VGP NV: Notice of the Annual and Extraordinary Shareholders’

Meeting

Press Release

Antwerp (Berchem), 8 April 2020, 07h00

CET

The shareholders are hereby invited to attend the

annual and extraordinary shareholders’ meeting of the Company which

shall take place at registered office of the Company, at

Uitbreidingstraat 72, 2600 Antwerp, Belgium, on Friday 8 May

2020 at 10:00 am, with following agenda and proposed

resolutions:

Information note:

The board of directors closely monitors the

evolution of the Covid-19 pandemic and the sanitary regulations

issued by the Belgian authorities in this regard and continues to

evaluate the impact thereof on the organisation of the

shareholders’ meetings.

The board of directors has at this stage decided

not to postpone the shareholders’ meetings. The Company will

however take appropriate measures to ensure that the shareholders’

meetings take place in compliance with the sanitary regulations and

taking into account any health and safety concerns.

To that effect and to the maximum extent

permitted by law, shareholders will not be allowed to attend the

meetings in person. No reception will be held. Shareholders are

required to vote prior to the meetings taking place, either

remotely via letter or via proxy granted to Mr. Dirk Stoop, the

Company’s CFO.

The board of directors may decide to facilitate

virtual shareholders’ meetings, in which case shareholders may be

allowed to attend via electronical means.

Depending on the evolution of the Covid-19

situation in the coming weeks and the adoption of any Belgian law

or decree applicable to the organisation of shareholders’ meetings,

the Company may communicate further in relation to the attendance

and organisation of the meetings by way of a press release.

A.

Annual shareholders’ meeting:

AGENDA AND PROPOSED

RESOLUTIONS

- Acknowledgement and discussion of the annual report of the

board of directors and the report of the auditor on the annual

accounts for the financial year ending

31 December 2019.

- Acknowledgement and approval of the remuneration report for the

financial year ending 31 December 2019.

Proposed resolution: The

general meeting approves the remuneration report for the financial

year ending 31 December 2019.

3. Acknowledgement and

approval of the annual accounts for the financial year ending

31 December 2019 and allocation of the

results.Proposed resolution: The general meeting

approves the annual accounts for the financial year ending

31 December 2019. The general meeting approves the

allocation of the results as proposed by the board of directors,

including the payment of a gross dividend for a total amount of EUR

60,394,912.50. The determination of the payment date as well as all

other formalities relating to the payment of the dividend are

delegated to the board of directors.

- Acknowledgment and discussion of the annual report of

the board of directors and the report of the auditor on the

consolidated annual accounts for the financial year ending

31 December 2019.

- Acknowledgment of the consolidated annual accounts for the

financial year ending 31 December 2019.

- Release from liability to be granted to the directors and to

the respective permanent representatives of the legal

entity-directors.

Proposed resolution: The

general meeting resolves, by a separate vote, that the directors

and the respective permanent representatives of the legal

entity-directors be released from any liability arising from the

performance of their duties during the financial year ending

31 December 2019.

7. Release from liability

to be granted to the auditor.Proposed resolution:

The general meeting resolves that the auditor be released from any

liability arising from the performance of its duties during the

financial year ending 31 December 2019.

8. Reappointment of

Deloitte Bedrijfsrevisoren / Reviseurs d’Entreprises CVBA as

auditor of the Company given the expiry of its mandate and

determination of the auditor’s remuneration.Proposed

resolution: The general meeting resolves (i) to re-appoint

Deloitte Bedrijfsrevisoren CVBA, with registered office at Gateway

Building, Luchthaven Brussel Nationaal 1J, 1930 Zaventem, Belgium,

represented by Mrs. Kathleen De Brabander, as auditor of the

Company for a period of 3 years, with immediate effect and until

the closing of the annual meeting which will be held in the year

2023 and at which the decision will be taken to approve the annual

accounts closed at 31 December 2022 and (ii) to determine the

annual remuneration of the auditor at EUR 159,700 for the audit of

the statutory and the consolidated accounts. This amount is

exclusive of expenses and VAT, and is subject to an annual

indexation as from 2021 and to an annual review reflecting any

changes in the audit scope which would be required to ensure that

such audit scope remains aligned with the evolution of the VGP

group.

