VGP NV: Allianz and VGP announce new logistics joint venture for

the development of VGP Park Munich

Munich/Antwerp, 2 June 2020, 7:00 am CEST

VGP NV (“VGP”), the Antwerp-based European

provider of high-quality logistics and semi-industrial real estate,

and Allianz have expanded their strategic partnership by entering

an agreement in respect of a new 50:50 joint venture for the

development of VGP Park München.

The managerial and governance setup of the new

partnership is similar to the existing two joint ventures between

the two partners. VGP will serve the new joint venture as its sole

asset, property and development manager. Allianz Real Estate

will manage the joint venture on behalf of Allianz group companies.

Contrary to the two existing joint ventures which concentrate on

the acquisition of income-generating assets developed by VGP, this

new joint venture will initially be focussed on the development of

VGP Park München.

Once fully developed the park will consist of

five logistic buildings, two stand-alone parking houses and one

office building for a total gross lettable area of approx. 270,000

m2. The park is almost entirely pre-let to KraussMaffei

Technologies and BMW.

There are currently already 3 buildings and 2

parking houses under construction, with the completion of the first

building expected to occur in August 2020 and all but one of the

other buildings to be delivered by November 2022. The remaining

building is expected to be delivered by the beginning of 2026.

“We are delighted to further expand our

partnership with Allianz Real Estate, breaking new grounds as we

have found an agreement to develop our iconic VGP Park Munich

together.” said Jan Van Geet, CEO of VGP. “This transaction is a

testament to the quality of our development franchise, including

our high-quality building and construction standards.” Jan Van

Geet, concluded: “Through this new partnership we are able to share

the required capital expenditure, secure disposal proceeds and

continue to invest in the expansion of our portfolio pipeline.”

Kari Pitkin, Head of Business Development for

Europe at Allianz Real Estate, commented: “We are very pleased to

build on our established partnership with VGP with the new

development of VGP Park Munich. Logistics as an asset class remains

a key focus for Allianz Real Estate, having grown our global

exposure in the sector to more than EUR 6.6bn AUM.”

- End -

Allianz enquiries:

Allianz Real Estate Claire Fraser+49 89 3800

8236+49 175 321 5732claire.fraser@allianz.com

Citigate Dewe Rogerson (UK)Oliver Parry / Hugh

Fasken+44 (0) 20 7025 6400oliver.parry@citigatedewerogerson.com

hugh.fasken@citigatedewerogerson.com

VGP enquiries:

Martijn Vlutters

(Investor Relations)Tel: +32 (0)3 289

1433

Karen

Huybrechts(Marketing)Tel: +32

(0)3 289 1432

Petra Vanclova

(External Communications)Tel: +42 (0) 602

262 107

Anette NachbarBrunswick

GroupTel: +49 (0)152 288 10363

About AllianzThe Allianz Group is one of the

world's leading insurers and asset managers with more than 100

million retail and corporate customers in more than 70 countries.

Allianz customers benefit from a broad range of personal and

corporate insurance services, ranging from property, life and

health insurance to assistance services to credit insurance and

global business insurance. Allianz is one of the world’s largest

investors, managing around 740 billion euros on behalf of its

insurance customers. Furthermore, our asset managers PIMCO and

Allianz Global Investors manage more than 1.6 trillion euros of

third-party assets. Thanks to our systematic integration of

ecological and social criteria in our business processes and

investment decisions, we hold the leading position for insurers in

the Dow Jones Sustainability Index. In 2019, over 147,000 employees

achieved total revenues of 142 billion euros and an operating

profit of 11.9 billion euros for the group.

About Allianz Real Estate Allianz Real Estate

is the dedicated real estate investment manager within the Allianz

Group and has grown to become the world’s largest investor in real

estate. The firm develops and executes worldwide tailored portfolio

and investment strategies on behalf of a range of global liability

driven investors, including Allianz companies, creating value for

clients through direct as well as indirect investments and real

estate loans. The operational management of investments and assets

is performed out of 21 offices in key gateway cities across 5

regions (West Europe, North & Central Europe, Switzerland, USA

and Asia Pacific). As at 31 December 2019, Allianz Real Estate held

73.6 billion euros assets under management. For more information,

please visit: http://www.allianz-realestate.com

These assessments are, as always, subject to the disclaimer

provided below.

Cautionary note regarding forward-looking

statementsThis document may include forward-looking

statements, such as prospects or expectations, that are based on

management's current views and assumptions and subject to known and

unknown risks and uncertainties. Actual results, performance

figures, or events may differ significantly from those expressed or

implied in such forward-looking statements. Deviations may arise

due to changes in factors including, but not limited to, the

following: (i) the general economic and competitive situation in

the Allianz Group's core business and core markets, (ii) the

performance of financial markets (in particular market volatility,

liquidity, and credit events), (iii) the frequency and severity of

insured loss events, including those resulting from natural

catastrophes, and the development of loss expenses, (iv) mortality

and morbidity levels and trends, (v) persistency levels, (vi)

particularly in the banking business, the extent of credit

defaults, (vii) interest rate levels, (viii) currency exchange

rates, most notably the EUR/USD exchange rate, (ix) changes in laws

and regulations, including tax regulations, (x) the impact of

acquisitions including and related integration issues and

reorganization measures, and (xi) the general competitive

conditions that, in each individual case, apply at a local,

regional, national, and/or global level. Many of these changes can

be exacerbated by terrorist activities.

No duty to updateThe Allianz Group assumes no

obligation to update any information or forward-looking statement

contained herein, save for any information we are required to

disclose by law.

OtherThe figures regarding the net assets,

financial position and results of operations have been prepared in

conformity with International Financial Reporting Standards.

Privacy Note

Allianz SE is committed to protecting your

personal data. Find out more in our Privacy

Statement.

About VGP VGP is a leading European developer,

manager and owner of high-quality logistics and semi- industrial

real estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain. The

company has a development land bank (owned or committed) of 6.67

million m2 and the strategic focus is on the development of

business parks. Founded in 1998 as a family-owned real estate

developer in the Czech Republic, VGP with a staff of circa 220

employees today owns and operates assets in 12 European countries

directly and through VGP European Logistics and VGP European

Logistics 2, both joint ventures with Allianz Real Estate. As of

December 2019, the Gross Asset Value of VGP, including the joint

ventures at 100%, amounted to €2.77 billion and the company had a

Net Asset Value (EPRA NAV) of €741 million. VGP is listed on

Euronext Brussels and on the Prague Stock Exchange (ISIN:

BE0003878957)

Forward-looking Statements

This press release may contain forward-looking statements. Such

statements reflect the current views of management regarding future

events, and involve known and unknown risks, uncertainties and

other factors that may cause actual results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. VGP is

providing the information in this press release as of this date and

does not undertake any obligation to update any forward-looking

statements contained in this press release in light of new

information, future events or otherwise. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in VGP or an invitation or inducement to engage

in any other investment activities. VGP disclaims any

liability for statements made or published by third parties and

does not undertake any obligation to correct inaccurate data,

information, conclusions or opinions published by third parties in

relation to this or any other press release issued by

VGP.

For more information, please visit:

http://www.vgpparks.eu

- 20200602 Joint Release Allianz VGP EN

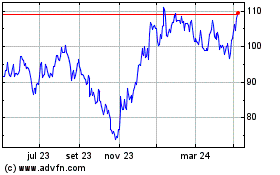

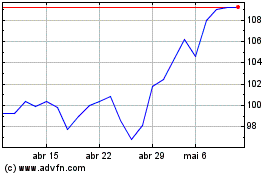

VGP NV (EU:VGP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

VGP NV (EU:VGP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024