UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Materials Pursuant to Rule 14a-12 |

| MATINAS

BIOPHARMA HOLDINGS, INC. |

| (Name

of Registrant as Specified in Its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials: |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

MATINAS

BIOPHARMA HOLDINGS, INC.

1545

ROUTE 206 SOUTH

SUITE

302

BEDMINSTER

NJ 07921

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

be held on April , 2025

To

the Stockholders of

Matinas

BioPharma Holdings, Inc.

NOTICE

IS HEREBY GIVEN that a Special Meeting of Stockholders of Matinas BioPharma Holdings, Inc. (the “Company”) will be held

on April , 2025, beginning at 9 a.m. local time via the internet. Stockholders

will be able to listen, vote and ask questions regardless of location via the Internet at www.virtualshareholdermeeting.com/MTNB2025SM

by using the control number included on your notice regarding the availability of proxy materials, proxy card (printed in the

box and marked by the arrow) and the instructions that accompanied your proxy materials. You will not be able to attend the Special

Meeting in person. At the Special Meeting, stockholders will act on the following matters:

| |

● |

To

approve, for purposes of complying with the applicable provisions of Section 713 of the NYSE American LLC Company Guide (the “NYSE

Company Guide”), (i) the issuance of up to an aggregate of 16,894,212 shares of common stock upon the conversion of our Series

C Convertible Preferred Stock and the exercise of Warrants (as such terms are defined in the Proxy Statement), and (ii) the terms

thereof, which may constitute a “Change of Control” as defined in the NYSE Company Guide; |

| |

|

|

| |

● |

To

ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2025;

and |

| |

|

|

| |

● |

To

approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are

not sufficient votes to approve the Stock Issuance Proposal or ratify the appointment of EisnerAmper LLP as our independent registered

public accounting firm for the year ending December 31, 2025. |

Only

stockholders of record of our common stock at the close of business on February 10, 2025, are entitled to receive notice of and to vote

at the Special Meeting or any postponements or adjournments thereof.

Your

vote is important. Whether you plan to attend the meeting virtually or not, you may vote your shares online or by marking, signing, dating

and mailing the enclosed proxy card in the envelope provided. If you attend the meeting virtually and prefer to vote during the meeting,

you may do so even if you have already voted your shares. You may revoke your proxy in the manner described in the proxy statement at

any time before it has been voted at the meeting. Regardless of the number of shares you own, please be sure you are represented at the

Special Meeting either by attending virtually or by returning your proxy or voting on the internet as soon as possible.

This

Notice of Special Meeting of Stockholders, Proxy Statement and the proxy card are available online at: www.proxyvote.com.

| |

By

Order of the Board of Directors |

| |

|

| |

|

| |

Jerome

D. Jabbour |

| |

Chief Executive Officer |

March ,

2025

Bedminster,

New Jersey

MATINAS

BIOPHARMA HOLDINGS, INC.

1545

ROUTE 206 SOUTH

SUITE

302

BEDMINSTER

NJ 07921

PROXY

STATEMENT

This

proxy statement contains information related to a Special Meeting of Stockholders to be held on April ,

2025 at 9 a.m. local time via the internet at www.virtualshareholdermeeting.com/MTNB2025SM, or at such other time and place

to which the Special Meeting may be adjourned or postponed. The enclosed proxy is solicited by the Board of Directors of Matinas BioPharma

Holdings, Inc. (the “Board”). The proxy materials relating to the Special Meeting are being mailed to stockholders entitled

to vote at the meeting on or about March , 2025.

Important

Notice of Availability of Proxy Materials for the Special Meeting of Stockholders to be held on April ,

2025.

Our

proxy materials including our Proxy Statement for the Special Meeting and proxy card are available on the Internet at www.proxyvote.com.

ABOUT

THE MEETING

Why

are we calling this Special Meeting?

We

are calling the Special Meeting to seek the approval of our stockholders:

| |

● |

To

approve , for purposes of complying with the applicable provisions Section 713 of the NYSE American LLC Company Guide (the “NYSE

Company Guide”), (i) the issuance of up to an aggregate of 16,894,212 shares of common stock upon the conversion of our Series

C Convertible Preferred Stock and the exercise of Warrants (as such terms are defined in the Proxy Statement), and (ii) the terms

thereof, which may constitute a “Change of Control” as defined in the NYSE Company Guide (the “Stock Issuance Proposal”);

|

| |

|

|

| |

● |

To

ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2025;

and |

| |

|

|

| |

● |

To

approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are

not sufficient votes to approve the Stock Issuance Proposal or to ratify the appointment of EisnerAmper LLP as our independent registered

public accounting firm for the year ending December 31, 2025 (the “Adjournment Proposal”). |

What

are the Board’s recommendations?

