Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF), is pleased to announce its financial results for

the three and six months ended June 30, 2019.

During the quarter, the Company expanded its

AI-driven, machine-created content distribution agreement with

Refinitiv, to now provide research coverage on approximately 3,000

dividend-paying companies in Canada, US and the UK. AI-driven

content is becoming increasingly important as financial

corporations move to embrace AI and analytics as the content

cornerstones for their client offerings. AnalytixInsight’s

financial analytics platform is a powerful analytics engine capable

of 100 billion daily computations, and currently provides analysis

on approximately 50,000 worldwide stocks and North American

ETFs.

Marketwall grew revenues by 42% to $2.6 million

during the six-month period ended June 30, 2019 and increased

profit by 159% to $0.7 million. Marketwall has made application to

become an online financial broker in Europe and, upon approval of

the brokerage application, will evaluate funding opportunities to

enable the company’s global growth expansion plans. During its

short four-year operating history, Marketwall has developed

leading-edge FinTech stock-trading solutions that have been

embraced by dominant banks in Europe.

AnalytixInsight believes its key strategic

initiatives - Artificial Intelligence and FinTech – are well

positioned to capitalize on the market trends occurring in the

industry.

AnalytixInsight Highlights:

- Revenue for the three months ended June 30, 2019 was $1,150,392

compared to revenue of $1,325,814 during the same period in the

previous year.

- Revenue for the six-month period ended June 30, 2019 was

$2,097,474 compared to revenue of $2,341,100 during the same period

in the previous year.

- At June 30, 2019, the Company had current assets of $3,463,365,

working capital of $2,826,962 and no long-term debt.

- Expanded AI-driven research distribution agreement with

Refinitiv to provide dividend analysis coverage on approximately

3,000 dividend-paying companies in Canada, US and the UK, and

expanded the scope of pre-revenue analysis reports already in

production to include pre-revenue companies in Italy, Germany, Hong

Kong and Japan.

- Completed a private placement financing of $1.6 million.

- Developed a Robo-Advisor on the CapitalCube platform and

completed a new graphical user interface for CapitalCube which

contains several updated improvements and ease-of-use

features.

Marketwall Highlights:

- Marketwall, a developer of FinTech solutions, is an associated

company 49%-owned by AnalytixInsight.

- Marketwall revenue for the six-month period ended June 30, 2019

was $2,588,742, an increase of 42% compared to $1,818,605 during

the same period in the previous year. Marketwall’s revenue is not

included in AnalytixInsight’s consolidated revenue.

- Marketwall net income for the six-month period was $691,302, an

increase of 159% compared to $267,173 during the same period in the

previous year.

- Marketwall’s board of directors approved a new strategic plan

whereby Marketwall will be established as an online financial

broker in Italy, with plans to expand to other European

countries.

AnalytixInsight Selected Financial

Information:

|

AnalytixInsight$ Canadian (unaudited) |

Three months ended June 30 |

|

Six months ended June 30 |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Revenue |

1,150,392 |

|

1,325,814 |

|

2,097,474 |

|

2,341,100 |

|

|

Basic net income (loss) per share |

(0.00 |

) |

(0.00 |

) |

(0.01 |

) |

(0.01 |

) |

|

|

June 30, 2019 |

|

December 31,2018 |

|

|

|

|

Total assets |

6,665,758 |

|

5,096,567 |

|

|

|

|

Total liabilities |

636,403 |

|

663,754 |

|

|

|

|

|

|

|

|

|

|

|

Marketwall Selected Financial

Information:

AnalytixInsight owns 49% of Marketwall which is

considered an associated company as its financial results are not

consolidated in AnalytixInsight’s financial results.

|

|

|

|

|

Marketwall (Associated investment of

AnalytixInsight, $ Canadian) |

Six months ended June 30,

2019 |

Six months ended June 30,

2018 |

|

Revenue |

2,588,742 |

1,818,605 |

|

Net income (loss) |

691,302 |

267,173 |

|

|

June 30, 2019 |

December 31, 2018 |

|

Total assets |

4,335,493 |

3,919,233 |

|

Total liabilities |

1,975,663 |

2,250,174 |

|

|

|

|

Management Commentary

Prakash Hariharan, President & CEO of

AnalytixInsight, commented: “We advanced our strategic initiatives

during the quarter. Our CapitalCube content delivery to Refinitiv

is expanding, Marketwall had a strong quarter with plans to become

an online financial broker, we raised $1.6 million and we continue

to develop our technical capabilities across all of our business

divisions.”

