Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF) is pleased to report that Intesa Sanpaolo, a

co-owner of AnalytixInsight’s FinTech affiliate Marketwall, has

announced plans to accelerate its digital transformation as Italy’s

first digital bank, and plans to invest 2.8 billion euros over the

next three years to increase the bank’s digitized business to 70%.

Marketwall, a developer of FinTech solutions, is

a technology provider within Intesa Sanpaolo’s digitization

initiative and developed the “Intesa Sanpaolo Investo”

stock-trading app which was recently launched to Intesa Sanpaolo

customers. Marketwall is 49% owned by AnalytixInsight, and 33%

owned by Intesa Sanpaolo.

Intesa Sanpaolo is a leading bank in Europe with

11.9 million customers, a network of approximately 4,400 branches

throughout Italy, and has emerged as Italy's first digital

bank. It was ranked as one of the three best digital banks in

Europe according to the report “2017 European Online Banking

Functionality Benchmark” by Forrester Research. Intesa Sanpaolo now

reports 8 million multi-channel customers, of which 3 million are

now using the Intesa Sanpaolo Mobile banking app with 56 million

logins per month on the app alone, and 53 million mobile

transactions with the app since the start of 2018.

In a press release dated November 30, 2018

Intesa Sanpaolo announced a digital transformation roadmap,

stating:

“Mobile is at the heart of the Bank's digital

ecosystem: the "app constellation" that is centred on Intesa

Sanpaolo Mobile, provides access to banking services, financing,

savings and is enriched with the new Intesa Sanpaolo Investo app

that enables customers to independently invest and monitor their

assets.

The strategy for the future is in the digital

channels which is in line with the objectives set out in the

Business Plan: investments of 2.8 billion euro over three years to

increase the Bank's digitised business to 70%.”

Intesa Sanpaolo also provided the following

update regarding the Investo stock-trading app (developed by

Marketwall):

“Intesa Sanpaolo Investo: the new

investments app

The latest addition to Intesa Sanpaolo’s app

constellation is Intesa Sanpaolo Investo, an application dedicated

to investments, that allows customers to trade securities in a

simple, fast and informed way and to monitor their investment

assets by means of a digital experience that is similar to that of

a branch with its own manager.

With Investo, customers have a wide range of

information at their disposal which elevates the app to the level

of the leading market players: customers can use the advanced

search to navigate through thousands of listed securities; they can

view a complete set of information including financial statement

information, financial indicators, price history, advanced

interactive charts and related news; they can create and manage

virtual portfolios to simulate trading strategies and monitor their

favourite securities with the watchlist. Customers can also

activate widgets to view their preferred securities and important

news reports, without having to access the app.

Less than a month after its release in the app

stores, the results are noteworthy: 20% of the orders placed by

Intesa Sanpaolo's customers on the secondary market have, in fact,

been placed with Investo.”

The full version of Intesa Sanpaolo’s press

release is available here, or at www.group.intesasanpaolo.com.

CONTACT INFORMATION:

Scott UrquhartVP Corporate

DevelopmentScott.Urquhart@AnalytixInsight.comTel: (416)

522-3975

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight’s (AnalytixInsight.com)

artificial intelligence platform transforms data into knowledge.

AnalytixInsight’s financial analytics platform CapitalCube

(capitalcube.com) algorithmically analyzes market price data and

regulatory filings to create insightful actionable narratives and

research on approximately 50,000 global companies and ETFs,

providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight holds a 49% interest in Marketwall, developer of

FinTech solutions for financial institutions

(marketwallcorporate.com). AnalytixInsight owns Euclides

Technologies Inc. (euclidestech.com), a workflow analytics systems

integrator.

AnalytixInsight is a 2018 Venture 50TM company

(tsx.com/venture50).

Regulatory Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the growth of the Company’s

business operations; the Company’s ability to spin out or monetize

its interest in Marketwall, the relationship between the Company

and Intesa Sanpaolo, the impact to Marketwall resulting from Intesa

Sanpaolo’s plans, the use of the Company’s content by various

parties; and the Company’s future performance. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved”. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of AnalytixInsight Inc., as

the case may be, to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the Company’s technology and revenue

generation; risks associated with operation in the technology

sector; ability to successfully integrate new technology and

employees; foreign operations risks; and other risks inherent in

the technology industry. Although AnalytixInsight has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. AnalytixInsight does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

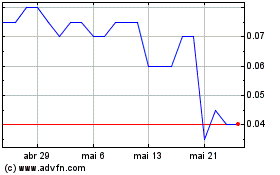

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024