3 Tech Stocks Cathie Wood Is Buying In 2021

06 Maio 2021 - 8:46AM

Finscreener.org

In the last year, ARK Invest’s CEO and CIO

Cathie Wood has risen in popularity. ARK Invest is known for its

thematic ETFs (exchange-traded funds) that have generated

market-thumping returns since the pandemic-induced bear market

witnessed in early 2020. Cathie Wood can be considered Wall Street

royalty given her ability to identify companies that have the

potential to generate multifold gains for investors.

Let’s take a look at a few of the stocks Wood

is buying right now!

Shopify

Cathie Wood is bullish on Shopify (NYSE:

SHOP) which is also Canada’s largest company in terms of market

cap. Shopify is a stock that has crushed the broader market ever

since it went public back in 2015. Since its IPO, Shopify has

returned an astonishing 4,120%. For example, $1,000 invested in

Shopify stock soon after it went public would have been worth close

to $42,000 today.

Despite its staggering returns, there is

enough room for Shopify to derive outsized gains in 2021 and

beyond. The COVID-19 pandemic acted as a tailwind for e-commerce

companies as people were forced to shop online. This also meant

that Shopify increased its merchant base in the last year as small

and medium enterprises had to innovate to avoid

closures.

Shopify’s sales soared by 86% year over year

in 2020 to $2.9 billion. The company’s merchant solutions sales

were up 117% year over year while subscription revenue also soared

53% last year. This allowed the e-commerce heavyweight to report a

net income of $320 million in 2020, compared to a loss of $125

million in 2019.

While top-line growth is forecast to

decelerate in 2021, it will still grow by a healthy 39.6% to $4.1

billion and by 31% to $5.36 billion in 2022. Shopify stock is

currently trading 25% below its record high giving investors an

opportunity to buy a quality growth at a lower multiple.

Coinbase

Unless you have been living under a rock in

the last year, you would have heard about the breathtaking returns

generated by Bitcoin and several other digital currencies. One way

to gain exposure to the highly disruptive cryptocurrency market is

by investing in shares of the largest crypto exchange in the

world-Coinbase (NASDAQ: COIN).

Ark Invest purchased close to 750,000 shares

of Coinbase soon after it went public and added another 340,273

shares a few days back.

Coinbase is a company that you should add to

your growth portfolio especially if you are bullish on the crypto

space in the long term. This company has an 11% market share in the

crypto exchange vertical. Like any other exchange, Coinbase

generates a majority of its revenue from transaction fees

that accounted for 96% of total sales in 2020. So, its revenue

is directly related to the volume of trading on its

platform.

In the first quarter of 2021, Coinbase

reported revenue of $1.8 billion. Comparatively, its revenue in

2020 and 2019 stood at $1.3 billion and $533.7 million

respectively. It also expects an adjusted EBITDA of $1.1 billion in

the March quarter compared to an EBITDA of $527 million in the

whole of 2020.

Sea Limited

Another stock that Ark Invest has been

purchasing in 2021 is Sea Limited (NYSE:

SE) which is one of the leading e-commerce platforms in

Southeast Asia. Sea Limited was initially a communication platform

for gamers and it then started distributing games developed by

China’s Tencent for its audience base in Southeast Asia. It then

published its own in-house game called Free Fire which

took the gaming world by storm.

Sea Limited has since expanded into

e-commerce with Shopee and also launched SeaMoney which is

itU+02019s fin-tech vertical. Sea Limited stock soared 385% in 2020

and is up approximately 1,500% since its IPO in late

2017.

In the last quarter, the company’s sales more

than doubled driven by a 178% growth in e-commerce and a 72%

increase in its online entertainment business. The company is now

expanding in other growth regions including Latin America which is

a much bigger market compared to Southeast Asia. We can see why Ark

Invest is betting on this little-known stock that is already valued

at

a market cap of $126 billion.

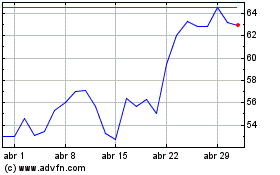

Sea (NYSE:SE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Sea (NYSE:SE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024