American Airlines Group Inc. (NASDAQ: AAL) today reported its

first-quarter 2020 financial results, including:

- First-quarter net loss of $2.2 billion, or ($5.26) per

share. Excluding net special items1, first-quarter net loss of $1.1

billion, or ($2.65) per share.

- Ended first quarter with $6.8 billion of available

liquidity and expects to end second quarter with approximately $11

billion of liquidity.

“Never before has our airline, or our industry, faced such a

significant challenge,” said American Airlines Chairman and CEO

Doug Parker. “True to fashion, the American Airlines team has done

a phenomenal job taking care of our customers and each other during

such difficult and often heartbreaking times. We are incredibly

proud of their selflessness and dedication to others.

“We have moved quickly and aggressively to reduce our costs and

bolster our liquidity,” Parker continued. “We are particularly

grateful for the $5.8 billion in financial assistance American will

receive through the Payroll Support Program, and we appreciate the

bipartisan congressional and U.S. Department of the Treasury and

Department of Transportation support to protect airline jobs and

ensure a strong and competitive U.S. airline industry.

“We have a lot of difficult work ahead of us. And while there is

still uncertainty in what’s to come, we are confident that through

the dedication of the American Airlines team and our swift actions,

we will get through this for our team, our customers and our

shareholders.”

COVID-19 responseIn response to the precipitous

drop-off in demand, American has acted quickly to take care of its

team members, customers and communities; reduce costs; and improve

its liquidity position.

Taking care of team members, customers and

communitiesCaring for team members, customers and the

communities American serves remains at the heart of the airline’s

actions in the first quarter.

To ensure the safety of team members and customers,

American:

- Enhanced its cleaning procedures through expanded fogging and

the use of an EPA-approved disinfectant in high-touch areas.

- Purchased face masks for frontline team members and made them

required for flight attendants starting May 1.

- Began distributing sanitizing wipes or gels and face masks to

customers. This will expand to all flights as supplies and

operational conditions allow.

- Temporarily relaxed its seating policies and adjusted airport

procedures to encourage social distancing.

- Reduced onboard food and beverage service to limit

contact.

To provide customers additional peace of mind, American:

- Extended waivers for travel occurring through the end of

September 2020, enabling customers to change plans and travel

through December 2021, and waived change fees for customers who

purchase new tickets by May 31, 2020, for future travel.

- Introduced flexible travel waivers and name changes for

corporate customers.

- Made it easier for top-tier customers to earn AAdvantage® elite

status this year.

- Extended 2020 AAdvantage status into early 2022 for all

members.

- Extended all paid Admirals Club memberships by six months.

To support the communities it serves, American:

- Launched the company’s first cargo-only flights since 1984 to

transport critical goods between the U.S. and Europe, Asia and

Latin America. American is currently able to transport more than

6.5 million pounds of critical goods weekly on its cargo-only

flights.

- Donated more than 100 tons of food to food banks in the

company’s hub cities.

- Raised, with customer participation, approximately $3 million

for the American Red Cross to support workers on the front lines of

the COVID-19 pandemic.

- Donated thousands of supply kits to patients and healthcare

workers and care packages to U.S. military members in

quarantine.

Rightsizing the airline and its cost

structureAmerican estimates a reduction of more than $12

billion in its 2020 operating and capital expenditures, achieved

through lower fuel expense and a series of actions. The

company:

- Reduced system capacity by approximately 80% in both April and

May, and 70% in June, including schedule changes announced

today.

- Accelerated the retirement of four aircraft types, consisting

of 20 Embraer 190s, 34 Boeing 757s, 17 Boeing 767s and nine Airbus

A330-300s, along with a number of older regional aircraft. These

changes remove operating complexity and bring forward cost savings

and efficiencies associated with operating fewer aircraft

types.

- Suspended all nonessential hiring, paused noncontractual pay

increases, reduced executive and board compensation, and

implemented voluntary leave and early retirement programs to reduce

labor costs. In total, nearly 39,000 team members have opted for an

early retirement, a reduced work schedule or a partially paid

leave.

- Deferred marketing expenditures and reduced contractor, event

and training expenses.

- Consolidated its footprint at its airport facilities.

Maximizing LiquidityTo bolster liquidity, the

company:

- Ended the first quarter with $6.8 billion of available

liquidity, including approximately $2 billion raised during the

quarter.

- Obtained the right to access $10.6 billion in financial

assistance through the Coronavirus Aid, Relief, and Economic

Security (CARES) Act.

- Recently had its unencumbered assets appraised and believes the

value of those assets is in excess of $10 billion, excluding the

value of the AAdvantage program. The company expects to pledge a

portion of its assets as collateral for future financings,

including the approximately $4.75 billion secured loan American has

applied for under the CARES Act.

- Suspended its capital return program, including share

repurchases and the payment of future dividends, in accordance with

the CARES Act.

- Does not have any large non-aircraft debt maturities for more

than 24 months, outside of the recently arranged $1 billion,

364-day delayed draw term loan facility.

