UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

November, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

Financial Information

Jan-Sep/2024

—

|

B3: PETR3 (ON) | PETR4 (PN)

NYSE: PBR (ON) | PBRA (PN)

www.petrobras.com.br/ir

petroinvest@petrobras.com.br

+ 55 21 3224-1510

Disclaimer

This presentation

contains some financial indicators that are not recognized by GAAP or the IFRS. The indicators presented herein do not have standardized

meanings and may not be comparable to indicators with a similar description used by others. We provide these indicators because we use

them as measures of company performance and liquidity; they should not be considered in isolation or as a substitute for other financial

metrics that have been disclosed in accordance with IFRS. See definitions of Adjusted EBITDA, LTM Adjusted EBITDA, Adjusted Cash and Cash

Equivalents, Net Debt, Gross Debt, Free Cash Flow, and Leverage in the Glossary and their reconciliations in the sections Liquidity and

Capital Resources, Reconciliation of LTM Adjusted EBITDA, Net Debt/LTM Adjusted EBITDA Metrics and Consolidated Debt.

TABLE OF CONTENTS

CONSOLIDATED RESULTS

The main functional currency of the Petrobras Group (the “Company”)

is the Brazilian real, which is the functional currency of the parent company and its Brazilian subsidiaries. As the presentation currency

of the Petrobras Group is the U.S. dollar, the results of operations in Brazilian reais are translated into U.S. dollars using the average

exchange rates prevailing during the period (average exchange rate of R$/US$ 5.24 in Jan-Sep/2024 compared to R$/US$ 5.01 in Jan-Sep/2023).

Key Financial Information

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change

(%) |

| Sales revenues |

70,601 |

75,302 |

(6.2) |

| Cost of Sales |

(34,612) |

(35,982) |

(3.8) |

| Gross profit |

35,989 |

39,320 |

(8.5) |

| Income (expenses) |

(11,900) |

(9,309) |

27.8 |

| Consolidated net income attributable to the shareholders of Petrobras |

10,308 |

18,625 |

(44.7) |

| Net cash provided by operating activities |

29,780 |

31,543 |

(5.6) |

| Adjusted EBITDA |

33,234 |

38,944 |

(14.7) |

| Average Brent crude (US$/bbl) * |

82.79 |

82.14 |

0.8 |

| Average Domestic basic oil products price (US$/bbl) |

91.76 |

99.97 |

(8.2) |

|

* Source: Refinitiv.

|

|

|

|

| US$ million |

09.30.2024 |

12.31.2023 |

Change

(%) |

| Gross Debt |

59,132 |

62,600 |

(5.5) |

| Net Debt |

44,251 |

44,698 |

(1.0) |

| Net Debt/LTM Adjusted EBITDA ratio |

0.95 |

0.85 |

11.8 |

| |

|

|

|

| |

|

|

|

Sales Revenues

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change

(%) |

| Diesel |

21,086 |

23,575 |

(10.6) |

| Gasoline |

9,418 |

10,881 |

(13.4) |

| Liquefied petroleum gas (LPG) |

2,400 |

2,722 |

(11.8) |

| Jet fuel |

3,477 |

3,677 |

(5.4) |

| Naphtha |

1,390 |

1,357 |

2.4 |

| Fuel oil (including bunker fuel) |

786 |

834 |

(5.8) |

| Other oil products |

3,304 |

3,364 |

(1.8) |

| Subtotal Oil Products |

41,861 |

46,410 |

(9.8) |

| Natural gas |

3,610 |

4,307 |

(16.2) |

| Crude oil |

3,421 |

3,997 |

(14.4) |

| Renewables and nitrogen products |

147 |

62 |

137.1 |

| Breakage |

362 |

645 |

(43.9) |

| Electricity |

509 |

423 |

20.3 |

| Services, agency and others |

641 |

797 |

(19.6) |

| Total domestic market |

50,551 |

56,641 |

(10.8) |

| Exports |

19,358 |

17,752 |

9.0 |

| Crude oil |

14,701 |

13,245 |

11.0 |

| Fuel oil (including bunker fuel) |

3,726 |

3,734 |

(0.2) |

| Other oil products and other products |

931 |

773 |

20.4 |

| Sales abroad * |

692 |

909 |

(23.9) |

| Total foreign market |

20,050 |

18,661 |

7.4 |

| Sales revenues |

70,601 |

75,302 |

(6.2) |

|

* Sales revenues from operations outside

of Brazil, including trading and excluding exports.

|

|

|

|

Sales revenues were US$ 70,601 million for

the period Jan-Sep/2024, a 6.2% decrease (US$ 4,701 million) when compared to US$ 75,302 million for the period Jan-Sep/2023, mainly due

to:

| (i) | a US$ 4,549 million decrease in

domestic market oil products revenues, of which US$ 3,652 million relates to a decrease in average domestic basic oil products prices

following the reduction in average international prices for diesel and gasoline, and US$ 897 million relates to a decrease in sales volumes; |

| (ii) | a US$ 576 million decrease in domestic

market crude oil revenues, composed of a US$ 650 million decrease which relates to a decrease in sales volumes, partially offset by a

