Madison Metals and American Pacific Mining Corp (CSE: USGD / FWB:

1QC / OTCPK: USGDF) (“APM” or the “Company”) is pleased to announce

the company has signed a definitive agreement with Madison Metals

to acquire the Madison Copper Gold Project near Silver Star

Montana, USA. The project is currently under an earn-in, joint

venture agreement announced by Broadway Gold on April 30, 2019,

whereby Kennecott Exploration Company, part of the Rio Tinto Group

(ASX, LON: RIO) may spend $30 million USD to earn up to 70% of the

project.

Drill results from Kennecott’s 2019 drill

program are pending and should be released shortly.

Highlight intervals from the 2017 drill program

include the following:

- UG17-05: 24.5 g/t Gold over 30m (from

8.2m)including 68.6 g/t Gold over 4.6m (from 22.8m)and 82.9 g/t

Gold over 2.7m (from 9.1m)

- UG17-06: 41.7 g/t gold over 11m (from

8.2m)including 51.8 g/t gold over 4.6m (from 9.1m)

- C17-13: 6% copper over 4.6m

(from123.4m)Including 11.45% copper over 1.8m (from 124.4m)

For more details on the drilling please see this page for more

info:

https://americanpacific.ca/projects/madison-cu-au-project/

APM will also roll back its shares in tandem

with this announcement, three for one (3 for 1). An updated share

structure will be available on the website post consolidation.

Key terms of the Broadway/APM Madison

Transaction

- APM will issue 20 million APM shares to Madison Metals

post-consolidation (subject to a 6 month hold period in

escrow)

- APM will issue 5 million APM warrants priced at $0.25 to

Madison Metals post-consolidation (18 month expiry)

- Madison Metals will add one member to the APM Advisory

board

Terms listed are subject to shareholder

approval. Once completed the APM securities will be distributed

pro-rata to the Madison shareholders.

“We are very excited to acquire Madison’s

interest in the fully-permitted, past-producing Madison Copper Gold

Project, under option to Kennecott Exploration Company, part of the

Rio Tinto Group,” commented Warwick Smith, CEO and Director of APM.

“Our corporate strategy is to build a portfolio of high-grade

properties in the Western USA that will attract mid-tier partners

to come in and help advance these assets. Madison certainly

fulfils this objective and complements our growing portfolio of

gold, silver and now copper assets as well.”

“Madison is a great acquisition for APM. The

project has infrastructure, power, roads, 3000 feet of underground

development, recent production and plenty of exploration

potential,” said Eric Saderholm, President and Director of APM.

“This high-grade project includes two underground mines, the

Broadway and the Madison Mines, plus two distinct geological

targets: a high-grade gold skarn and a deeper copper gold porphyry

system. Plus, the joint venture partner is currently performing a

lot of exploration work to better define what may well be the

feeder system for the mineralization at Madison.” About the Madison

Copper Gold ProjectThe Madison Copper Gold Project is located in

the heart of Montana’s prolific copper-gold belt only 38km

southeast of the world-renowned Butte Mining District. The project,

a high-grade Cadia-like skarn over porphyry system, encompasses

2,514 acres consisting of six patented lode claims and 136

unpatented mineral claims. Recent interpretations identified

multiple priority target areas believed to be associated with

large-scale porphyry mineralization at depth and located within a

well-mineralized, two-mile-long geological, geophysical and

geochemical trend. The project is permitted for mining, surface and

underground exploration.

The Broadway mine produced 144,000 ounces of

gold from 1880-1950. The Madison mine was developed between

2005-2011 and generated 7,570 ounces of gold and 3,020,000 pounds

of copper from bulk samples of 19,803 tons (average 0.52 ounce/ton

Au and 25% Cu). Approximately 3,000 total feet of underground

workings go to a depth of 215 feet underground. Broadway Gold

Mining Ltd. refurbished parts of the Madison Mine in 2017,

rehabilitating the underground workings in order to access certain

stopes and mineralization, allowing for a successful exploration

drill program to take place as well.

Currently, known skarn mineralization,

gold-bearing jasperoid and massive sulphide gold and copper

mineralization is proposed to be linked to a deeper porphyry

system.

