Wabash National Corporation (NYSE: WNC), the innovation leader of

engineered solutions for the transportation, logistics and

distribution industries, today reported results for the full year

and quarter ended December 31, 2019.

Net sales for the fourth quarter 2019 were

$579.0 million while operating income was $31.8 million or 5.5

percent of net sales. For the full year of 2019, total revenue

reached a new record of $2.3 billion while generating operating

income of $142.8 million or 6.2 percent of net sales.

Net income for the fourth quarter 2019 was $18.4

million, or $0.34 per diluted share. For the full year of 2019, net

income was $89.6 million or earnings per diluted share of

$1.62. Operating EBITDA, a non-GAAP measure that excludes the

effects of certain items, for the fourth quarter 2019 was $44.2

million, or 7.6 percent of net sales, and full year operating

EBITDA of $194.2 million, or 8.4 percent of net sales.

“I’m pleased to achieve a new all-time

sales record of $2.3 billion in 2019 while also generating stronger

operating income, net income and EPS versus the prior year,"

explained Brent Yeagy, president and chief executive

officer. "Additionally, full year cash generation was

strong and I’m excited to add to our streak of what is

now 7 consecutive years of free cash conversion of 100% or

greater.”

Outlook

For the full year ending December 31, 2020,

the company has issued guidance of $2.05 to $2.15 billion in sales

and an earnings per diluted share midpoint of $1.20 with a

range of $1.10 to $1.30.

Mr. Yeagy continued, “Moderating trailer demand

in 2020 has been expected for some time and we've taken a proactive

approach toward strengthening our balance sheet and planning to

execute in such an environment. I am confident in our team's

ability to succeed in any phase of the cycle and also to continue

moving forward with our strategic initiatives under the guidance of

the Wabash Management System.”

Business Segment Highlights

The table below is a summary of select segment

operating and financial results prior to the elimination of

intersegment sales for the fourth quarter of 2019 and 2018. A

complete disclosure of the results by individual segment is

included in the tables following this release.

| |

|

Commercial Trailer Products |

|

Diversified Products |

|

Final Mile Products |

|

Three Months Ended December 31, |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

(dollars in thousands) |

| New trailers shipped |

|

14,300 |

|

|

16,750 |

|

|

650 |

|

|

750 |

|

|

— |

|

|

— |

|

|

Net sales |

|

$ |

399,288 |

|

|

$ |

438,667 |

|

|

$ |

94,661 |

|

|

$ |

102,322 |

|

|

$ |

92,740 |

|

|

$ |

74,532 |

|

| Gross profit |

|

$ |

50,384 |

|

|

$ |

45,170 |

|

|

$ |

16,324 |

|

|

$ |

17,420 |

|

|

$ |

6,239 |

|

|

$ |

7,362 |

|

| Gross profit margin |

|

12.6 |

% |

|

10.3 |

% |

|

17.2 |

% |

|

17.0 |

% |

|

6.7 |

% |

|

9.9 |

% |

| Income (loss) from

operations |

|

$ |

43,135 |

|

|

$ |

39,075 |

|

|

$ |

5,610 |

|

|

$ |

(6,111 |

) |

|

$ |

(5,914 |

) |

|

$ |

(1,463 |

) |

| Income (loss) from operations

margin |

|

10.8 |

% |

|

8.9 |

% |

|

5.9 |

% |

|

(6.0 |

)% |

|

(6.4 |

)% |

|

(2.0 |

)% |

Commercial Trailer Products’ net sales for the

fourth quarter totaled $399.3 million, a decrease of $39.4 million,

or 9.0 percent. Gross profit margin for the fourth quarter

increased 230 basis points as compared to the prior year period

primarily due to successful efforts to recover cost pressures as

well as product and customer mix. Operating income increased $4.1

million, or 10.4 percent, from the fourth quarter last year to

$43.1 million, or 10.8 percent of net sales.

Diversified Products’ net sales for the fourth

quarter were $94.7 million, a decrease of $7.7 million, or 7.5

percent, as compared to the prior year quarter, due primarily to

the impact from the divestiture of a business. Gross profit margin

as compared to the prior year period increased 20 basis points,

primarily due to product and customer mix. Operating income in the

fourth quarter of 2019 was $5.6 million, or 5.9 percent of net

sales, compared to a loss of $6.1 million on a GAAP basis or income

of $6.9 million on a non-GAAP Adjusted basis during the fourth

quarter 2018.

