false

0001473334

0001473334

2025-02-20

2025-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 20, 2025

Nova

LifeStyle, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-36259 |

|

90-0746568 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

6565

E. Washington Blvd., Commerce, CA 90040

(Address

of Principal Executive Office) (Zip Code)

(323)

888-9999

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

NVFY |

|

Nasdaq

Stock Market |

Item

1.01 Entry into a Material Definitive Agreement

On

February 20, 2025, Nova LifeStyle, Inc. (the “Company”)

entered into a Debt Repayment Agreement (the

“Agreement”) with Huge Energy International Limited, a company incorporated

in Hong Kong and a creditor of the Company (the “Creditor”), pursuant to

which the Company agreed to repay $217,000 debt owed to the Creditor in the form of shares of Common Stock of the Company for an aggregate

of 434,000 shares at a price of $0.50 per share (the “Debt Repayment”). The

Debt Repayment will be completed pursuant to the exemption from registration provided by Regulation S promulgated under the Securities

Act of 1933, as amended.

The

form of the Agreement is filed as Exhibits 10.1 to this Current Report on Form 8-K. The foregoing summary of the terms of the Agreement

is subject to, and qualified in its entirety by, the Debt Repayment Agreement, which is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

Please

see the disclosure set forth under Item 1.01, which is incorporated by reference into this Item 3.02.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

Nova

LifeStyle, Inc. |

| |

|

|

| |

By:

|

/s/

Thanh H. Lam |

| |

|

Thanh

H. Lam |

| |

|

Chairperson,

President and Chief Executive Officer |

Date:

February 24, 2025

Exhibit 10.1

DEBT

REPAYMENT AGREEMENT

This

Debt Repayment Agreement (this “Agreement”) is dated as of February 20, 2025 (the “Effective Date”) by and between

Nova LifeStyle Inc., a Nevada corporation (the “Company”) and Huge Energy International Limited, a company incorporated in

Hong Kong (the “Creditor”, collectively with the Company, the “Parties”).

RECITALS

WHEREAS,

the Company has debt payable to the Creditor in principal and interest for an aggregate amount of $217,000.00 (the “Debt”),

pursuant to a Loan Agreement between the Parties on February 21, 2024;

WHEREAS,

subject to the terms and conditions set forth in this Agreement and pursuant to an exemption from the registration requirements of Section

5 of the Securities Act contained in Section 4(a)(2) thereof and/or Regulations S thereunder, the Creditor desires to cancel the Debt

and the Company desires to issue the certain securities of the Company as repayment to the Debt which are more fully described in this

Agreement.

NOW,

THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the

receipt and adequacy of which are hereby acknowledged, the Company and the Creditor agree as follows:

ARTICLE

I. DEFINITIONS

1.1

Definitions. In addition to the terms defined elsewhere in this Agreement, the following terms have the meanings set forth in

this Section 1.1:

“Affiliate”

means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under

common control with a Person as such terms are used in, and construed, under Rule 405 under the Securities Act.

“Board

of Directors” means the board of directors of the Company.

“Business

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day

on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Commission”

means the United States Securities and Exchange Commission.

“Common

Stock” means the common stock of the Company, par value $0.001 per share, and any other class of securities into which such

securities may hereafter be reclassified or changed.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange

Rules” shall mean the listing rules of The NASDAQ Stock Market.

“Liens”

means a lien, charge, pledge, security interest, encumbrance, right of first refusal, preemptive right or other restriction.

“Per

Share Price” equals $0.50 per share of Common Stock, subject to adjustment for reverse and forward stock splits, stock combinations

and other similar transactions of the Common Stock that may occur after the date of this Agreement.

“Person”

means an individual, corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company,

joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Required

Approvals” shall have the meaning ascribed to such term in Section 3.1(c).

“Rule

144” means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted

from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect

as such Rule.

“SEC

Reports” shall have the meaning ascribed to such term in Section 3.1(f).

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Securities

Laws” means, collectively, the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”), the Securities

Act, the Exchange Act, the Rules and Regulations, the auditing principles, rules, standards and practices applicable to auditors of “issuers”

(as defined in Sarbanes-Oxley) promulgated or approved by the Public Company Accounting Oversight Board, the Exchange Rules and applicable

state securities laws and regulations.