American’s average estimated second-quarter 2020 cash burn rate

is expected to be approximately $70 million per day. As the

company’s cost initiatives gain traction, its estimated daily cash

burn rate is expected to decline over time to approximately $50

million per day for the month of June. Based on its current

forecast, the company expects to have approximately $11 billion of

liquidity at the end of the second quarter.

Conference call and webcast detailsThe

company will conduct a live audio webcast of its earnings call

today at 7:30 a.m. CDT, which will be available to the public

on a listen-only basis at aa.com/investorrelations. An archive of

the webcast will be available on the website through May

31.

NotesSee the accompanying notes in the

Financial Tables section of this press release for further

explanation, including a reconciliation of all GAAP to non-GAAP

financial information.

1. In the

first quarter of 2020, the company recognized $1.4 billion in net

special items before the effect of income taxes. The 2020 first

quarter mainline operating special items, net principally included

$744 million of fleet impairment charges, which consisted of a $676

million non-cash write-down of aircraft and spare parts and $68

million in write-offs of right-of-use assets and lease return costs

associated with the company’s mainline fleet, principally Boeing

757, Boeing 767, Airbus A330-300, and Embraer 190 aircraft, which

are being retired earlier than previously planned as a result of

the decline in demand for travel due to COVID-19. The company also

recognized $218 million of one-time labor contract expenses

resulting from the ratification of a new contract with its

maintenance and fleet service team members, including signing

bonuses and adjustments to vacation accruals resulting from pay

rate increases, and $205 million of salary and medical costs

associated with certain team members who opted in to a voluntary

early retirement program.

First quarter 2020 regional operating special items, net

included an $88 million non-cash write-down of regional aircraft,

principally certain Embraer 140 and Bombardier CRJ200 aircraft,

which are being retired earlier than previously planned as a result

of the decline in demand for travel due to COVID-19.

In addition, the company recognized $217 million in nonoperating

net special items in the first quarter of 2020, which principally

included mark-to-market net unrealized losses associated with

certain equity investments and treasury rate lock derivative

instruments.

About American Airlines GroupAmerican’s purpose

is to care for people on life’s journey. Shares of American

Airlines Group Inc. trade on Nasdaq under the ticker symbol AAL and

the company’s stock is included in the S&P 500. Learn more

about what’s happening at American by visiting news.aa.com and

connect with American on Twitter @AmericanAir and at

Facebook.com/AmericanAirlines.

Cautionary Statement Regarding Forward-Looking

Statements and InformationCertain of the statements

contained in this report should be considered forward-looking

statements within the meaning of the Securities Act of 1933, as

amended (the Securities Act), the Securities Exchange Act of 1934,

as amended (the Exchange Act), and the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may

be identified by words such as “may,” “will,” “expect,” “intend,”

“anticipate,” “believe,” “estimate,” “plan,” “project,” “could,”

“should,” “would,” “continue,” “seek,” “target,” “guidance,”

“outlook,” “if current trends continue,” “optimistic,” “forecast”

and other similar words. Such statements include, but are not

limited to, statements about our plans, objectives, expectations,

intentions, estimates and strategies for the future, and other

statements that are not historical facts. These forward-looking

statements are based on our current objectives, beliefs and

expectations, and they are subject to significant risks and

uncertainties that may cause actual results and financial position

and timing of certain events to differ materially from the

information in the forward-looking statements. These risks and

uncertainties include, but are not limited to, those set forth in

our Quarterly Report on Form 10-Q for the quarter ended March 31,

2020 (especially in Part I, Item 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations, and Part

II, Item 1A. Risk Factors), and other risks and uncertainties

listed from time to time in our other filings with the Securities

and Exchange Commission. There may be other factors of which we are

not currently aware that may affect matters discussed in the

forward-looking statements and may also cause actual results to

differ materially from those discussed. In particular, the

consequences of the COVID-19 outbreak to economic conditions and

the travel industry in general and the financial position and

operating results of our company in particular have been material,

are changing rapidly, and cannot be predicted. We do not assume any

obligation to publicly update or supplement any forward-looking

statement to reflect actual results, changes in assumptions or

changes in other factors affecting these forward-looking statements

other than as required by law. Any forward looking statements

speak only as of the date hereof or as of the dates indicated in

the statement.

| American

Airlines Group Inc. |

| Condensed

Consolidated Statements of Operations |

| (In

millions, except share and per share amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended March

