false

0000814586

0000814586

2025-02-14

2025-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 14, 2025

LIFEWAY FOODS, INC.

(Exact name of registrant as specified in its charter)

| ILLINOIS |

|

000-17363 |

|

36-3442829 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 6431

Oakton St. Morton

Grove, IL |

|

60053 |

| (Address of principal executive

offices) |

|

(Zip code) |

Registrant’s telephone number, including

area code: (847) 967-1010

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock |

LWAY |

Nasdaq |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b 2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation

FD Disclosure.

On February 14, 2025, counsel to Lifeway Foods, Inc. (the “Company”)

sent a letter to counsel for Edward Smolyansky and Ludmila Smolyanksy (the “Letter”) outlining certain of Edward and Ludmila’s

recently made public misstatements. The Letter is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LIFEWAY FOODS, INC.

|

|

| Dated: February 14, 2025 |

By: |

/s/ Julie Smolyansky |

|

| |

|

Name: Julie Smolyansky |

|

| |

|

Title: Chief Executive Officer and Secretary |

|

Exhibit 99.1

|

Timothy

R. Lavender

Kelley Drye

& Warren LLP 333

West Wacker Drive Suite 2600

Chicago, IL 60606

Tel:

(312) 857-2630

Fax::

(312) 857-7095

tlavender@kelleydrye.com

|

| |

|

February 14, 2025

Via E-Mail nick.callahan@bfkn.com

Mr. Nicholas Callahan

Barack Ferrazzano Kirschbaum & Nagelberg LLP

200 West Madison Street, Suite 3900

Chicago, IL 60606

Re: Edward Smolyansky and Ludmila Smolyansky

Dear Mr. Callahan:

We are contacting you as legal

counsel to Edward Smolyansky (“Edward”) and Ludmila Smolyansky (“Ludmila”) with respect to certain matters relating

to Lifeway Foods, Inc. (the “Company”). Reference is made to a certain press release dated February 4, 2025 (the “Press

Release”), in which Edward and Ludmila made various misstatements and omit facts necessary to make their statements not misleading.

In fact, the misstatements

and omissions that plague the entire Press Release begin with the very first sentence, which states, “(o)n December 23, 2024, Lifeway’s

Compensation Committee […],” at which meeting the compensation of Julie Smolyansky (“Julie”) was addressed. This

statement is false. Lifeway’s Board of Directors met on December 23, 2024—not its Compensation Committee. Further, the statement

misleadingly omits that Julie neither attended nor participated in the portion of the Board meeting at which her retention bonus and employment

agreement were discussed. Nor did Julie vote on the retention bonus or employment agreement—only the independent directors

voted on those issues.

The Press Release then falsely

characterizes the retention bonus approved for Julie as “another desperate leverage tactic to enable Julie to continue to fund her

war against the Founding Shareholders.” Again, Julie did not participate in the discussions and votes of the Board of Directors

with respect to the employment agreement and retention bonus. Moreover, the Board had no knowledge of Julie’s plan to commence a

lawsuit against Edward that she filed individually and in her personal capacity. The implication that the Board of Directors participated

in a plan to wage a proxy war via Julie against Edward and Ludmila is not only baseless and defamatory, but damaging to the integrity

of the independent Board of Directors whose actions were taken in accordance with all applicable authority and corporate governance best

practices. In fact, this retention bonus and employment agreement were the product of a negotiation process with both parties represented

by counsel that had been in process for many months. From the Company’s perspective, the “war” to which the Smolyanskys

are presumably referring is purely a personal family matter, which does not involve the Company and which Julie has never attempted to

intertwine with the Company’s affairs. Further, Edward and Ludmila’s references to a perceived “war” only serves

to illustrate Edward’s irrational behavior and thinly veiled threats that led Julie to seek a restraining order against Edward.

