Why DocuSign Stock Just Fell By 42% on Friday?

06 Dezembro 2021 - 7:07AM

Finscreener.org

Shares of

DocuSign (NASDAQ: DOCU)

fell by 42% on Friday to $135.09 per share, valuing the company at

a market cap of $26.6 billion. DOCU stock is now trading 56% below

its all-time highs.

What impacted DocuSign last week?

In the fiscal third quarter of

2022 that ended in October, DocuSign

reported revenue

of $545.5 million, an increase of

42% year over year. Its subscription sales rose 44% to $528.6

million while adjusted earnings more than doubled to $0.58 per

share. Comparatively, Wall Street forecast Q3 sales of $530.67

million and earnings of $0.46 per share. So why did DOCU stock

crash despite beating consensus estimates for Q3?

Investors and analysts were

worried about the company’s decelerating growth after economies all

over the world are reopening resulting in slower than expected

demand for DocuSign’s suite of solutions.

DocuSign’s billings at the end of

Q3 rose 28% to $565.2 million, which was significantly lower than

the 47% growth experienced in Q2. The billings are basically the

amount of sales that have been booked but not recognized as

revenue.

In fiscal Q4 of 2022, DocuSign

forecast sales between $557 million and $563 million, below

estimates of $574 million. DocuSign estimated billings of $653

million in fiscal Q4 which again fell short of Wall Street

forecasts of $705.4 million.

DocuSign’s CEO Dan Springer said

the weak demand was disappointing after a pandemic-fueled year

allowed the company to record exceptionally high growth rates at

scale. In fact, DocuSign experienced six quarters of accelerated

growth after which customers returned to normalized buying

patterns.

Wall Street downgrades DOCU stock

Shortly after DocuSign’s less

than impressive Q3 results, several analysts on Wall Street

downgraded the stock.

According to multiple reports

from TheFly:

- JPMorgan (NYSE:

JPM) downgraded DocuSign

stock to “underweight” from “neutral” with a price target of

$175

- UBS downgraded DocuSign stock to

“neutral” from “buy” and lowered its price target to $170 from

$350

- Piper Sandler downgraded

DocuSign stock to “neutral” from “overweight” and lowered its price

target to $200 from $330

- Citi (NYSE: C)

maintained a buy rating on DocuSign stock but lowered its price

target to $231 from $389

Several other investment banks

including Wells Fargo (NYSE:

WFC), Wedbush, and RBC

Capital (NYSE:

RY) also lowered 12-month

price targets for DocuSign stock.

Let’s see if the ongoing pullback

provides long-term investors an opportunity to buy the dip or will

it continue to move lower in the upcoming trading

sessions.

The bull case for DocuSign

DocuSign has estimated its total

addressable market at $50 billion providing it with enough

opportunities to grow top-line at a rapid rate. It is well poised

to keep gaining traction in a world that’s increasingly shifting

towards a digitally-powered economy. DocuSign has already increased

sales from $518 million in fiscal 2018 to $1.45 billion in fiscal

2021. In the last 12-month period, its sales have stood at $1.79

billion.

DocuSign will now have to

transition from demand fulfillment to demand generation which means

revenue is all set to decelerate in the next few quarters. In case,

the company reports sales of $2.09 billion in fiscal 2022, its

three-year growth rate stands at 42%. Further, its earnings are

also forecast to expand at an annual rate of 166% from $0.09 in

fiscal 2019 to $1.70 in fiscal 2022.

DocuSign stock is now valued at a

forward price to sales multiple of over 12x which is still steep.

It remains vulnerable in a broader market sell-off but is also one

of the market leaders in its vertical.

DocuSign stands to benefit from

multiple secular tailwinds going forward and the stock should

remain on your buying radar in the future.

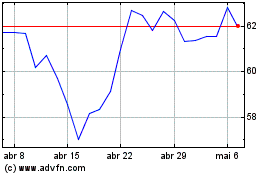

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

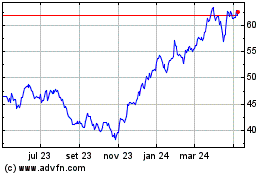

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024