31, |

|

|

|

| |

|

|

2020 |

|

|

|

2019 |

|

|

PercentChange |

|

| |

|

|

|

|

|

|

|

| Operating

revenues: |

|

|

|

|

|

|

|

|

Passenger |

|

$ |

7,681 |

|

|

$ |

9,658 |

|

|

(20.5 |

) |

|

|

Cargo |

|

|

147 |

|

|

|

218 |

|

|

(32.7 |

) |

|

|

Other |

|

|

687 |

|

|

|

708 |

|

|

(2.9 |

) |

|

|

Total operating revenues |

|

|

8,515 |

|

|

|

10,584 |

|

|

(19.6 |

) |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Aircraft fuel and related taxes |

|

|

1,395 |

|

|

|

1,726 |

|

|

(19.2 |

) |

|

|

Salaries, wages and benefits |

|

|

3,140 |

|

|

|

3,090 |

|

|

1.6 |

|

|

|

Regional expenses: |

|

|

|

|

|

|

|

|

Fuel |

|

|

389 |

|

|

|

423 |

|

|

(8.1 |

) |

|

|

Depreciation and amortization |

|

|

83 |

|

|

|

79 |

|

|

5.7 |

|

|

|

Other |

|

|

1,452 |

|

|

|

1,261 |

|

|

15.2 |

|

|

|

Maintenance, materials and repairs |

|

|

629 |

|

|

|

561 |

|

|

12.1 |

|

|

|

Other rent and landing fees |

|

|

468 |

|

|

|

503 |

|

|

(7.1 |

) |

|

|

Aircraft rent |

|

|

334 |

|

|

|

327 |

|

|

2.4 |

|

|

|

Selling expenses |

|

|

305 |

|

|

|

370 |

|

|

(17.7 |

) |

|

|

Depreciation and amortization |

|

|

560 |

|

|

|

480 |

|

|

16.7 |

|

|

|

Special items, net |

|

|

1,132 |

|

|

|

138 |

|

|

nm |

(1) |

|

Other |

|

|

1,177 |

|

|

|

1,251 |

|

|

(5.9 |

) |

|

|

Total operating expenses |

|

|

11,064 |

|

|

|

10,209 |

|

|

8.4 |

|

|

| |

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

(2,549 |

) |

|

|

375 |

|

|

nm |

|

| |

|

|

|

|

|

|

|

| Nonoperating

income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

|

21 |

|

|

|

33 |

|

|

(35.8 |

) |

|

|

Interest expense, net |

|

|

(257 |

) |

|

|

(271 |

) |

|

(5.0 |

) |

|

|

Other income (expense), net |

|

|

(105 |

) |

|

|

108 |

|

|

nm |

|

|

Total nonoperating expense, net |

|

|

(341 |

) |

|

|

(130 |

) |

|

nm |

|

| |

|

|

|

|

|

|

|

| Income

(loss) before income taxes |

|

|

(2,890 |

) |

|

|

245 |

|

|

nm |

|

| |

|

|

|

|

|

|

|

| Income tax

provision (benefit) |

|

|

(649 |

) |

|

|

60 |

|

|

nm |

|

| |

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(2,241 |

) |

|

$ |

185 |

|

|

nm |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Earnings

(loss) per common share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

(5.26 |

) |

|

$ |

0.41 |

|

|

|

|

|

Diluted |

|

$ |

(5.26 |

) |

|

$ |

0.41 |

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted

average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

Basic |

|

|

425,713 |

|

|

|

451,951 |

|

|

|

|

|

Diluted |

|

|

425,713 |

|

|

|

453,429 |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Note: Percent change may not recalculate due to

rounding. |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (1) Not

meaningful. |

| |

|

|

|

|

|

|

|

| American

Airlines Group Inc. |

| Consolidated

Operating Statistics |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended March

