What Should You Expect from the S&P 500 In 2023?

03 Janeiro 2023 - 6:56AM

Finscreener.org

Stock market investors

experienced a tough year in 2022 as the sell-off across sectors

weighed heavily on shareholder sentiment. While the

S&P 500 is down

20% from all-time highs, the tech-heavy Nasdaq

Composite index fell

more than 33% in 2022.

Let’s see what investors can

expect from the S&P 500 in 2023.

Is a market recovery on the cards?

Given historical data, the stock

market has staged a recovery in subsequent years after a drawdown

of 10% or more. In case quantitative tightening measures result in

lower inflation numbers, consumer demand should accelerate in the

second half of 2023.

The Federal Reserve lowered

interest rates soon after the markets crashed back in 2008. A lower

interest rate environment acted as a tailwind for growth stocks as

the cost of debt was minimal.

So, you could easily fund

expansion plans as well as highly accretive acquisitions. Between

2009 and 2021, growth stocks easily outpaced value

stocks.

But interest rates rose rapidly

in the last year and have spiked to 4.3%. Investors are now worried

about macroeconomic challenges ranging from inflation to supply

chain disruptions driving valuations of companies across multiple

sectors lower.

In 2022, value stocks

outperformed growth stocks by a wide margin as shareholders

gravitated towards companies with healthier balance sheets,

predictable cash flows, and reasonable multiples.

There is a good chance for value

stocks to keep outpacing growth stocks in 2023 as the Federal

Reserve is focused on keeping inflation in check even if it results

in an economic recession.

Alternatively, if the Fed pauses

rate hikes and treasury yields stabilize, growth stocks may once

again gain pace in the coming months.

Which sectors will perform well in 2023?

In the last year, higher

commodity prices, as well as the Russian invasion of Ukraine,

ensured the energy sector was the best-performing one. Oil and gas

companies managed to generate record earnings and benefit from

lofty oil prices in 2022.

Alternatively, the threat of an

upcoming recession meant bank stocks were under the pump in 2022.

Investors expect delinquency rates to surge and demand for

mortgage, consumer, and corporate loans to plummet in the near

term. Additionally, lower investment banking transactions should

drive commission and related fees toward multi-year

lows.

Apart from energy, the three

top-performing sectors in 2022 were utilities, healthcare, and

consumer staples. Each of these sectors is defensive in nature and

recession-resistant. Most of the companies in these sectors enjoy

pricing power and stable demand across market cycles.

As the U.S. economy is expected

to head into a mild recession in Q1 and Q2 of 2023, investors

should expect defensive stocks to hold much better in comparison to

broader markets. But cyclical stocks such as banking may rebound in

the second half as the economy limps towards a recovery.

In such a scenario, it makes

sense to bet on sectors levered to economic growth and moderating

inflation, such as industrials and consumer discretionary.

Basically, you need to maintain a diversified portfolio of

defensive and growth stocks as we head into 2023.

The final takeaway

There are a few headwinds

impacting stock markets in 2023, suggesting the S&P 500 will

remain volatile in the next two quarters. But we have seen that

time spent in the market is a much better strategy than timing the

markets.

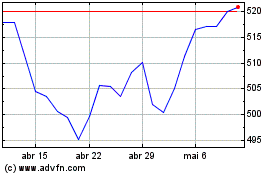

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

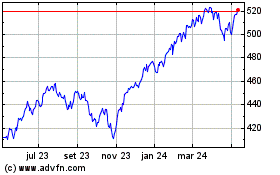

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024