The Company understands that, in 2024, an Emergency Order of Protection was granted by the Cook County Circuit Court against Edward in

order to protect Julie’s [and her family’s] safety. Edward is later quoted saying that, “Lifeway seems determined to

plunge the Company deeper and deeper into litigation this time via proxy by Julie” and refers to the Company as “America’s

Worst Governed Publicly Traded Company.” Edward and Ludmila’s statements here are not only damaging to the Company, its reputation

and its perception in the market, but more importantly falsely attempt to link a personal lawsuit by Julie with the operations of the

Company. The Company is not involved in this litigation and does not control or direct the manner in which Julie handles personal, family

trust and estate matters. The subject lawsuit, which Edward and Ludmila apparently expect to yield a “fully transparent accounting

of the inner workings” of the Company, is a purely personal matter, devoid of any involvement from the Company. The lawsuit was

apparently brought by Julie against Edward for tortious interference in a matter relating to an inheritance from their father and for

breach of fiduciary duty.

Mr. Nicholas Callahan

February 14, 2025

Page 2

The unfounded claims continue

in the very next sentence, where Edward and Ludmila call into question the independence of two directors, Jason Scher and Pol Sikar, as

having “deep and conflicting personal motives” that are contrary to the interests of the rest of the Company’s shareholders.

This narrative omits key facts that repudiate their claim. It is worth noting that both Edward and Ludmila voted in favor of Jason Scher

and Pol Sikar’s independence until 2021, which is coincidentally the same year that the Company’s Compensation Committee,

comprised entirely of independent directors, reduced both Edward and Ludmila’s compensation. That same year, Edward and Ludmila

began to question the independence of Jason Scher and Jody Levy, the two independent directors on the Compensation Committee, due to alleged

personal relationships with Julie. These accusations by Edward and Ludmila resulted in the formation of a special committee of independent

directors that retained independent legal counsel to investigate the independence of all the then current members of the Board of Directors

previously determined to be independent. After investigation, the independent counsel concluded that none of the then current members

of the Board of Directors previously deemed to be independent—including Jody Levy, Jason Scher, Pol Sikar and Dorri McWhorter—had

any relationships that would disqualify them from being considered independent and had no relationship with the Company or management

that would interfere with their respective ability to exercise independent judgment as a director. There have been no changes in the relationships

investigated since that time. Jason Scher also has deferred his compensation as restricted stock units in order to further align his interests

with stockholders. Furthermore, the special committee was tasked with several investigations at that same time, including into alleged

wrongdoing by Edward and Ludmila. The findings from those independent investigations into wrongdoing by Edward and Ludmila Smolyansky

resulted in the termination of their employment and consulting arrangements, respectively.

It bears noting that Edward

and Ludmila now make the same claims against Julie in the Press Release as they did in 2019, which resulted in an investigation by a different

committee of independent directors and independent counsel hired by the special committee, and which claims were resolved at that time

without any finding of misconduct by Julie. However, what Edward and Ludmila’s account of that investigation omits is that while

the investigation did not indicate any impropriety, the investigation uncovered problematic behavior which resulted in Edward’s

role and responsibilities being changed (including removing treasury functions), certain of his titles being removed, and his placement

on probation.

One of the more troubling

declarations Edward and Ludmila make in the Press Release is that Ludmila’s attempt to monetize Edward’s shares was thwarted

by the Company’s counsel, contrary to a 1999 Shareholders Agreement. The quote is reproduced below for reference. The Company repudiates

Ludmila’s statements wholeheartedly. Fault for Edward’s inability to monetize his shares falls squarely on his own shoulders.

The latest of Edward’s failures to sell his shares between December 30, 2024 and January 22, 2025 was related to his inability to

provide accurate and complete information to the Company’s transfer agent, the Company, and your firm. Edward and his banking representatives

requested certain information with respect to a sale of 148,000 shares by Edward, which your partner, Bill Fay, instructed the Company

he would handle and revert with anything needed from the Company to effect the sale. No further requests were made, or documents provided,

until January 15, 2025, when the Company’s transfer agent received a request by Edward to sell 523,439 shares of the Company’s

common stock, without any of the other documents the transfer agent requires. Mr. Fay was not aware of any sales and had to himself follow

up with Edward. On January 22, 2025, your partner, Mr. Fay, wrote to the Company as follows: “I understand from Ed that this originated

when he was seeking to have a blanket opinion issued, and a certificate broken into smaller amounts. He said that request has been cancelled.