9. Resignation of Mrs.

Ann Gaeremynck as an independent director of the

Company.Proposed resolution: The general meeting

approves the resignation of Mrs. Ann Gaeremynck, residing at

Dadizelestraat 43, 8560 Moorsele, Belgium, as an independent

director of the Company.

10.

Appointment of GAEVAN BV, with permanent representative Mrs. Ann

Gaeremynck as independent director of the Company.Proposed

resolution: The general meeting approves the appointment

of GAEVAN BV, with registered office at Dadizelestraat 43, 8560

Wevelgem, Belgium, permanently represented by Mrs. Ann Gaeremynck,

as an independent director of the Company in the meaning of and

meeting the conditions stipulated in article 7:87 of the Code of

Companies and Associations (the “CCA”), for a

period of 3 years with immediate effect and until the closing of

the annual meeting which will be held in the year 2023 and at which

the decision will be taken to approve the annual accounts closed at

31 December 2022.

11. Determination

of an increased annual fixed remuneration for all directors of the

Company.Proposed resolution: The general meeting

approves the proposal of the board of directors with regard to the

increased annual fixed remuneration of EUR 75,000 per director of

the Company.

B.

Extraordinary shareholders’ meeting:

AGENDA AND PROPOSED

RESOLUTIONS

1. Amendment to the

articles of association as a consequence of a change in the time at

which the ordinary general meeting is held.

The board of directors proposes to change the

time at which the ordinary general meeting (also called the annual

meeting) of the Company is held from 17h00 to 10h00. The date of

the annual meeting remains unchanged.

Proposed resolution: The

shareholders’ meeting resolves to hold the annual meeting on the

second Friday of May at 10 a.m.; the time at which the annual

meeting is held is adapted accordingly in the articles of

association of the Company.

2. Amendment to the

articles of association as a consequence of a change to the

external representation.

The Board of Directors proposes to amend the

provisions of the articles of association relation to the external

representation of the Company by deleting the current

representation powers of the chairman of the Board of

Directors.

Proposed resolution: The

shareholders’ meeting resolves to amend the rules on external

representation in such a way that the Company can henceforth only

be validly represented externally vis-à-vis third parties by either

two directors acting jointly or a managing director acting alone;

the relevant provision of the articles of association is amended

accordingly.

3. Amendments to the

articles of association as a consequence of the newly applicable

CCA.

Pursuant to Article 39, §1, first paragraph, and

§2 of the law of 23 March 2019 introducing the CCA, as from 1

January 2020, the Company is subject to the provisions of the CCA

by operation of law and, in accordance with Article 39, §1, third

paragraph, of the aforementioned law, is legally obliged to bring

its articles of association into line with the provisions of the

CCA on the occasion of the next amendment of the articles of

association after 1 January 2020.

The board of directors therefore proposes,

following the amendments to the articles of association proposed in

the previous agenda items 1 and 2, to bring the articles of

association of the Company fully in line with the CCA while

retaining the legal form of a listed limited liability company with

a classic one-tier board structure and without altering the object

(i.e. the former purpose), except for terminological changes.

Proposed resolution: The

shareholders’ meeting resolves to fully revise the articles of

association of the Company and to adopt and approve a new text of

the articles of association in accordance with the provisions of

the CCA for a listed limited liability company with a classic

one-tier board and with the introduction of a double voting right

for shareholders who qualify for this by law and in particular

taking into account the amendments to the existing articles of

association as specifically set out below as well as the amendments

to the articles of association pursuant to the previous agenda

items 1 and 2 as well as agenda items 4 and 5 below. The full text

of the new articles of association is available on the Company's

website (www.vgpparks.eu). Every shareholder can request an

electronic copy free of charge via info@vgpparks.eu.