Our

Board believes that approval of the Stock Issuance Proposal, the appointment of EisnerAmper LLP as our independent registered public

accounting firm for the year ending December 31, 2025, and the Adjournment Proposal are advisable and in our best interests and that

of our stockholders and recommends that you vote FOR these proposals.

Who

is entitled to vote at the meeting?

Only

stockholders of record of our common stock at the close of business on the record date, February 10, 2025, are entitled to receive notice

of the Special Meeting and to vote the shares of common stock that they held on that date at the meeting, or any postponement or adjournment

of the meeting. Holders of our common stock are entitled to one vote per share on each matter to be voted upon.

As

of the record date, we had 5,086,985 outstanding shares of common stock.

Who

can attend the meeting?

The

Special Meeting will take place virtually through the Internet. There will not be a physical meeting location and you will not be able

to attend the Special Meeting in person. We have designed the format of the virtual Special Meeting to ensure that our stockholders who

attend the Special Meeting online will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

You will be able to attend the Special Meeting online, vote your shares online during the Special Meeting and submit questions online

during the Special Meeting by visiting www.virtualshareholdermeeting.com/MTNB2025SM. You are entitled to attend and participate

in the Special Meeting only if you were a stockholder of record as of the close of business on February 10, 2025. To be admitted to the

Special Meeting at www.virtualshareholdermeeting.com/MTNB2025SM, you must enter the 16-digit control number found on your proxy

card or other proxy materials. If you do not have a control number, please contact the brokerage firm, bank, dealer, or other similar

organization that holds your account as soon as possible so that you can be provided with a control number. The Special Meeting will

begin promptly at 9:00 a.m. local time. We encourage you to access the Special Meeting before it begins. Online check-in will start 15

minutes before the meeting on April , 2025. If you encounter any difficulties accessing

the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual

Special Meeting log-in page.

What

constitutes a quorum?

The

presence at the Special Meeting, virtually or by proxy, of the holders of a majority of our common stock outstanding on the record date

will constitute a quorum for our meeting. Signed proxies received but not voted and broker non-votes will be included in the calculation

of the number of shares considered to be present at the meeting.

How

do I vote?

You

can vote on matters that come before the Special Meeting via the Internet, by following the instructions at www.virtualshareholdermeeting.com/MTNB2025SM,

or by submitting your proxy card by mail.

Your

shares will be voted as you indicate on your proxy card. If you vote the enclosed proxy but you do not indicate your voting preferences,

and with respect to any other matter that properly comes before the meeting, the individuals named on the proxy card will vote your shares

FOR the matters submitted at the meeting, or if no recommendation is given, in their own discretion.

If

you are a stockholder of record, to submit your proxy by telephone or via the Internet, follow the instructions on the proxy card. If

you hold your shares in street name, you may vote by telephone or via the Internet as instructed by your broker, bank or other nominee.

If

you are a stockholder of record, virtually attend the Special Meeting and prefer to vote online at the Special Meeting, you may do so

even if you have already voted your shares by proxy. If you hold shares in “street name,” however, you must provide a legal

proxy executed by your broker or other nominee in order to vote your shares at the Special Meeting.

What

if I vote and then change my mind?

You

may revoke your proxy at any time before it is exercised by:

| |

● |

filing

with our Secretary of a notice of revocation; |

| |

|

|

| |

● |

sending

in another duly executed proxy by telephone, internet or mail bearing a later date; or |

| |

|

|

| |

● |

attending

the meeting virtually and casting your vote online. |

Your

latest vote will be the vote that is counted.

What

is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many

of our stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized

below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder

of Record

If

your shares are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered, with respect to those

shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote

virtually at the Special Meeting.

Beneficial

Owner

If

your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held

in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect

to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are

also invited to attend the Special Meeting. However, because you are not the stockholder of record, you may not vote these shares online

at the Special Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you do not

vote your shares or otherwise provide the stockholder of record with voting instructions, your shares may constitute broker non-votes.

The effect of broker non-votes is more specifically described in “What vote is required to approve each proposal?”

below.

What

vote is required to approve each proposal?

The

holders of a majority of our shares of common stock outstanding on the record date must be present, virtually or by proxy, at the Special

Meeting in order to have the required quorum for the transaction of business. Pursuant to Delaware corporate law, abstentions and broker

non-votes will be counted for the purpose of determining whether a quorum is present.

Assuming

that a quorum is present, the Stock Issuance Proposal (Proposal No. 1), the ratification of the appointment of EisnerAmper LLP as our

independent registered public accounting firm for the year ending December 31, 2025 (Proposal No. 2), and the Adjournment Proposal (Proposal

3), each require the approval of the affirmative vote of a majority of the votes cast virtually or represented by proxy at the Annual

Meeting.

Holders

of common stock will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the meeting.

What

are “broker non-votes”?