“Shares”

means 434,000 shares of Common Stock issued or issuable to the Creditor pursuant to this Agreement.

“Short

Sales” means all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be

deemed to include the location and/or reservation of borrowable shares of Common Stock).

“Debt

Cancellation Amount” means, as to the Creditor, the amount for the payment of shares hereunder as specified below the Creditor’s

name on the signature page of this Agreement and next to the heading “Debt Cancellation Amount,” in United States dollars

and in immediately available funds.

“Creditor

Shares” means, as to the Creditor, the shares of Common Stock of the Company hereunder as specified below the Creditor’s

name on the signature page of this Agreement and next to the heading “Creditor Shares”.

“Subsidiary”

means any subsidiary of the Company and shall, where applicable, also include any direct or indirect subsidiary of the Company formed

or acquired after the date hereof.

“Trading

Day” means a day on which the principal Trading Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date

in question: NASDAQ Capital Market (or any successors to any of the foregoing).

“Transaction

Documents” means this Agreement, and any other documents or agreements executed between the Company and the Creditor in connection

with the transactions contemplated hereunder.

“Transfer

Agent” means Issuer Direct Corporation, the current transfer agent of the Company, and any successor transfer agent of the

Company.

ARTICLE

II.

CANCELLATION

OF DEBT AND ISSUANCE OF SHARES

2.1

Repayment of Debt. Upon the terms and subject to the conditions set forth herein, substantially concurrent with the execution

and delivery of this Agreement by the parties hereto, the Company agrees to sell, and the Creditor, severally and not jointly, agrees

to cancel the debt amount as specified under the Creditor’s name on the signature page of this Agreement, up to an aggregate of

$217,000 as the payment for the Shares at a price of $0.50 per share. The Creditor’s Debt Cancellation Amount as set forth on the

signature page hereto executed by the Creditor shall be settled for “Delivery Versus Payment” with the Company. The Company

shall deliver the Creditor Shares to the Creditor as the repayment of Debt within 30 days of this Agreement.

ARTICLE

III.

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. Except as indicated in the SEC Reports, the Company hereby represents and warrants

to the Creditor as of the date of this Agreement as follows:

(a) Organization and Qualification. The Company and each of the Subsidiaries, if any, is an entity duly incorporated or otherwise

organized and validly existing under the laws of each jurisdiction in which it owns or leases properties or conducts any business so

as to require such qualification, with the requisite power and authority to own and use its properties and assets and to carry on its

business as currently conducted.

(b) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions

contemplated by this Agreement and each of the other Transaction Documents and otherwise to carry out its obligations hereunder and thereunder.

The execution and delivery of this Agreement and each of the other Transaction Documents by the Company and the consummation by it of

the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no

further action is required by the Company, the Board of Directors or the Company’s stockholders in connection herewith or therewith

other than in connection with the Required Approvals (as defined below).

(c) Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any

notice to, or make any filing or registration with, any governmental authority or any court or other federal, state, local or other governmental

authority or other Person in connection with the execution, delivery and performance by the Company of the Transaction Documents or the

offer, issue and sale of the Shares, other than: (i) the disclosure filing required for this Agreement, (ii) such filings as are required

to be made under applicable state securities laws and stock exchange, if any (collectively, the “Required Approvals”).

(d) Authorization of the Shares. The Shares to be issued by the Company and debt cancellation are duly authorized and, when issued

and paid for in accordance with the applicable Transaction Documents, will be duly and validly issued, and free and clear of all Liens

imposed by the Company.

(e) Capitalization. Except as may be described in the SEC Reports, all of the issued share capital of the Company has been duly and

validly authorized and issued, and non-assessable.

(f) SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company

under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the

date hereof (or such shorter period as the Company was required by law or regulation to file such material) (the foregoing materials,

including the exhibits thereto, documents incorporated by reference therein, being collectively referred to herein as the “SEC

Reports”).

(g) Investment Company. The Company is not, and is not an Affiliate of, and immediately after receipt of payment for the Shares, will

not be or be an Affiliate of, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

(h) No Broker. The Company has not employed any broker, finder or agent, nor become obligated in any way to pay any broker’s,

finder’s or agent’s or similar fee with respect to the issuance of the Shares.