Roll Back

APM’s common shares will consolidate at the

start of market trading on April 16th, 2020, with a roll back of

three old shares for one new share. The record (effective) date for

the consolidation is April 17th, 2020, with the trading symbol

remaining unchanged. APM will not issue any fractional common

shares as a result of the consolidation. Instead, all

fractional shares resulting from the consolidation will be rounded

down to the nearest whole number. Outstanding stock options and

share purchase warrants will also be adjusted by the consolidation

ratio and the respective exercise prices adjusted accordingly.

Registered shareholders will receive a letter of

transmittal from the Company's transfer agent, TMX Trust Company,

with instructions for exchanging their pre‑consolidated

shares. Shareholders who hold their common shares through a

broker or other intermediary and do not have common shares

registered in their name, will not need to complete a letter of

transmittal.

Qualified Person

Technical aspects of this press release have

been reviewed and approved by Eric Saderholm, P.Geo., the

designated Qualified Person (QP) under National Instrument

43-101.

About American Pacific Mining

Corp.

American Pacific Mining Corp. is a gold explorer

focused on precious metal opportunities in the Western United

States. The Gooseberry Gold/Silver Project and the Tuscarora Gold

Project are two high-grade, precious metal projects located in key

mining districts of Nevada USA. The company’s mission is to grow by

the drill bit and by acquisition. American Pacific is Eyeing a Gold

Discovery amidst gold’s next bull market.

About Madison Metals:

Madison Metals Inc is a private B.C registered

corporation that was set up to receive the Madison Mine project

from Mind Medicine as a Spin-out as a result the Broadway Gold

Reverse Take Over. Madison Metals owns 100% interest in the Madison

Mine Project including the Company’s right, title and interest to

the Broadway and Madison mine - 450 acres of land, a 192

acre ranch, buildings, mine equipment and fixtures, 6

patented, 35 unpatented mineral claims, and mineral rights to a

four-square-mile property in the Butte-Anaconda region of Montana,

a porphyry-based mining district. The Project is currently under

option to Kennecott Exploration.

On Behalf of the Board of American Pacific

Mining Corp. "Warwick Smith" CEO & Director Corporate Office:

Suite 910 – 510 Burrard Street Vancouver, BC, V6C 3A8 Canada

Contact MarketSmart: 1.877.261.4466

info@marketsmart.ca

Forward-looking Information

Some statements in this news release contain

forward-looking information (within the meaning of Canadian

securities legislation) including, without limitation, statements

as to planned exploration activities and the expected timing of the

receipt of results. These statements address future events and

conditions and, as such, involve known and unknown risks,

uncertainties and other factors, which may cause the actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the statements. Such factors include, without

limitation, customary risks of the mineral resource industry as

well as the performance of services by third parties.

Forward-looking statements are statements that are not historical

facts; they are generally, but not always, identified by the words

"expects," "plans," "anticipates," "believes," "intends,"

"estimates," "projects," "aims," "potential," "goal," "objective,"

"prospective," and similar expressions, or that events or

conditions "will," "would," "may," "can," "could" or "should"

occur, or are those statements, which, by their nature, refer to

future events. The Company cautions that Forward-looking statements

are based on the beliefs, estimates and opinions of the Company's

management on the date the statements are made and they involve a

number of risks and uncertainties. Consequently, there can be no

assurances that such statements will prove to be accurate and

actual results and future events could differ materially from those

anticipated in such statements. The CSE has neither approved nor

disapproved the contents of this news release. Neither the CSE nor

its Regulation Services Provider (as that term is defined in the

policies of the CSE) accepts responsibility for the adequacy or

accuracy of this release.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/95e2636d-1de2-4a7e-b98e-d7e467f32b41

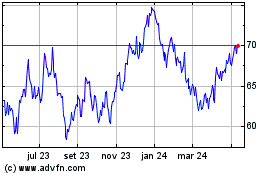

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

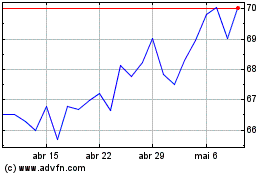

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024