Broker

non-votes occur when nominees, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions

from the beneficial holders at least ten days before the meeting. If that happens, the nominees may vote those shares only on matters

deemed “routine”. Nominees cannot vote on non-routine matters unless they receive voting instructions from beneficial holders,

resulting in so-called “broker non-votes.” The approval of the Stock Issuance Proposal and the Adjournment Proposal are generally

not considered to be “routine” matters and banks or brokers are not permitted to vote on these matters if the bank or broker

has not received instructions from the beneficial owner. If such proposals are deemed to be “routine,” a bank or broker may

be able to vote on the Stock Issuance Proposal and the Adjournment Proposal even if it does not receive instructions from you, so long

as it holds your shares in its name. The determination of which proposals are deemed “routine” versus “non-routine”

may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it

is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your

shares.

How

are we soliciting this proxy?

We

are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. We have engaged Advantage Proxy (the

“Proxy Solicitor”) as the proxy solicitor for the Special Meeting for an approximate fee of $15,000 plus fees for additional

services, if needed. We have also agreed to reimburse the Proxy Solicitor for its reasonable out of pocket expenses. Some of our officers

and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal

conversations, or by telephone, facsimile or other electronic means.

We

will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable

out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

If

you have questions about the proposals or if you need additional copies of the proxy statement or the enclosed proxy card you should

contact:

Advantage

Proxy, Inc.

P.O. Box 10904

Yakima, WA 98909

Toll Free 877-870-8565

Collect: 206-870-8565

Email: ksmith@advantageproxy.com

PROPOSAL

1: STOCK ISSUANCE PROPOSAL

Overview

On

February 13, 2025, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain investors

(the “Purchasers”), pursuant to which the Company agreed to issue and sell, in a private placement (the “Offering”),

an aggregate of 3,300 shares of the Company’s Series C Convertible Preferred Stock, par value $0.0001 per share (the “Preferred

Stock”), initially convertible into up to 5,631,404 shares of the Company’s common stock, par value $0.0001 per share (the

“Common Stock”), with a stated value of $1,000 per share (the “Stated Value”), and warrants (the “Warrants”)

to purchase up to an aggregate of 200% of the shares of Common Stock into which the shares of Preferred Stock are initially convertible,

or 11,262,808 shares of Common Stock, for an offering price of $1,000 per share of Preferred Stock and accompanying Warrants.

Pursuant

to the Purchase Agreement, on February 13, 2025, the Company issued and sold in an initial closing of the Offering (the “Initial

Closing”), 1,650 shares of Preferred Stock, initially convertible into up to 2,815,702 shares of Common Stock, and accompanying

Warrants, initially exercisable for up to 5,631,404 shares of Common Stock, for gross proceeds to the Company of $1.65 million. On the

date on which the Company obtains stockholder approval for the issuance of the shares of Common Stock issuable upon conversion of the

Preferred Stock and exercise of the Warrants, and the terms of the Offering, which may constitute a “Change of Control” as

defined in the NYSE Company Guide, as may be required by the rules and regulations of NYSE American LLC (the “NYSE”), including

Section 713 of the NYSE Company Guide (“Stockholder Approval”), the Company will issue and sell, in a second closing of the

Offering (the “Second Closing”), 1,650 shares of Preferred Stock, initially convertible into up to 2,815,702 shares of Common

Stock, and accompanying Warrants, initially exercisable for up to 5,631,404 shares of Common Stock, for gross proceeds to the Company

of $1.65 million.

The

Company is required to use its reasonable best efforts to obtain Stockholder Approval by April 10, 2025. If the Company does not obtain

Stockholder Approval at the Special Meeting being held April , 2025 (the “Initial

Stockholder Meeting”), the Company is required to call a meeting of stockholders every four months thereafter to seek Stockholder

Approval until the earlier of the date Stockholder Approval is obtained or the Preferred Stock and Warrants are no longer outstanding.

Registration

Rights

The

shares of Preferred Stock and Warrants were sold without registration under the Securities Act of 1933, as amended (the “Securities

Act”), or state securities laws in reliance on the exemption provided by Section 4(a)(2) of the Securities Act and/or Regulation

D promulgated thereunder and in reliance on similar exemptions under applicable state laws. The shares of Common Stock underlying the

Preferred Stock and Warrants will be issued pursuant to the same exemption or pursuant to the exemption provided by Section 3(a)(9) of

the Securities Act.

Pursuant

to the Purchase Agreement, the Company is required to file a registration statement with the Securities and Exchange Commission (“SEC”)

to register for resale the shares of Common Stock underlying the Preferred Stock and Warrants. The registration statement must be filed

with the SEC no later than the 15th calendar day following the date on which the Company files its Annual Report on Form 10-K

for the fiscal year ended December 31, 2024.