3.2 Representations

and Warranties of the Creditor. The Creditor hereby represents and warrants as of the date hereof to the Company as

follows (unless as made of a specific date stated therein, in which case they shall be accurate as of such date):

(a) Organization; Authority. The Creditor is an entity duly incorporated or formed, validly existing and in good standing under the

laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company or similar

power and authority to enter into and to consummate the transactions contemplated by the Transaction Documents and otherwise to carry

out its obligations hereunder and thereunder. The execution and delivery of the Transaction Documents and performance by the Creditor

of the transactions contemplated by the Transaction Documents have been duly authorized by all necessary corporate, partnership, limited

liability company or similar action, as applicable, on the part of the Creditor. Each Transaction Document to which it is a party has

been duly executed by the Creditor, and when delivered by the Creditor in accordance with the terms hereof, will constitute the valid

and legally binding obligation of the Creditor, enforceable against it in accordance with its terms.

(b) Understandings or Arrangements. The Creditor is acquiring the Creditor Shares for its own account and has no direct or indirect

arrangement or understandings with any other persons to distribute or regarding the distribution of the Shares (this representation and

warranty not limiting the Creditor’s right to sell the Creditor Shares in compliance with applicable federal and state securities

laws). The Creditor is acquiring the Creditor Shares as principal, not as nominee or agent, and not with a view to or for distributing

or reselling the Shares or any part thereof in violation of the Securities Act or any applicable state securities law.

(c) Foreign Investors. The Creditor hereby represents that it has satisfied itself as to the full observance by the Creditor of the

laws of its jurisdiction applicable to the Creditor in connection with the issuance of the Creditor Shares or the execution and delivery

by the Creditor of this Agreement and the Transaction Documents, including (i) the legal requirements within its jurisdiction for the

acquisition of the Creditor Shares, (ii) any foreign exchange restrictions applicable to the acquisition, (iii) any governmental or other

consents that may need to be obtained, and (iv) the income tax and other tax consequences, if any, that may be relevant to the Creditor’s

debt cancellation, holding, redemption, sale, or transfer of the Creditor Shares. The Creditor’s debt cancellation and payment

for, and continued beneficial ownership of, the Creditor Shares will not violate any securities or other laws of the Creditor’s

jurisdiction applicable to the Creditor.

(d) Experience of Creditor. The Creditor, either alone or together with its representatives, has such knowledge, sophistication and

experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in

the Creditor Shares, and has so evaluated the merits and risks of such investment. The Creditor is able to bear the economic risk of

an investment in the Creditor Shares and, at the present time, is able to afford a complete loss of such investment.

(e) Access to Information. The Creditor acknowledges that it has had the opportunity to review the Transaction Documents and the SEC

Reports and has been afforded (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives

of the Company concerning the terms and conditions of the offering of the Creditor Shares and the merits and risks of investing in the

Creditor Shares; (ii) access to information about the Company and its financial condition, results of operations, business, properties,

management and prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information

that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision

with respect to the investment.

(f) Regulation S. The Creditor is a non-U.S. person (as such term is defined in Rule 902 of Regulation S under the Securities Act)

and is not acquiring the Creditor Shares for the account or benefit of a U.S. person. The Creditor will not, within six (6) months of

the date of the transfer of the Creditor Shares to the Creditor, (i) make any offers or sales of the Creditor Shares in the United States

or to, or for the benefit of, a U.S. person (in each case, as defined in Regulation S) other than in accordance with Regulation S or

another exemption from the registration requirements of the Securities Act, or (ii) engage in hedging transactions with regard to the

Creditor Shares unless in compliance with the Securities Act. Neither the Creditor nor any of the Creditor’s Affiliates or any

person acting on his/her or their behalf has engaged or will engage in directed selling efforts (within the meaning of Regulation S)

with respect to the Creditor Shares, and all such persons have complied and will comply with the offering restriction requirements of

Regulation S in connection with the offering of the Creditor Shares outside of the United States.