Final Mile Products’ net sales for the fourth

quarter totaled $92.7 million, an increase of $18.2 million or 24.4

percent. Gross profit and gross profit margin for the fourth

quarter were $6.2 million and 6.7 percent, respectively. Operating

loss during the fourth quarter was $5.9 million, or 6.4 percent of

net sales. While the business saw continued growth, operating

results were negatively impacted during the quarter by operational

inefficiencies as the business encountered headwinds relating to

demand fluctuations and product mix.

Non-GAAP Measures

In addition to disclosing financial results

calculated in accordance with United States generally

accepted accounting principles (GAAP), the financial information

included in this release contains non-GAAP financial measures,

including operating EBITDA, adjusted operating income, adjusted net

income and adjusted earnings per diluted share. These

non-GAAP measures should not be considered a substitute for, or

superior to, financial measures and results calculated in

accordance with GAAP, including net income, and reconciliations to

GAAP financial statements should be carefully evaluated.

Operating EBITDA is defined as earnings before

interest, taxes, depreciation, amortization, stock-based

compensation, acquisition expenses and related charges, and other

non-operating income and expense. Management believes providing

operating EBITDA is useful for investors to understand the

Company’s performance and results of operations period to period

with the exclusion of the items identified above. Management

believes the presentation of operating EBITDA, when combined with

the GAAP presentations of operating income and net income, is

beneficial to an investor’s understanding of the Company’s

operating performance. A reconciliation of operating EBITDA to net

income is included in the tables following this release.

Adjusted Segment EBITDA, a non-GAAP financial

measure, is calculated by adding back segment depreciation and

amortization expense to segment operating income (loss), and

excludes certain costs, expenses, other charges, gains or income

that are included in the determination of operating income under

GAAP, but that management would not consider important in

evaluating the quality of the Company’s segment operating results

as they are not indicative of each segment's core operating results

or may obscure trends useful in evaluating the segment's continuing

activities. Adjusted Segment EBITDA Margin is calculated by

dividing Adjusted Segment EBITDA by segment total net sales.

Adjusted operating income, a non-GAAP financial

measure, excludes certain costs, expenses, other charges, gains or

income that are included in the determination of operating income

under U.S. GAAP, but that management would not consider important

in evaluating the quality of the Company’s operating results as

they are not indicative of the Company’s core operating results or

may obscure trends useful in evaluating the Company’s continuing

activities. Accordingly, the Company presents adjusted operating

income excluding these Special Items to help investors evaluate our

operating performance and trends in our business consistent with

how management evaluates such performance and trends. Further, the

Company presents adjusted operating income to provide investors

with a better understanding of the Company’s view of our results as

compared to prior periods. A reconciliation of adjusted

operating income to operating income, the most comparable GAAP

financial measure, is included in the tables following this press

release.

Adjusted net income and adjusted earnings per

diluted share, each reflect adjustments for income or losses

recognized on the sale and/or closure of former Company locations,

the losses attributable to the Company's extinguishment of debt, a

non-cash impairment of assets, acquisition expenses and related

charges, and tax reform and other discrete tax adjustments.

Management believes providing adjusted measures and excluding

certain items facilitates comparisons to the Company’s prior year

periods and, when combined with the GAAP presentation of net income

and diluted net income per share, is beneficial to an investor’s

understanding of the Company’s performance. A reconciliation of

each of adjusted net income and adjusted earnings per diluted share

to net income and net income per diluted share is included in the

tables following this release.

Fourth Quarter 2019 Conference

Call

Wabash National will discuss its results during

its quarterly investor conference call on Wednesday, February 12th,

beginning at 10:00 a.m. EST. The call and an accompanying

slide presentation will be accessible on the "Investors" section of

the Company’s website www.wabashnational.com. The conference call

will also be accessible by dialing 844-778-4139, participant code

5877386. A replay of the call will be available on the site

shortly after the conclusion of the presentation.

About Wabash National

Corporation

As the innovation leader of engineered solutions

for the transportation, logistics and distribution industries,

Wabash National Corporation (NYSE:WNC) is changing how the world

reaches you. Headquartered in Lafayette, Indiana, the company’s

mission is to enable customers to succeed with breakthrough ideas

and solutions that help them move everything from first to final

mile. Wabash National designs and manufactures a diverse range of

products, including: dry freight and refrigerated trailers,

platform trailers, bulk tank trailers, dry and refrigerated truck

bodies, structural composite panels and products, trailer

aerodynamic solutions, and specialty food grade and pharmaceutical

equipment. Its innovative products are sold under the following

brand names: Wabash National®, Beall®, Benson®, Brenner® Tank, Bulk

Tank International, DuraPlate®, Extract Technology®, Supreme®,

Transcraft®, Walker Engineered Products, and Walker Transport.

