Interest Rates and Inflation Likely to Drive S&P 500 Lower This Week!

10 Abril 2022 - 5:13PM

Finscreener.org

After gaining momentum in the

month of March, equity markets continued to trade in the red in the

first full week of April 2022. In the week ended on April 8, 2022,

the S&P 500 fell by 1.3% while indices such as the Nasdaq

Composite and Dow Jones also declined by 4% and 0.2%

respectively.

Inflation, interest rates, and bank earnings will drive

markets this week

In the upcoming week, investors

will be closely watching the inflation report for March and several

big bank earnings, which will mark the beginning of the earnings

season. Financial giants such as JPMorgan

Chase (NYSE:

JPM) and BlackRock

(NYSE: BLK) will

report Q1 earnings on Wednesday, followed by Goldman

Sachs (NYSE:

GS), Morgan Stanley

(NYSE: MS), Citigroup

(NYSE: C), and Wells Fargo

(NYSE:

WFC) on Thursday.

The ongoing war in Ukraine will

also remain in focus as Wall Street will follow any signs of new

development in the region.

In

an interview with

CNBC, the chief equity

strategist at LPL Financial, Quincy Krosby explained Q1 earnings

report from companies part of the banking and finance sector will

be critical to market participants given the Federal Reserve’s

hawkish policy with plans to increase interest rates multiple times

this year.

Krosby stated, “We want to get a

picture of how do they see the Fed’s plan... quantitative

tightening, the liquidity drain, coupled with higher rates,

affecting their clients and their business units. If you look at

the XLF [Financial Select Sector SPDR Fund

ETF], on days it goes up,

it’s the insurance companies because they’re raising premiums.

Higher rates are good for banks, until, the belief is, the higher

rates are going to hurt the economy.”

Additionally, the 10-year

Treasury yield rates increased for the third consecutive week by at

least 30 basis points and were around 2.7% on Friday. Interest

rates have an inverse relationship to bond prices and the former

moved higher in the last week as the Fed announced plans to trim

its balance sheet by $95 billion, including $60 billion in

Treasurys this month.

The Treasury yield is an

important financial benchmark as the rate impacts the pricing of

mortgages and other loans. Considering the generous uptick of the

10-year Treasury yield, there is a good chance for rates to move

higher going forward.

Economic data will be a catalyst for the S&P

500

In addition to interest rates and

earnings, economic data published in the upcoming week will be

another driver of the S&P 500. The four-day week will see

the consumer price report getting published on Tuesday. Economists

expect the CPI for March to top 7.9% which was reported for the

month of February.

The CPI will be an important data

point before the Fed meets again in May 2022. Even if the CPI is in

line with expectations, the Fed might increase rates by 50 basis

points. The central bank increased interest rates by 0.25% for the

first time after several years in March. The PPI or producer price

index report is slated to release on Wednesday, while retail sales

and consumer sentiment data are due on Thursday.

Investment bank Barclays expects

CPI to rise by 1.24% in March after rising 8.5% year over year. The

annual rate of CPI is estimated to peak in March and then trend

lower driven by a few positive base effects.

Earnings remain key

Data from Refinitiv suggests

S&P 500 earnings are forecast to rise by 6.1% year over year

in Q1. Comparatively, earnings for companies part of the financial

sector might decline by 22.9%.

In a nutshell, investors have to

wrestle with interest rates hike, balance sheet reductions, and

quantitative tightening measures in the near term.

So, it makes sense to increase

exposure to defensive stocks or companies part of sectors such as

consumer staples and healthcare, in addition to real estate

investment trusts.

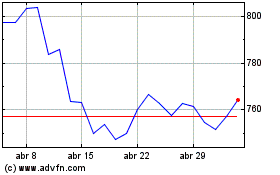

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024