31, |

|

|

|

|

| |

|

2020 |

|

2019 |

|

Change |

|

|

| |

|

|

|

|

|

|

|

|

|

Mainline |

|

|

|

|

|

|

|

|

|

Revenue passenger miles (millions) |

|

39,313 |

|

48,481 |

|

(18.9 |

) |

% |

|

| Available

seat miles (ASM) (millions) |

|

53,189 |

|

58,323 |

|

(8.8 |

) |

% |

|

| Passenger

load factor (percent) |

|

73.9 |

|

83.1 |

|

(9.2 |

) |

pts |

|

| |

|

|

|

|

|

|

|

|

| Passenger

enplanements (thousands) |

|

30,353 |

|

36,546 |

|

(16.9 |

) |

% |

|

| Departures

(thousands) |

|

253 |

|

271 |

|

(6.7 |

) |

% |

|

| Aircraft at

end of period |

|

942 |

|

962 |

|

(2.1 |

) |

% |

|

| |

|

|

|

|

|

|

|

|

| Block hours

(thousands) |

|

759 |

|

835 |

|

(9.2 |

) |

% |

|

| Average

stage length (miles) |

|

1,153 |

|

1,178 |

|

(2.2 |

) |

% |

|

| Fuel

consumption (gallons in millions) |

|

763 |

|

853 |

|

(10.5 |

) |

% |

|

| Average

aircraft fuel price including related taxes (dollars per

gallon) |

|

1.83 |

|

2.02 |

|

(9.7 |

) |

% |

|

| Full-time

equivalent employees at end of period |

|

104,400 |

|

103,500 |

|

0.9 |

|

% |

|

| |

|

|

|

|

|

|

|

|

|

Regional (1) |

|

|

|

|

|

|

|

|

| Revenue

passenger miles (millions) |

|

5,858 |

|

6,321 |

|

(7.3 |

) |

% |

|

| Available

seat miles (millions) |

|

8,910 |

|

8,351 |

|

6.7 |

|

% |

|

| Passenger

load factor (percent) |

|

65.7 |

|

75.7 |

|

(10.0 |

) |

pts |

|

| |

|

|

|

|

|

|

|

|

| Passenger

enplanements (thousands) |

|

11,848 |

|

13,389 |

|

(11.5 |

) |

% |

|

| Aircraft at

end of period |

|

542 |

|

602 |

|

(10.0 |

) |

% |

|

| Fuel

consumption (gallons in millions) |

|

209 |

|

200 |

|

4.5 |

|

% |

|

| Average

aircraft fuel price including related taxes (dollars per

gallon) |

|

1.86 |

|

2.12 |

|

(12.1 |

) |

% |

|

| Full-time

equivalent employees at end of period (2) |

|

27,100 |

|

26,300 |

|

3.0 |

|

% |

|

| |

|

|

|

|

|

|

|

|

|

Total Mainline & Regional |

|

|

|

|

|

|

|

|

| Revenue

passenger miles (millions) |

|

45,171 |

|

54,802 |

|

(17.6 |

) |

% |

|

| Available

seat miles (millions) |

|

62,099 |

|

66,674 |

|

(6.9 |

) |

% |

|

| Passenger

load factor (percent) |

|

72.7 |

|

82.2 |

|

(9.5 |

) |

pts |

|

| Yield

(cents) |

|

17.00 |

|

17.62 |

|

(3.5 |

) |

% |

|

| Passenger

revenue per ASM (cents) |

|

12.37 |

|

14.49 |

|

(14.6 |

) |

% |

|

| Total

revenue per ASM (cents) |

|

13.71 |

|

15.87 |

|

(13.6 |

) |

% |

|

| Cargo ton

miles (millions) |

|

436 |

|

624 |

|

(30.2 |

) |

% |

|

| Cargo yield

per ton mile (cents) |

|

33.62 |

|

34.86 |

|

(3.5 |

) |

% |

|

| |

|

|

|

|

|

|

|

|

| Passenger

enplanements (thousands) |

|

42,201 |

|

49,935 |

|

(15.5 |

) |

% |

|

| Aircraft at

end of period (3) |

|

1,484 |

|

1,564 |

|

(5.1 |

) |

% |

|

| Fuel

consumption (gallons in millions) |

|

972 |

|

1,053 |

|

(7.6 |

) |

% |

|

| Average

aircraft fuel price including related taxes (dollars per

gallon) |

|

1.83 |

|

2.04 |

|

(10.1 |

) |

% |

|

| Full-time

equivalent employees at end of period |

|

131,500 |

|

129,800 |

|

1.3 |

|

% |

|

| |

|

|

|

|

|

|

|

|

| Operating

cost per ASM (cents) |

|

17.82 |

|

15.31 |

|

16.3 |

|

% |

|

| Operating

cost per ASM excluding net special items (cents) |

|

15.84 |

|

15.11 |

|

4.9 |

|

% |

|

| Operating

cost per ASM excluding net special items and fuel (cents) |

|

12.97 |

|

11.88 |

|

9.2 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

(1) Regional includes wholly-owned regional airline subsidiaries

and operating results from capacity purchase carriers. |

|

| (2) Regional full-time

equivalent employees only include our wholly-owned regional airline

subsidiaries. |

| (3) Includes aircraft

owned and leased by American as well as aircraft operated by

third-party regional carriers under capacity purchase agreements.

Excludes 49 regional aircraft that are in temporary storage as

follows: 17 Embraer 145, 15 Embraer 175, nine Embraer 140 and eight

Bombardier CRJ200 aircraft. |

| |

|

|

|

|

|

|

|

|

|

Note: Amounts may not recalculate due to

rounding. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| American

Airlines Group Inc. |

| Consolidated

Revenue Statistics by Region |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended March