Learn more at www.wabashnational.com.

Safe Harbor Statement

This press release contains certain

forward-looking statements as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements convey

the Company’s current expectations or forecasts of future events.

All statements contained in this press release other than

statements of historical fact are forward-looking statements. These

forward-looking statements include, among other things, all

statements regarding the Company’s outlook for trailer and truck

body shipments, backlog, expectations regarding demand levels for

trailers, truck bodies, non-trailer equipment and our other

diversified product offerings, pricing, profitability and earnings,

cash flow and liquidity, opportunity to capture higher margin

sales, new product innovations, our growth and diversification

strategies, our expectations for improved financial performance

during the course of the year and our expectations with regards to

capital allocation. These and the Company’s other forward-looking

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from those implied

by the forward-looking statements. Without limitation, these risks

and uncertainties include the continued integration of Supreme into

the Company’s business, adverse reactions to the transaction by

customers, suppliers or strategic partners, uncertain economic

conditions including the possibility that customer demand may not

meet our expectations, increased competition, reliance on certain

customers and corporate partnerships, risks of customer pick-up

delays, shortages and costs of raw materials including the impact

of tariffs or other international trade developments, risks in

implementing and sustaining improvements in the Company’s

manufacturing operations and cost containment, dependence on

industry trends and timing, supplier constraints, labor costs and

availability, customer acceptance of and reactions to pricing

changes and costs of indebtedness. Readers should review and

consider the various disclosures made by the Company in this press

release and in the Company’s reports to its stockholders and

periodic reports on Forms 10-K and 10-Q.

WABASH NATIONAL

CORPORATIONCONSOLIDATED BALANCE

SHEETS(Unaudited - dollars in thousands)

|

|

December 31, 2019 |

|

December 31, 2018 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

140,516 |

|

|

$ |

132,690 |

|

|

Accounts receivable, net |

172,737 |

|

|

181,064 |

|

|

Inventories |

186,914 |

|

|

184,404 |

|

|

Prepaid expenses and other |

41,222 |

|

|

51,261 |

|

|

Total current assets |

541,389 |

|

|

549,419 |

|

| Property, plant, and

equipment, net |

221,346 |

|

|

206,991 |

|

| Goodwill |

311,026 |

|

|

311,084 |

|

| Intangible assets |

189,898 |

|

|

210,328 |

|

| Other assets |

40,932 |

|

|

26,571 |

|

|

Total assets |

$ |

1,304,591 |

|

|

$ |

1,304,393 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Current portion of long-term debt |

$ |

— |

|

|

$ |

1,880 |

|

|

Current portion of finance lease obligations |

327 |

|

|

299 |

|

|

Accounts payable |

134,821 |

|

|

153,113 |

|

|

Other accrued liabilities |

124,230 |

|

|

116,384 |

|

|

Total current liabilities |

259,378 |

|

|

271,676 |

|

| Long-term debt |

455,386 |

|

|

503,018 |

|

| Finance lease obligations |

378 |

|

|

714 |

|

| Deferred income taxes |

37,576 |

|

|

34,905 |

|

| Other non-current

liabilities |

30,885 |

|

|

20,231 |

|

|

Total liabilities |

783,603 |

|

|

830,544 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

|

Common stock, $0.01 par value: 200,000,000 shares authorized;

53,473,620 and 55,135,788 shares outstanding, respectively |

750 |

|

|

744 |

|

|

Additional paid-in capital |

638,917 |

|

|

629,039 |

|

|

Retained earnings |

221,841 |

|

|

150,244 |

|

|

Accumulated other comprehensive loss |

(3,978 |

) |

|

(3,343 |

) |

|

Treasury stock, at cost: 21,640,109 and 19,372,735 common shares,

respectively |

(336,542 |

) |

|

(302,835 |

) |

|

Total stockholders' equity |

520,988 |

|

|

473,849 |

|

|

Total liabilities and stockholders' equity |

$ |

1,304,591 |

|

|

$ |

1,304,393 |

|

WABASH NATIONAL

CORPORATIONCONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited - dollars in thousands, except per

share amounts)