Description

of Preferred Stock

The

Company filed a certificate of designation (the “Certificate of Designation”) on February 13, 2025, with the Delaware Secretary

of State designating the rights, preferences and limitations of the shares of Preferred Stock, which provides that the Preferred Stock

is convertible as of the date of the Initial Stockholder Meeting; however, if the Company does not obtain Stockholder Approval at the

Initial Stockholder Meeting, or if such meeting is adjourned, postponed or cancelled for any reason, each holder of Preferred Stock will

be entitled to vote on an as-converted basis based on the Voting Conversion Price, as defined below, provided that such holders in the

aggregate will be prohibited from voting in excess of 1,016,888 shares of Common Stock, calculated on an as-converted basis, utilizing

the Voting Conversion Price, representing 19.99% of the number of shares of Common Stock outstanding immediately prior to the date of

the Purchase Agreement (the “19.99% Limit”), subject to adjustment. In the event of such vote, each holder of Preferred Stock

will be entitled to vote on a pro rata basis such that the aggregate voting amount does not exceed the 19.99% Limit. Upon the

date of the Initial Stockholder Meeting (the “Initial Stockholder Meeting Date”), the Preferred Stock shall vote with holders

of outstanding shares of Common Stock, voting together as a single class, with each share of Preferred Stock entitled to vote on an as-converted

basis based on a conversion price of $0.6393 pursuant to the rules and regulations of the NYSE (the “Voting Conversion Price”).

Upon

any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, the then holders of the Preferred Stock

are entitled to receive out of the assets available for distribution to stockholders of the Company an amount equal to 100% of the Stated

Value, in preference and priority to the Common Stock. The holders of Preferred Stock will be entitled to dividends, on an as-converted

basis, equal to dividends actually paid, if any, on shares of Common Stock. From and after the date of the Initial Stockholder Meeting,

each share of Preferred Stock will be convertible, at the option of the holder, into that number of shares of Common Stock determined

by dividing the Stated Value by $0.586 (the “Conversion Price”); provided, however, that if Stockholder Approval is not obtained

at the Initial Stockholder Meeting, or such meeting is adjourned, postponed or cancelled for any reason, the Preferred Stock will only

be convertible into up to an aggregate of 1,016,888 shares of Common Stock, representing the 19.99% Limit, subject to adjustment, until

such time as Stockholder Approval is obtained. Such aggregate amount will include any shares of Common Stock issuable upon exercise of

the Warrants.

Conversion

Price Adjustment and Rights; Fundamental Transaction

The

Conversion Price may be adjusted pursuant to the Certificate of Designation for stock dividends and stock splits, subsequent rights offering,

pro rata distributions of dividends or the occurrence of a Fundamental Transaction, which includes any merger or consolidation of the

Company, a sale of all or substantially all of its assets, a sale of 50% or more of the Company’s Common Stock, any reclassification,

reorganization or recapitalization of Common Stock or any compulsory share exchange pursuant to which the Common Stock is converted into

or exchanged for other securities, cash or property, or any transaction in which more than 50% of the outstanding shares of Common Stock

are acquired by a purchaser (a “Fundamental Transaction”), as more fully described in the Certificate of Designation. In

addition, from and after the date of the Initial Stockholder Meeting, the Conversion Price is subject to adjustment for issuances of

our securities at a price less than the Conversion Price, as more fully described in the Certificate of Designation. A holder of Preferred

Stock will not have the right to convert any portion of its Preferred Stock if the holder, together with its affiliates, would beneficially

own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of Common Stock outstanding immediately after

giving effect to such exercise (the “Beneficial Ownership Limit”). A holder may increase or decrease the Beneficial Ownership

Limit up to 9.99%, provided, however, that any increase in the Beneficial Ownership Limit shall not be effective until 61 days following

notice of such change to the Company. No holders of Preferred Stock will, as holders of Preferred Stock, have any preemptive rights to

purchase or subscribe for Common Stock or any of the Company’s other securities. The shares of Preferred Stock are not redeemable

by the Company.

Transferability

Subject

to applicable laws, a share of Preferred Stock may be transferred at the option of the holder upon surrender of the Preferred Stock together

with the appropriate instruments of transfer.

Exchange

Listing

We

do not intend to list the Preferred Stock on any securities exchange or nationally recognized trading system.

Rights

as Stockholder

Except

as otherwise provided in the Certificate of Designation or by virtue of a holder’s ownership of, the holders of the shares of Preferred

Stock do not have the rights or privileges of holders of our Common Stock until they convert their shares of Preferred Stock.

