THIS PRESS RELEASE IS NOT FOR DISTRIBUTION IN

THE UNITED STATES OR TO U.S. NEWS AGENCIES

Surge Energy Inc. ("Surge" or the "Company")

(TSX: SGY) is pleased to announce that it has entered into a $30

million bought-deal financing (the "Convertible Debenture

Financing") of five-year convertible unsecured subordinated

debentures (the "Debentures") with a syndicate of underwriters (the

"Underwriters") led by National Bank Financial Inc.. The Debentures

will have a coupon of 6.75 percent per annum, and a conversion

price of $2.25 per Surge common share ("Common Share"). The

Company has granted the Underwriters an over-allotment option to

purchase up to an additional $4.5 million aggregate principal

amount of the Debentures, on the same terms, exercisable in whole

or in part at any time up to the 30th day following initial closing

of the Convertible Debenture Financing.

The net proceeds from the Convertible Debenture

Financing will be used to pay down a portion of the outstanding

indebtedness under the Company's revolving term credit

facility.

The Debentures will mature and be repayable on

June 30, 2024 (the "Maturity Date") and will accrue interest at the

rate of 6.75 percent per annum payable semi-annually in arrears on

December 31 and June 30 of each year (each an "Interest Payment

Date"), with the first such payment to be made December 31, 2019.

The Company will have the option to satisfy its obligation to repay

the principal amount of the Debentures, in whole or in part, due on

the Maturity Date upon at least 40 days' and not more than 60 days'

prior notice, by delivering that number of freely tradable Common

Shares obtained by dividing the principal amount of the Debentures

by 95 percent of the volume weighted average trading price of the

Common Shares on the Toronto Stock Exchange (the "TSX") for the 20

consecutive trading days ending on the fifth trading day preceding

the Maturity Date.

At the holder's option, the Debentures will be

convertible into Common Shares at any time prior to the close of

business on the earlier of the business day immediately preceding

(i) the Maturity Date, or (ii) if called for redemption, the date

fixed for redemption by the Company, at a conversion price of $2.25

per Common Share, subject to adjustment in certain events (the

"Conversion Price"). This represents a conversion rate of

approximately 444.4444 Common Shares for each $1,000 principal

amount of Debentures, subject to the operation of certain

anti-dilution provisions expected to be contained in the indenture

under which the Debentures are issued. Holders who convert their

Debentures will receive accrued and unpaid interest for the period

from the date of the last Interest Payment Date prior to the date

of conversion to the date of conversion. In addition to the

foregoing, in the event of a change of control of the Company,

subject to certain terms and conditions, holders of Debentures will

be entitled to convert their Debentures and, subject to certain

limitations, receive, in addition to the number of Common Shares

they would otherwise be entitled to receive, an additional number

of Common Shares per $1,000 principal amount of Debentures.

The Debentures will be direct, subordinated

unsecured obligations of the Company, subordinated to any senior

indebtedness of the Company, including the Company's revolving

credit facility, and ranking equally with one another and with all

other existing and future subordinated unsecured indebtedness of

the Company to the extent subordinated on the same terms.

The Debentures will not be redeemable by the

Corporation prior to June 30, 2022. On or after June 30, 2022 and

prior to June 30, 2023, the Debentures will be redeemable by the

Corporation, in whole or in part, from time to time, on not more

than 60 days and not less than 30 days prior notice at a redemption

price equal to their principal amount plus accrued and unpaid

interest, if any, provided that the volume weighted average trading

price of the Common Shares on the TSX for the 20 consecutive

trading days prior to the date on which notice of redemption is

provided is not less than 125 percent of the Conversion Price. On

or after June 30, 2023 and prior to the Maturity Date, the

Debentures will be redeemable by the Corporation, in whole or in

part, from time to time, on not more than 60 days and not less than

30 days prior notice at a redemption price equal to their principal

amount plus accrued and unpaid interest, if any. Subject to certain

conditions, the Company will have the option to satisfy its

obligation to repay the principal amount of the Debentures, in

whole or in part, due upon redemption, by delivering that number of

freely tradable Common Shares obtained by dividing the principal

amount of the Debentures by 95 percent of the volume weighted

average trading price of the Common Shares on the TSX for the 20

consecutive trading days ending on the fifth trading day preceding

the date of redemption.

The Debentures will be offered in all provinces

of Canada, by way of short form prospectus and in certain other

jurisdictions as may be agreed by the Underwriters and the Company.

The Convertible Debenture Financing is expected to close on or

about May 8, 2019 and is subject to certain conditions including,

but not limited to, the receipt of all necessary approvals and

consents, including the approval of the Toronto Stock Exchange.

The Debentures offered, and the Common Shares

issuable on conversion or redemption thereof, have not and will not

be registered under the U.S. Securities Act of 1933, as amended

(the "Act"), and may not be offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements under the Act. This press release does

not constitute an offer to sell or a solicitation of any offer to

buy the common shares in the United States.

FORWARD LOOKING STATEMENTS:

This press release contains forward-looking

statements. The use of any of the words "anticipate", "continue",

"estimate", "expect", "may", "will", "project", "should", "believe"

and similar expressions are intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements.

More particularly, this press release contains

statements concerning the anticipated terms of, use of net proceeds

from and closing date of, the Convertible Debenture Financing.

The forward-looking statements are based on

certain key expectations and assumptions made by Surge, including

expectations and assumptions the performance of existing wells and

success obtained in drilling new wells; anticipated expenses, cash

flow and capital expenditures; the application of regulatory and

royalty regimes; prevailing commodity prices and economic

conditions; development and completion activities; the performance

of new wells; the successful implementation of waterflood programs;

the availability of and performance of facilities and pipelines;

the geological characteristics of Surge’s properties; the

successful application of drilling, completion and seismic

technology; the determination of decommissioning liabilities;

prevailing weather conditions; exchange rates; licensing

requirements; the impact of completed facilities on operating

costs; Surge's ability to obtain all necessary approvals and

consents; the availability and costs of capital, labour and

services; and the creditworthiness of industry partners.

Although Surge believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Surge can give no assurance that

they will prove to be correct. Since forward-looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to, risks

associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and constraint in the availability of services,

adverse weather or break-up conditions, uncertainties resulting

from potential delays or changes in plans with respect to

exploration or development projects or capital expenditures or

failure to obtain the continued support of the lenders under

Surge’s bank line. Certain of these risks are set out in more

detail in Surge’s Annual Information Form dated March 12, 2019 and

in Surge’s MD&A for the period ended December 31, 2018, both of

which have been filed on SEDAR and can be accessed at

www.sedar.com.

The forward-looking statements contained in this

press release are made as of the date hereof and Surge undertakes

no obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

FURTHER INFORMATION:

For more information, please contact:

| Paul Colborne, President &

CEO |

Jared Ducs, Vice President

Finance |

| Surge Energy Inc. |

Surge Energy Inc. |

| Phone: (403) 930-1507 |

Phone: (403) 930-1046 |

| Fax: (403) 930-1011 |

Fax: (403) 930-1011 |

| Email: pcolborne@surgeenergy.ca |

Email: jducs@surgeenergy.ca |

Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

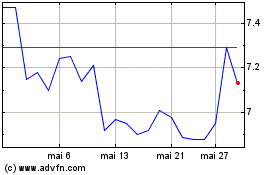

Surge Energy (TSX:SGY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Surge Energy (TSX:SGY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024