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net sales |

$ |

579,001 |

|

|

$ |

610,196 |

|

|

$ |

2,319,136 |

|

|

$ |

2,267,278 |

|

| Cost of sales |

506,694 |

|

|

541,140 |

|

|

2,012,754 |

|

|

1,983,627 |

|

|

Gross profit |

72,307 |

|

|

69,056 |

|

|

306,382 |

|

|

283,651 |

|

| General and administrative

expenses |

26,272 |

|

|

21,194 |

|

|

108,274 |

|

|

95,114 |

|

| Selling expenses |

9,136 |

|

|

7,455 |

|

|

34,851 |

|

|

33,046 |

|

| Amortization of intangible

assets |

5,118 |

|

|

4,650 |

|

|

20,471 |

|

|

19,468 |

|

| Acquisition expenses |

— |

|

|

— |

|

|

— |

|

|

68 |

|

| Impairment |

— |

|

|

12,979 |

|

|

— |

|

|

24,968 |

|

|

Income from operations |

31,781 |

|

|

22,778 |

|

|

142,786 |

|

|

110,987 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense |

(6,517 |

) |

|

(7,110 |

) |

|

(27,340 |

) |

|

(28,759 |

) |

|

Other, net |

40 |

|

|

1,290 |

|

|

2,285 |

|

|

13,776 |

|

|

Other expense, net |

(6,477 |

) |

|

(5,820 |

) |

|

(25,055 |

) |

|

(14,983 |

) |

| Income before income tax |

25,304 |

|

|

16,958 |

|

|

117,731 |

|

|

96,004 |

|

| Income tax expense |

6,929 |

|

|

5,374 |

|

|

28,156 |

|

|

26,583 |

|

| Net income |

$ |

18,375 |

|

|

$ |

11,584 |

|

|

$ |

89,575 |

|

|

$ |

69,421 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.34 |

|

|

$ |

0.21 |

|

|

$ |

1.64 |

|

|

$ |

1.22 |

|

|

Diluted |

$ |

0.34 |

|

|

$ |

0.21 |

|

|

$ |

1.62 |

|

|

$ |

1.19 |

|

| Weighted average

common shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

Basic |

53,917 |

|

|

55,543 |

|

|

54,695 |

|

|

56,996 |

|

|

Diluted |

54,613 |

|

|

56,290 |

|

|

55,290 |

|

|

58,430 |

|

| |

|

|

|

|

|

|

|

| Dividends declared per

share |

$ |

0.080 |

|

|

$ |

0.080 |

|

|

$ |

0.320 |

|

|

$ |

0.305 |

|

WABASH NATIONAL

CORPORATIONCONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited - dollars in thousands)