US$ 74 million increase which relates to an increase in average crude oil prices in domestic market following the appreciation of average

Brent crude prices; and |

| (iii) | partially offset by a US$ 1,456

million increase in exported crude oil revenues, of which US$ 1,238 million relates to an increase in sales volumes, and US$ 218 million

relates to an increase in the average price of crude oil exports following the appreciation of average Brent crude prices. |

Cost of Sales

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change

(%) |

| Raw material, products for resale, materials and third-party services * |

(16,929) |

(18,164) |

(6.8) |

| Depreciation, depletion and amortization |

(7,434) |

(7,740) |

(4.0) |

| Production taxes |

(8,772) |

(8,853) |

(0.9) |

| Employee compensation |

(1,477) |

(1,225) |

20.6 |

| Total |

(34,612) |

(35,982) |

(3.8) |

* It includes short-term leases and inventory turnover.

Cost of sales was US$ 34,612 million for the

period Jan-Sep/2024, a 3.8% decrease (US$ 1,370 million) when compared to US$ 35,982 million for the period Jan-Sep/2023, mainly due to

lower costs with raw material and products for resale with emphasis on lower acquisition costs for imported crude oil and oil products.

Income (Expenses)

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change

(%) |

| Selling expenses |

(3,794) |

(3,709) |

2.3 |

| General and administrative expenses |

(1,405) |

(1,140) |

23.2 |

| Exploration costs |

(715) |

(828) |

(13.6) |

| Research and development expenses |

(571) |

(512) |

11.5 |

| Other taxes |

(1,143) |

(643) |

77.8 |

| Impairment (losses) reversals, net |

46 |

(482) |

- |

| Other income and expenses, net |

(4,318) |

(1,995) |

116.4 |

| Total |

(11,900) |

(9,309) |

27.8 |

Selling expenses were US$ 3,794 million for

the period Jan-Sep/2024, a 2.3% increase (US$ 85 million) compared to US$ 3,709 million for the period Jan-Sep/2023, mainly due to

higher logistical expenses related to natural gas transportation and higher volumes of crude oil exports.

General and administrative expenses were US$

1,405 million for the period Jan-Sep/2024, a 23.2% increase (US$ 265 million) compared to US$ 1,140 million for the period Jan-Sep/2023,

mainly due to effects of the 2023 labor agreement and the higher expenses with third-party services.

Other taxes were US$ 1,143 million for the

period Jan-Sep/2024, a 77.8% increase (US$ 500 million) compared to US$ 643 million for the period Jan-Sep/2023, mainly

due to enrollment to the tax settlement program, which allowed the settlement of significant legal disputes related to discussions on

the incidence of taxes on remittances abroad involving chartering of vessels or platforms and their respective service contracts. Partially

offset by a 9.2% extraordinary taxation over exports of crude oil in 2023, pursuant to Provisional Measure No. 1,163/2023. This extraordinary

taxation was temporary and only applicable for the period March to June 2023.

Other income and expenses, net was a US$ 4,318

million expense in Jan-Sep/2024, a 116.4% increase (US$ 2,323 million) compared to a US$ 1,995 million expense for the period Jan-Sep/2023,

mainly due to (i) effects of the intermediate remeasurement on the health care plan for retired employees due to the 2023 labor agreement

(a US$ 1,000 million expense), and (ii) lower results on disposal/write-offs of assets (a US$ 189 million income in Jan-Sep/2024

compared to a US$ 1,150 million income in Jan-Sep/2023).

Net finance (expense) income

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change

(%) |

| Finance income |

1,520 |

1,581 |

(3.9) |

| Income from investments and marketable securities (Government Bonds) |

1,175 |

1,211 |

(3.0) |

| Other finance income |

345 |

370 |

(6.8) |

| Finance expenses |

(4,885) |

(2,875) |

69.9 |

| Interest on finance debt |

(1,628) |

(1,715) |

(5.1) |

| Unwinding of discount on lease liability |

(1,648) |

(1,253) |

31.5 |

| Capitalized borrowing costs |

1,157 |

927 |

24.8 |

| Unwinding of discount on the provision for decommissioning costs |

(772) |

(647) |

19.3 |

| Other finance expenses * |

(1,994) |

(187) |

966.3 |

| Foreign exchange gains (losses) and indexation charges |

(5,724) |

(1,334) |

329.1 |

| Foreign exchange gains (losses) |

(3,834) |

1,388 |

- |

| Reclassification of hedge accounting to the Statement of Income |

(2,118) |

(2,990) |

(29.2) |

|

Indexation to the Selic interest rate of anticipated dividends

and dividends

Payable |

(370) |

(428) |

(13.6) |

| Recoverable taxes inflation indexation income |

77 |

113 |

(31.9) |

| Other foreign exchange gains and indexation charges, net * |

521 |

583 |

(10.6) |

| Total |

(9,089) |

(2,628) |

245.9 |

* It includes, in Jan-Sep/2024, finance expense of US$ 1,804 million

and indexation charges of US$ 235 million related to the tax settlement program - federal taxes..

