Societe Generale: Description of the share buyback programme 2020

13 Maio 2020 - 1:48PM

Societe Generale: Description of the share buyback programme 2020

DESCRIPTION OF THE SHARE BUYBACK PROGRAMME

SUBJECT TO THE AUTORISATION OF THE

COMBINED GENERAL MEETINGDATED 19 MAY

2020

Regulated information

13 May 2019

This description is drawn up in accordance with

the provisions of Articles 241-1 and 241-2 I of the General

Regulation of the French Financial Markets Authority (Autorité des

marchés financiers).

1. Date of the General Meeting called to

authorise the share buyback programme

The authorisation for the Company to buy its own

shares will be proposed to the combined General Meeting dated 19

May 2020.

2. Breakdown by objectives of the

securities held

As at 11 May 2020, the allocation of the shares

held directly is as follows:

|

Cancellation |

0 |

|

Allocation to employees and company officers |

2,238,415 |

|

Exercise of rights attached to securities |

0 |

|

External growth |

0 |

|

Liquidity agreement |

33,500 |

3. Purposes of the share buyback

programme

Societe Generale contemplates renewing its

authorisation to buy its own shares so it can:

- grant, cover and honour any free shares allocation plan,

employee savings plan and any form of allocation for the benefit of

employees and executive officers of the Company or affiliated

companies under the conditions defined by the applicable legal and

regulatory provisions;

- cancel them, in accordance with the terms of the authorisation

of the combined General Meeting in its 26th resolution;

- deliver shares upon the exercise of rights attached to

securities giving access to the Company’s share capital;

- hold and subsequently deliver shares as payment or exchange as

part of Group’s external growth transactions;

- allow an investment services provider to trade in the Company’s

shares as part of a liquidity agreement compliant with the

regulations of the French Financial Markets Authority (Autorité des

Marchés Financiers).

4. Maximum amount allocated to the share

buyback programme, maximum number and characteristics of the

securities, maximum purchase price

The resolution proposed to the General Meeting

provides that Societe Generale could purchase its ordinary shares

for an amount of up to 5% of the share capital at the completion

date of these purchases, within the legal limit of an amount of

shares held representing 10% of the share capital after these

buybacks.

As at 12 May 2020, without taking into account

the shares already held, a theoretical maximum number of 42,668,574

shares could be purchased. Given the number of securities already

held at this date and the possibility to hold an amount of shares

representing up to 10% of the share capital, the Company could

purchase up to 42,668,574 shares.

The maximum purchase price would be set at EUR

75 per share, i.e. a potential maximum amount allocated to the

programme of EUR 3,200,143,050.

The Board of Directors will ensure that the

implementation of the buybacks is conducted in compliance with the

prudential requirements as set by the regulations.

5. Duration of the share buyback

programme

It is proposed to the combined General Meeting

dated 19 May 2020 to set the duration of the authorisation for the

Company to buy and sell its own shares at 18 months from the date

of the General Meeting.

6. Recommendation of the European

Central Bank

Societe Generale shall not be able to buyback

shares aimed at remunerating shareholders during the COVID-19

pandemic and until « at least beginning of October 2020 »

in accordance with the recommendation of the European Central Bank

(ECB) dated 27 March 2020.

Press contact :

Corentin Henry _ 01 58 98 01

75_ corentin.henry@socgen.com

Societe Generale

Societe Generale is one of the leading European financial

services groups. Based on a diversified and integrated banking

model, the Group combines financial strength and proven expertise

in innovation with a strategy of sustainable growth. Committed to

the positive transformations of the world’s societies and

economies, Societe Generale and its teams seek to build, day after

day, together with its clients, a better and sustainable future

through responsible and innovative financial solutions.

Active in the real economy for over 150 years, with a solid

position in Europe and connected to the rest of the world, Societe

Generale has over 138,000 members of staff in 62 countries and

supports on a daily basis 29 million individual clients, businesses

and institutional investors around the world by offering a wide

range of advisory services and tailored financial solutions. The

Group is built on three complementary core businesses:

- French Retail Banking which encompasses the

Societe Generale, Crédit du Nord and Boursorama brands. Each offers

a full range of financial services with omnichannel products at the

cutting edge of digital innovation;

- International Retail Banking, Insurance and Financial

Services to Corporates, with networks in Africa, Russia,

Central and Eastern Europe and specialised businesses that are

leaders in their markets;

- Global Banking and Investor Solutions, which

offers recognised expertise, key international locations and

integrated solutions.

Societe Generale is included in the principal socially

responsible investment indices: DJSI (World and Europe), FTSE4Good

(Global and Europe), Euronext Vigeo (World, Europe and Eurozone),

four of the STOXX ESG Leaders indices, and the MSCI Low Carbon

Leaders Index. For more information, you can follow us on Twitter

@societegenerale or visit our website www.societegenerale.com

- Description-of-the-share-buyback-programme-2020

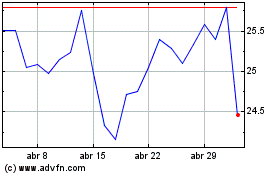

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

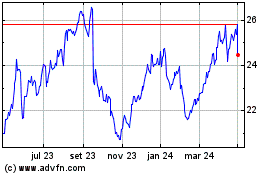

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024