31, |

|

|

|

| |

|

|

2020 |

|

2019 |

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

Domestic (1) |

|

|

|

|

|

|

|

|

Revenue passenger miles (millions) |

|

31,856 |

|

37,717 |

|

(15.5 |

) |

% |

|

Available seat miles (ASM) (millions) |

|

44,238 |

|

45,282 |

|

(2.3 |

) |

% |

|

Passenger load factor (percent) |

|

72.0 |

|

83.3 |

|

(11.3 |

) |

pts |

|

Passenger revenue (dollars in millions) |

|

5,780 |

|

7,226 |

|

(20.0 |

) |

% |

|

Yield (cents) |

|

18.14 |

|

19.16 |

|

(5.3 |

) |

% |

|

Passenger revenue per ASM (cents) |

|

13.07 |

|

15.96 |

|

(18.1 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

Latin America (2) |

|

|

|

|

|

|

|

|

Revenue passenger miles (millions) |

|

7,116 |

|

8,351 |

|

(14.8 |

) |

% |

|

Available seat miles (millions) |

|

9,068 |

|

10,208 |

|

(11.2 |

) |

% |

|

Passenger load factor (percent) |

|

78.5 |

|

81.8 |

|

(3.3 |

) |

pts |

|

Passenger revenue (dollars in millions) |

|

1,180 |

|

1,371 |

|

(14.0 |

) |

% |

|

Yield (cents) |

|

16.57 |

|

16.42 |

|

0.9 |

|

% |

|

Passenger revenue per ASM (cents) |

|

13.01 |

|

13.43 |

|

(3.2 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

Atlantic |

|

|

|

|

|

|

|

|

|

Revenue passenger miles (millions) |

|

4,185 |

|

5,042 |

|

(17.0 |

) |

% |

|

Available seat miles (millions) |

|

6,239 |

|

6,825 |

|

(8.6 |

) |

% |

|

Passenger load factor (percent) |

|

67.1 |

|

73.9 |

|

(6.8 |

) |

pts |

|

Passenger revenue (dollars in millions) |

|

523 |

|

673 |

|

(22.3 |

) |

% |

|

Yield (cents) |

|

12.50 |

|

13.35 |

|

(6.4 |

) |

% |

|

Passenger revenue per ASM (cents) |

|

8.39 |

|

9.86 |

|

(15.0 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

Pacific |

|

|

|

|

|

|

|

|

|

Revenue passenger miles (millions) |

|

2,014 |

|

3,692 |

|

(45.5 |

) |

% |

|

Available seat miles (millions) |

|

2,554 |

|

4,359 |

|

(41.4 |

) |

% |

|

Passenger load factor (percent) |

|

78.8 |

|

84.7 |

|

(5.9 |

) |

pts |

|

Passenger revenue (dollars in millions) |

|

198 |

|

388 |

|

(48.9 |

) |

% |

|

Yield (cents) |

|

9.84 |

|

10.50 |

|

(6.3 |

) |

% |

|

Passenger revenue per ASM (cents) |

|

7.76 |

|

8.90 |

|

(12.8 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

Total International |

|

|

|

|

|

|

|

|

Revenue passenger miles (millions) |

|

13,315 |

|

17,085 |

|

(22.1 |

) |

% |

|

Available seat miles (millions) |

|

17,861 |

|

21,392 |

|

(16.5 |

) |

% |

|

Passenger load factor (percent) |

|

74.5 |

|

79.9 |

|

(5.4 |

) |

pts |

|

Passenger revenue (dollars in millions) |

|

1,901 |

|

2,432 |

|

(21.9 |

) |

% |

|

Yield (cents) |

|

14.28 |

|

14.24 |

|

0.3 |

|

% |

|

Passenger revenue per ASM (cents) |

|

10.64 |

|

11.37 |

|

(6.4 |

) |

% |

| |

|

|

|

|

|

|

|

|

| (1) Domestic results

include Canada, Puerto Rico and U.S. Virgin Islands. |

| (2) Latin America

results include the Caribbean. |

| |

|

|

|

|

|

|

|

|

|

Note: Amounts may not recalculate due to

rounding. |

|

|

|

|

|

|

Reconciliation of GAAP Financial Information to Non-GAAP

Financial Information |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| American Airlines

Group Inc. (the company) sometimes uses financial measures that are

derived from the condensed consolidated financial statements but

that are not presented in accordance with GAAP to understand and

evaluate its current operating performance and to allow for

period-to-period comparisons. The company believes these non-GAAP

financial measures may also provide useful information to investors

and others. These non-GAAP measures may not be comparable to

similarly titled non-GAAP measures of other companies, and should

be considered in addition to, and not as a substitute for or

superior to, any measure of performance, cash flow or liquidity

prepared in accordance with GAAP. The company is providing a

reconciliation of reported non-GAAP financial measures to their

comparable financial measures on a GAAP basis. The tables below

present the reconciliations of the following GAAP measures to their

non-GAAP measures: - Pre-Tax Income (Loss) (GAAP measure) to

Pre-Tax Income (Loss) Excluding Net Special Items (non-GAAP

measure)- Pre-Tax Margin (GAAP measure) to Pre-Tax Margin Excluding

Net Special Items (non-GAAP measure) - Net Income (Loss) (GAAP

measure) to Net Income (Loss) Excluding Net Special Items (non-GAAP

measure) - Basic and Diluted Earnings (Loss) Per Share (GAAP

measure) to Basic and Diluted Earnings (Loss) Per Share Excluding

Net Special Items (non-GAAP measure) - Operating Income (Loss)

(GAAP measure) to Operating Income (Loss) Excluding Net Special

Items (non-GAAP measure) Management uses these non-GAAP financial

measures to evaluate the company's current operating performance

and to allow for period-to-period comparisons. As net special items

may vary from period-to-period in nature and amount, the adjustment

to exclude net special items allows management an additional tool

to understand the company’s core operating performance.