Net finance (expense) income was an expense of US$ 9,089 million

for the period Jan-Sep/2024, an increase of US$ 6,461 million compared to an expense of US$ 2,628 million for the period Jan-Sep/2023,

mainly due to:

| · | a foreign exchange loss of US$ 3,834 million in Jan-Sep/2024,

as compared to a US$ 1,388 million gain in Jan-Sep/2023 reflecting a 12.5% depreciation of the real/US$ exchange rate in Jan-Sep/2024

(09/30/2024: R$ 5.45/US$, 12/31/2023: R$ 4.84/US$) compared to a 4.0% appreciation in Jan-Sep/2023 (09/30/2023: R$ 5.01/US$, 12/31/2022:

R$ 5.22/US$), which applied to a higher average net liability exposure to the US$ during Jan-Sep/2024 than in Jan-Sep/2023. |

| · | other finance expenses of US$ 1,994 million in Jan-Sep/2024,

a 966.3% increase (US$ 1,807 million) compared to US$ 187 million for the period Jan-Sep/2023 mainly due to financial expenses

related to the tax settlement program, which were accrued and include indexation charges. |

| · | partially offset by lower reclassification of hedge

accounting to the Statement of Income of US$ 2,118 million in Jan-Sep/2024, a 29.2% decrease (US$ 872 million) compared to US$ 2,990 million

for the period Jan-Sep/2023. |

Income tax expenses

Income tax was an expense of US$ 4,325 million in Jan-Sep/2024, compared

to an expense of US$ 8,435 million in Jan-Sep/2023. The decrease was mainly due to lower net income before income taxes (US$ 14,696 million

of income in Jan-Sep/2024 compared to a US$ 27,148 million income in Jan-Sep/2023), resulting in nominal income taxes computed based on

Brazilian statutory corporate tax rates (34%) of US$ 4,996 million in Jan-Sep/2024 compared to a US$ 9,231 million in Jan-Sep/2023.

Net Income attributable to shareholders of Petrobras

Net income attributable to shareholders of Petrobras was US$

10,308 million for the period Jan-Sep/2024, a US$ 8,317 million decrease compared to a net income attributable to shareholders of

Petrobras of US$ 18,625 million for the period Jan-Sep/2023, as explained above, mainly due to lower gross profit (US$ 35,989 million

in Jan-Sep/2024 compared to US$ 39,320 million in Jan-Sep/2023), higher expenses (US$ 11,900 million of expenses in Jan-Sep/2024 compared

to US$ 9,309 million of expenses in Jan-Sep/2023), higher net finance expenses (US$ 9,089 million of expenses in Jan-Sep/2024 compared

to US$ 2,628 million of expenses in Jan-Sep/2023) partially offset by lower income tax expenses (US$ 4,325 million of expenses in Jan-Sep/2024

compared to US$ 8,435 million of expenses in Jan-Sep/2023).

CAPITAL EXPENDITURES (CAPEX)

| CAPEX (US$ million) |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Exploration and Production * |

9,034 |

7,672 |

17.8 |

| Refining, Transportation and Marketing |

1,262 |

1,029 |

22.6 |

| Gas and Low Carbon Energies |

297 |

143 |

107.7 |

| Corporate and Other businesses |

298 |

271 |

10.0 |

| Total |

10,891 |

9,115 |

19.5 |

* In Jan-Sep/2023, there is US$ 141 million of signature

bonuses related to the Sudoeste de Sagitário, Água Marinha and Norte de Brava Blocks. In Jan-Sep/2024, there is US$ 21 million

of signature bonuses related to the Pelotas Blocks.

In line with our Strategic Plan, our Capital Expenditures

were primarily directed toward investment projects which Management believes are most profitable, relating to oil and gas production.

In

Jan-Sep/2024, Capital Expenditures in the E&P segment totaled US$ 9,034

million, representing 82.9% of the CAPEX of the Company, a 17.8% increase when compared to US$ 7,672

million in Jan-Sep/2023, mainly due to the development of large projects in the Santos Basin, especially in the Búzios Field, and

in development of production projects in the Campos Basin and to the US$ 21 million of signature bonuses related to the Pelotas Blocks

in Jan-Sep/2024, partially offset by US$ 141 million of signature bonuses related to the Sudoeste de Sagitário, Água Marinha

and Norte de Brava Blocks occurred in Jan-Sep/2023. CAPEX in Jan-Sep/2024 were mainly concentrated on: (i) the development of production

in the pre-salt layer of the Santos Basin (US$ 4.9

billion); (ii) the development of production in Campos Basin pre-and post-salt layer projects (US$ 2.1 billion); and (iii) exploratory

investments (US$ 0.7 billion).

