Form 8-A12B - Registration of securities [Section 12(b)]

26 Fevereiro 2025 - 7:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-A

FOR

REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

Johnson & Johnson

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

| New Jersey |

|

22-1024240 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| One Johnson & Johnson Plaza

New Brunswick, New Jersey |

|

08933 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

|

| Title of Each Class

to be Registered |

|

Name of Each Exchange on Which

Each Class is to be Registered |

| 2.700% Notes due 2029 |

|

New York Stock Exchange |

| 3.050% Notes due 2033 |

|

New York Stock Exchange |

| 3.350% Notes due 2037 |

|

New York Stock Exchange |

| 3.600% Notes due 2045 |

|

New York Stock Exchange |

| 3.700% Notes due 2055 |

|

New York Stock Exchange |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant

to General Instruction A.(c), check the following box. ☒

If this form relates to the registration of a class of securities

pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following box. ☐

If this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following

box. ☐

Securities Act registration statement file number to which this form relates:

333-269836

(if

applicable)

Securities to be registered pursuant to Section 12(g) of the Act:

None

Item 1. Description of Registrant’s Securities to be Registered.

The titles of the securities to be registered hereunder are “2.700% Notes due 2029,” “3.050% Notes due 2033,” “3.050%

Notes due 2037,” “3.600% Notes due 2045” and “3.700% Notes due 2055” (collectively, the “Notes”). For a description of the securities to be registered hereunder, reference is made to the information under the

heading “Description of the Notes” in the prospectus supplement, dated February 19, 2025, which was filed with the Securities and Exchange Commission (the “Commission”) on February 21, 2025, pursuant to Rule 424(b)(2)

under the Securities Act of 1933, and under the heading “Description of Debt Securities” in the prospectus, dated February 16, 2023, contained in our effective registration statement on Form S-3

(Registration No. 333-269836), which registration statement was filed with the Commission on February 16, 2023, which information is incorporated herein by reference and made part of this registration statement in its entirety.

Item 2. Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1*** |

|

Indenture dated as of September

15, 1987, between the Registrant and Harris Trust and Savings Bank, as Trustee (incorporated herein by reference to Exhibit 4(a) to the Registrant’s Registration Statement on Form S-3 (Registration No. 33-55977), filed October 11, 1994). |

|

|

| 4.2*** |

|

First Supplemental Indenture dated as of September

1, 1990 between the Registrant and Harris Trust and Savings Bank, as Trustee (incorporated herein by reference to Exhibit 4(b) to the Registrant’s Registration Statement on Form S-3 (Registration No. 33-55977), filed

October 11, 1994). |

|

|

| 4.3 |

|

Second Supplemental Indenture dated as of November 9, 2017 between the Registrant and The Bank of New York Mellon Trust Company, N.A., as Trustee

(incorporated herein by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed November 13, 2017). |

|

|

| 4.4 |

|

Company Order establishing the terms of the Notes (incorporated herein by reference to Exhibit 4.1 to the Current Report on Form 8-K dated February 26, 2025 and filed on February 26, 2025). |

|

|

| 4.5 |

|

Form of Johnson

& Johnson’s 2.700% Notes due 2029 (incorporated herein by reference to Exhibit 4.2 to the Current Report on Form 8-K dated February 26, 2025 and filed on February 26, 2025). |

|

|

| 4.6 |

|

Form of Johnson

& Johnson’s 3.050% Notes due 2033 (incorporated herein by reference to Exhibit 4.3 to the Current Report on Form 8-K dated February 26, 2025 and filed on February 26, 2025). |

|

|

| 4.7 |

|

Form of Johnson

& Johnson’s 3.350% Notes due 2037 (incorporated herein by reference to Exhibit 4.4 to the Current Report on Form 8-K dated February 26, 2025 and filed on February 26, 2025). |

|

|

| 4.8 |

|

Form of Johnson

& Johnson’s 3.600% Notes due 2045 (incorporated herein by reference to Exhibit 4.5 to the Current Report on Form 8-K dated February 26, 2025 and filed on February 26, 2025). |

|

|

| 4.9 |

|

Form of Johnson

& Johnson’s 3.700% Notes due 2055 (incorporated herein by reference to Exhibit 4.6 to the Current Report on Form 8-K dated February 26, 2025 and filed on February 26, 2025). |

2

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this registration

statement to be signed on its behalf by the undersigned, thereto duly authorized.

Dated: February 26, 2025

|

|

|

| JOHNSON & JOHNSON |

|

|

| By: |

|

/s/ Marc Larkins |

| Name: |

|

Marc Larkins |

| Title: |

|

Corporate Secretary |

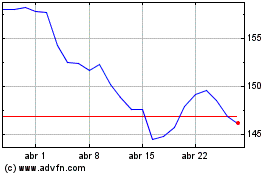

Johnson and Johnson (NYSE:JNJ)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Johnson and Johnson (NYSE:JNJ)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025