The specific amendments to the existing articles

of association are as follows (where relevant or clarifying,

reference is made to the number of the article in the current

coordinated articles of association drawn up on 10/05/2019):

- In Article 1 ('Legal form - Name'), the

designation of the Company as 'a public limited company carrying

out public calls for investments' is deleted; it is replaced by the

fact that the Company is a 'listed company'.- In Article 2

("Registered office"), the Region where the registered office of

the Company is located is added and the address of the registered

office is deleted along with the other statutory provisions

relating to the transfer of registered office and the holding of

any other offices, so that the new provisions of the CCA will apply

in this respect.- In Article 3 of the Dutch language version of the

articles of association only ("Purpose"/”Doel”), the term

"purpose"/"doel”, including in the title, is replaced by the new

term "object"/"voorwerp”, confirming, to the extent necessary, that

in accordance with the new relevant provisions and terminology, the

Company has no other purpose than to distribute or provide a direct

or indirect financial benefit to its shareholders.- Amendment to

the provisions of the articles of association relating to capital

increase and preferential subscription right in compliance with the

new provisions in this respect in the WVV (amendment of articles 6

and 7).- Amendment to the provisions of the articles of association

relating to paid-up capital (amendment of Article 8).- Addition in

the articles of association of the possibility to keep the share

register in electronic form and deletion of the redundant

provisions of the articles of association concerning dematerialised

shares, so that the new provisions of the CCA will apply in this

respect (amendment article 9).- Deletion of all provisions of the

articles of association relating to the notification and disclosure

of major shareholdings and the statutory threshold of three percent

(3%) in addition to the thresholds with respect to transparency

obligations imposed by law (amendment article 14).- Amendment to

the provisions of the articles of association relating to the

composition, operation, decision-making, powers and external

representation of the board of directors in accordance with the

specific new provisions in the CCA for a listed limited liability

company with a one-tier board of directors, including amendment to

the provisions concerning the mandatory designation of a permanent

representative by legal entity-directors, proxies for directors,

unanimous writing resolutions by directors, with the addition of

the possibility of meetings of the board of directors by means of

tele- and videoconferencing (amendment articles 15 to 17).-

Deletion of the existing possibility in the articles of association

of setting up an executive committee, which has been abolished

under the new law, including deletion of the statutory provision on

the executive committee's representation power (deletion of Article

18).- Amendment to the provisions of the articles of association

relating to the powers of and representation by the daily

management in accordance with the new provisions in this respect in

the CCA (amendment article 17).- Amendment to the remuneration

scheme for directors, including application of the possibility for

listed companies to deviate in the articles of association from the

arrangements set out in article 7:91 CCA (amendment article 20).-

Amendment to the provisions of the articles of association relating

to the audit of the Company in accordance with the new provisions

in the CCA (amendment article 21).- Amendment to the provisions of

the articles of association relating to the organisation and powers

of the shareholders’ meeting in accordance with the specific new

provisions in the CCA for a listed limited liability company with

introduction and addition in the articles of association of new

regulations concerning (i) participation to the shareholders’

meeting by electronic means in accordance with article 7:137 of the

CCA, (ii) remote voting prior to the shareholders’ meeting in

accordance with article 7:146 of the CCA and (iii) double voting

rights for shareholders who qualify for this by law in accordance

with article 7:53 of the CCA (amendment articles 22 to 27 and 29 to

34).- Amendment to the provisions of the articles of association

relating to the authority of the board of directors to adjourn

shareholders’ meetings (amendment article 28).- Deletion of the

provisions of the articles of association relating to the documents

and reports to be drawn up at the close of the financial year, so

that the new provisions of the CCA will apply in this respect

(deletion of article 35 as from the second paragraph).- Amendment

to the authorisation of the board of directors to pay interim

dividends in accordance with the new provisions in this respect in

the CCA (amendment article 38).- Deletion of the provisions of the

articles of association relating to prohibited dividend so that the

new provisions of the CCA will apply in this respect (deletion of

Article 39 in full).- Deletion of the provisions of the articles of

association relating to the alarm bell procedure so that the new

provisions of the CCA will apply in this respect (deletion of

article 40 in full).- Amendment to the provisions of the articles

of association relating to winding up and liquidation of the

Company in accordance with the new provisions in this respect in

the CCA (amendment article 41).- Amendment to the provisions of the

articles of association relating to the choice of domicile in

accordance with the new provisions in this respect in the CCA

(amendment article 42).- Amendment to the provisions of the

articles of association relating to applicable law (amendment of

Article 43).- Addition in the articles of association of new

provisions on written communication from and with the Company.