LIQUIDITY AND CAPITAL RESOURCES

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

| Adjusted Cash and Cash Equivalents at the beginning of the period |

17,902 |

12,283 |

| Government bonds, bank deposit certificates and time deposits with maturities of more than three months at the beginning of the period |

(5,175) |

(4,287) |

| Cash and cash equivalents at the beginning of the period |

12,727 |

7,996 |

| Net cash provided by operating activities |

29,780 |

31,543 |

| Acquisition of PP&E and intangibles assets |

(10,215) |

(8,520) |

| Acquisition of equity interests |

(13) |

(22) |

| Proceeds from disposal of assets – (Divestments) |

791 |

3,564 |

| Financial compensation from co-participation agreement |

397 |

391 |

| Dividends received |

121 |

75 |

| Divestment (Investment) in marketable securities |

(1,179) |

(215) |

| Net cash used in investing activities |

(10,098) |

(4,727) |

| (=) Net cash provided by operating and investing activities |

19,682 |

26,816 |

| Proceeds from finance debt |

1,553 |

1,300 |

| Repayments of finance debt |

(5,756) |

(4,054) |

| Net change in finance debt |

(4,203) |

(2,754) |

| Repayment of lease liability |

(5,796) |

(4,494) |

| Dividends paid to shareholders of Petrobras |

(12,871) |

(15,234) |

| Dividends paid to non-controlling interest |

(77) |

(48) |

| Share repurchase program |

(380) |

(197) |

| Changes in non-controlling interest |

(107) |

(102) |

| Net cash used in financing activities |

(23,434) |

(22,829) |

| Effect of exchange rate changes on cash and cash equivalents |

(281) |

127 |

| Cash and cash equivalents at the end of the period |

8,694 |

12,110 |

| Government bonds, bank deposit certificates and time deposits with maturities of more than three months at the end of the period |

6,187 |

5,162 |

| Adjusted Cash and Cash Equivalents at the end of the period |

14,881 |

17,272 |

| |

|

|

| Reconciliation of Free Cash Flow |

|

|

| Net cash provided by operating activities |

29,780 |

31,543 |

| Acquisition of PP&E and intangible assets |

(10,215) |

(8,520) |

| Acquisition of equity interests |

(13) |

(22) |

| Free Cash Flow * |

19,552 |

23,001 |

*Free Cash Flow (FCF) is in accordance with the new Shareholder Remuneration

Policy (“Policy”), approved in July 2023, which is the result of the equation: FCF = net cash provided by operating activities

less the sum of acquisition of PP&E and intangible assets and acquisition of equity interests.

As of September 30, 2024, the balance of Cash and cash equivalents

was US$ 8,694 million and Adjusted Cash and Cash Equivalents totaled US$ 14,881 million.

The nine-month period ended September 30, 2024 had net cash

provided by operating activities of US$ 29,780 million and positive Free Cash Flow of US$ 19,552 million. This level of cash generation,

together with proceeds from disposal of assets (divestments) of US$ 791 million, financial compensation from co-participation agreements

of US$ 397 million, dividends received of US$ 121 million and proceeds from finance debt of US$ 1,553 million, were allocated to:

(a) debt prepayments and payments of principal and interest due in the period of US$ 5,756 million; (b) repayment of lease liability

of US$ 5,796 million; (c) dividends paid to shareholders of Petrobras of US$ 12,871 million; (d) share repurchase program of US$

380 million; and (e) acquisition of PP&E and intangibles assets of US$ 10,215 million.

In the nine-month period ended September 30, 2024,

the Company repaid several finance debts, in the amount of US$ 5,756 million, notably: (i) repurchase and withdraw of US$ 1,318

million of securities in the international capital market; and (ii) the pre-payment of US$ 250 million of loan in the international

banking market.

In September 2024, the Company raised US$ 978

million through the issuance of Global Notes in the international capital market, maturing in 2035.

CONSOLIDATED DEBT

| Debt (US$ million) |

09.30.2024 |

12.31.2023 |

Change (%) |

| Capital Markets |

16,005 |

17,514 |

(8.6) |

| Banking Market |

7,490 |

8,565 |

(12.6) |

| Development banks |

587 |

698 |

(15.9) |

| Export Credit Agencies |

1,517 |

1,870 |

(18.9) |

| Others |

157 |

154 |

1.9 |

| Finance debt |

25,756

|

28,801 |

(10.6) |

| Lease liability |

33,376

|

33,799 |

(1.3) |

| Gross Debt |

59,132

|

62,600 |

(5.5) |

| Adjusted Cash and Cash Equivalents |

14,881

|

17,902 |

(16.9) |

| Net Debt |

44,251

|

44,698 |

(1.0) |

| Leverage: Net Debt/(Net Debt + Market Capitalization) |

33% |

30% |

10.0 |

| Average interest rate (% p.a.) |

6.6 |

6.4 |

3.1 |

| Weighted average maturity of outstanding debt (years) |

11.57 |

11.38 |

1.7 |

As of September 30, 2024, the Company has maintained

its liability management strategy to improve the debt profile and to adapt to the maturity terms of the Company’s long-term investments.

