UiPath Stock Tanks Post Quarterly Results

07 Setembro 2022 - 10:54AM

Finscreener.org

Shares of

UiPath (NYSE:

PATH) are down over 20%

in pre-market trading today after the company announced its fiscal

second quarter (ended in July) of 2023 results. It reported revenue

of $242.2 million and an adjusted loss of $0.02 per share in the

quarter. Comparatively, analysts forecast revenue of $230.8 million

and adjusted earnings of $0.11 per share in Q2.

So, why is PATH stock price

falling off a cliff despite beating consensus estimates? Investors

were disappointed after UiPath issued disappointing revenue

guidance for Q3. In the quarter ending in October, the company

forecast revenue between $243 million and $245 million, compared to

estimates of $269.6 million.

For fiscal 2023, UiPath’s sales

forecast stood between $1 billion and $1.01 billion, below

estimates of $1.09 billion. Let’s see if the tech stock can stage a

comeback in the last quarter of the current year.

Is UiPath stock a buy right now?

UiPath provides an end-to-end

automation platform. It offers a wide range of RPA (robotic process

automation) solutions in the U.S., Japan, and Romania. Its suite of

integrated software allows enterprises to build, manage, run,

engage, measure, and govern automation across

enterprises.

In Q2, UiPath surpassed annual

recurring revenue of $1 billion and is forecast to reach ARR of

$1.15 billion by end of fiscal 2023. During the earnings call,

UiPath’s Co-Founder and CEO Robert Enslin stated, “The market is

evolving and UiPath is leading the way with our end-to-end platform

that covers the full automation lifecycle. To capitalize on the

significant opportunity in front of us we are strategically

repositioning the Company to elevate customer conversations, sell

business outcomes, and help organizations realize the

transformational benefits of automation.

We firmly believe these changes

will position us for both growth and profitability.”

UiPath was named a leader for the

fourth consecutive year by Gartner in its Magic Quadrant for RPA.

It was positioned highest for its ability to execute and

completeness of vision.

Due to its robust portfolio of

solutions, UiPath has managed to increase sales from $336 million

in fiscal 2020 to 892 million in fiscal 2022.

In Q2, it completed the

acquisition Re:infer, a London-based natural language processing

company for unstructured documents and communications. Re:infer

uses machine learning technology to mine context from communication

messages and transform them into actionable data.

UiPath also announced technology

integrations with Snowflake (NYSE:

SNOW), a cloud-based data

platform.

Is PATH stock undervalued or overvalued?

UiPath stock price has fallen by

77% from all-time highs. But the company is part of a rapidly

expanding addressable market, allowing it to surpass $1 billion in

ARR within seven years. A report from Grand View Research forecasts

the global RPA market to grow by 38% annually through 2030 to

almost $31 billion.

Given that UiPath has a 27% share

of the RPA market, it is well positioned to unlock multiple

opportunities in the upcoming decade. If UiPath maintains its

market share, the company’s sales will grow to $8.4 billion.

Further, if its market share improves to 30%, UiPath’s revenue

might touch $9.3 billion.

Analysts expect UiPath to

increase revenue by 22% to $1.1 billion in fiscal 2023 and by 28%

to $1.4 billion in fiscal 2024. So, PATH stock is valued at 6x

forward sales, given its market cap of $8.4 billion, which is quite

reasonable.

Considering consensus price

target estimates, UiPath stock is trading at a discount of 100%

right now.

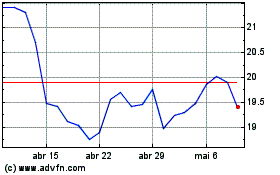

UiPath (NYSE:PATH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

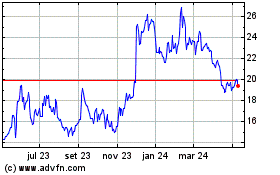

UiPath (NYSE:PATH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024