3 Top Renewable Energy Stocks to Buy Right Now

25 Abril 2022 - 7:54AM

Finscreener.org

Most countries are aggressively

looking to switch power sources due to concerns over climate

change. The world is moving from fossil fuels

toward renewable energy

at an accelerated pace. According to

experts, the decarbonization of the world economy will attract $100

trillion worth of investments through 2050, making renewable energy

stocks such as NextEra Energy (NYSE:

NEE),

Brookfield Renewable Partners (NYSE:

BEP), and Clearway Energy

(NYSE:

CWEN) top bets

right now.

Right now, renewable energy

sources including hydro, wind, and solar account for 25% of the

total electricity generated by the power sector. In the past

decade, renewables have increased capacity at an annual rate of 8%

as corporates look to lower carbon footprint by signing long-term

power purchase agreements with renewable energy

companies.

NextEra Energy

One of the largest renewable

energy companies in the world, NextEra has returned over 500% to

investors in the last 10 years, after adjusting for dividends.

Despite its market-thumping gains, NextEra offers investors a tasty

dividend yield of 2.2%.

A key catalyst for NextEra’s

stellar returns is the company’s above-average earnings

growth.

Since 2005, NextEra has increased

adjusted earnings at an annual rate of 8.7%. Comparatively, its

dividend payout has increased by 9.6% annually in this period.

NextEra expects earnings to rise between 6% and 8% through 2023

which suggests dividends should increase going forward as

well.

In Q1 of 2022, NextEra’s adjusted

earnings stood at $1.5 billion or $0.74 per share, increasing by

10.4% year over year. Its strong performance in the March quarter

was driven by NextEra’s Florida-based electric utility

business.

In Q1, NextEra completed 450

megawatts of solar energy projects and aims to complete 9.5

gigawatts of solar energy by 2030. The company’s focus on expanding

its base of cash-generating assets will allow NextEra to increase

earnings by 10% in 2022.

NextEra stock is trading at a

discount of 30% compared to consensus price target

estimates.

Brookfield Renewable Partners

Another renewable energy

heavyweight, Brookfield Renewable is one of the world’s largest

producers of hydroelectric power which accounts for 62% of its

portfolio. Brookfield is also expanding its base of wind and solar

energy assets and sells a majority of the power generated via

long-term power purchase agreements.

Brookfield Renewable Partners has

managed to deliver annual returns of 20% in the last two decades.

Its growth has been powered by a consistent expansion of its

portfolio by acquisitions as well as organic

investments.

Since 2012,

BrookfieldU+02019s

earnings have risen

at an annual rate of 10% while

dividends have grown by 6% in this period. The company expects to

derive returns of at least 20% through 2025 while increasing

dividends between 5% and 9% each year. Right now, Brookfield

Renewable provides investors a tasty forward yield of

3.4%.

Clearway Energy

The final stock on my list is

Clearway Energy which is valued at $6.2 billion by market cap.

After adjusting for dividends, Clearway Energy has returned 134% to

investors in the last five years. Currently, it offers investors a

dividend yield of 4.4%. In Q4 of 2021, Clearway Energy’s cash

available for distribution rose by 16.7% to $35

million.

Further, its CAFD rose by 14%

year over year to $336 million in 2021, which was higher than the

company’s initial forecast of $325 million. Clearway’s dividend

payouts have increased by 7% in the last year and it also invested

$820 million to expand its renewable energy portfolio.

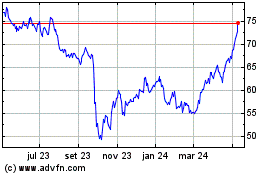

NextEra Energy (NYSE:NEE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

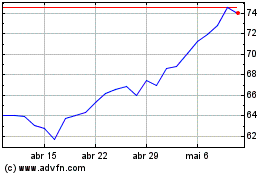

NextEra Energy (NYSE:NEE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024