- Renewal of the authorizations regarding authorised

capital and corresponding amendments to the articles of association

of the Company.

4.1.

Preliminary acknowledgment of the report of the board of directors

in accordance with article 7:199 of the CCA setting out the

specific circumstances in which the board of directors is allowed

to make use of the authorised capital and the reasons

therefore.

4.2.

Renewal of the authorisations of the board of directors with

respect to the authorised capital and corresponding amendment to

the articles of association of the Company.

Proposed resolution: The

existing authorisation of the board of directors with regard to the

authorised capital will be withdrawn as from the entry into force

of the new authorisation mentioned hereinafter. Subsequently, the

shareholders’ meeting grants to the board of directors the power,

in the broadest sense permitted under articles 7:200 and 7:201

of the CCA, to increase the capital in one or more times

without the cumulative amount of these increases exceeding a total

amount of ninety-two million, six hundred sixty-six thousand eight

hundred fifteen euros (EUR 92,666,815.00) for a period of five (5)

years as from the publication of this decision. The board of

directors will also be authorised to use these powers for a period

of three (3) years in the circumstances described in

article 7:202 of the CCA. The existing temporary provisions of

the articles of association in this respect will be replaced in

full by the new provisions as included in the new articles of

association of the Company referred to in agenda item 3.

- Renewal of the authorisation of the board of

directors regarding the acquisition and divestment of the Company’s

treasury shares and corresponding amendment to the articles of

association of the Company.

5.1.

Renewal of the authorisation of the board of directors regarding

the acquisition and disposal of the Company’s own shares in case of

impending serious harm.

Proposed resolution: The

existing authorisation of the board of directors with regard to the

acquisition and disposal of the Company’s own shares will be

withdrawn as from the entry into force of the new authorisation

mentioned hereinafter. Subsequently, the shareholders’ meeting

resolves to renew, for a period of three (3) years as from the date

of publication of this decision, the powers granted to the board of

directors to acquire and dispose of the Company’s own shares

without a prior resolution of the shareholders’ meeting thereto in

case the acquisition or disposal is necessary to prevent impending

serious harm to the Company.

5.2.

Renewal of the authorisation of the board of directors to acquire

the Company’s own shares.

Proposed resolution: The

existing authorisation of the board of directors with regard to the

acquisition of the Company’s treasury shares will be withdrawn as

from the entry into force of the new authorisation mentioned

hereinafter. Subsequently, the shareholders’ meeting resolves to

renew, for a period of five (5) years as from the publication of

this decision, the powers granted to the board of directors in

order to acquire a maximum number of shares which added together

does not amount to more than twenty percent (20%) of the issued

capital at a price per share which may not be higher than the

maximum price permitted by applicable law and which may not be

lower than 1 eurocent (EUR 0.01). Moreover, this authorisation also

applies to the acquisition of the Company’s shares by one of its

directly controlled subsidiary companies in accordance with

applicable law.

5.3.

Authorisation of the board of directors to dispose of the Company’s

own shares by way of an offer to sell directed to one or more

particular persons other than members of the personnel of the

Company or one of its subsidiaries

Proposed resolution: The

shareholders’ meeting resolves to grant the authorisation to the

board of directors to dispose of the Company’s own shares by way of

an offer to sell directed to one or more particular persons other

than members of the personnel of the Company or one of its

subsidiaries.

5.4.

Amendment to the articles of association as a consequence of the

above-mentioned decisions.

Proposed resolution: The

shareholders’ meeting resolves to replace the existing provisions

of the articles of association relating to the acquisition and

disposal of own shares in full by the new provisions as included in

the new articles of association of the Company referred to in

agenda item 3.

6. Approval of change of

control clauses.

In

accordance with article 7:151 of the CCA, the shareholders’ meeting

is requested to approve (i) condition 6.2 of the terms and

conditions of the bonds issued by the Company on 2 December 2019,

as set out in part V of the prospectus dated 19 November 2019 for

the public offer of the bonds, and in particular the change of

control clauses included therein and (ii) the change of control

clause as set out in the J.P. Morgan loan agreement entered into on

8 November 2019 by the Company and J.P. Morgan Securities plc (as

“Arranger”).

