Will the S&P 500 Index Continue to Rise In The Next Week?

07 Agosto 2022 - 6:28PM

Finscreener.org

The U.S. benchmark indices posted

mixed performance in the last five trading sessions but ended the

week in the green. Strong jobs reports and falling global crude oil

prices weighed on the S&P 500 index (AMEX:

SPY) and Nasdaq

Composite, which declined marginally on Friday. The Dow

Jones Industrial Average index, on the other hand, lost 0.13%

last week.

Strong jobs report

The U.S. labor market has

remained sturdy despite the global economic slowdown and recession

concerns. The economy added 528,000 non-farm payroll jobs last

month, higher than the consensus estimate of 250,000

jobs.

July marked the

19th consecutive month of non-farm payroll expansion,

with the U.S. achieving full labor market recovery since the

pandemic. Also, the unemployment rate in the economy fell by 10

basis points month-over-month to a pre-pandemic low of

3.5%.

Recession concerns loom large

This impending recession will be

like no other. While strong macroeconomic data such as

better-than-expected jobs reports and consumer spending reflects

economic resiliency, it also signals a more aggressive Fed

stance.

Analysts and traders are now

expecting an “unusually large” rate hike in September, as the

economy remains red-hot despite two consecutive 75-basis point rate

hikes over the past few months. This comes as U.S. GDP declined for

two consecutive quarters in the first half of

2022.

Around 68% of traders now expect

the Fed overnight funds rate to be in the 3%-3.25% range. This

could potentially eliminate the chances of a “soft landing,” as the

Fed is poised to implement a third 75-basis point hike next month,

marking the fastest rate hike in more than a

generation.

Regarding this Jim Baird, chief

investment officer at Plante Moran Financial Advisors said, “The

fact of the matter is this gives the Fed additional room to

continue to tighten, even if it raises the probability of pushing

the economy into recession … It’s not going to be an easy task to

continue to tighten without negative repercussions for the consumer

and the economy.”

Declining oil prices

In other news, oil prices dropped

sharply last week, signaling a global economic slowdown. On August

4, oil prices dropped to their lowest levels since the Russian

invasion of Ukraine, as U.S. crude oil inventories remained

unexpectedly high. The U.S.-benchmark West Texas Intermediate

crude

futures closed below $90 per barrel last week, marking a weekly

decline of 9.74%. Moreover, as OPEC+ is gearing to raise output in

September, the oil price weakness is expected to continue in the

near term.

The declining oil prices are one

of the key indicators pointing towards recession. The economy’s

manufacturing output declined sequentially last month as well, due

to weaker demand.

Bottom line

The U.S. Treasury yield curve has

remained inverted for a month straight – another parameter

signaling a recession. In fact, the difference between the 2-year

and 10-year

treasury yields is at the widest level in 22 years since the

dot-com bubble.

Thus, even with a strong jobs

report, the U.S. is inevitably headed toward a recession. Markets

are now keenly awaiting the July Consumer Price Index scheduled to

release next week, which would point out whether inflation rates

are cooling.

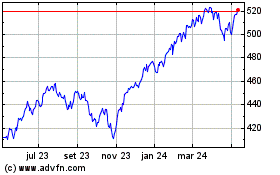

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

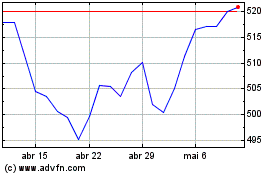

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024