CGG Announces its 2020 Third

Quarter Results

Solid Q3

Adjusted EBITDAs performance

Business activity

gradually resuming

PARIS, France – November 5, 2020 –

CGG (ISIN: FR0013181864), a

world leader in Geoscience, announced today its

2020 third quarter unaudited results.

Commenting on these results, Sophie

Zurquiyah, CGG CEO, said:

“CGG markets stabilized in Q3 as large

Independents and NOCs started to resume activity, mainly in their

core areas. We are on track with the implementation of the

cost reduction plan resulting in increased Adjusted EBITDAs. Our

high-end technology significantly improves our client’s

understanding of the subsurface and provides important insights to

the prioritization of their energy investments. This,

combined with our focus on mature basins and the technology vital

for step-out exploration, development and production, provides CGG

with a unique value proposition for our clients. We have been

able to maintain market share in our core businesses throughout the

year, and I have been pleased with our progress towards developing

offerings in adjacent fields, including structural health

monitoring, CCUS, geothermal and environmental geosciences. “

Q3

2020:

stable Revenue and

increased Adjusted

EBITDAs quarter-on-quarter

-

IFRS figures: revenue at $178m, OPINC at $(43)m,

Group net loss at $(93)m

-

Segment revenue at $199m, stable

quarter-on-quarter

-

Geoscience: Resilient activity of large and dedicated imaging

centers

-

Multi-client: Increased sales driven by higher after-sales

-

Equipment: Lower land activity and delays in deliveries

-

Segment EBITDAs at $52m and

Adjusted*

Segment EBITDAs at

$80m before

$(28)m of non-recurring severance costs, up 6% quarter-on-quarter,

a 40% margin

-

Segment Operating Income at $(38)m and

Adjusted*

Segment Operating Income at

$(4)m before $(34)m of

non-recurring charges

*Adjusted indicators represent supplementary information

adjusted for non-recurring charges triggered by economic

downturn. Liquidity of $465m at the end of September

2020

-

Q3 2020 negative change in working capital

of $(37)m supporting increased Q4 sales

-

Q3 2020 non-recurring cash costs

of $(26)m, including $(7)m severance and $(19)m of

CGG 2021 plan costs

-

Q3 2020 Segment Free Cash Flow at

$(59)m,

including high negative change in working capital. Net Cash

Flow of $(92)m

-

Liquidity of $465m and

Net debt before IFRS 16 of

$749m at

September 30, 2020

Confirming 2020 Cash Capex and 2020

cost reduction measures**

- 2020

Cash Capex around $300 million:

-

2020 Multi-client cash capex confirmed at around $225

million and around 75% prefunding

rate

-

2020 Industrial and development costs cash capex around $75

million

-

All saving plans (2021 plan and Covid-19) expected to generate cash

costs reductions of around $35m in 2020 and around

$135m annualized, including around

$90m of fixed cash costs

-

Covid-19 plan total expenses of around $(50)m,

with P&L impact of $(44)m in 2020 and $(6)m$ in 2021 and

cash-out sequence of $(15)m in 2020 and $(35)m in 2021

**As mentioned on May 12, 2020, capex and cost reductions are the

only two metrics for 2020 guidance provided by the company in

current crisis environment Sercel

and Shearwater agreed to suspend

negotiations on marine streamer

JV Due to the downturn in the oil & gas

industry, triggered by the COVID-19 pandemic, CGG and Shearwater

have jointly agreed to suspend negotiations around creating a

marine streamer equipment JV until visibility in the streamer

replacement cycle improves. Both parties continue to benefit from

the marine acquisition partnership and remain committed to the

establishment of its technology component to further their mually

beneficial cooperation. |

|

Key Figures - Third Quarter 2020 |

|

Key Figures IFRS - Quarter In million $ |

2020 Q2 |

2020 Q3 |

Variances % |

|

Operating revenues |

239 |

178 |

(26)% |

|

Operating Income |

(32) |

(43) |

(32)% |

|

Equity from Investment |

0 |

0 |

- |

|

Net cost of financial debt |

(33) |

(34) |

4% |

|

Other financial income (loss) |

(36) |

(12) |

(67)% |

|

Income taxes |

(33) |

1 |

103% |

|

Net Income / Loss from continuing

operations |

(134) |

(88) |

34% |

|

Net Income / Loss from discontinued operations |

(13) |

(5) |

62% |

|

Group net income / (loss) |

(147) |

(93) |

37% |

|

Operating Cash Flow |

81 |

12 |

(85)% |

|

Net Cash Flow |

(77) |

(92) |

(20)% |

|

Net debt |

783 |

910 |

16% |

|

Net debt before lease |

626 |

749 |

20% |

|

Capital employed |

2,129 |

2,172 |

2% |

|

Key Segment Figures - Third Quarter 2020 |

|

Key Segment Figures - Quarter In million $ |

2020 Q2 |

2020 Q3 |

Variances % |

|

Segment revenue |

202 |

199 |

(1)% |

|

Segment EBITDAs |

68 |

52 |

(24)% |

|

Group EBITDAs margin |

34% |

26% |

(77) bps |

|

Segment operating income |

(53) |

(38) |

29% |

|

Opinc margin |

(26)% |

(19)% |

75 bps |

|

IFRS 15 adjustment |

21 |

(5) |

(123)% |

|

IFRS operating income |

(32) |

(43) |

(32)% |

|

Operating Cash Flow |

81 |

12 |

(85)% |

|

Net Segment Cash Flow |

(77) |

(92) |

(20)% |

|

Supplementary information |

|

|

|

|

Adjusted segment EBITDAs before NRC |

76 |

80 |

6% |

|

EBITDAs margin |

37% |

40% |

29 bps |

|

Adjusted segment operating income before

NRC |

(5) |

(4) |

15% |

|

Opinc margin |

(2)% |

(2)% |

3 bps |

|

Key Figures – 9 Months 2020 |

|

Key Figures IFRS - YTD In million $ |

2019 Sept YTD |

2020 Sept YTD |

Variances % |

|

Operating revenues |

930 |

669 |

(28)% |

|

Operating Income |

169 |

(115) |

- |

|

Equity from Investment |

0 |

0 |

- |

|

Net cost of financial debt |

(98) |

(100) |

(1)% |

|

Other financial income (loss) |

4 |

(42) |

- |

|

Income taxes |

(11) |

(37) |

- |

|

Net Income / Loss from continuing

operations |

63 |

(293) |

- |

|

Net Income / Loss from discontinued operations |

(151) |

(45) |

70% |

|

Group net income / (loss) |

(87) |

(338) |

- |

|

Operating Cash Flow |

572 |

238 |

(58)% |

|

Net Cash Flow |

179 |

(152) |

- |

|

Net debt |

732 |

910 |

24% |

|

Net debt before leases |

544 |

749 |

38% |

|

Capital employed |

2,312 |

2,172 |

(6)% |

|

Key Segment Figures – 9 Months 2020 |

|

Key Segment Figures - YTD In million $ |

2019 Sept YTD |

2020 Sept YTD |

Variances % |

|

Segment revenue |

1,004 |

672 |

(33)% |

|

Segment EBITDAs |

515 |

243 |

(53)% |

|

Group EBITDAs margin |

51% |

36% |

(152) bps |

|

Segment operating income |

175 |

(122) |

- |

|

Opinc margin |

17% |

(18)% |

(356) bps |

|

IFRS 15 adjustment |

(6) |

7 |

- |

|

IFRS operating income |

169 |

(115) |

- |

|

Operating Cash Flow |