Proposed resolution: The

shareholders’ meeting resolves to approve, in accordance with

article 7:151 of the CCA, (i) condition 6.2 of the terms and

conditions of the bonds issued by the Company on 2 December 2019,

as set out in Part V of the prospectus dated 19 November 2019 for

the public offer of the bonds, pertaining to the possibility for

the bondholders to require the Company to redeem the bonds in case

of a change of control and (ii) the change of control clause as set

out in the J.P. Morgan loan agreement entered into on 8 November

2019 by the Company and J.P. Morgan Securities plc (as “Arranger”).

In accordance with the requirements of article 7:151, second

indent, of the CCA, this resolution shall be filed in accordance

with article 2:8 of the CCA and shall be published as an

announcement in the Belgian State Gazette by including an extract

of the minutes of this shareholders’ meeting in accordance with

article 2:14, 4° of the CCA.

- Special powers of attorney.

7.1.

Power of attorney to the board of directors to execute the above

decisions.

Proposed resolution: The

shareholders’ meeting resolves to grant the broadest powers to the

board of directors and/or one or more designated directors to

execute the decisions taken by the shareholders’ meeting regarding

the above agenda items.

7.2.

Power of attorney for the representation of the Company with the

Crossroad Bank for Enterprises, counters for enterprises, registers

of the enterprise court, administrative agencies and fiscal

administrations.

Proposed resolution: The

shareholders’ meeting resolves to grant authority to any member of

the board of directors and/or Mr Dirk Stoop, as well as to the

instrumenting notary, acting individually, with power of

substitution, to fulfil all necessary formalities with regard to

the legally required publication formalities regarding the

decisions taken by the shareholders’ meeting with the Crossroad

Bank for Enterprises, counters for enterprises, registers of the

enterprise courts, administrative agencies and fiscal

administrations.

Conditions of admission to the annual

and extraordinary shareholders’ meeting

Shareholders may only

participate in the annual and extraordinary shareholders’ meeting

and exercise their voting rights if the following two conditions

are satisfied:

(i) Based on the proof

submitted in accordance with the registration procedure set out

below, the Company must be able to determine that at midnight

(24:00) (CET) on the Record Date, 24 April 2020 (the

“Record Date”), you owned the number of shares for

which you intend to participate in the annual and extraordinary

shareholders’ meeting.

(ii)

On 2 May 2020 at the

latest, you must explicitly confirm to the Company that you intend

to participate in the annual and extraordinary shareholders’

meeting.

These conditions must

be satisfied in accordance with the formalities mentioned

below.

1. Holders of registered

sharesIn accordance with article 7:134, §2 of the CCA and article

24 of the articles of association the holders of registered shares

are entitled to participate in and to vote at the annual and

extraordinary shareholders’ meeting, provided that:

- their shares are recorded in their name in the register of

registered shares at midnight (24:00) (CET) on the Record Date,

24 April 2020, and this irrespective of the number of

shares that they own on the date of the annual and extraordinary

shareholders’ meeting; and

- they notify the Company in writing of (i) their intention to

participate in the annual and extraordinary shareholders’ meeting,

and (ii) the number of securities for which they wish to

participate in the annual and extraordinary shareholders’ meeting,

by means of a signed form that must be received by the Company at

the Company’s registered office at the latest on

2 May 2020; a model of this form is available at the

Company’s registered office and on the Company’s website under the

tab “Investors - Shareholders Meetings” (www.vgpparks.eu).

2. Holders of dematerialized

sharesIn accordance with article 7:134, §2 of the CCA and article

24 of the articles of association the holders of dematerialized

shares are entitled to participate in and to vote at the annual and

extraordinary shareholders’ meeting, provided that:

- their shares are recorded in their name in the accounts of a

recognized account holder or a settlement institution at midnight

(24:00) (CET) on the Record Date, 24 April 2020, and this

irrespective of the number of shares that they own on the date of

the annual and extraordinary shareholders’ meeting; and

- at the latest on 2 May 2020, they provide the Company

(at the Company’s registered office) with, or arrange for the

Company (at the Company’s registered office) to be provided with, a

certificate issued by the recognized account holder or the

settlement institution certifying the number of dematerialized

shares recorded in the shareholder’s accounts on the Record Date in

respect of which the shareholder has indicated his intention to

participate in the annual and extraordinary shareholders’

meeting.