Gross Debt decreased 5.5% (US$ 3,468 million) to US$ 59,132

million as of September 30, 2024 from US$ 62,600 million as of December 31, 2023, mainly due to lower finance debt (with a US$ 3,045

million decrease in the period) and decreased lease liabilities in the period (a US$ 423 million decrease). Gross Debt was maintained

in the range between US$ 50,000 million and US$ 65,000 million target defined in the 2024-2028 Strategic Plan, mainly due to debt prepayments

and scheduled repayments.

As of September 30, 2024, Net Debt decreased by 1.0% (US$ 447

million), reaching US$ 44,251 million, compared to US$ 44,698 million as of December 31, 2023, mainly due to a 16.9% decrease (US$ 3,021

million) in adjusted cash and cash equivalents (US$ 14,881 million as of September 30,2024 compared to US$ 17,902 million as of December

31, 2023).

RECONCILIATION OF ADJUSTED EBITDA, LTM ADJUSTED EBITDA AND NET

DEBT/LTM ADJUSTED EBITDA METRICS

LTM Adjusted EBITDA reflects the sum of the last twelve months

of Adjusted EBITDA, which is computed by using the net income before net finance (expense) income, income taxes, depreciation, depletion

and amortization adjusted by items not considered part of the Company’s primary business, which include results in equity-accounted

investments, results on disposal and write-offs of assets, impairment and results from co-participation agreements in bid areas.

LTM Adjusted EBITDA represents an alternative to the Company's operating

cash generation. This measure is used to calculate the metric Net Debt/LTM Adjusted EBITDA, to support management’s assessment of

liquidity and leverage.

Adjusted EBITDA and Net cash provided

by operating activities – OCF

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Net income |

10,371 |

18,713 |

(44.6) |

| Net finance (expense) income |

9,089 |

2,628 |

245.9 |

| Income taxes |

4,325 |

8,435 |

(48.7) |

| Depreciation, depletion and amortization |

9,483 |

9,648 |

(1.7) |

| Results in equity-accounted investments |

304 |

235 |

29.4 |

| Impairment of assets (reversals) |

(46) |

482 |

- |

| Results on disposal/write-offs of assets |

(189) |

(1,150) |

(83.6) |

| Results from co-participation agreements in bid areas |

(103) |

(47) |

119.1 |

| Adjusted EBITDA |

33,234 |

38,944 |

(14.7) |

| Allowance for credit loss on trade and other receivables |

54 |

49 |

10.2 |

| Trade and other receivables |

1,622 |

587 |

176.3 |

| Inventories |

(354) |

1,132 |

- |

| Trade payables |

634 |

(1,017) |

- |

| Taxes payable |

(7,763) |

(8,085) |

(4.0) |

| Others |

2,353 |

(67) |

- |

| Net cash provided by operating activities – OCF |

29,780 |

31,543 |

(5.6) |

LTM Adjusted EBITDA and LTM Net cash provided

by operating activities – OCF

| |

US$ million |

| |

Last twelve months (LTM) at |

|

|

|

|

| |

09.30.2024 |

12.31.2023 |

Oct-Dec/2023 |

Jan-Mar/2024 |

Apr-Jun/2024 |

Jul-Sep/2024 |

| Net income (loss) |

16,653 |

24,995 |

6,282 |

4,805 |

(325) |

5,891 |

| Net finance (expense) income |

8,794 |

2,333 |

(295) |

1,939 |

6,869 |

281 |

| Income taxes |

6,291 |

10,401 |

1,966 |

2,147 |

(27) |

2,205 |

| Depreciation, depletion and amortization |

13,115 |

13,280 |

3,632 |

3,362 |

3,138 |

2,983 |

| Results in equity-accounted investments |

373 |

304 |

69 |

93 |

188 |

23 |

| Impairment of assets (reversals) |

2,152 |

2,680 |

2,198 |

(9) |

(37) |

0 |

| Results on disposal/write-offs of assets |

(334) |

(1,295) |

(145) |

(162) |

(124) |

97 |

| Results from co-participation agreements in bid areas |

(340) |

(284) |

(237) |

(48) |

(55) |

0 |

| Adjusted EBITDA |

46,704 |

52,414 |

13,470 |

12,127 |

9,627 |

11,480 |

| Allowance (reversals) for credit loss on trade and other receivables |

45 |

40 |

(9) |

30 |

18 |

6 |

| Trade and other receivables |

1,123 |

88 |

(499) |

604 |

855 |

163 |

| Inventories |

78 |

1,564 |

432 |

(627) |

272 |

1 |

| Trade payables |

697 |

(954) |

63 |

407 |

(165) |

392 |

| Taxes payable |

(10,141) |

(10,463) |

(2,378) |

(3,143) |

(3,440) |

(1,180) |

| Others |

2,943 |

523 |

590 |

(12) |

1,920 |

445 |

| Net cash provided by operating activities - OCF |

41,449 |

43,212 |

11,669 |

9,386 |

9,087 |

11,307 |

Adjusted Cash and Cash Equivalents, Gross

Debt, Net Debt, Net Cash provided by Operating Activities (LTM OCF), LTM Adjusted EBITDA, Gross Debt Net of Cash and Cash Equivalents/LTM