| |

Year Ended December 31, |

|

|

2019 |

|

2018 |

|

Cash flows from operating activities |

|

|

|

|

Net income |

$ |

89,575 |

|

|

$ |

69,421 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation |

21,886 |

|

|

21,215 |

|

|

Amortization of intangibles |

20,471 |

|

|

19,468 |

|

|

Net gain on sale of property, plant and equipment |

(109 |

) |

|

(10,148 |

) |

|

Loss on debt extinguishment |

165 |

|

|

280 |

|

|

Deferred income taxes |

2,671 |

|

|

(2,976 |

) |

|

Stock-based compensation |

9,036 |

|

|

10,169 |

|

|

Non-cash interest expense |

1,045 |

|

|

1,745 |

|

|

Impairment of goodwill and other long-lived assets |

— |

|

|

24,968 |

|

|

Accounts receivable |

8,327 |

|

|

(39,539 |

) |

|

Inventories |

(2,510 |

) |

|

(18,713 |

) |

|

Prepaid expenses and other |

(2,536 |

) |

|

4,548 |

|

|

Accounts payable and accrued liabilities |

(2,887 |

) |

|

32,653 |

|

|

Other, net |

1,150 |

|

|

(620 |

) |

|

Net cash provided by operating activities |

146,284 |

|

|

112,471 |

|

|

Cash flows from investing activities |

|

|

|

|

Capital expenditures |

(37,645 |

) |

|

(34,009 |

) |

|

Proceeds from sale of property, plant and equipment |

785 |

|

|

17,776 |

|

|

Acquisitions, net of cash acquired |

— |

|

|

— |

|

|

Other, net |

— |

|

|

3,060 |

|

|

Net cash used in investing activities |

(36,860 |

) |

|

(13,173 |

) |

|

Cash flows from financing activities |

|

|

|

|

Proceeds from exercise of stock options |

848 |

|

|

961 |

|

|

Borrowings under senior notes |

— |

|

|

— |

|

|

Dividends paid |

(17,797 |

) |

|

(17,768 |

) |

|

Borrowings under revolving credit facilities |

619 |

|

|

937 |

|

|

Payments under revolving credit facilities |

(619 |

) |

|

(937 |

) |

|

Principal payments under finance lease obligations |

(308 |

) |

|

(290 |

) |

|

Proceeds from issuance of term loan credit facility |

— |

|

|

— |

|

|

Principal payments under term loan credit facility |

(50,470 |

) |

|

(1,880 |

) |

|

Principal payments under industrial revenue bond |

— |

|

|

(93 |

) |

|

Debt issuance costs paid |

(164 |

) |

|

(476 |

) |

|

Convertible senior notes repurchase |

— |

|

|

(80,200 |

) |

|

Stock repurchase |

(33,707 |

) |

|

(58,383 |

) |

|

Net cash (used in) provided by financing activities |

(101,598 |

) |

|

(158,129 |

) |

|

Cash and cash equivalents: |

|

|

|

|

Net increase (decrease) in cash, cash equivalents, and restricted

cash |

7,826 |

|

|

(58,831 |

) |

|

Cash, cash equivalents, and restricted cash at beginning of

year |

132,690 |

|

|

191,521 |

|

|

Cash, cash equivalents, and restricted cash at end of year |

$ |

140,516 |

|

|

$ |

132,690 |

|

WABASH NATIONAL

CORPORATIONSEGMENTS AND RELATED

INFORMATION(Unaudited - dollars in thousands)