Only persons who are a shareholder of the

Company on the Record Date (24 April 2020) and who have

indicated, on 2 May 2020 at the latest, their intention to

participate in the annual and extraordinary shareholders’ meeting

as set out above will be allowed to participate in the

shareholders’ meeting. We point out to the shareholders that 2 May

2020 is a Saturday and that 1 May 2020 is a public holiday and

that, as the case may be, they should make the necessary

arrangements to fulfil the required formalities before, on 30 April

2020.

The shares are not blocked as a result of the

above-mentioned process. As a result, the shareholders are free to

dispose of their shares after the Record Date.

Right to add agenda items and to submit

proposed resolutions

In accordance with article 7:130 of the CCA, one

or more shareholders holding jointly at least three per cent (3%)

of the capital of the Company may request items to be added to the

agendas of the shareholders’ meeting and submit proposed

resolutions in relation to existing agenda items or new items to be

added to the agenda, provided that:

- they prove ownership of such shareholding as at the date of

their request and record their shares representing such

shareholding on the Record Date (i.e., on 24 April 2020);

the shareholding must be proven either by a certificate evidencing

the registration of the relevant shares in the register of

registered shares of the Company or by a certificate issued by a

recognized account holder or a settlement institution certifying

the book-entry of the relevant number of dematerialized shares in

the name of the relevant shareholder(s);

- the additional agenda items and/or proposed resolutions have

been submitted in writing by these shareholder(s) to the board of

directors at the latest on 16 April 2020.

These additional agenda items and/or proposed

resolutions may be delivered to the Company by mail sent to the

Company’s registered office for the attention of Mr Dirk Stoop or

by e-mail sent to dirk.stoop@vgpparks.eu. The Company shall confirm

the receipt of the proposed requests, by e-mail or by mail to the

address mentioned by the shareholder, within 48 hours.

As the case may be, the Company shall publish

the modified agenda of the shareholders’ meeting, together with the

ad-hoc proxy form and the remote voting form, completed with the

additional agenda items and/or proposed resolutions on the website

of the Company (www.vgpparks.eu) at the latest on

23 April 2020.

The proxies and remote votes that were notified

to the Company prior to the publication of a completed agenda,

remain valid for the agenda items for which they were granted /

submitted. Exception is made for agenda items for which new

proposed resolutions have been submitted, in accordance with

article 7:130 of the CCA: in such case the proxy holder may deviate

during the shareholders’ meeting of the instructions of the

shareholder granting the proxy, if the execution of such

instructions would prejudice the interests of the shareholder. The

proxy holder must inform the shareholder thereof. The proxy must

indicate whether the proxy holder is authorised to vote on new

agenda items or whether he should abstain from voting.

Right to ask questions

In accordance with article 7:139 of the CCA and

article 29 of the articles of association, all shareholders are

entitled, whether during the meeting or in writing before the

meeting, to ask questions to the directors with respect to their

reports as referred to in the agendas of the annual and

extraordinary shareholders’ meeting or the agenda items and to the

auditor with respect to its report as referred to in the agenda of

the annual shareholders’ meeting. To ensure that the shareholders’

meetings are organised in a way that is compliant with the sanitary

measures issued in relation to the COVID-19 crisis and taking into

account general health and safety considerations, shareholders are

requested to submit their questions in writing before the

meeting.

Questions asked in writing will only be answered

if the relevant shareholder has fulfilled the formalities set out

above to be admitted to the annual and extraordinary shareholders’

meeting and if the written question has been received by the

Company at the latest on 2 May 2020.

Written questions may be delivered to the

Company by mail sent to the Company’s registered office for the

attention of Mr Dirk Stoop or by e-mail sent to

dirk.stoop@vgpparks.eu.

Proxy

In accordance with article 25 of the articles of

association, each shareholder may be represented at the

shareholders’ meeting by a proxy holder, who does not need to be a

shareholder. To ensure that the shareholders’ meetings are

organised in a way that is compliant with the sanitary measures

issued in relation to the COVID-19 crisis and taking into account

general health and safety considerations, shareholders may only

appoint Mr. Dirk Stoop, the Company’s CFO, as their proxy.