Additionally, the tables below present the reconciliations of total

operating costs (GAAP measure) to total operating costs excluding

net special items and fuel (non-GAAP measure). Management uses

total operating costs excluding net special items and fuel to

evaluate the company's current operating performance and for

period-to-period comparisons. The price of fuel, over which the

company has no control, impacts the comparability of

period-to-period financial performance. The adjustment to exclude

aircraft fuel and net special items allows management an additional

tool to understand and analyze the company’s non-fuel costs and

core operating performance. |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

3 Months Ended March

31, |

|

Percent Change |

|

|

| |

Reconciliation of Pre-Tax Income (Loss) Excluding Net

Special Items |

|

|

2020 |

|

|

|

2019 |

|

|

|

|

| |

|

|

(in millions, except

per share amounts) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Pre-tax income (loss) as reported |

|

$ |

(2,890 |

) |

|

$ |

245 |

|

|

|

|

|

| |

Pre-tax net

special items: |

|

|

|

|

|

|

|

|

| |

Mainline

operating special items, net (1) |

|

|

1,132 |

|

|

|

138 |

|

|

|

|

|

| |

Regional

operating special items, net (2) |

|

|

93 |

|

|

|

- |

|

|

|

|

|

| |

Nonoperating

special items, net (3) |

|

|

217 |

|

|

|

(69 |

) |

|

|

|

|

| |

Total

pre-tax net special items |

|

|

1,442 |

|

|

|

69 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Pre-tax

income (loss) excluding net special items |

|

$ |

(1,448 |

) |

|

$ |

314 |

|

|

nm |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Calculation of Pre-Tax Margin |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Pre-tax

income (loss) as reported |

|

$ |

(2,890 |

) |

|

$ |

245 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Total

operating revenues as reported |

|

$ |

8,515 |

|

|

$ |

10,584 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Pre-tax

margin |

|

|

-33.9 |

% |

|

|

2.3 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Calculation of Pre-Tax Margin Excluding Net Special

Items |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Pre-tax

income (loss) excluding net special items |

|

$ |

(1,448 |

) |

|

$ |

314 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Total

operating revenues as reported |

|

$ |

8,515 |

|

|

$ |

10,584 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Pre-tax

margin excluding net special items |

|

|

-17.0 |

% |

|

|

3.0 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Reconciliation of Net Income (Loss) Excluding Net Special

Items |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net income

(loss) as reported |

|

$ |

(2,241 |

) |

|

$ |

185 |

|

|

|

|

|

| |

Net special

items: |

|

|

|

|

|

|

|

|

| |

Total

pre-tax net special items (1), (2), (3) |

|

|

1,442 |

|

|

|

69 |

|

|

|

|

|

| |

Net

tax effect of net special items |

|

|

(330 |

) |

|

|

(17 |

) |

|

|

|

|

| |

Net income

(loss) excluding net special items |

|

$ |

(1,129 |

) |

|

$ |

237 |

|

|

nm |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Reconciliation of Basic and Diluted Earnings (Loss) Per

Share Excluding Net Special Items |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net income

(loss) excluding net special items |

|

$ |

(1,129 |

) |

|

$ |

237 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Shares used

for computation (in thousands): |

|

|

|

|

|

|

|

|

| |

Basic |

|

|

425,713 |

|

|

|

451,951 |

|

|

|

|

|

| |

Diluted |

|

|

425,713 |

|

|

|

453,429 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Earnings

(loss) per share excluding net special items: |

|

|

|

|

|

|

|

|

| |

Basic |

|

$ |

(2.65 |

) |

|

$ |

0.53 |

|

|

|

|

|

| |

Diluted |

|

$ |

(2.65 |

) |

|

$ |

0.52 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

3 Months Ended March

31, |

|

|

|

|

| |

Reconciliation of Operating Income (Loss) Excluding Net

Special Items |

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

| |

|

|

(in millions) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating

income (loss) as reported |

|

$ |

(2,549 |

) |

|

$ |

375 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating

net special items: |

|

|

|

|

|

|

|

|

| |

Mainline

operating special items, net (1) |

|

|

1,132 |

|

|

|

138 |

|

|

|

|

|

| |

Regional

operating special items, net (2) |

|

|

93 |

|

|

|

- |

|

|

|

|

|

| |

Operating

income (loss) excluding net special items |

|

$ |

(1,324 |

) |

|

$ |

513 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Reconciliation of Total Operating Cost per ASM Excluding