OCF and Net Debt/LTM Adjusted EBITDA Metrics

The Net Debt/LTM Adjusted EBITDA metric is an important

metric that supports our management in assessing the liquidity and leverage of Petrobras Group. This ratio is an important measure for

management to assess the Company’s ability to pay off its debt, mainly because our Strategic Plan 2024-2028 defines US$ 65 billion

as a maximum level for our Gross Debt.

The following table presents the reconciliation

for this metric to the most directly comparable measure derived from IFRS captions, which is in this case the Gross Debt Net of Cash and

Cash Equivalents/Net Cash provided by operating activities ratio:

| |

US$ million |

| |

|

|

| |

09.30.2024 |

12.31.2023 |

| Cash and cash equivalentes |

8,694 |

12,727 |

| Government bonds, bank deposit certificates and time deposits (maturity of more than three months) |

6,187 |

5,175 |

| Adjusted Cash and Cash equivalents |

14,881 |

17,902 |

| Finance debt |

25,756 |

28,801 |

| Lease liability |

33,376 |

33,799 |

| Current and non-current debt - Gross Debt |

59,132 |

62,600 |

| Net Debt |

44,251 |

44,698 |

| Net cash provided by operating activities - LTM OCF |

41,449 |

43,212 |

| Allowance for credit loss on trade and other receivables |

(45) |

(40) |

| Trade and other receivables |

(1,123) |

(88) |

| Inventories |

(78) |

(1,564) |

| Trade payables |

(697) |

954 |

| Taxes payable |

10,141 |

10,463 |

| Others |

(2,943) |

(523) |

| LTM Adjusted EBITDA |

46,704 |

52,414 |

| Gross Debt net of cash and cash equivalents/LTM OCF ratio |

1.22 |

1.15 |

| Net Debt/LTM Adjusted EBITDA ratio |

0.95 |

0.85 |

| |

|

|

|

RESULTS BY OPERATING BUSINESS SEGMENTS

Exploration and Production (E&P)

Financial information

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Sales revenues |

47,128 |

48,374 |

(2.6) |

| Gross profit |

28,307 |

28,732 |

(1.5) |

| Income (Expenses) |

(3,403) |

(1,837) |

85.2 |

| Operating income |

24,904 |

26,895 |

(7.4) |

| Net income attributable to the shareholders of Petrobras |

16,499 |

17,719 |

(6.9) |

| Average Brent crude (US$/bbl) |

82.79 |

82.14 |

0.8 |

| Production taxes – Brazil |

8,760 |

8,856 |

(1.1) |

| Royalties |

5,483 |

5,144 |

6.6 |

| Special Participation |

3,250 |

3,677 |

(11.6) |

| Retention of areas |

27 |

35 |

(22.9) |

[1]

In the period Jan-Sep/2024, the gross profit for

the E&P segment was US$ 28,307 million, a decrease of 1.5% compared to the period Jan-Sep/2023, mainly due to the reduction in sales

revenues.

Operating income was US$ 24,904 million in

the Jan-Sep/2024 period, a decrease of 7.4% compared to the Jan-Sep/2023 period, mainly due to the gain from the sale of Albacora Leste,

Norte Capixaba and Potiguar Clusters in the period Jan-Sep/2023 which had no equivalent in Jan-Sep/2024. In addition to the higher

tax expenses resulting from the adherence to the tax transaction related to taxes on remittances abroad involving chartering of vessels

or platforms and their respective service contract.

In the period Jan-Sep/2024, the production taxes

were US$ 8.760 million, a decrease of 1.1% compared to the period from Jan-Sep/2023 caused primarily by the lower special participation,

due to the lower production in Tupi field.

Operational information

| Production in thousand barrels of oil equivalent per day (mboed) |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Crude oil, NGL and natural gas – Brazil |

2,687 |

2,696 |

(0.3) |

| Crude oil and NGL (mbbl/d) |

2,173 |

2,188 |

(0.7) |

| Natural gas (mboed) |

513 |

508 |

1.0 |

| Crude oil, NGL and natural gas – Abroad |

34 |

35 |

(2.9) |

| Total (mboed) |

2,721 |

2,731 |

(0.4) |

Production of crude oil, NGL and natural gas was

2,721 mboed in the period Jan-Sep/2024, representing a decrease of 0.4% compared to Jan-Sep/2023, mainly due to interventions to comply

with operational safety requirements, decommissioning of the FPSO Cidade de Niterói platform (Marlim Leste field), divestments,

higher volume of losses from scheduled maintenance stoppages and the natural production decline. Partially offset by the ramp up

of platforms Almirante Barroso (Búzios field), P-71 (Itapu field), FPSO Anna Nery (Marlim field), FPSO Anita Garibaldi (Marlim,

Voador and Espadim fields) and FPSO Sepetiba (Mero field), in addition to the entry into production of new wells from complementary projects

in the Campos and Santos Basins.