(g) Certain Transactions and Confidentiality. Other than consummating the transactions contemplated hereunder, the Creditor has not,

nor has any Person acting on behalf of or pursuant to any understanding with the Creditor, directly or indirectly executed any purchases

or sales, including Short Sales, of the securities of the Company during the period commencing as of the time that the Creditor first

discussed the transaction with the Company or any other Person representing the Company setting forth the material terms of the transactions

contemplated hereunder and ending on the date when this Agreement is publicly disclosed by the Company. The Creditor has maintained the

confidentiality of all disclosures made to it in connection with this transaction (including the existence and terms of this transaction).

(h) No Registration. The Creditor understands that the Creditor Shares have not been, and will not be, registered under the Securities

Act or applicable securities laws of any state or country and therefore the Creditor Shares cannot be sold, pledged, assigned or otherwise

disposed of unless they are subsequently registered under the Securities Act and applicable state securities laws or exemptions from

such registration requirements are available. The Company shall be under no obligation to register the Creditor Shares under the Securities

Act and applicable state securities laws, and any such registration shall be in the Company’s sole discretion.

(i) No General Solicitation. The Creditor is not purchasing the Creditor Shares as a result of any advertisement, article, notice

or other communication regarding the Creditor Shares published in any newspaper, magazine or similar media or broadcast over television

or radio or presented at any seminar or any other general solicitation or general advertisement.

(j) Brokers or Finders. The Creditor has not engaged any brokers, finders or agents, and the Company has not, nor will, incur, directly

or indirectly, as a result of any action taken by the Creditor, any liability for brokerage or finders’ fees or agents’ commissions

or any similar charges in connection with this Agreement.

ARTICLE

IV.

OTHER

AGREEMENTS OF THE PARTIES

4.1 Reservation of Securities. As of the date hereof, the Company has reserved and the Company shall continue to reserve and keep

available at all times, free of preemptive rights, a sufficient number of shares of Common Stock for issuance pursuant to the Transaction

Documents in such amount as may then be required to fulfill its obligations in full under the Transaction Documents.

4.2 Certain Transactions and Confidentiality. The Creditor covenants that neither it nor any Affiliate acting on its behalf or pursuant

to any understanding with it will execute any purchases or sales, including Short Sales of any of the Company’s securities during

the period commencing with the execution of this Agreement and ending on the date when this Agreement is publicly disclosed by the Company.

The Creditor also covenants that until such time as the transactions contemplated by this Agreement are publicly disclosed by the Company,

the Creditor will maintain the confidentiality of the existence and terms of this transaction.

4.3 Legends. The Shares may only be disposed of in compliance with state and federal securities laws. In connection with any transfer

of Shares other than pursuant to an effective registration statement or Rule 144, the Company may require the transferor thereof to provide

to the Company an opinion of counsel selected by the transferor and reasonably acceptable to the Company, the form and substance of which

opinion shall be reasonably satisfactory to the Company, to the effect that such transfer does not require registration of such transferred

Shares under the Securities Act. The Creditor agrees to the imprinting, so long as is required by this Section 4.3, of a legend on all

of the certificates evidencing the Shares in the following form:

THIS

SECURITY HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON

AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED(THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY

NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION

FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE

SECURITIES LAWS.

ARTICLE

V. MISCELLANEOUS

5.1 Fees and Expenses. Except as expressly set forth in the Transaction Documents to the contrary, each party shall pay the fees and

expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the

negotiation, preparation, execution, delivery and performance of this Agreement.

5.2 Entire Agreement. The Transaction Documents contain the entire understanding of the parties with respect to the subject matter

hereof and thereof and supersede all prior agreements and understandings, oral or written, with respect to such matters, which the parties

acknowledge have been merged into such documents, exhibits and schedules.

5.3 Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in

writing and shall be deemed given and effective on the earliest of: (a) the date of transmission, if such notice or communication is

delivered via facsimile or email at or prior to 5:30 p.m. (New York City time) on a Trading Day, (b) the next Trading Day after the date

of transmission, if such notice or communication is delivered via facsimile or email on a day that is not a Trading Day or later than

5:30 p.m. (New York City time) on any Trading Day, (c) the second (2nd) Trading Day following the date of mailing, if sent by U.S. nationally

recognized overnight courier service or (d) upon actual receipt by the party to whom such notice is required to be given. The address

for such notices and communications shall be as set forth on the signature pages attached hereto.