Net Special Items and Fuel |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Total

operating expenses as reported |

|

$ |

11,064 |

|

|

$ |

10,209 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating

net special items: |

|

|

|

|

|

|

|

|

| |

Mainline

operating special items, net (1) |

|

|

(1,132 |

) |

|

|

(138 |

) |

|

|

|

|

| |

Regional

operating special items, net (2) |

|

|

(93 |

) |

|

|

- |

|

|

|

|

|

| |

Total

operating expenses, excluding net special items |

|

|

9,839 |

|

|

|

10,071 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Fuel: |

|

|

|

|

|

|

|

|

| |

Aircraft fuel and related taxes - mainline |

|

|

(1,395 |

) |

|

|

(1,726 |

) |

|

|

|

|

| |

Aircraft fuel and related taxes - regional |

|

|

(389 |

) |

|

|

(423 |

) |

|

|

|

|

| |

Total

operating expenses, excluding net special items and fuel |

|

$ |

8,055 |

|

|

$ |

7,922 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

(in cents) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Total

operating expenses per ASM as reported |

|

|

17.82 |

|

|

|

15.31 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating

net special items per ASM: |

|

|

|

|

|

|

|

|

| |

Mainline

operating special items, net (1) |

|

|

(1.82 |

) |

|

|

(0.21 |

) |

|

|

|

|

| |

Regional

operating special items, net (2) |

|

|

(0.15 |

) |

|

|

- |

|

|

|

|

|

| |

Total

operating expenses per ASM, excluding net special items |

|

|

15.84 |

|

|

|

15.11 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Fuel per

ASM: |

|

|

|

|

|

|

|

|

| |

Aircraft fuel and related taxes - mainline |

|

|

(2.25 |

) |

|

|

(2.59 |

) |

|

|

|

|

| |

Aircraft fuel and related taxes - regional |

|

|

(0.63 |

) |

|

|

(0.63 |

) |

|

|

|

|

| |

Total

operating expenses per ASM, excluding net special items and

fuel |

|

|

12.97 |

|

|

|

11.88 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Note: Amounts may not recalculate due to

rounding. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

FOOTNOTES: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

(1) |

The 2020 first

quarter mainline operating special items, net principally included

$744 million of fleet impairment charges, $218 million of one-time

labor contract expenses resulting from the ratification of a new

contract with our maintenance and fleet service team members,

including signing bonuses and adjustments to vacation accruals

resulting from pay rate increases, and $205 million of salary and

medical costs associated with certain team members who opted in to

a voluntary early retirement program. The fleet impairment charges

included a $676 million non-cash write-down of aircraft and spare

parts and $68 million in write-offs of right-of-use assets and

lease return costs associated with our mainline fleet, principally

Boeing 757, Boeing 767, Airbus A330-300 and Embraer 190 aircraft,

which are being retired earlier than previously planned as a result

of the decline in demand for air travel due to COVID-19. The 2019

first quarter mainline operating special items, net principally

included $83 million of fleet restructuring expenses and $37

million of merger integration expenses. |

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

The 2020 first

quarter regional operating special items, net primarily included an

$88 million non-cash write-down of regional aircraft, principally

certain Embraer 140 and certain Bombardier CRJ200 aircraft, which

are being retired earlier than previously planned as a result of

the decline in demand for air travel due to COVID-19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