Refining, Transportation and Marketing

Financial information

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Sales revenues |

65,990 |

69,590 |

(5.2) |

| Gross profit |

4,947 |

6,994 |

(29.3) |

| Income (Expenses) |

(2,318) |

(3,120) |

(25.7) |

| Operating income |

2,629 |

3,874 |

(32.1) |

| Net income attributable to the shareholders of Petrobras |

1,309 |

2,325 |

(43.7) |

| Average refining cost (US$ / barrel) – Brazil |

2.70 |

2.25 |

20.0 |

| Average domestic basic oil products price (US$/bbl) |

91.76 |

99.97 |

(8.2) |

In the period Jan-Sep/2024, Refining, Transportation and

Marketing gross profit was US$ 2,047 million lower than in the period Jan-Sep/2023 mainly due to a decrease in international margins,

especially diesel and gasoline.

The decrease in operating income for the period Jan-Sep/2024

reflects lower gross profit partially offset by a decrease of expenses, mainly expenses with impairment related to the 2nd refining unit

of RNEST and expenses with compensation for the termination of a vessel charter agreement, both occurred in Jan-Sep/2023.

The average refining cost in the period Jan-Sep/2024 was

US$ 2.70/bbl, 20.0% higher than in the period Jan-Sep/2023, due to inflationary effects on personnel and service costs and to an increased

scope of maintenance and revitalization activities in our refineries.

Operational information

| Thousand barrels per day (mbbl/d) |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Total production volume |

1,772 |

1,763 |

0.5 |

| Domestic sales volume |

1,707 |

1,747 |

(2.3) |

| Reference feedstock |

1,813 |

1,835 |

(1.2) |

| Refining plants utilization factor (%) |

93% |

91% |

2.2 |

| Processed feedstock (excluding NGL) |

1,650 |

1,637 |

0.8 |

| Processed feedstock |

1,697 |

1,685 |

0.7 |

| Domestic crude oil as % of total |

91% |

91% |

- |

Domestic sales in the period Jan-Sep/2024 were

1,707 mbbl/d, a decrease of 2.3% compared to Jan-Sep/2023.

Gasoline sales volume decreased 7.2% in Jan-Sep/2024

compared to Jan-Sep/2023 mainly due to the higher competitiveness in price of hydrous ethanol compared to gasoline. Diesel sales volume

decreased 3.1% between periods because of the higher imports from third parties and the increase of in biodiesel content from 12% to 14%

in March 2024.

Total production of oil products for the period

Jan-Sep/2024 was 1,772 mbbl/d, 0.5% higher than Jan-Sep/2023. In the first nine months of 2024 the utilization factor of our refineries

was higher than in the same period of the previous year, compensating the effects of the divestment of the Guamaré Industrial Asset

refinery, former RPCC.

Processed feedstock for the period Jan-Sep/2024

was 1,697 mbbl/d, 0.7% more than Jan-Sep/2023.

Gas and Low Carbon Energies

Financial information

| US$ million |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Sales revenues |

6,961 |

8,250 |

(15.6) |

| Gross profit |

3,317 |

3,991 |

(16.9) |

| Income (expenses) |

(2,557) |

(2,450) |

4.4 |

| Operating income (loss) |

760 |

1,541 |

(50.7) |

| Net income (loss) attributable to the shareholders of Petrobras |

530 |

978 |

(45.8) |

| Average natural gas sales price – Brazil (US$/bbl) |

63.74 |

70.16 |

(9.2) |

In Jan-Sep/2024, the sales revenues reduction in relation

to Jan-Sep/2023 was due to the lower volume of natural gas sold to non-thermoelectric market and the lower average natural gas sales price.

The lower operating income in Jan-Sep/2024 compared to

Jan-Sep/2023 is mainly due to the lower gross profit and the increase in sales expenses.

Operational information

| |

Jan-Sep/2024 |

Jan-Sep/2023 |

Change (%) |

| Sale of Thermal Availability at Auction (ACR)- Average MW |

1,169 |

1,655 |

(29.4) |

| Sale of electricity - average MW |

647 |

520 |

24.4 |

| National gas delivered - million m³/day |

30 |

34 |

(11.8) |

| Regasification of liquefied natural gas - million m³/day |

4 |

1 |

300.0 |

| Import of natural gas from Bolivia - million m³/day |

14 |

16 |

(12.5) |

In Jan-Sep/2024, Petrobras thermal availability

sales decreased by 29.4% compared to Jan-Sep/2023, due to the expiration of contracts. In the same period, energy sales increased by 24.4%

due to a less favorable hydrological scenario. In this scenario, thermal energy generation supplied periods of lower renewable energy

generation.