5.4 Amendments; Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument

signed, in the case of an amendment, by the Company and the Creditor, in the case of a waiver, by the party against whom enforcement

of any such waived provision is sought. No waiver of any default with respect to any provision, condition or requirement of this Agreement

shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition

or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise

of any such right.

5.5 Headings. The headings herein are for convenience only, do not constitute a part of this Agreement and shall not be deemed to

limit or affect any of the provisions hereof.

5.6 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and

permitted assigns. No party hereto may assign this Agreement or any rights or obligations hereunder.

5.7 No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors

and permitted assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

5.8 Governing Law. All questions concerning the construction, validity, enforcement and interpretation of the Transaction Documents

shall be governed by and construed and enforced in accordance with the internal laws of the State of California, without regard to the

principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and

defense of the transactions contemplated by this Agreement and any other Transaction Documents (whether brought against a party hereto

or its respective affiliates, directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively

in the federal courts sitting in the State of California. Each party hereby irrevocably submits to the exclusive jurisdiction of the

federal courts sitting in the State of California, for the adjudication of any dispute hereunder or in connection herewith or with any

transaction contemplated hereby or discussed herein (including with respect to the enforcement of any of the Transaction Documents),

and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject

to the jurisdiction of any such court, that such suit, action or proceeding is improper or is an inconvenient venue for such proceeding.

Each party hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding

by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address

in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process

and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted

by law.

5.9 Survival. The representations and warranties contained herein shall survive the consummation of the transaction in this Agreement

and the delivery of the Shares.

5.10 Execution. This Agreement may be executed in multiple counterparts, all of which when taken together shall be considered one and

the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party, it

being understood that the parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission

or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party

executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature

page were an original thereof.

5.11 Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to

be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall

remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially

reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated

by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would

have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared

invalid, illegal, void or unenforceable.

5.12 Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required

or granted herein shall not be a Business Day, then such action may be taken or such right may be exercised on the next succeeding Business

Day.

5.13 Construction. The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise

the Transaction Documents and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against

the drafting party shall not be employed in the interpretation of the Transaction Documents or any amendments thereto. In addition, each

and every reference to share prices and shares of Common Stock in any Transaction Document shall be subject to adjustment for reverse

and forward stock splits, stock combinations and other similar transactions of the Common Stock that occur after the date of this Agreement.

5.14 WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANYJURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES

EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY

AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

(Signature

Pages Follow)

IN

WITNESS WHEREOF, the parties hereto have caused this Debt Repayment Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

| NOVA LIFESTYLE, INC. |

|

Address

for Notice: |

| |

|

|

|

| By: |

/s/

Thanh Lam |

|

|

| Name: |

Thanh Lam |

|

|

| Title: |

Chief Executive Officer |

|

|

Address

for Notice: Nova Lifestyle Inc.

6565

E Washington Blvd.

Commerce,

CA 90040

E-Mail:

info@novalifestyle.com

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE

PAGE FOR PURCHASER FOLLOWS]

[CREDITOR

SIGNATURE PAGE TO DEBT REPAYMENT AGREEMENT]

IN

WITNESS WHEREOF, the undersigned have caused this Debt Repayment Agreement to be duly executed as of the date first indicated above.

Name

of Creditor: Huge Energy International Limited

Signature

of Authorized Signatory of Purchaser: /s/ Ng Man Shek________________

Name

of Authorized Signatory: Ng Man Shek

Title

of Authorized Signatory: Director

Debt

Cancellation Amount: $ 217,000.00

Creditor

Shares: 434,000 shares

Email

Address of Creditor:

Address

for Notice to Creditor:

Address

for Delivery of Shares to Creditor (if not same as address for notice): N/A

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

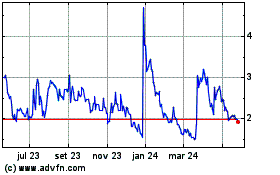

Nova Lifestyle (NASDAQ:NVFY)

Gráfico Histórico do Ativo

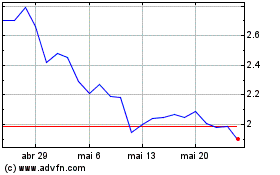

De Jan 2025 até Fev 2025

Nova Lifestyle (NASDAQ:NVFY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025