Description

of Warrants

Duration,

Exercise Price and Exercisability

The

Warrants are exercisable as of the Initial Stockholder Meeting Date at an exercise price equal to 110% of the Conversion Price, or $0.6446

per share (the “Exercise Price”), and will expire on the five-year anniversary of the date of the Initial Stockholder Meeting;

provided, however, that if Stockholder Approval is not obtained at the Initial Stockholder Meeting, or such meeting is adjourned, postponed

or cancelled for any reason, the Warrants will only be exercisable into up to an aggregate of 1,016,888 shares of Common Stock, representing

the 19.99% Limit, subject to adjustment, until such time as Stockholder Approval is obtained. Such aggregate amount that can be exercised

subject to the 19.99% Limit will include any shares of Common Stock issuable upon conversion of the Preferred Stock. A holder of Warrants

will not have the right to exercise any portion of its Warrants if the holder, together with its affiliates, would beneficially own in

excess of the Beneficial Ownership Limit. A holder may increase or decrease the Beneficial Ownership limit up to 9.99%, provided, however,

that any increase in the Beneficial Ownership Limit shall not be effective until 61 days following notice of such change to the Company.

Exercise

Price Adjustment; Fundamental Transaction

The

Exercise Price of the Warrants may be adjusted for stock dividends and stock splits, subsequent rights offering, pro rata distributions

of dividends or the occurrence of a Fundamental Transaction, as more fully described in the Form of Warrant. In addition, from and after

the date of the Initial Stockholder Meeting, the Exercise Price of the Warrants is subject to adjustment for issuances of our securities

at a price less than the Exercise Price, as more fully described in the Form of Warrant.

Company

Redemption Right

If

the trailing five-day VWAP, as defined in the Warrants, is 300% higher than the initial Exercise Price of the Warrants, subject to adjustment,

the Company shall have the right but not the obligation to redeem any of the unexercised portion of the Warrants (the “Call Amount”).

Subject to the terms and conditions of the Warrants, upon such a redemption, the holders of the Warrants shall exercise the Warrants

for up to the Call Amount.

Cashless

Exercise

If,

at the time a holder exercises its Warrants, a registration statement registering the issuance of the shares of Common Stock underlying

the Warrants under the Securities Act is not effective or available, then in lieu of making the cash payment otherwise contemplated to

be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise

(either in whole or in part) the net number of shares of Common Stock determined according to a formula set forth in the Warrants.

Transferability

Subject

to applicable laws, a Warrant may be transferred at the option of the holder upon surrender of the Warrant together with the appropriate

instruments of transfer.

Exchange

Listing

We

do not intend to list the Warrants on any securities exchange or nationally recognized trading system.

Right

as a Stockholder

Except

as otherwise provided in the Warrants or by virtue of such holder’s ownership, the holders of the Warrants do not have the rights

or privileges of holders of our Common Stock, including any voting rights, until they exercise their Warrants.

Right

to Board Nominees

Pursuant

to the Purchase Agreement, until such time as the Purchasers no longer own at least 10% of the outstanding shares of Common Stock on

a fully diluted, as-converted basis, the Purchasers will be entitled to nominate one director to serve on the Board of Directors of the

Company (the “Board”). At the time of the Initial Closing, the Purchasers nominated, and the Board approved the appointment

of, Dr. Robin Smith to the Board. Commencing on the date of the Second Closing until such time as the Purchasers no longer own at least

30% of the outstanding shares of Common Stock on a fully diluted, as-converted basis, the Purchasers will be entitled to nominate one

additional director to serve on the Board.

The

foregoing descriptions of the Purchase Agreement, the Certificate of Designation and the Warrants do not purport to be complete and are

subject to, and qualified in their entirety by, the form of Purchase Agreement, the Certificate of Designation and the form of Warrant

attached as Exhibits 10.1, 3.1 and 4.1, respectively, to the Company’s Current Report on Form 8-K, filed with the SEC on February

13, 2025.

Reasons

for the Proposal

Our

Common Stock is listed on NYSE American, and, as such, we are subject to the applicable rules of the New York Stock Exchange, including

Section 713 of the NYSE Company Guide, which requires stockholder approval in connection with the sale, issuance, or potential issuance

by the issuer of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less

than the greater of book or market value of the stock. For purposes of Section 713 of the NYSE Company Guide, the issuance of any Common

Stock upon conversion of the Preferred Stock or exercise of the Warrants in the Initial Closing and Second Closing would be aggregated

together.

In

addition, Section 713(b) of the NYSE American Company Guide requires stockholder approval of a transaction involving the issuance or

potential issuance of shares that will result in a change of control of the issuer. On February 10, 2025, we had 5,086,985 shares of

Common Stock outstanding. If all shares of Preferred Stock are converted at the Conversion Price, and all Warrants are exercised at the

Exercise Price, an additional 16,894,212 shares of Common will be outstanding, which would represent a change of control of the Company

requiring shareholder approval under Section 713(b) of the NYSE Company Guide. The terms of the Preferred Stock and Warrants, as described

above, limit their conversion to a number of shares of Common Stock equal to no more than 1,016,888 shares, which is less than the 19.99%

Limit, until Shareholder Approval is obtained. In addition, the Preferred Stock and Warrants contain Beneficial Ownership Limits. Thus,

in order to permit the issuance of Common Stock upon conversion of the Preferred Stock and exercise of the Warrants in excess of the

19.99% Limit, we must first obtain stockholder approval of this conversion.

