hong Kong Listing Rules.

As the highest applicable percentage

ratio in respect of the proposed annual caps for the acceptance of property lease services under the 2024 Kingsoft Framework Agreement

is less than 0.1%, such transactions contemplated thereunder (including the proposed annual caps) are fully exempt from reporting, announcement,

annual review and independent shareholders’ approval requirements under Chapter 14A of the Hong Kong Listing Rules.

In respect of 2024 Xiaomi Framework

Agreement

As at the date of this announcement,

Xiaomi directly and indirectly held an aggregate of 12.25% of the Shares, thus is a connected person of the Company as defined under

the Hong Kong Listing Rules. Accordingly, the entering into of the 2024 Xiaomi Framework Agreement and the transactions contemplated

thereunder constitute continuing connected transactions of the Company under Chapter 14A of the Hong Kong Listing Rules.

As one or more of the applicable percentage

ratios in respect of the proposed annual caps for each of (i) provision of the cloud services, (ii) the acceptance of finance

lease (including sale-and-leaseback finance lease and direct finance lease), (iii) the acceptance of factoring, and (iv) the

acceptance of secured loans contemplated under the 2024 Xiaomi Framework Agreement are more than 5%, such agreements and transactions

contemplated thereunder (including the proposed annual caps) are subject to the reporting, annual review, announcement and independent

shareholders’ approval requirements under Chapter 14A of the Hong Kong Listing Rules.

As

the highest applicable percentage ratios in respect of the proposed annual caps for each of (i) the finance lease (including

sale-and-leaseback finance lease and direct finance lease) and (ii) the factoring under the 2024 Xiaomi Framework Agreement are

more than 5% but less than 25%, such transactions contemplated thereunder (including the proposed annual caps) are also subject to the

reporting and announcement requirements applicable to discloseable transaction under Chapter 14 of the Hong Kong Listing Rules.

| VII. | EXTRAORDINARY GENERAL MEETING |

The EGM will be convened to seek the

approval of the Independent Shareholders with respect to each of the 2024 Kingsoft Framework Agreement and the 2024 Xiaomi Framework

Agreement, and the relevant transactions contemplated thereunder (including the respective proposed annual caps), where applicable.

To the best knowledge and belief of

the Directors having made all reasonable enquiries, save for the share scheme trustee (in respect of both 2024 Xiaomi Framework Agreement

and 2024 Kingsoft Framework Agreement), Kingsoft Corporation and its associates (in respect of 2024 Xiaomi Framework Agreement) and Xiaomi

and its associates (in respect of 2024 Kingsoft Framework Agreement), no other Shareholder has any material interest in the proposed

resolutions and/or is required to abstain from voting on the EGM.

The circular for the EGM, containing

among others, (i) further information on the matters seeking Independent Shareholders’ approval, (ii) a letter from the

Independent Board Committee to the Independent Shareholders and (iii) a letter from Gram Capital to the Independent Board Committee

and the Independent Shareholders, is expected to be dispatched to the Shareholder on or around November 29, 2024.

In this announcement, unless the context

otherwise requires, the following words and expressions shall have the meanings ascribed to them below:

| “2022

Kingsoft Framework Agreement” |

|

the business

cooperation and service framework agreement entered into between Kingsoft Corporation and the Company on December 20, 2022 in

relation to the provision of cloud services and the acceptance of comprehensive property management and administrative services by

the Group |

| |

|

|

| “2022 Xiaomi

Framework Agreement” |

|

the business cooperation

and service framework agreement entered into between Xiaomi and the Company on December 20, 2022 in relation to the provision

of cloud services, the purchase of customized terminal devices and software, and the acceptance of finance lease by the Group |

| |

|

|

| “2024 Kingsoft

Framework Agreement” |

|

the business cooperation

and service framework agreement entered into between Kingsoft Corporation and the Company on November 19, 2024 in relation to

the provision of cloud services, the acceptance of comprehensive property services, the acceptance of comprehensive technology services,

and the acceptance of property lease services by the Group |

| “2024 Xiaomi

Framework Agreement” |

|

the business cooperation

and service framework agreement entered into between Xiaomi and the Company on November 19, 2024 in relation to the provision

of cloud services and the acceptance of financing services (including the sale-and-leaseback finance lease, the direct finance lease,

the factoring and the secured loan) by the Group |

| |

|

|

| “ADS(s)” |

|

American Depositary Shares,

each representing 15 Shares |

| |

|

|

| “associate(s)” |

|

has the meaning ascribed

to it under the Hong Kong Listing Rules |

| |

|

|

| “Board” |

|

the board of Directors |

| |

|

|

| “Company” |

|

Kingsoft Cloud Holdings

Limited, an exempted company with limited liability incorporated in the Cayman Islands on January 3, 2012, the ADSs of which

were listed on Nasdaq in May 2020, and the ordinary Shares of which were listed on the main board of the Hong Kong Stock Exchange

on December 30, 2022 |

| |

|

|

| “connected

person(s)” |

|

has the meaning ascribed

to it under the Hong Kong Listing Rules |

| |

|

|

| “connected

transaction(s)” |

|

has the meaning ascribed

to it under the Hong Kong Listing Rules |

| |

|

|

| “continuing

connected transaction(s)” |

|

has the meaning ascribed

to it under the Hong Kong Listing Rules |

| |

|

|

| “controlling

shareholder” |

|

has the meaning ascribed

to it under the Hong Kong Listing Rules |

| |

|

|

| “Director(s)” |

|

the director(s) of

the Company |

| |

|

|

| “EGM” |

|

the extraordinary general

meeting of the Company to be convened on or around December 31, 2024 at 10:00 a.m. (Hong Kong time) to consider and, if

