Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF), comments on CFRA, one of the world’s largest

providers of independent investment research, who today announced

the release of a new data product focused on Canadian-listed

Exchange Traded Funds (ETFs) that provides CFRA clients with the

same level of detail the firm has long made available covering the

U.S. ETF landscape.

“CFRA’s ETF data is used on our platform to

screen ETFs, generate machine-created narratives, and as a data

feed for our robo-advisor,” explains Prakash Hariharan, President

& CEO of AnalytixInsight. “Our technical teams have worked

together for several months to improve data quality on North

American ETFs and to develop future product offerings. We are

pleased to support CFRA’s launch of its Canadian ETF data set.”

AnalytixInsight’s financial analytics platform,

CapitalCube, is capable of over 100 billion daily computations and

utilizes CFRA’s ETF data in the development of its robo-advisor,

which is being prepared for commercial deployment.

CFRA reports that for the first time, their

users will be able to get in-depth looks at Canadian ETF

constituent holdings, granular classifications and key reference

fields, which include issuer, expense ratio, strategy, and

underlying index, as well as historical returns for each fund since

inception. In the investment research space, wealth managers,

financial advisors, and investment management firms will be able to

scan the universe of Canadian ETFs to find specific asset classes,

strategies, and types of exposures while simultaneously comparing

specific ETFs based on cost, investment objectives, and holdings.

It will also be possible to analyze the underlying constituents

across ETFs to better understand sector, factor, and other risk

exposures. This new data offering can be easily integrated into

existing ETF screeners, portfolio analytics tools and other

applications, allowing CFRA clients to build and share more robust

offerings with their own clients.

“The Canadian ETF marketplace is one of the

largest in the world, with well over $150 billion in assets and

more than 30 fund sponsors that have products listed on Canadian

exchanges,” said Aniket Ullal, Head of ETF Data & Analytics for

CFRA. “Until now, there has not been a data solution that captures

the nuances of the different ETF share classes specific to the

Canadian marketplace. We’ve sought to fill that void, while also

leveraging our proprietary fund data framework created specifically

for ETFs, so these fast-growing new funds aren’t forced into

out-of-date categories and classifications.”

“We’re very excited to add this Canada-focused

ETF data offering to our U.S. capabilities, and look forward to

announcing similar data and analytics offerings focused on the

world’s other major ETF marketplaces,” added Ullal, who prior to

joining CFRA was the founder of First Bridge Data, LLC, which was

acquired by CFRA in 2019.

ABOUT CFRA

CFRA is one of the world’s largest providers of

independent investment research, analytics and data. Through a

differentiated methodology blending forensic accounting and

fundamental equity research, CFRA empowers sophisticated investment

professionals, advisors and risk managers with actionable analysis

and proven results. CFRA’s global research team of 75 analysts

critically evaluates industries, funds and companies of interest to

help over 2,000 clients, including the world’s leading

institutional investors, wealth advisors, corporations, academics

and governments, to make sound investment and business decisions.

Founded in 1994, CFRA is privately held with offices in or near New

York, London, Hong Kong, Kuala Lumpur, Charlottesville, and

Washington, D.C. In October 2016, CFRA acquired and has since fully

integrated the Equity and Fund Research business from S&P

Global. www.cfraresearch.com.

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial

Intelligence, machine-learning company. AnalytixInsight’s financial

analytics platform CapitalCube.com algorithmically analyzes market

price data and regulatory filings to create insightful actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in MarketWall, a developer of FinTech solutions for

financial institutions. For more information, visit

AnalytixInsight.com.

CONTACT INFORMATION:

Scott UrquhartVP Corporate

DevelopmentScott.Urquhart@AnalytixInsight.com

Regulatory Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the growth of the Company’s

business operations; the relationship between the Company and CFRA,

the impact to the Company resulting from its use of CFRA data, the

Company’s ability to commercially deploy its robo-advisor; and the

Company’s future performance. Generally, forward-looking

information can be identified by the use of forward-looking

terminology such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of AnalytixInsight Inc., as

the case may be, to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the Company’s technology and revenue

generation; risks associated with operation in the technology

sector; ability to successfully integrate new technology and

employees; foreign operations risks; and other risks inherent in

the technology industry. Although AnalytixInsight has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. AnalytixInsight does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

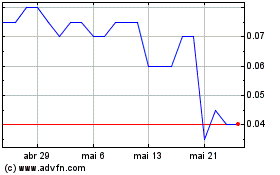

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024