Reasons

for the Offering

After careful consideration, the Board determined that the Offering, including the issuance

of Common Stock upon conversion of the Preferred Stock and exercise of the Warrants, are advisable and in the best interests of the Company

and its stockholders, and determined to recommend that our stockholders approve the Stock Issuance Proposal.

In

making its determination, the Board considered various factors, including:

| ● | The

immediate and longer-term benefit to the Company’s financial condition of receiving

an aggregate of $3.3 million in gross proceeds from the sale of the Preferred Stock and Warrants,

in light of the Company’s current cash position and liquidity needs. |

| | | |

| ● | The

likelihood of securing alternative sources of capital, of a potential public or private sale

of common stock, warrants, or convertible or nonconvertible debt securities and the likely

price and other terms and conditions of such sales, which revealed a low likelihood of consummation

of any alternatives, as well as a significant cost of any such financing, assuming it could

be obtained, to the Company and the associated significant dilution to stockholders, which

the Board determined was substantially less favorable to the Company than pursuing the Offering. |

| | | |

| ● | The

significant likelihood that, without the consummation of the Offering, the Company would

pursue a liquidation and dissolution, which would likely result in stockholders receiving

no or little value in respect of their shares of Common Stock after payment of the Company’s

outstanding liabilities and obligations. |

| | | |

| ● | The

funding provided by the Purchasers would allow the Company to continue to explore strategic

alternatives in an attempt to maximize shareholder value. |

| | | |

| ● | The

recent performance of the Company’s stock on the NYSE American, and the capital markets

as a whole, and the Company’s inability to secure an acquisition of the Company or

its assets, or a financing on more favorable terms. |

| | | |

| ● | The

Company’s extensive exploration, both by the Company’s management as well as

through its strategic advisors, of opportunities for a strategic partnership and/or investment,

based on which the Board determined that the Offering offered the opportunity with the most

favorable financial benefit, including after considering the risks that any such anticipated

benefits could ultimately not materialize. |

| | | |

| ● | The

fact that we have covenanted under the Purchase Agreement to solicit approval of the proposals

from our stockholders. |

| | | |

| ● | The

terms and conditions of the Purchase Agreement, including, among other things, the representations,

warranties, covenants and agreements of the parties, the conditions to closing, the form

and governance of the Company post-closing and the termination rights of the parties, taken

as a whole, which the Board determined were more favorable to the Company and its stockholders

than those terms and conditions which could have been negotiated with or offered by other

potential strategic partners and/or investors. |

| | | |

| ● | Potential

risks associated with alternatives to the Offering, including the potential impact on the

price of our Common Stock and ability to generate sufficient capital to support our ongoing

operations. |

Consequences

of Not Approving the Proposal

The

Company is required to use its reasonable best efforts to obtain Stockholder Approval by April 10, 2025. If the Company does not obtain

Stockholder Approval at the Initial Stockholder Meeting, the Company is required to call a meeting of stockholders every four months

thereafter to seek Stockholder Approval until the earlier of the date Stockholder Approval is obtained or the Preferred Stock and Warrants

are no longer outstanding. Further, if Stockholder Approval is not obtained at the Initial Stockholder Meeting, or such meeting is adjourned,

postponed or cancelled for any reason, then after the Initial Stockholder Meeting Date and until Stockholder Approval is obtained, (i)

the holders of Preferred Stock shall be entitled to vote on an as-converted basis with the Common Stock, subject to the 19.99% Limit,

as described above; (ii) the holders of Preferred Stock shall be entitled to convert their shares of Preferred Stock into Common Stock,

subject to the 19.99% Limit and Beneficial Ownership Limit, as described above; and (iii) the holders of the Warrants shall be entitled

to exercise their Warrants for Common Stock, subject to the 19.99% Limit and Beneficial Ownership Limit, as described above. Lastly,

the Company will not receive proceeds from the Second Offering unless and until Stockholder Approval is obtained, which proceeds will

fund our continued operations. In the event Stockholder Approval is not obtained, the Company will continue its evaluation of alternatives,

including a winddown or dissolution of the Company.

Potential

Adverse Effects of the Approval of the Stock Issuance Proposal

If

the Stock Issuance Proposal is approved, existing stockholders will suffer dilution in their ownership interests in the future upon the

issuance of shares of common stock upon conversion of the Preferred Stock and exercise of the Warrants. Assuming the full conversion

of the Preferred Stock and full exercise of the Warrants, an aggregate of 16,666,674 additional shares of Common Stock will be outstanding,

and the ownership interest of our existing stockholders would be correspondingly reduced. In addition, the sale into the public market

of these shares also could materially and adversely affect the market price of our common stock.

No

Appraisal Rights

No

appraisal rights are available under Delaware law or under our charter or bylaws with respect to the Stock Issuance Proposal.

