Corporate Earnings and Housing Market Data to Drive S&P 500 Index This Week

16 Outubro 2022 - 5:51PM

Finscreener.org

Investors experienced yet another

week of turbulence in the last five trading sessions. In the past

week, the

S&P 500 index fell

by 1.8%, while the Nasdaq Composite index declined by 3.2%. Comparatively, the

Dow Jones Industrial Average index rose by 0.73%.

The 10-year U.S. Treasury yield

rose to 4%, the highest level since 2008, on hotter-than-expected

inflation data. The consumer price index, or CPI, rose 0.4% in

September after rising 0.1% in August. In the last 12 months, the

CPI has surged by 8.2%.

Increases in shelter, food, and

medical care were the largest of many contributors to the monthly

rise in costs. To tame inflation, the Federal Reserve has already

raised interest rates several times in 2022. But a

stronger-than-expected labor market continues to fuel price

increases making it difficult for the central bank to get commodity

prices under control.

Additionally, crude oil prices

slumped 7% last week after surging 15% in the previous week on

concerns over a slowdown in demand as China continues to impose

lockdowns in multiple regions.

Let’s see what will impact the

stock market in

the upcoming week.

The S&P 500 earnings season will gain

pace

Investors can expect the stock

market to remain volatile as several companies will be reporting

their Q3 earnings this week. It includes financial giants such

as:

Bank of America (NYSE:

BAC)

Goldman Sachs (NYSE:

GS)

Barclays (NYSE: BCS)

Other big-ticket earnings in the

week will include:

Netflix (NASDAQ: NFLX)

Tesla (NASDAQ: TSLA)

Procter & Gable (NYSE:

PG)

American Express (NYSE:

AXP) and

Verizon (NYSE:

VZ)

Analysts expect Q3 earnings to be

a mixed bag for corporates as a strong dollar and a sluggish

economy might impact profit margins as well as revenue. The average

earnings growth for companies part of the S&P 500 is

forecast at 2.4%, the weakest quarter since Q3 of 2020, where

earnings fell by 5.7%.

FactSet data suggests 65

companies part of the index expect to report negative earnings

guidance while 41 have issued positive guidance.

Home sales data

The U.S. housing market will be

under the radar this week. The NAHB, or the National Association of

Home Builders, will publish the monthly Housing Market Index on

Tuesday, which tracks the sentiment of home builders.

The U.S. Census Bureau will

release housing starts and building permits for September on

Wednesday. Housing starts are forecast to fall to 1.48 million in

September, compared to 1.58 million in August.

Thursday will see the National

Association of Realtors issue existing home sales numbers for

September that is forecast at 4.7 million, compared to 4.8 million

in August. Rising interest rates are weighing heavily on demand,

with the 30-year fixed-year mortgage rising to 7%, which is the

highest in more than 20 years. The 30-year mortgage rate stood at

3.11% in January 2022.

China all set to report GDP figures

Investors will be closely

watching a crucial growth update from China, the world’s

second-largest economy, on Monday. The country’s gross domestic

product, or GDP, is forecast to rise by 3.8% in Q3, compared to a

2.6% decline in Q2. On a year-over-year basis, China’s economy is

forecast to grow by 3.5%.

A report from Investopedia

explains, “The Chinese economy slowed considerably during the first

half of the year, as the government imposed stringent lockdowns in

major cities in an effort to contain COVID-19 outbreaks. China’s

economy is projected to expand by 5.5% in 2022, slowing sharply

from an 8.1% growth rate in 2021.”

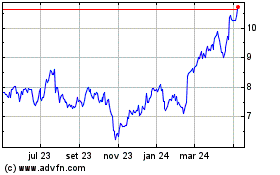

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

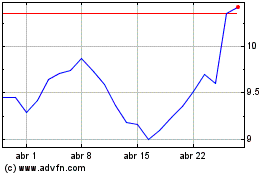

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024