Cogeco Announces Renewal of Its Normal Course Issuer Bid

31 Julho 2019 - 9:00AM

Cogeco Inc. (TSX: CGO) (the "Corporation" or "Cogeco")

announces that the Toronto Stock Exchange (the "TSX") has

accepted its notice of intention for a normal course issuer bid in

respect of its Subordinate Voting Shares (the "Subordinate

Shares"). Purchases pursuant to the notice will not commence prior

to August 2, 2019, the date following the date upon which the

Corporation’s current normal course issuer bid is set to expire,

and will not continue beyond August 1, 2020.

The notice will enable Cogeco to acquire up to

300,000 Subordinate Shares for cancellation representing

approximately 2.1% percent of the 14,337,777 shares of such class

which were issued and outstanding as at July 19, 2019.

All purchases will be conducted through the

facilities of the TSX or Canadian alternative trading systems, if

eligible, and will conform to their regulations. Purchases under

the normal course issuer bid will be made by means of open market

transactions.

Under TSX rules, the Corporation will be allowed

to purchase daily, through the facilities of the TSX, a maximum of

3,711 Subordinate Shares representing 25% of the average daily

trading volume, as calculated per the TSX rules. In addition, the

Corporation may make, once per week, a block purchase (as such term

is defined in the TSX Company Manual) of Subordinate Shares not

directly or indirectly owned by insiders of the Corporation, in

accordance with TSX rules. The Subordinate Shares purchased

pursuant to the normal course issuer bid will be cancelled.

The price to be paid by the Corporation for any

Subordinate Share will be the market price at the time of

acquisition, plus brokerage fees where

applicable.

The Corporation has entered into an automatic

share purchase plan with a designated broker on the date hereof to

allow for the purchase of Subordinate Shares under the normal

course issuer bid at times when the Corporation would ordinarily

not be permitted to purchase Subordinate Shares due to regulatory

restrictions or self-imposed blackout periods.

Under its current normal course issuer bid that

commenced on August 2, 2018 and will end on August 1, 2019, Cogeco

received the approval of the TSX to purchase for cancellation a

maximum of 550,000 Subordinate Shares. During the period from

August 2, 2018 to July 19, 2019 inclusively, Cogeco purchased a

total of 286,704 Subordinate Shares at a weighted average price per

Subordinate Shares of $73.36.

Cogeco currently believes that the purchase of

its Subordinate Shares under the normal course issuer bid is an

appropriate and desirable use of available cash to increase

shareholder value and that it provides additional investment

returns to its shareholders.

ABOUT COGECO

Cogeco Inc. is a diversified holding corporation

which operates in the communications and media sectors. Its Cogeco

Communications Inc. subsidiary provides residential and business

customers with Internet, video and telephony services through its

two-way broadband fibre networks, operating in Québec and Ontario,

Canada, under the Cogeco Connexion name, and in the United States

under the Atlantic Broadband brand (in 11 states along the East

Coast, from Maine to Florida). Its Cogeco Media subsidiary owns and

operates 23 radio stations with complementary radio formats and

extensive coverage serving a wide range of audiences mainly across

the province of Québec, as well as Cogeco News, a news agency.

Cogeco’s subordinate voting shares are listed on the Toronto Stock

Exchange (TSX: CGO). The subordinate voting shares of Cogeco

Communications Inc. are also listed on the Toronto Stock Exchange

(TSX: CCA).

FORWARD-LOOKING STATEMENTS

Certain statements contained in this news

release may constitute forward-looking information within the

meaning of securities laws. Forward-looking information may relate

to Cogeco Inc.’s ("Cogeco" or the "Corporation") future outlook and

anticipated events, business, operations, financial performance,

financial condition or results and, in some cases, can be

identified by terminology such as "may"; "will"; "should";

"expect"; "plan"; "anticipate"; "believe"; "intend"; "estimate";

"predict"; "potential"; "continue"; "foresee", "ensure" or other

similar expressions concerning matters that are not historical

facts. Particularly, statements regarding the Corporation’s

financial guidelines, future operating results and economic

performance, objectives and strategies are forward-looking

statements. These statements are based on certain factors and

assumptions including expected growth, results of operations,

performance and business prospects and opportunities, which Cogeco

believes are reasonable as of the current date.

Refer in particular to the "Corporate Objectives

and Strategies" section of the Corporation's 2018 annual

Management’s Discussion and Analysis ("MD&A"), the "Fiscal 2019

Revised Financial Guidelines" section of the second quarter of

fiscal 2019 MD&A and the “Fiscal 2020 Preliminary Financial

Guidelines” section of the third quarter of fiscal 2019 MD&A

for a discussion of certain key economic, market and operational

assumptions we have made in preparing forward-looking statements.

While Management considers these assumptions to be reasonable based

on information currently available to the Corporation, they may

prove to be incorrect. Forward-looking information is also subject

to certain factors, including risks and uncertainties that could

cause actual results to differ materially from what Cogeco

currently expects. These factors include risks such as competitive

risks, business risks, regulatory risks, technology risks,

financial risks, economic conditions, ownership risks, human-caused

and natural threats to our network, infrastructure and systems and

litigation risks, many of which are beyond the Corporation’s

control. For more exhaustive information on these risks and

uncertainties, the reader should refer to the "Uncertainties and

Main Risk Factors" section of the Corporation's 2018 annual

MD&A and of the third quarter of fiscal 2019 MD&A. These

factors are not intended to represent a complete list of the

factors that could affect Cogeco and future events and results may

vary significantly from what Management currently foresees. The

reader should not place undue importance on forward-looking

information contained in this news release which represent Cogeco's

expectations as of the date of this news release (or as of the date

they are otherwise stated to be made) and are subject to change

after such date. While Management may elect to do so, the

Corporation is under no obligation (and expressly disclaims any

such obligation) and does not undertake to update or alter this

information at any particular time, whether as a result of new

information, future events or otherwise, except as required by law.

All amounts are stated in Canadian dollars unless otherwise

indicated.

SOURCE:

Cogeco Inc.Andrée PinardVice

President and TreasurerTel.: 514-764-4700

INFORMATION:

Media Marie-Hélène LabrieSenior

Vice President, Public Affairs and Communications Tel.:

514-764-4700

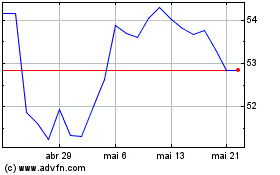

Cogeco (TSX:CGO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Cogeco (TSX:CGO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024