It sounds like that information might not have gotten through to Computershare, but if they need anything formal from Ed or Citi to rescind

the request/instructions, could you please let me know (or, feel free to have them contact me or Citi directly)?” It was Edward’s

responsibility to inform the Company or its transfer agent of the termination of the requested transfer. As your own partner recognized,

Edward failed to do so. As you are aware, removal of a restrictive legend requires an opinion of counsel, which you have given for Ludmila

numerous times in the past several years, including with respect to sales in December 2024 and January 2025, when the legal requirements

for a sale with legend removal are met. Edward appears to have misled the transfer agent and the Company by indicating that there was

a sale proposed. The delay on these non-existent sales, which Edward now attempts to attribute to anyone but himself, comes as a result

of lack of proper documentation from Edward, who additionally appears to have lied to Ludmila when he attributed his inability to dispose

his shares as the fault of Julie, the Company, and the Company’s counsel.

“Mrs. Smolyansky continued, ‘On

January 23, Julie filed suit. In anticipation of this, on January 3, I began to sell some of my shares to defend Edward. I have no choice,

as Lifeway's legal counsel has refused to provide the adequate paperwork to Edward to monetize his holdings in LWAY as permitted under

our 1999 Shareholders Agreement between our family member and Group Danone."

Mr. Nicholas Callahan

February 14, 2025

Page 3

According to Ludmila’s

statements in the Press Release, “Julie and her Board seem determined to obstruct the ability to monetize these assets and prohibit

making significant charitable contributions.” However, it appears to have been Edward who stood in the way of such “significant

charitable contributions,” without any participation from “Julie and her Board.” It is difficult to understand the basis

for these statements, or of Ludmila’s later statement that “while [her] daughter’s Board can attempt to interfere with

[their] philanthropic efforts, [they] are mere speed bumps on the road to [their] singular goal, fresh new management and new independent

slate of Directors” when Ludmila has had no trouble selling her shares after producing the necessary documentation to the Company’s

transfer agent. Further, Ludmila’s interpretation of what constitutes a “philanthropic effort” for purposes of selling

her shares is flawed insofar as the Press Release clearly states that Ludmila had to sell her shares to fund Edward’s defense against

Julie’s lawsuit. Furthermore, while the value of the Company’s shares has risen since Edward and Ludmila’s departure

from the Company in 2022, such an increase is directly attributable to an increase in positive financial metrics, including revenues,

margin and EBITDA. While Edward and Ludmila seek to take credit for the rise in the value of the Company’s shares in the Press Release

as a result of the activist campaign they launched in 2022, it is just as likely that their actions since 2022 have depressed the value

of the Company’s shares.

Edward and Ludmila’s

statements in the Press Release find no support in fact. There is no factual basis on which to assert that a sale of Edward’s shares

was delayed or otherwise interfered with by the Company or Company counsel. Since Ludmila stated as much in the Press Release, it is very

likely that Ludmila received inaccurate information from Edward or from other sources about Edward’s ability to monetize the shares

of Company stock he owns. We write this letter to bring this to your attention and so that you may consider intervention in order to afford

your client, Ludmila, an accurate factual basis on which to make informed decisions and statements. We would also request that you advise

your clients to immediately cease and desist making such misleading and defamatory statements, especially in public forums, with respect

to Julie and the Company.

Sincerely,

/s/ Timothy R. Lavender

Timothy R. Lavender

cc: Bill Fay

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

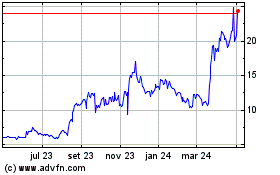

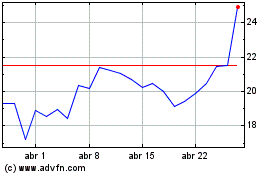

Lifeway Foods (NASDAQ:LWAY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Lifeway Foods (NASDAQ:LWAY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025