On the natural gas supply side, with the impact

of interventions in 2024, such as the planned maintenance on the Mexilhão Plataform and UTGCA gas processing unit in March, and

with the lower volume of Bolivian gas available, there was a need to import more LNG in Jan-Sep/2024.

GLOSSARY

ACL – Ambiente de Contratação Livre

(Free contracting market) in the electricity system.

ACR – Ambiente de Contratação Regulada

(Regulated contracting market) in the electricity system.

Adjusted Cash and Cash Equivalents - Sum of cash and

cash equivalents, government bonds, bank deposit certificates and time deposits with maturities of more than 3 months from the date of

acquisition, considering the expected realization of those financial investments in the short-term. This measure is not defined under

the International Financial Reporting Standards – IFRS and should not be considered in isolation or as a substitute for cash and

cash equivalents computed in accordance with IFRS. It may not be comparable to adjusted cash and cash equivalents of other companies.

However, management believes that it is an appropriate supplemental measure to assess our liquidity and supports leverage management and

uses this measure in the calculation of Net Debt.

Adjusted EBITDA Net income plus net finance (expense)

income; income taxes; depreciation, depletion and amortization; results in equity-accounted investments; impairment; results on disposal/write-offs

of assets; and results from co-participation agreements in bid areas. Adjusted EBITDA is not a measure defined by IFRS and it is possible

that it may not be comparable to similar measures reported by other companies. However, management believes that it is an appropriate

supplemental measure to assess our liquidity and supports leverage management.

ANP - Brazilian National Petroleum, Natural Gas and Biofuels

Agency.

Average Domestic basic oil products price (US$/bbl) -

represents Petrobras' domestic sales revenues per unit of basic oil products, which are: diesel, gasoline, LPG, jet fuel, naphtha and

fuel oil.

Capital Expenditures – Capital

expenditures based on the cost assumptions and financial methodology adopted in our Strategic Plan, which include acquisition of PP&E

and intangible assets, acquisition of equity interests, as well as other items that do not necessarily qualify as cash flows used in investing

activities, comprising geological and geophysical expenses, research and development expenses, pre-operating charges, purchase of property,

plant and equipment on credit and borrowing costs directly attributable to works in progress.

CTA – Cumulative translation adjustment –

The cumulative amount of exchange variation arising on translation of foreign operations that is recognized in Shareholders’ Equity

and will be transferred to profit or loss on the disposal of the investment.

Effect of average cost in the Cost of Sales –

In view of the average inventory term of 60 days, the crude oil and oil products international prices movement, as well as foreign

exchange effect over imports, production taxes and other factors that impact costs, do not entirely influence the cost of sales in

the current period, having their total effects only in the following period.

Free Cash Flow – Net cash provided by operating

activities less the sum of acquisition of PP&E and intangibles assets and acquisition of equity interests. Free cash flow is not defined

under the IFRS and should not be considered in isolation or as a substitute for cash and cash equivalents calculated in accordance with

IFRS. It may not be comparable to free cash flow of other companies. However, management believes that it is an appropriate supplemental

measure to assess our liquidity and supports leverage management.

Gross Debt – Sum of current and non-current

finance debt and lease liability, this measure is not defined under the IFRS.

Leverage – Ratio between the Net Debt and the sum

of Net Debt and Market Capitalization. Leverage is not a measure defined in the IFRS and it is possible that it may not be comparable

to similar measures reported by other companies, however management believes that it is an appropriate supplemental measure to assess

our liquidity.

Lifting Cost - Crude oil and natural gas lifting cost

indicator, which considers expenditures occurred in the period.

LTM Adjusted EBITDA – Adjusted EBITDA for the last

twelve months.

OCF - Net Cash provided by (used in) operating activities

(operating cash flow)

Operating income (loss) – Net income (loss) before finance

(expense) income, results in equity-accounted investments and income taxes.

Net Debt – Gross Debt less Adjusted Cash and Cash

Equivalents. Net Debt is not a measure defined in the IFRS and should not be considered in isolation or as a substitute for total long-term

debt calculated in accordance with IFRS. Our calculation of Net Debt may not be comparable to the calculation of Net Debt by other companies.

Management believes that Net Debt is an appropriate supplemental measure that helps investors assess our liquidity and supports leverage

management.

Results by Business Segment – The information

by the company's business segment is prepared based on available financial information that is directly attributable to the segment or

that can be allocated on a reasonable basis, being presented by business activities used by the Executive Board to make resource allocation

decisions and performance evaluation.

When calculating segmented results, transactions with third parties, including

jointly controlled and associated companies, and transfers between business segments are considered. Transactions between business segments

are valued at internal transfer prices calculated based on methodologies that take into account market parameters, and these transactions

are eliminated, outside the business segments, for the purpose of reconciling the segmented information with the consolidated financial

statements of the company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 25, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

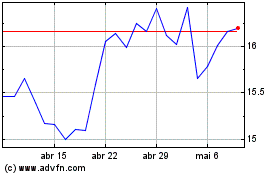

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024