Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 Novembro 2024 - 6:15PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of November, 2024

Commission

File Number: 1-13546

STMicroelectronics N.V.

(Name

of Registrant)

WTC Schiphol Airport

Schiphol Boulevard 265

1118 BH Schiphol Airport

The Netherlands

(Address

of Principal Executive Offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F

o

Enclosure: A press release dated November

25, 2024, announcing the results of trading in STMicroelectronics' own shares as part of the previously announced share buy-back program

for the period from November 18, 2024, to November 22, 2024.

PR N°C3298C

STMicroelectronics Announces Status of

Common Share Repurchase Program

Disclosure of Transactions in Own Shares –

Period from Nov 18, 2024 to Nov 22, 2024

AMSTERDAM – November 25, 2024 -- STMicroelectronics

N.V. (the “Company” or “STMicroelectronics”), a global semiconductor leader serving customers across the spectrum

of electronics applications, announces full details of its common share repurchase program (the “Program”) disclosed via a

press release dated June 21, 2024. The Program was approved by a shareholder resolution dated May 22, 2024 and by the supervisory board.

STMicroelectronics N.V. (registered with the

trade register under number 33194537) (LEI: 213800Z8NOHIKRI42W10) announces the repurchase (by a broker acting for the Company) on the

regulated market of Euronext Paris, in the period between Nov 18, 2024 to Nov 22, 2024 (the “Period”), of 468,800 ordinary

shares (equal to 0.05% of its issued share capital) at the weighted average purchase price per share of EUR 23.2951 and for an overall

price of EUR 10,920,729.99.

The purpose of these transactions under article

5(2) of Regulation (EU) 596/2014 (the Market Abuse Regulation) was to meet obligations arising from share option programmes, or other

allocations of shares, to employees or to members of the administrative, management or supervisory bodies of the issuer or of an associate

company.

The shares may be held in treasury prior to

being used for such purpose and, to the extent that they are not ultimately needed for such purpose, they may be used for any other lawful

purpose under article 5(2) of the Market Abuse Regulation.

Below is a summary of the repurchase transactions

made in the course of the Period in relation to the ordinary shares of STMicroelectronics (ISIN: NL0000226223), in detailed form.

Transactions in Period

| Dates of transaction |

Number of shares purchased |

Weighted average purchase price per share (EUR) |

Total amount paid (EUR) |

Market on which the shares were bought (MIC code) |

| 18-Nov-24 |

106,500 |

23.8398 |

2,538,938.70 |

XPAR |

| 19-Nov-24 |

89,500 |

23.2365 |

2,079,666.75 |

XPAR |

| 20-Nov-24 |

90,800 |

23.1068 |

2,098,097.44 |

XPAR |

| 21-Nov-24 |

91,000 |

22.8518 |

2,079,513.80 |

XPAR |

| 22-Nov-24 |

91,000 |

23.3463 |

2,124,513.30 |

XPAR |

| Total for Period |

468,800 |

23.2951 |

10,920,729.99 |

|

Following the share buybacks detailed above,

the Company holds in total 13,045,041 treasury shares, which represents approximately 1.4% of the Company’s issued share capital.

In accordance with Article 5(1)(b) of the Market

Abuse Regulation and Article 2(3) of Commission Delegated Regulation (EU) 2016/1052, a full breakdown of the individual trades in the

Program are disclosed on the ST website (https://investors.st.com/stock-and-bond-information/share-buyback).

About STMicroelectronics

At ST, we are over 50,000 creators and makers of semiconductor technologies

mastering the semiconductor supply chain with state-of-the-art manufacturing facilities. An integrated device manufacturer, we work with

more than 200,000 customers and thousands of partners to design and build products, solutions, and ecosystems that address their challenges

and opportunities, and the need to support a more sustainable world. Our technologies enable smarter mobility, more efficient power and

energy management, and the wide-scale deployment of cloud-connected autonomous things. We are committed to achieving our goal to become

carbon neutral on scope 1 and 2 and partially scope 3 by 2027. Further information can be

found at www.st.com.

For further information, please contact:

INVESTOR RELATIONS:

Jérôme Ramel

EVP Corporate Development & Integrated External Communication

Tel: +41.22.929.59.20

jerome.ramel@st.com

MEDIA RELATIONS:

Alexis Breton

Corporate External Communications

Tel: +33.6.59.16.79.08

alexis.breton@st.com

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

STMicroelectronics N.V. |

| |

|

|

|

| Date: |

November 25, 2024 |

By: |

/s/ Lorenzo Grandi |

| |

|

|

|

| |

|

Name: |

Lorenzo Grandi |

| |

|

Title: |

Chief Financial Officer

President, Finance, Purchasing, ERM and Resilience |

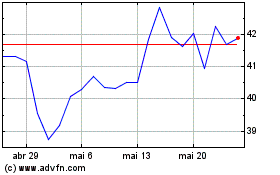

STMicroelectronics NV (NYSE:STM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

STMicroelectronics NV (NYSE:STM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024