CapitalCube

AnalytixInsight is an established AI-driven

content supplier to Refinitiv with ability to provide content on

small & mid-cap companies worldwide through its CapitalCube

platform, which provides machine-created content with ability to

scale. CapitalCube began publishing pre-revenue research reports to

Refinitiv’s Eikon users in November 2018. On June 17, 2019, the

Company expanded the scope of the pre-revenue analysis reports to

now include companies located in Italy, Germany, Hong Kong and

Japan in response to the increasing Refinitiv client usage of the

North American reports currently in production.

During the quarter, the Company also expanded

the scope of its Refinitiv agreement to begin providing dividend

analysis coverage on approximately 3,000 dividend-paying companies

in Canada, US and the UK. The CapitalCube dividend analysis report

provides powerful insights, analysis and scoring regarding a

company’s dividend quality, yield, coverage, flexibility, payment

history, peer comparisons and sustainability.

AnalytixInsight is pleased to be an AI-driven

content provider to Refinitiv and believes that its ability to

create scalable financial content on worldwide companies is being

recognized with increasing importance as global industry leaders

embrace analytics within the financial industry. On August 1, 2019,

London Stock Exchange agreed to buy Refinitiv in a US$27 billion

transaction to create a global financial markets infrastructure

provider with leading data and analytics to Refinitiv’s 40,000

institutions in over 190 countries.

During the quarter the Company completed a new

graphical user interface for CapitalCube which contains several

updated improvements and ease-of-use features. The Company has also

developed a Robo-Advisor on the CapitalCube platform, which it

expects to commercially deploy to clients and money managers in the

future. The performance results of the Company’s Robo-Advisor are

displayed on the CapitalCube website home page.

Workforce Optimization

AnalytixInsight’s Workforce Optimization

division joined the IFS Partner Network during 2018, and during the

quarter, the Company continued to advance its sales initiatives in

this market. IFS is a world leader in developing workforce

optimization enterprise software for global customers who manage

service-focused operations. AnalytixInsight plans to explore

opportunities with IFS to jointly develop machine intelligence

solutions to help organizations maximize operational efficiency,

increase revenue, reduce costs and improve customer

satisfaction.

Marketwall

Marketwall, a developer of FinTech solutions, is

49% owned by AnalytixInsight, and 33% owned by Intesa Sanpaolo.

Marketwall revenue for the six-month period ended June 30, 2019 was

$2,588,742, an increase of 42% compared to $1,818,605 during the

same period in the previous year. Marketwall’s revenues are not

included in AnalytixInsight’s consolidated revenue.

On July 15, 2019, the Company announced that

Marketwall made application to become an online financial broker

(“Marketwall Brokerage”) to offer leading FinTech-enabled services

for receiving, transmitting and executing stock trading orders,

using the Investment Bank of Intesa Sanpaolo as its execution

broker. Marketwall Brokerage has requested regulatory

approvals for brokerage services initially in Italy with intentions

to expand to other European countries. Marketwall Brokerage intends

to develop multi-device trading platforms, combining research and

financial education.

During its four-year operating history,

Marketwall has developed leading-edge FinTech solutions including

financial portal www.marketwall.com, trading & research

platforms for leading financial institutions, and mobile

stock-trading applications for Intesa Sanpaolo. Intesa Sanpaolo is

a leading bank in Europe with approximately 11.9 million customers,

a network of approximately 4,400 branches throughout Italy,

and has emerged as Italy's first digital bank.

CONTACT INFORMATION:

Scott UrquhartVP Corporate

DevelopmentScott.Urquhart@AnalytixInsight.comTel: (416)

522-3975

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial

Intelligence, machine-learning company. AnalytixInsight’s financial

analytics platform CapitalCube.com algorithmically analyzes market

price data and regulatory filings to create insightful actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in Marketwall, a developer of FinTech solutions for

financial institutions. For more information, visit

AnalytixInsight.com.

Regulatory Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the growth of the Company’s

business operations; the Company’s ability to spin out or

monetize it’s interest in Marketwall, the use of the Company’s

content by various parties; the impact of the distribution

agreement with Refinitiv; the impact of the agreement with

IFS and the Company’s ability to enter into commercial transactions

with members thereof; the Company’s ability to expand its content

distribution; and the Company’s future performance. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved”.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of AnalytixInsight

Inc., as the case may be, to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to: general business, economic, competitive,

geopolitical and social uncertainties; the Company’s technology and

revenue generation; risks associated with operation in the

technology sector; ability to successfully integrate new technology

and employees; foreign operations risks; and other risks inherent

in the technology industry. Although AnalytixInsight has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. AnalytixInsight does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

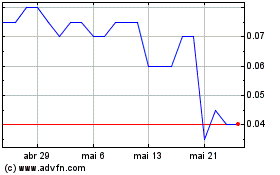

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024