Q2 Earnings Likely to Drive S&P 500 This Week

10 Julho 2022 - 2:25PM

Finscreener.org

Equity market participants will

brace for consumer inflation data and the start of Q2 earnings,

both of which are likely to impact stocks in the upcoming week.

Consumer giant PepsiCo (NASDAQ: PEP) will

report earnings on Tuesday, followed by Delta Air

Lines (NYSE:

DAL) on Wednesday and banking heavyweights such

as JPMorgan (NYSE:

JPM) and

Morgan Stanley (NYSE: MS) on

Thursday.

Several inflation reports will

also impact equities and will set the tone on how aggressive the

Federal Reserve will have to be to battle inflation.

The consumer price index report

will be published on Wednesday and might be higher than the 8.6%

reported in May. Economists expect higher energy prices to keep

inflation elevated which suggests core inflation (which excludes

energy and food prices) will be lower.

Further, the West Texas

Intermediate crude

futures stood at $122 per barrel in June but have since

declined to $105 per barrel. It will be interesting to see how

moderation in product prices will be offset by rising services

prices including rent.

The producer price index report

will be published on Thursday while the University of Michigan will

release the consumer sentiment report on Thursday. The retail sales

report which also measures consumer behavior will be released on

Friday.

The new inflation data follows a

strong employment report where the economy added 372,000 jobs in

June which was 120,000 higher than estimates. Now strategists

anticipate the Fed to increase interest rates by another 75 basis

points or 0.75% in July to keep inflation in check, as employment

data remains strong.

How will the S&P 500 perform in Q3?

Most analysts and investors are

waiting for inflation to peak as it has continued to move higher

much longer than initially expected. In an interview with CNBC,

Michael Arone, the chief investment strategist at State Street

Global Advisors stated, “I do think a risk to the markets is this

fact that inflation may not have peaked. I do still believe the

markets are at least hopeful, if not expecting, that inflation will

decelerate.”

In addition to inflation, the Q2

earnings season will also be a key catalyst for the S&P 500

in July. Corporate profits might easily cause turbulence especially

if earnings forecasts continue to move lower for the rest of 2022.

In Q2, the S&P 500 is forecast to expand earnings by 5.7%

while earnings in Q3 and Q4 are estimated to increase by 10.9% and

10.5% respectively.

Arone explains, “I think the

market is bracing for a challenging earnings quarter, so how much

it will result in volatility is unclear. I think they will lower

their guidance. Why not? It just makes it easier to beat down the

road. I do think earnings season will be a disappointment. It will

be interesting to see how the market reacts.”

In the last week, the S&P

500 gained 1.9% while the tech-heavy Nasdaq was up 4.5%. The

worst performing sectors were energy and utilities while the

consumer discretionary sector rose by 4.5%.

Treasury yields stand at 3.07%

The 10-year

Treasury note yielded 3.07% on Friday while the 2-year

Treasury note surpassed the former for the third time since

March. The yield curve is now inverted which signals an upcoming

recession. The 2-year yield stood at 3.11% on Friday.

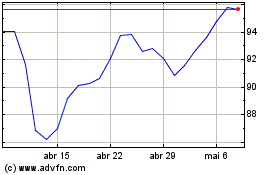

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

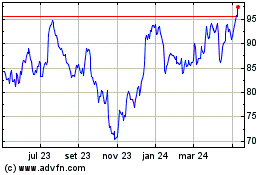

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024