VivoPower International PLC Announces Update on Sale of US Solar Projects, Leadership Change and Strategy

26 Fevereiro 2019 - 11:00AM

VivoPower International PLC (Nasdaq: VVPR) (“VivoPower” or the

“Company”), an international solar power company, today announced

it has received letters of intent in relation to the purchase of a

number of its solar projects with a total power generation capacity

of 103MW from its 1.8GW DC U.S. solar development joint venture

portfolio. It is expected that this first sale from the portfolio

will be completed by the end of March 2019. VivoPower is

progressing with negotiations on the sale of the entire portfolio

as well as other individual projects.

VivoPower also announced that the Company’s New

York based Chief Executive Officer (“CEO”), Carl Weatherley-White,

has resigned from the Company. Art Russell, currently Chief

Financial Officer of VivoPower will assume the role of Interim CEO.

Matthew Cahir, who has been working closely with the VivoPower

Board of Directors and CEO since October 2018 on the U.S. solar

development portfolio sale process, will continue to act as Senior

Advisor with a specific mandate to complete the sale of the

portfolio and maximize proceeds to the Company in the process.

Kevin Chin, Executive Chairman of VivoPower said “We would like to

thank Carl for his contribution to the Company and while he may

still consult for us from time to time in the coming months, we

would like to take this opportunity to wish him well for the

future. We are pleased that Art Russell has agreed to take on the

role as interim CEO and he will work closely with Matt Cahir, who

has been instrumental in accelerating the sales process and

continues to work on a range of other project sales at

present”.

With regards to the sale process, Art Russell

commented “Since the VivoPower Board of Directors decided in

December to explore a sale of the U.S. solar portfolio as a

sum of the parts process in parallel with a sale of the entire

portfolio, we have been pleased with the level of interest from

various parties for clusters of projects as well as individual

projects. The imminent sale of the Texas projects vindicates

the strategy to be more flexible in how the portfolio is

sold. We are engaging with a diverse range of potential buyers

including IPPs, EPC firms, OEM manufacturers, infrastructure funds,

renewable funds, and non-profit foundations and expect that it will

take an estimated 6 months to consummate the sale of the remainder

of the portfolio”.

On future strategy, VivoPower’s Executive

Chairman, Kevin Chin said “Over the coming months, we expect to be

announcing further updates with regards to sales of the Company’s

U.S. solar projects. We continue to drive growth in our Australian

power services business, Aevitas, which is winning record levels of

work across a diverse range of industries including solar, data

centers, water, mining and utilities. As more U.S. solar

projects are sold, we anticipate that the Company’s cash reserves

will increase and, in this context, the Board of Directors has

commenced a review of our strategic options in terms of how to

deploy the proceeds from sale. We will update the market on a

timely basis”.

About VivoPowerVivoPower is an

international solar power producer that develops, owns and operates

PV solar projects in a capital efficient manner. VivoPower partners

with long-term investors, suppliers and developers to accelerate

the growth of its portfolio of solar projects. In addition, the

Company provides critical energy infrastructure solutions to

commercial and industrial customers throughout Australia.

Forward-Looking Statements

This communication includes certain statements

that may constitute “forward-looking statements” for purposes of

the U.S. federal securities laws. Forward-looking statements

include, but are not limited to, statements that refer to

projections, forecasts or other characterizations of future events

or circumstances, including any underlying assumptions. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would” and similar expressions may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements may include, for example, statements

about the benefits of the events or transactions described in this

communication and the expected returns therefrom. These statements

are based on VivoPower’s management’s current expectations or

beliefs and are subject to risk, uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements herein due to changes in

economic, business, competitive and/or regulatory factors, and

other risks and uncertainties affecting the operation of

VivoPower’s business. These risks, uncertainties and contingencies

include changes in business conditions, fluctuations in customer

demand, changes in accounting interpretations, management of rapid

growth, intensity of competition from other providers of products

and services, changes in general economic conditions, geopolitical

events and regulatory changes and other factors set forth in

VivoPower’s filings with the United States Securities and Exchange

Commission. The information set forth herein should be read in

light of such risks. VivoPower is under no obligation to, and

expressly disclaims any obligation to, update or alter its

forward-looking statements whether as a result of new information,

future events, changes in assumptions or otherwise.

Contact

Julie-Anne Byrne

Investor Relations

shareholders@vivopower.com

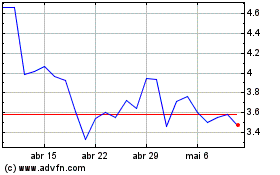

VivoPower (NASDAQ:VVPR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

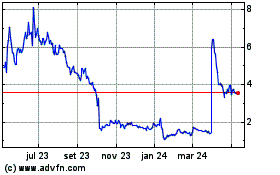

VivoPower (NASDAQ:VVPR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024