Plug Power Stock Spikes Post Amazon Deal

29 Agosto 2022 - 5:27AM

Finscreener.org

Shares of hydrogen and fuel cell

solutions company Plug Power (NASDAQ:

PLUG) rose over 9% on Thursday, pricing the stock at

$30. Plug Power stock rose after it announced a partnership with

e-commerce heavyweight Amazon (NASDAQ:

AMZN).

According to the terms of the

partnership, Plug Power will supply Amazon with 10,950 tons of

green hydrogen each year to power the latter’s trucking fleet and

fulfillment center equipment. The agreement is likely to deliver

power that will allow Amazon to operate 800 long-haul heavy-duty

trucks and 30,000 forklifts.

Kara Hurst, vice president of

Worldwide Sustainability at Amazon, stated, “Amazon is proud to be

an early adopter of green hydrogen given its potential to

decarbonize hard-to-abate sectors like long-haul trucking, steel

manufacturing, aviation, and ocean shipping.”

A deep dive into the Amazon-Plug Power

partnership

Plug Power delivers fuel cell

solutions for supply chain and logistics applications, in addition

to electric vehicles and stationary power markets in North America

and other international regions. It aims to build an end-to-end

green hydrogen ecosystem that includes the production of green

hydrogen, storage & delivery, and energy generation.

Plug Power emphasized its deal

with Amazon validates its ambitious growth strategy. The two

companies could also expand the partnership to add other

hydrogen-powered applications such as power generation stations or

fuel-cell electric trucks.

In the last 12 months, Plug Power

generated revenue of $600 million and is on track to

grow sales by 81.9% to

$914 million in 2022. Plug Power expects to hit $3 billion in

annual sales by 2025, and the Amazon partnership will act as a key

driver for top-line growth in the future.

Additionally, the venture with

Amazon should accelerate Plug Power’s goal of producing 500 tons of

liquid hydrogen each day by 2025.

Amazon also received a warrant to

buy up to 16 million shares of Plug Power. It can purchase 9

million Plug Power shares at an exercise price of

$22.9841.

Plug Power and Amazon have

partnered since 2016, when the tech giant deployed 15,000 fuel

cells to replace forklift batteries at multiple distribution

centers. Now, Plug Power is looking to gain traction by expanding

its hydrogen application portfolio.

Is Plug Power stock a buy right now?

In Q2 of 2022, Plug Power

increased sales by 21% to $151.3 million. But it ended the quarter

with a negative gross margin of 21%, which was narrower compared to

its margin of -32% in the year-ago period. It also reported a net

loss of $173 million, an increase of 73% year-over-year.

In addition to revenue

projections of $3 billion, Plug Power expects gross margins to

exceed 30% by 2025. During the company’s Q2 earnings call, CEO Andy

Marsh explained Plug Power expects a “boom” in the green hydrogen

and electrolyzer segment due to the Inflation Reduction Act

announced recently.

According to Plug Power, the

clean hydrogen production tax credit of $3 per kilogram of green

hydrogen produced after 2022 under the act may increase cash flows

by $500 million each year when its production levels reach 500 tons

per day.

Plug Power stock is valued at

$17.36 billion by market cap, valuing the company at 19x sales,

which is quite steep for a loss-making entity. Despite its sky-high

valuation, analysts remain bullish on PLUG stock and expect it to

gain over 20% in the next year.

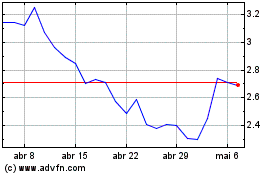

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024