Shareholders who wish to be represented by

proxy, are requested to use the model of proxy form (with voting

instructions) that is available at the Company’s registered office

and on the Company’s website under the tab “Investors -

Shareholders Meetings” (www.vgpparks.eu).

Notification of the proxy to the Company must

occur in writing, either by mail sent to the Company’s registered

office for the attention of Mr Dirk Stoop or by e-mail sent to

dirk.stoop@vgpparks.eu.

The signed proxy form must in original be

received by the Company at the Company’s registered office at the

latest on 2 May 2020.

Shareholders who wish to be represented by

proxy, must have fulfilled the formalities set out above to be

admitted to the annual and extraordinary shareholders’ meeting

(registration- and confirmation procedure).

Remote voting

To ensure that the shareholders’ meetings are

organised in a way that is compliant with the sanitary measures

issued in relation to the COVID-19 crisis and taking into account

general health and safety considerations, shareholders may

exceptionally vote remotely by letter prior to the shareholders’

meetings, by means of a form that is available at the Company’s

registered office and on the Company’s website under the tab

“Investors - Shareholders Meetings” (www.vgpparks.eu).

The signed remote voting form must be delivered

to the Company, either by mail sent to the Company’s registered

office for the attention of Mr Dirk Stoop or by e-mail sent to

dirk.stoop@vgpparks.eu, and must be received by the Company at the

latest on 2 May 2020.

Availability of the

documents

In accordance with article 7:132 of the CCA, the

shareholders of the Company can, as of 8 April 2020, upon

presentation of their security or of a certificate issued by a

recognized account holder or a settlement institution certifying

the number of dematerialized shares recorded in the name of the

shareholder, obtain at the Company’s registered office

(Uitbreidingstraat 72 box 7, 2600 Berchem (Antwerp)), free of

charge, a copy of the documents and reports that relate to this

meeting or that must be made available to them pursuant to law.

Requests to obtain copies, free of charge, may

also in writing or electronically by mail or by e‑mail for the

attention of:

Mr Dirk Stoop Telephone: +32 3 289 14 34 Fax:

+32 3 289 14 39 E-mail: dirk.stoop@vgpparks.eu

All the relevant information with regard to the

annual and extraordinary shareholders’ meeting, including all of

the reports and documents, referred to in the items of the agenda

of the annual and extraordinary shareholders’ meeting, as well as

the aforementioned proxy forms, are available on the website of the

Company (www.vgpparks.eu) as of 8 April 2020.

The board of directors

CONTACT DETAILS FOR INVESTORS

AND MEDIA ENQUIRIES

|

Martijn Vlutters (VP – Business Development & Investor

Relations) |

Tel: +32 (0)3 289 1433 |

|

Petra Vanclova (External Communications) |

Tel: +42 0 602 262 107 |

ABOUT VGP

VGP is a leading pan-European developer, manager

and owner of high-quality logistics and semi-industrial real

estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain. The

company has an development land bank (owned or committed) of 6.2

million m² and the strategic focus is on the development of

business parks. Founded in 1998 as a family-owned real estate

developer in the Czech Republic, VGP with a staff of circa 220

employees today owns and operates assets in 12 European countries

directly and through VGP European Logistics and VGP European

Logistics 2, both joint ventures with Allianz Real Estate. As of

December 2019, the Gross Asset Value of VGP, including the joint

ventures at 100%, amounted to €2.77 billion and the company had a

Net Asset Value (EPRA NAV) of €741 million. VGP is listed on

Euronext Brussels and on the Prague Stock Exchange (ISIN:

BE0003878957).

For more information, please

visit: http://www.vgpparks.eu

- 2020.04.08_VGP Press Release_AGM_EGM_ENG_08.05.2020

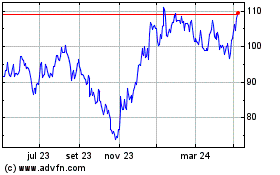

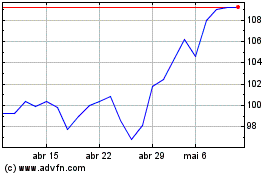

VGP NV (EU:VGP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

VGP NV (EU:VGP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024