|

Three Months Ended December 31, |

|

Commercial Trailer Products |

|

Diversified Products |

|

Final Mile Products |

|

Corporate and Eliminations |

|

Consolidated |

| 2019 |

|

|

|

|

|

|

|

|

|

|

|

New trailers shipped |

|

14,300 |

|

|

650 |

|

|

— |

|

|

— |

|

|

14,950 |

|

|

Used trailers shipped |

|

25 |

|

|

15 |

|

|

— |

|

|

— |

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Trailers |

|

$ |

386,037 |

|

|

$ |

51,222 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

437,259 |

|

|

Used Trailers |

|

199 |

|

|

301 |

|

|

— |

|

|

— |

|

|

500 |

|

|

Components, parts and service |

|

9,350 |

|

|

24,343 |

|

|

2,858 |

|

|

(7,447 |

) |

|

29,104 |

|

|

Equipment and other |

|

3,702 |

|

|

18,795 |

|

|

89,882 |

|

|

(241 |

) |

|

112,138 |

|

|

Total net external sales |

|

$ |

399,288 |

|

|

$ |

94,661 |

|

|

$ |

92,740 |

|

|

$ |

(7,688 |

) |

|

$ |

579,001 |

|

|

Gross profit |

|

$ |

50,384 |

|

|

$ |

16,324 |

|

|

$ |

6,239 |

|

|

$ |

(640 |

) |

|

$ |

72,307 |

|

|

Income (Loss) from operations |

|

$ |

43,135 |

|

|

$ |

5,610 |

|

|

$ |

(5,914 |

) |

|

$ |

(11,050 |

) |

|

$ |

31,781 |

|

| |

|

|

|

|

|

|

|

|

|

|

| 2018 |

|

|

|

|

|

|

|

|

|

|

|

New trailers shipped |

|

16,750 |

|

|

750 |

|

|

— |

|

|

— |

|

|

17,500 |

|

|

Used trailers shipped |

|

100 |

|

|

50 |

|

|

— |

|

|

— |

|

|

150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Trailers |

|

$ |

424,131 |

|

|

$ |

48,950 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

473,081 |

|

|

Used Trailers |

|

824 |

|

|

1,025 |

|

|

— |

|

|

— |

|

|

1,849 |

|

|

Components, parts and service |

|

9,214 |

|

|

27,141 |

|

|

2,628 |

|

|

(5,282 |

) |

|

33,701 |

|

|

Equipment and other |

|

4,498 |

|

|

25,206 |

|

|

71,904 |

|

|

(43 |

) |

|

101,565 |

|

|

Total net external sales |

|

$ |

438,667 |

|

|

$ |

102,322 |

|

|

$ |

74,532 |

|

|

$ |

(5,325 |

) |

|

$ |

610,196 |

|

|

Gross profit |

|

$ |

45,170 |

|

|

$ |

17,420 |

|

|

$ |

7,362 |

|

|

$ |

(896 |

) |

|

$ |

69,056 |

|

|

Income (Loss) from operations |

|

$ |

39,075 |

|

|

$ |

(6,111 |

) |

|

$ |

(1,463 |

) |

|

$ |

(8,723 |

) |

|

$ |

22,778 |

|

|

Twelve Months Ended December 31, |

|

Commercial Trailer Products |

|

Diversified Products |

|

Final Mile Products |

|

Corporate and Eliminations |

|

Consolidated |

| 2019 |

|

|

|

|

|

|

|

|

|

|

|

New trailers shipped |

|

54,650 |

|

|

2,850 |

|

|

— |

|

|

— |

|

|

57,500 |

|

|

Used trailers shipped |

|

75 |

|

|

75 |

|

|

— |

|

|

— |

|

|

150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Trailers |

|

$ |

1,464,636 |

|

|

$ |

198,043 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,662,679 |

|

|

Used Trailers |

|

435 |

|

|

2,044 |

|

|

— |

|

|

— |

|

|

2,479 |

|

|

Components, parts and service |

|

40,344 |

|

|

113,024 |

|

|

15,023 |

|

|

(27,902 |

) |

|

140,489 |

|

|

Equipment and other |

|

16,126 |

|

|

71,405 |

|

|

426,887 |

|

|

(929 |

) |

|

513,489 |

|

|

Total net external sales |

|

$ |

1,521,541 |

|

|

$ |

384,516 |

|

|

$ |

441,910 |

|

|

$ |

(28,831 |

) |

|

$ |

2,319,136 |

|

|

Gross profit |

|

$ |

177,190 |

|

|

$ |

74,588 |

|

|

$ |

57,815 |

|

|

$ |

(3,211 |

) |

|

$ |

306,382 |

|

|

Income (Loss) from operations |

|

$ |

145,877 |

|

|

$ |

29,748 |

|

|

$ |

9,804 |

|

|

$ |

(42,643 |

) |

|

$ |

142,786 |

|

| |

|

|

|

|

|

|

|

|

|

|

| 2018 |

|

|

|

|

|

|

|

|

|

|

|

New trailers shipped |

|

59,500 |

|

|

2,650 |

|

|

— |

|

|

— |

|

|

62,150 |

|

|

Used trailers shipped |

|

950 |

|

|

150 |

|

|

— |

|

|

— |

|

|

1,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Trailers |

|

$ |

1,473,583 |

|

|

$ |

164,790 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,638,373 |

|

|

Used Trailers |

|

9,618 |

|

|

3,514 |

|

|

— |

|

|

— |

|

|

13,132 |

|

|

Components, parts and service |

|

34,994 |

|

|

122,099 |

|

|

9,968 |

|

|

(21,811 |

) |

|

145,250 |

|

|

Equipment and other |

|

18,743 |

|

|

103,568 |

|

|

348,281 |

|

|

(69 |

) |

|

470,523 |

|

|

Total net external sales |

|

$ |

1,536,938 |

|

|

$ |

393,971 |

|

|

$ |

358,249 |

|

|

$ |

(21,880 |

) |

|

$ |

2,267,278 |

|

|

Gross profit |

|

$ |

168,343 |

|

|

$ |

68,428 |

|

|

$ |

48,771 |

|

|

$ |

(1,891 |

) |

|

$ |

283,651 |

|

|

Income (Loss) from operations |

|

$ |

141,793 |

|

|

$ |

(3,033 |

) |

|

$ |

7,909 |

|

|

$ |

(35,682 |

) |

|

$ |

110,987 |

|

WABASH NATIONAL

CORPORATIONSEGMENT and COMPANY FINANCIAL

INFORMATION(Unaudited - dollars in thousands)

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Commercial Trailer

Products |

|

|

|

|

|

|

|

|

Income from operations |

$ |

43,135 |

|

|

$ |

39,077 |

|

|

$ |

145,877 |

|

|

$ |

141,795 |

|

| |

|

|

|

|

|

|

|

| Diversified

Products |

|

|

|

|

|

|

|

|

Income from operations |

5,610 |

|

|

(6,111 |

) |

|

29,748 |

|

|

(3,033 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Impairment |

— |

|

|

12,979 |

|

|

— |

|

|

24,968 |

|

|

Adjusted operating income |

5,610 |

|

|

6,868 |

|

|

29,748 |

|

|

21,935 |

|

| |

|

|

|

|

|

|

|

| Final Mile

Products |

|

|

|

|

|

|

|

|

Income from operations |

(5,914 |

) |

|

(1,465 |

) |

|

9,804 |

|

|

7,907 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Acquisition expenses and related charges |

— |

|

|

— |

|

|

— |

|

|

751 |

|

|

Adjusted operating income |

(5,914 |

) |

|

(1,465 |

) |

|

9,804 |

|

|

8,658 |

|

| |

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

|

|

|

|

Income from operations |

(11,050 |

) |

|

(8,723 |

) |

|

(42,643 |

) |

|

(35,682 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Acquisition expenses and related charges |