Principally

included mark-to-market net unrealized gains and losses associated

with certain equity investments and treasury rate lock derivative

instruments. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| American

Airlines Group Inc. |

| Condensed

Consolidated Balance Sheets |

| (In

millions) |

| |

| |

|

|

|

| |

March 31, 2020 |

|

December 31, 2019 |

| |

(unaudited) |

|

|

| Assets |

|

|

|

| |

|

|

|

| Current

assets |

|

|

|

|

Cash |

$ |

474 |

|

|

$ |

280 |

|

|

Short-term investments |

|

3,102 |

|

|

|

3,546 |

|

|

Restricted cash and short-term investments |

|

157 |

|

|

|

158 |

|

|

Accounts receivable, net |

|

1,020 |

|

|

|

1,750 |

|

|

Aircraft fuel, spare parts and supplies, net |

|

1,772 |

|

|

|

1,851 |

|

|

Prepaid expenses and other |

|

650 |

|

|

|

621 |

|

|

Total current assets |

|

7,175 |

|

|

|

8,206 |

|

| |

|

|

|

| Operating

property and equipment |

|

|

|

|

Flight equipment |

|

39,305 |

|

|

|

42,537 |

|

|

Ground property and equipment |

|

9,602 |

|

|

|

9,443 |

|

|

Equipment purchase deposits |

|

1,740 |

|

|

|

1,674 |

|

|

Total property and equipment, at cost |

|

50,647 |

|

|

|

53,654 |

|

|

Less accumulated depreciation and amortization |

|

(16,441 |

) |

|

|

(18,659 |

) |

|

Total property and equipment, net |

|

34,206 |

|

|

|

34,995 |

|

| |

|

|

|

| Operating

lease right-of-use assets |

|

8,619 |

|

|

|

8,737 |

|

| |

|

|

|

| Other

assets |

|

|

|

|

Goodwill |

|

4,091 |

|

|

|

4,091 |

|

|

Intangibles, net |

|

2,059 |

|

|

|

2,084 |

|

|

Deferred tax asset |

|

1,237 |

|

|

|

645 |

|

|

Other assets |

|

1,193 |

|

|

|

1,237 |

|

|

Total other assets |

|

8,580 |

|

|

|

8,057 |

|

| |

|

|

|

|

Total assets |

$ |

58,580 |

|

|

$ |

59,995 |

|

| |

|

|

|

| Liabilities

and Stockholders’ Equity (Deficit) |

|

|

|

| |

|

|

|

| Current

liabilities |

|

|

|

|

Current maturities of long-term debt and finance leases |

$ |

3,518 |

|

|

$ |

2,861 |

|

|

Accounts payable |

|

1,648 |

|

|

|

2,062 |

|

|

Accrued salaries and wages |

|

1,633 |

|

|

|

1,541 |

|

|

Air traffic liability |

|

5,473 |

|

|

|

4,808 |

|

|

Loyalty program liability |

|

3,094 |

|

|

|

3,193 |

|

|

Operating lease liabilities |

|

1,752 |

|

|

|

1,708 |

|

|

Other accrued liabilities |

|

2,095 |

|

|

|

2,138 |

|

|

Total current liabilities |

|

19,213 |

|

|

|

18,311 |

|

| |

|

|

|

| Noncurrent

liabilities |

|

|

|

|

Long-term debt and finance leases, net of current maturities |

|

21,564 |

|

|

|

21,454 |

|

|

Pension and postretirement benefits |

|

6,107 |

|

|

|

6,052 |

|

|

Loyalty program liability |

|

5,757 |

|

|

|

5,422 |

|

|

Operating lease liabilities |

|

7,239 |

|

|

|

7,421 |

|

|

Other liabilities |

|

1,336 |

|

|

|

1,453 |

|

|

Total noncurrent liabilities |

|

42,003 |

|

|

|

41,802 |

|

| |

|

|

|

|

Stockholders' equity (deficit) |

|

|

|

|

Common stock |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

3,861 |

|

|

|

3,945 |

|

|

Accumulated other comprehensive loss |

|

(6,480 |

) |

|

|

(6,331 |

) |

|

Retained earnings (deficit) |

|

(21 |

) |

|

|

2,264 |

|

|

Total stockholders' deficit |

|

(2,636 |

) |

|

|

(118 |

) |

| |

|

|

|

|

Total liabilities and stockholders’ equity (deficit) |

$ |

58,580 |

|

|

$ |

59,995 |

|

|

|

|

|

|

| American

Airlines Group Inc. |

| Condensed

Consolidated Statements of Cash Flows |

| (In

millions)(Unaudited) |

|

|

|

|

|

|

|

3 Months Ended March

31, |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

| Net

cash provided by (used in) operating activities |

$ |

(168 |

) |

|

$ |

1,651 |

|

| Cash

flows from investing activities: |

|

|

|

|

Capital expenditures and aircraft purchase deposits |

|

(845 |

) |

|

|

(1,305 |

) |

|

Proceeds from sale-leaseback transactions |

|

280 |

|

|

|

352 |

|

|

Proceeds from sale of property and equipment |

|

35 |

|

|

|

7 |

|

|

Purchases of short-term investments |

|

(820 |

) |

|

|

(570 |

) |

|

Sales of short-term investments |

|

1,237 |

|

|

|

1,051 |

|

|

Other investing activities |

|

(49 |

) |

|

|

(15 |

) |

|

Net cash used in investing activities |

|

(162 |

) |

|

|

(480 |

) |

| Cash

flows from financing activities: |

|

|

|

|

Proceeds from issuance of long-term debt |

|

1,698 |

|

|

|

400 |

|

|

Payments on long-term debt and finance leases |

|

(926 |

) |

|

|

(849 |

) |

|

Deferred financing costs |

|

(31 |

) |

|

|

(6 |

) |

|

Treasury stock repurchases |

|

(171 |

) |

|

|

(608 |

) |

|

Dividend payments |

|

(43 |

) |

|

|

(46 |

) |

|

Other financing activities |

|

(1 |

) |

|

|

- |

|

|

Net cash provided by (used in) financing activities |

|

526 |

|

|

|

(1,109 |

) |

| Net increase

in cash and restricted cash |

|

196 |

|

|

|

62 |

|

| Cash and

restricted cash at beginning of period |

|

290 |

|

|

|

286 |

|

| Cash and

restricted cash at end of period (1) |

$ |

486 |

|

|

$ |

348 |

|

| |

|

|

|

| |

|

|

|

|

(1) The following table provides a reconciliation of cash and

restricted cash to amounts reported within the condensed

consolidated balance sheets: |

| |

|

|

|

| Cash |

$ |

474 |

|

|

$ |

337 |

|

| Restricted

cash included in restricted cash and short-term investments |

|

12 |

|

|

|

11 |

|

|

Total cash and restricted cash |

$ |

486 |

|

|

$ |

348 |

|

| |

|

|

|

Corporate Communicationsmediarelations@aa.com

Investor Relationsinvestor.relations@aa.com

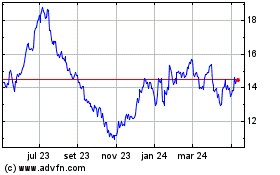

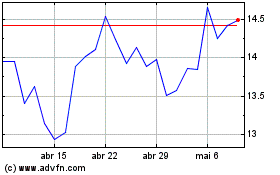

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024