Firsthand Technology Value Fund Discloses Top Portfolio Holdings

22 Março 2019 - 5:15PM

Firsthand Technology Value Fund, Inc. (NASDAQ: SVVC) (the “Fund”),

a publicly traded venture capital fund that invests in technology

and cleantech companies, disclosed today that its top five holdings

as of February 28, 2019, were Revasum, Pivotal Systems, IntraOp

Medical, Phunware, and QMAT.

| 1. |

Revasum, Inc.

(ASX: RVS) is a provider of chemical-mechanical

planarization (CMP) and grinding tools to the semiconductor

industry. As of February 28, 2019, the Fund’s investment in Revasum

consisted of 53,834,340 shares of restricted and unrestricted

common stock and common stock equivalents, and represented

approximately 30.8% of the Fund’s estimated net assets.* |

| |

|

| 2. |

Pivotal Systems

Corp. (ASX: PVS) provides monitoring and process control

technologies for the semiconductor manufacturing industry. As of

February 28, 2019, the Fund’s investment in Pivotal consisted of

53,758,441 shares of restricted and unrestricted common stock and

common stock equivalents and represented approximately 26.1% of the

Fund’s estimated net assets.* |

| |

|

| 3. |

IntraOp Medical

Corp. is the manufacturer of the Mobetron, a medical

device that is used to deliver intra-operative radiation to cancer

patients. As of February 28, 2019, the Fund’s investment in IntraOp

consisted of 26,856,187 shares of preferred stock plus debt

securities and represented approximately 15.5% of the Fund’s

estimated net assets.* |

| |

|

| 4. |

Phunware,

Inc. (NASDAQ: PHUN) is a mobile app

developer and pioneer of Multiscreen as a Service (MaaS). As of

February 28, 2019, the Fund’s investment in Phunware consisted of

1,495,113 shares of restricted common stock and represented

approximately 10.0% of the Fund’s estimated net assets.* |

| |

|

| 5. |

QMAT,

Inc. is developing advanced materials technologies for

applications in the electronics industry. As of February 28, 2019,

the Fund’s investment in QMAT consisted of 18,000,240 shares of

preferred stock plus debt securities and warrants to purchase

additional shares, and represented approximately 7.3% of the Fund’s

estimated net assets.* |

The Fund also announced that as of February 28, 2019, estimated

net assets of the Fund were approximately $190 million, or $26.52

per share, including cash and cash equivalents of approximately

$0.13 per share. As of that date, the Fund’s top five holdings

constituted 89.8% of the Fund’s estimated net assets* and 81.1% of

the Fund’s estimated gross assets.* Complete financial statements

and a detailed schedule of investments as of March 31, 2019, will

be available in the Fund’s quarterly report filing on Form 10-Q in

May.

*Estimated net/gross assets as of February 28, 2019, represent

the net/gross assets as of December 31, 2018, plus the net change

in unrealized appreciation/depreciation and realized gains/losses

on publicly traded and private securities since December 31, 2018.

Due to the high volatility and thinly-traded nature of Phunware

(NASDAQ: PHUN) common stock, we continue to treat Phunware stock as

an illiquid security for valuation purposes and have relied on the

December 31, 2018 valuation for estimating the net/gross assets of

the Fund. For the purposes of calculating the percentage of net

assets represented by each investment, the value of each holding is

determined by the most recent of: (1) the purchase price, (2) the

market value for public securities, less any discounts taken due to

restrictions on the stock, or (3) the December 31, 2018, fair value

of each security, as determined under procedures approved by our

Board of Directors.

About Firsthand Technology Value FundFirsthand

Technology Value Fund, Inc. is a publicly traded venture capital

fund that invests in technology and cleantech companies. More

information about the Fund and its holdings can be found online at

www.firsthandtvf.com.

The Fund is a non-diversified, closed-end investment company

that elected to be treated as a business development company under

the Investment Company Act of 1940. The Fund’s investment objective

is to seek long-term growth of capital. Under normal circumstances,

the Fund will invest at least 80% of its total assets for

investment purposes in technology and cleantech companies. An

investment in the Fund involves substantial risks, some of which

are highlighted below. Unlike most business development companies,

the Fund is taxed as a corporation rather than a Regulated

Investment Company under federal tax laws, based on the composition

of its assets. Please see the Fund’s public filings for more

information about fees, expenses and risk. Past investment

results do not provide any assurances about future results.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains "forward-looking statements" as defined under the

U.S. federal securities laws. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "will,"

and similar expressions identify forward-looking statements, which

generally are not historical in nature. Forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to materially differ from the Fund’s historical

experience and its present expectations or projections indicated in

any forward-looking statement. These risks include, but are not

limited to, changes in economic and political conditions,

regulatory and legal changes, technology and cleantech industry

risk, valuation risk, non-diversification risk, interest rate risk,

tax risk, and other risks discussed in the Fund’s filings with the

SEC. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. The Fund

undertakes no obligation to publicly update or revise any

forward-looking statements made herein. There is no assurance that

the Fund’s investment objectives will be attained. We acknowledge

that, notwithstanding the foregoing, the safe harbor for

forward-looking statements under the Private Securities Litigation

Reform Act of 1995 does not apply to investment companies such as

us.

Contact:

Phil MosakowskiFirsthand Capital Management, Inc. (408)

624-9526vc@firsthandtvf.com

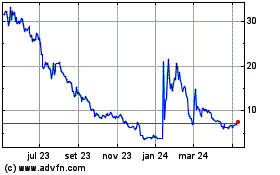

Phunware (NASDAQ:PHUN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

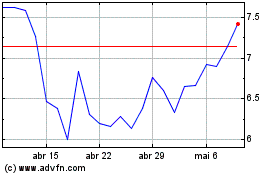

Phunware (NASDAQ:PHUN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024