— |

|

|

— |

|

|

— |

|

|

68 |

|

|

Executive severance |

— |

|

|

180 |

|

|

— |

|

|

180 |

|

|

Facility transactions |

— |

|

|

413 |

|

|

— |

|

|

413 |

|

|

Adjusted operating income |

(11,050 |

) |

|

(8,130 |

) |

|

(42,643 |

) |

|

(35,021 |

) |

| |

|

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

|

Income from operations |

31,781 |

|

|

22,778 |

|

|

142,786 |

|

|

110,987 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Impairment |

— |

|

|

12,979 |

|

|

— |

|

|

24,968 |

|

|

Acquisition expenses and related charges |

— |

|

|

— |

|

|

— |

|

|

819 |

|

|

Executive severance |

— |

|

|

180 |

|

|

— |

|

|

180 |

|

|

Facility transactions |

— |

|

|

413 |

|

|

— |

|

|

413 |

|

|

Adjusted operating income |

$ |

31,781 |

|

|

$ |

36,350 |

|

|

$ |

142,786 |

|

|

$ |

137,367 |

|

WABASH NATIONAL

CORPORATIONRECONCILIATION OF GAAP FINANCIAL

MEASURES TONON-GAAP FINANCIAL

MEASURES(Unaudited - dollars in thousands, except per

share amounts)

| Operating

EBITDA1: |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income |

$ |

18,375 |

|

|

$ |

11,584 |

|

|

$ |

89,575 |

|

|

$ |

69,421 |

|

| Income tax expense |

6,929 |

|

|

5,374 |

|

|

28,156 |

|

|

26,583 |

|

| Interest expense |

6,517 |

|

|

7,110 |

|

|

27,340 |

|

|

28,759 |

|

| Depreciation and

amortization |

10,746 |

|

|

10,164 |

|

|

42,357 |

|

|

40,683 |

|

| Stock-based compensation |

1,674 |

|

|

1,690 |

|

|

9,036 |

|

|

10,169 |

|

| Impairment |

— |

|

|

12,979 |

|

|

— |

|

|

24,968 |

|

| Acquisition expenses |

— |

|

|

— |

|

|

— |

|

|

68 |

|

| Other non-operating

income |

(40 |

) |

|

(1,290 |

) |

|

(2,285 |

) |

|

(13,776 |

) |

| Operating EBITDA |

$ |

44,201 |

|

|

$ |

47,611 |

|

|

$ |

194,179 |

|

|

$ |

186,875 |

|

| Adjusted Net

Income2: |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income |

$ |

18,375 |

|

|

$ |

11,584 |

|

|

$ |

89,575 |

|

|

$ |

69,421 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Facility transactions3 |

— |

|

|

194 |

|

|

— |

|

|

(10,585 |

) |

|

Loss on debt extinguishment |

— |

|

|

106 |

|

|

— |

|

|

280 |

|

|

Impairment |

— |

|

|

12,979 |

|

|

— |

|

|

24,968 |

|

|

Acquisition expenses and related charges |

— |

|

|

— |

|

|

— |

|

|

819 |

|

|

Executive severance expense |

— |

|

|

180 |

|

|

— |

|

|

180 |

|

|

Tax effect of aforementioned items |

— |

|

|

(3,499 |

) |

|

— |

|

|

(4,072 |

) |

|

Tax reform and other discrete tax adjustments |

— |

|

|

— |

|

|

— |

|

|

3,084 |

|

| Adjusted net income |

$ |

18,375 |

|

|

$ |

21,544 |

|

|

$ |

89,575 |

|

|

$ |

84,095 |

|

| Adjusted Diluted

Earnings Per Share2: |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Diluted earnings per share |

$ |

0.34 |

|

|

$ |

0.21 |

|

|

$ |

1.62 |

|

|

$ |

1.19 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Facility transactions3 |

— |

|

|

— |

|

|

— |

|

|

(0.18 |

) |

|

Loss on debt extinguishment |

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

|

Impairment |

— |

|

|

0.23 |

|

|

— |

|

|

0.43 |

|

|

Acquisition expenses and related charges |

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

|

Executive severance expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Tax effect of aforementioned items |