Required

Vote

In

accordance with our charter, bylaws and Delaware law, approval and adoption of the Stock Issuance Proposal requires the affirmative vote

of a majority of the votes cast in person via attendance at the virtual Special Meeting or by proxy. We do not believe the Stock Issuance

Proposal will be deemed “routine” and, as a result, unless the NYSE deems otherwise, abstentions and broker non-votes, if

any, with respect to this proposal are not expected to be counted as votes cast and are not expected to affect the outcome of this proposal.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE STOCK ISSUANCE PROPOSAL

PROPOSAL

NO. 2:

RATIFY

THE APPOINTMENT OF EISNERAMPER LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2025

The

Audit Committee has reappointed EisnerAmper LLP as our independent registered public accounting firm to audit the financial statements

of the Company for the fiscal year ending December 31, 2025, and has further directed that management submit their selection of independent

registered public accounting firm for ratification by our stockholders at the Annual Meeting. Neither the accounting firm nor any of

its members has any direct or indirect financial interest in or any connection with us in any capacity other than as public registered

accounting firm.

Principal

Accountant Fees and Services

The

following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2024 and 2023, by EisnerAmper

LLP, the Company’s independent registered public accounting firm.

| | |

Years Ended December 31, | |

| | |

2024 | | |

2023 | |

| | |

(in thousands) | |

| Audit Fees | |

$ | 230 | | |

$ | 270 | |

| Audit-Related Fees | |

| - | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| Total Fees | |

$ | 230 | | |

$ | 270 | |

Audit

Fees consist of fees billed for professional services rendered for the audit of our annual financial statements, audit of internal

controls over financial reporting, review of our interim consolidated financial statements and comfort letters.

Audit-Related

Fees consist of fees billed for professional services rendered for assurance related services that are reasonably related to the

performance of the audit or review of our financial services.

Tax

Fees are for tax-related services related primarily to tax consulting and tax planning.

The

Audit Committee pre-approves all auditing services and any non-audit services that the independent registered public accounting firm

is permitted to render under Section 10A(h) of the Exchange Act. The Audit Committee may delegate the pre-approval to one of its members,

provided that if such delegation is made, the full Audit Committee must be presented at its next regularly scheduled meeting with any

pre-approval decision made by that member.

Attendance

at Annual Meeting

Representatives

of EisnerAmper LLP are expected to be present at the Special Meeting, where they will be available to respond to appropriate questions

from stockholders and, if they desire, to make a statement.

Vote

Required

The

ratification of the appointment of EisnerAmper LLP as our independent registered public accounting firm to audit the financial statements

of the Company for the fiscal year ending December 31, 2025 requires the affirmative vote of the holders of the majority of the votes

cast in person via attendance at the Special Meeting or by proxy.

THE

BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE

RATIFICATION

OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PROPOSAL

3:

ADJOURNMENT

PROPOSAL

Our

stockholders are being asked to consider and vote upon an adjournment of the Special Meeting, if necessary, if a quorum is present, to

solicit additional proxies if there are insufficient votes in favor of approval of the Stock Issuance Proposal or to ratify the appointment

of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2025.

Required

Vote

Approval

of the Adjournment Proposal requires the affirmative vote of the holders of the majority of the votes cast in person via attendance at

the virtual Special Meeting or by proxy. We do not believe the Adjournment Proposal will be deemed “routine” and, as a result,

unless the NYSE deems otherwise, abstentions and broker non-votes, if any, with respect to this proposal are not expected to be counted

as votes cast and are not expected to affect the outcome of this proposal .

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADJOURNMENT PROPOSAL

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth the number of shares of common stock beneficially owned as of February 10, 2025 by:

| |

● |

each

of our stockholders who is known by us to beneficially own 5% or more of our common stock; |

| |

|

|

| |

● |

each

of our named executive officers; |

| |

|

|

| |

● |

each

of our directors; and |

| |

|

|

| |

● |

all

of our directors and current executive officers as a group. |

Beneficial

ownership is determined based on the rules and regulations of the SEC. A person has beneficial ownership of shares if such individual

has the power to vote and/or dispose of shares. This power may be sole or shared and direct or indirect. Applicable percentage ownership

in the following table is based on 5,086,985 shares outstanding as of February 10, 2025. In computing the number of shares beneficially

owned by a person and the percentage ownership of that person, shares of common stock that are subject to options or warrants held by

that person and exercisable as of, or within 60 days of, February 10, 2025 are counted as outstanding. These shares, however,

are not counted as outstanding for the purposes of computing the percentage ownership of any other person(s). Except as may be indicated

in the footnotes to this table and pursuant to applicable community property laws, each person named in the table has sole voting and

dispositive power with respect to the shares of common stock set forth opposite that person’s name. Unless indicated below, the

address of each individual listed below is c/o Matinas BioPharma Holdings, Inc., 1545 Route 206 South, Suite 302, Bedminster, NJ 07921.