thought fit, approve, the 2024 Kingsoft Framework Agreement, the 2024 Xiaomi Framework Agreement and the transactions contemplated

thereunder (including the respective proposed annual caps), where applicable, or any adjournment thereof |

| |

|

|

| “Group” |

|

the Company, its subsidiaries

and its consolidated affiliated entities from time to time |

| |

|

|

| “Hong Kong” |

|

Hong Kong Special Administrative

Region of the People’s Republic of China |

| “Hong Kong

Listing Rules” |

|

the Rules Governing

the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to

time |

| |

|

|

| “Hong Kong

Stock Exchange” |

|

The Stock Exchange of Hong

Kong Limited |

| |

|

|

| “Independent

Board Committee” |

|

the independent board committee

of the Company, comprising all independent non-executive Directors, namely Mr. Yu Mingto, Mr. Wang Hang and Ms. Qu

Jingyuan |

| |

|

|

| “Independent

Financial Adviser” or “Gram Capital” |

|

Gram Capital Limited, a

licensed corporation to carry out Type 6 (advising on corporate finance) regulated activity under the SFO, being the independent

financial adviser to the Independent Board Committee and the Independent Shareholders in relation to (i) the terms of, the cloud

services contemplated under and the proposed annual caps of the cloud services for the 2024 Kingsoft Framework Agreement; and (ii) the

terms of, the continuing connected transactions contemplated under and the proposed annual caps for the 2024 Xiaomi Framework Agreement |

| |

|

|

| “Independent

Shareholder(s)” |

|

the Shareholders who are

not required to abstain from voting on the resolutions to approve, where applicable, (1) the 2024 Kingsoft Framework Agreement

and the provision of cloud services contemplate thereunder (including the proposed annual caps for the three years ending December 31,

2027); and/or (2) the 2024 Xiaomi Framework Agreement and the transactions thereunder (including the proposed annual caps for

the three years ending December 31, 2027), at the EGM |

| |

|

|

| “Kingsoft

Corporation” |

|

Kingsoft Corporation Limited,

an exempted limited liability company incorporated in the British Virgin Islands on March 20, 1998 and discontinued in the British

Virgin Islands and continued into the Cayman Islands on November 15, 2005, with its shares listed on the Hong Kong Stock Exchange

(stock code: 3888), the controlling shareholder of the Company within the meaning of the Hong Kong Listing Rules |

| |

|

|

| “Kingsoft

Group” |

|

Kingsoft Corporation and

its subsidiaries |

| |

|

|

| “Listing Date” |

|

December 30, 2022,

the date on which the Shares were listed and on which dealings in the Shares were to be first permitted to take place on the Hong

Kong Stock Exchange |

| |

|

|

| “Listing Document” |

|

the listing document of

the Company dated December 23, 2022 |

| |

|

|

| “LPR” |

|

the Loan Prime Rate |

| “Nasdaq” |

|

the Nasdaq Global Select

Market |

| |

|

|

| “PRC”

or “China” |

|

the People’s Republic

of China |

| |

|

|

| “RMB” |

|

Renminbi, the lawful currency

of the PRC |

| |

|

|

| “Share(s)” |

|

ordinary share(s) in

the share capital of the Company with a par value of US$0.001 each |

| |

|

|

| “Shareholder(s)” |

|

the shareholder(s) of

the Company |

| |

|

|

| “subsidiary(ies)” |

|

has the meaning ascribed

to it under the Hong Kong Listing Rules |

| |

|

|

| “Xiaomi” |

|

Xiaomi Corporation, a company

with limited liability incorporated in the Cayman Islands on January 5, 2010, with its class B ordinary shares listed on the

Hong Kong Stock Exchange (Stock Codes: 1810 (HKD counter) and 81810 (RMB counter)), a substantial shareholder of the Company within

the meaning of the Hong Kong Listing Rules |

| |

|

|

| “Xiaomi Group” |

|

Xiaomi Corporation, its

subsidiaries and consolidated affiliated entities |

| |

|

|

| “%” |

|

per cent |

| |

By

order of the Board |

| |

Kingsoft

Cloud Holdings Limited |

| |

Mr. Zou

Tao |

| |

Executive

Director, Vice Chairman of the Board

and acting Chief Executive Officer |

Hong Kong, November 19, 2024

As

at the date of this announcement, the board of directors of the Company comprises Mr. Lei Jun as Chairman and non-executive director,

Mr. Zou Tao as Vice Chairman and executive director, Mr. He Haijian as executive director, Mr. Feng Honghua

as non-executive director, and Mr. Yu Mingto, Mr. Wang Hang and Ms. Qu Jingyuan as independent non-executive directors.

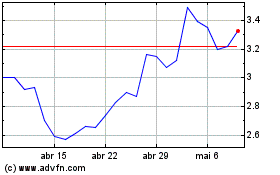

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

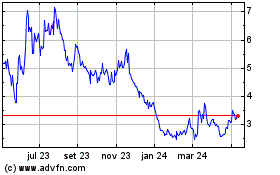

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024