— |

|

|

(0.06 |

) |

|

— |

|

|

(0.07 |

) |

|

Tax reform and other discrete tax adjustments |

— |

|

|

— |

|

|

— |

|

|

0.05 |

|

| Adjusted diluted earnings per

share |

$ |

0.34 |

|

|

$ |

0.38 |

|

|

$ |

1.62 |

|

|

$ |

1.44 |

|

| |

|

|

|

|

|

|

|

| Weighted Average # of Diluted

Shares O/S |

54,613 |

|

|

56,290 |

|

|

55,290 |

|

|

58,430 |

|

1Operating EBITDA is defined as earnings before

interest, taxes, depreciation, amortization, stock-based

compensation, acquisition expenses and related charges,

impairments, and other non-operating income and expense.2Adjusted

net income and adjusted earnings per diluted share reflect

adjustments for acquisition expenses, the losses attributable to

the Company’s extinguishment of debt, impairment charges, executive

severance costs, income or losses recognized on the sale and/or

closure of former Company locations, adjustments related to the

Company’s deferred tax assets as a result of IRS guidance on

application of the Tax Cuts and Jobs Act of 2017, and reversal of

reserves for uncertain tax positions.3Facility transactions in 2018

relate to gains and/or losses incurred for the sale or closure of

former Company locations.

WABASH NATIONAL

CORPORATIONRECONCILIATION OF FREE CASH FLOW

ANDFREE CASH FLOW CONVERSION(Unaudited -

dollars in thousands)

| |

Twelve Months Ended December 31, |

| |

2019 |

|

2018 |

|

Net cash provided by operating activities |

$ |

146,284 |

|

|

$ |

112,471 |

|

| Capital expenditures |

(37,645 |

) |

|

(34,009 |

) |

| Free cash flow1 |

$ |

108,639 |

|

|

$ |

78,462 |

|

| |

|

|

|

| Free cash flow |

$ |

108,639 |

|

|

$ |

78,462 |

|

| Divided by: Net income |

$ |

89,575 |

|

|

$ |

69,421 |

|

| Free cash flow

conversion2 |

121 |

% |

|

113 |

% |

1 Free cash flow is defined as net cash provided by operating

activities minus capital expenditures.2 Free cash flow conversion

is defined as free cash flow divided by net income.

WABASH NATIONAL

CORPORATIONRECONCILIATION OF ADJUSTED SEGMENT

EBITDA1AND ADJUSTED SEGMENT EBITDA

MARGIN1(Unaudited - dollars in thousands)

| |

Commercial Trailer Products |

|

Diversified Products |

|

Final Mile Products |

| Twelve Months Ended

December 31, |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Income (Loss) from operations |

$ |

145,877 |

|

|

$ |

141,795 |

|

|

$ |

29,748 |

|

|

$ |

(3,033 |

) |

|

$ |

9,804 |

|

|

$ |

7,907 |

|

| Depreciation and

amortization |

10,667 |

|

|

9,631 |

|

|

18,621 |

|

|

21,177 |

|

|

11,361 |

|

|

8,314 |

|

| Impairment |

— |

|

|

— |

|

|

— |

|

|

24,968 |

|

|

— |

|

|

— |

|

| Acquisition expenses and

related charges |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

751 |

|

| Adjusted Segment EBITDA |

$ |

156,544 |

|

|

$ |

151,426 |

|

|

$ |

48,369 |

|

|

$ |

43,112 |

|

|

$ |

21,165 |

|

|

$ |

16,972 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Segment EBITDA

Margin |

10.3 |

% |

|

9.9 |

% |

|

12.6 |

% |

|

10.9 |

% |

|

4.8 |

% |

|

4.7 |

% |

1 Adjusted Segment EBITDA, a non-GAAP financial

measure, is calculated by adding back segment depreciation and

amortization expense to segment operating income (loss), and

excludes certain costs, expenses, other charges, gains or income

that are included in the determination of operating income under

GAAP, but that management would not consider important in

evaluating the quality of the Company’s segment operating results

as they are not indicative of each segment's core operating results

or may obscure trends useful in evaluating the segment's continuing

activities. Adjusted Segment EBITDA Margin is calculated by

dividing Adjusted Segment EBITDA by segment total net sales.

Media Contact:Dana StelselDirector, Corporate

Communications(765) 771-5766dana.stelsel@wabashnational.com

Investor Relations:Ryan ReedDirector of

Investor Relations(765) 771-5805ryan.reed@wabashnational.com

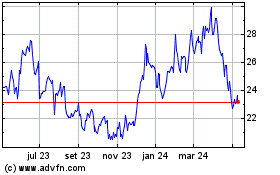

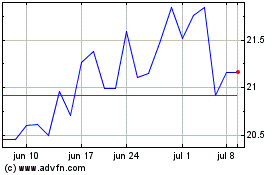

Wabash National (NYSE:WNC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Wabash National (NYSE:WNC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024