| Name of Beneficial Owner | |

Number of Shares

Beneficially

Owned | | |

Percentage of Shares Beneficially Owned | |

| 5% Stockholders | |

| | |

| |

| Highbridge Capital Management, LLC(1) | |

| 508,189 | (2) | |

| 9.99 | % |

| Directors and Executive Officers | |

| | | |

| | |

| Jerome D. Jabbour(3) | |

| 181,877 | | |

| 3.5 | % |

| Evelyn D’An | |

| - | | |

| * | % |

| Eric Ende(4) | |

| 34,031 | | |

| * | % |

| Natasha Giordano(5) | |

| 19,176 | | |

| * | % |

| Robin Smith | |

| - | | |

| * | % |

| Matthew Wikler(6) | |

| 33,959 | | |

| * | % |

| Keith A. Kucinski(7) | |

| 51,687 | | |

| 1.0 | % |

| Directors and Executive Officers as a group (7 persons)(8) | |

| 320,730 | | |

| 6.0 | % |

| * |

Less

than 1% |

| (1) |

Based

solely on information contained in a Schedule 13G filed on October 25, 2024. The address for the reporting person is 277 Park Avenue,

23rd Floor, New York, New York, 10172. |

| (2) |

Includes

379,233 shares of Common Stock issuable upon the exercise of warrants that cannot be exercised to the extent the holder would

beneficially own, after any such exercise, more than 9.99% of the outstanding Common Stock. |

| (3) |

Includes

172,670 shares of Common Stock issuable upon exercise of options. Does not include 68,766 shares of common stock underlying

options. |

| (4) |

Includes

31,149 shares of Common Stock issuable upon exercise of options. |

| (5) |

Includes

19,176 shares of Common Stock issuable upon exercise of options. |

| (6) |

Includes

28,149 shares of Common Stock issuable upon exercise of options. |

| (7) |

Includes

49,797 shares of Common Stock issuable upon exercise of options. Does not include 20,209 shares of common stock underlying

options. |

| (8) |

See

notes (3) through (7). |

STOCKHOLDER

PROPOSALS FOR 2025 ANNUAL MEETING

Our

by-laws state that a stockholder must provide timely written notice of a proposal to be brought before the meeting and supporting documentation

as well as be present at such meeting, either in person or by a representative. Any stockholder proposals submitted for inclusion in

our proxy statement and form of proxy for our 2025 Annual Meeting of Stockholders must be timely received at our principal executive

office no later than the close of business on the later of (i) the ninetieth (90th) day prior to the scheduled date of such

Annual Meeting; and (ii) the tenth (10th) day following the day on which such public announcement of the date of such Annual

Meeting is first made by us. Such proposals must also comply with the requirements as to form and substance established by the SEC if

such proposals are to be included in the proxy statement and form of proxy. Proxies solicited by our Board will confer discretionary

voting authority with respect to these proposals, subject to the SEC’s rules and regulations governing the exercise of this authority.

Any such proposal shall be mailed to: Matinas BioPharma Holdings, Inc., 1545 Route 206 South, Suite 302, Bedminster, New Jersey 07921,

Attn.: Corporate Secretary.

HOUSEHOLDING

OF SPECIAL MEETING MATERIALS

Some

banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements.

This means that only one copy of this Proxy Statement may have been sent to multiple stockholders in the same household. We will promptly

deliver a separate copy of this Proxy Statement to any stockholder upon written or oral request to: Matinas BioPharma Holdings, Inc.,

1545 Route 206 South, Suite 302, Bedminster, New Jersey 07921, Attn.: Corporate Secretary, or by phone at (908) 443-1860. Any stockholder

who wants to receive a separate copy of this Proxy Statement, or of our proxy statements or annual reports in the future, or any stockholder

who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder’s bank,

broker, or other nominee record holder, or the stockholder may contact us at the address and phone number above.

OTHER

MATTERS

As

of the date of this proxy statement, the Board does not intend to present at the Special Meeting of Stockholders any matters other than

those described herein and does not presently know of any matters that will be presented by other parties. If any other matter requiring

a vote of the stockholders should come before the meeting, it is the intention of the persons named in the proxy to vote with respect

to any such matter in accordance with the recommendation of the Board or, in the absence of such a recommendation, in accordance with

the best judgment of the proxy holder.

| |

By

Order of the Board of Directors |

| |

|

| |

|

| |

Jerome

D. Jabbour |

| |

Chief Executive Officer |

March ,

2025

Bedminster,

New Jersey

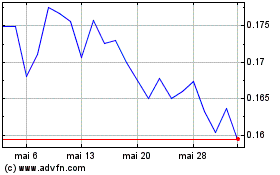

Matinas Biopharma (AMEX:MTNB)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Matinas Biopharma (AMEX:MTNB)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025