572 |

238 |

(58)% |

|

Net Segment Cash Flow |

179 |

(152) |

- |

|

Supplementary information |

|

|

|

|

Adjusted segment EBITDAs before NRC |

515 |

281 |

(46)% |

|

Group EBITDAs margin |

51% |

42% |

(96) bps |

|

Adjusted segment operating income before

NRC |

175 |

32 |

(82)% |

|

Opinc margin |

17% |

5% |

(127) bps |

|

Key figures bridge: Segment to IFRS - Third Quarter

2020 |

|

P&L items - Q3 In million $ |

Segment figures |

IFRS 15 adjustment |

IFRS figures |

|

Total Revenue |

199 |

(22) |

178 |

|

OPINC |

(38) |

(5) |

(43) |

| |

|

|

|

|

Cash Flow Statement items - Q3 In million $ |

Segment figures |

IFRS 15 adjustment |

IFRS figures |

|

EBITDAs |

52 |

(22) |

30 |

|

Change in Working Capital & Provisions |

(37) |

22 |

(16) |

|

Cash Provided by Operations |

12 |

(0) |

12 |

| |

|

|

|

|

Multi-Client Data Library NBV In million $ |

Segment figures |

IFRS 15 adjustment |

IFRS figures |

|

Opening Balance Sheet, Mar 20 |

340 |

140 |

480 |

|

Closing Balance Sheet, Sept 20 |

345 |

154 |

499 |

|

Key figures bridge: Segment to IFRS – 9 Months

2020 |

|

P&L items - YTD In million $ |

Segment figures |

IFRS 15 adjustment |

IFRS figures |

|

Total Revenue |

672 |

(3) |

669 |

|

OPINC |

(122) |

7 |

(115) |

| |

|

|

|

|

Cash Flow Statement items - YTD In million $ |

Segment figures |

IFRS 15 adjustment |

IFRS figures |

|

EBITDAs |

243 |

(3) |

240 |

|

Change in Working Capital & Provisions |

(1) |

3 |

2 |

|

Cash Provided by Operations |

238 |

(0) |

238 |

| |

|

|

|

|

Multi-Client Data Library NBV In million $ |

Segment figures |

IFRS 15 adjustment |

IFRS figures |

|

Opening Balance Sheet , Dec 19 |

376 |

155 |

531 |

|

Closing Balance Sheet , Sep 20 |

345 |

154 |

499 |

Third Quarter

2020 Segment Financial

Results

Geology, Geophysics & Reservoir

(GGR)

|

Geology, Geophysics & Reservoir

(GGR)In million $ |

2020Q2 |

2020Q3 |

Variances, % |

|

Segment revenue |

144 |

150 |

4% |

|

Geoscience |

83 |

77 |

(7)% |

|

Multi-Client |

62 |

73 |

18% |

|

Prefunding |

46 |

39 |

(15)% |

|

After-Sales |

15 |

34 |

120% |

|

Segment EBITDAs |

74 |

56 |

(24)% |

|

EBITDAs Margin |

51% |

38% |

(137) bps |

|

Segment operating income |

(39) |

(25) |

37% |

|

OPINC Margin |

(27)% |

(16)% |

106 bps |

|

Equity from investments |

0 |

0 |

- |

|

Capital employed (in billion $) |

1.7 |

1.7 |

1% |

|

Supplementary information |

|

|

|

|

Adjusted segment EBITDAs before NRC |

81 |

85 |

6% |

|

EBITDAs Margin |

56% |

57% |

10 bps |

|

Adjusted segment OPINC before NRC |

9 |

10 |

7% |

|

OPINC Margin |

6% |

7% |

2 bps |

|

Other Key Metrics |

|

|

|

|

Multi-Client cash capex ($m) |

(73) |

(58) |

(20)% |

|

Multi-Client cash prefunding rate (%) |

63% |

68% |

43 bps |

GGR segment revenue was $150

million, up 4% quarter-on-quarter.

-

Geoscience revenue was $77 million, down (7)%

quarter-on-quarter.

Despite the general slowdown of the economy and

its effect on clients’ E&P spending, Geoscience activity

remained resilient, down sequentially (7)% driven by sustained

activity in the main large imaging centers, GeoSoftware and our

dedicated processing centers.

Geoscience is adapting to lower demand as Q3

total production was down only (2)% sequentially.Preservation of

business continuity and profitability remains the focus. CGG’s

Geoscience leading technology continues to be recognized by major

clients. GeoSoftware continued to delivered innovation this quarter

with new reservoir characterization cloud technology, and Smart

Data Solutions business won significant data management

contracts.

- Multi-Client revenue was $73 million this

quarter, up 18% quarter-on-quarter.

- Prefunding revenue of our multi-client projects was $39

million, down (15)% quarter-on-quarter as multi-client cash capex

was (20)% lower at $(58)m in Q3. Prefunding rate was 68%.We had

four multi-client programs this quarter: three marine streamer

surveys – Nebula in Brazil, Gippsland – in Australia and North

Viking Graben in Norway, and one ocean bottom nodes survey in the

UK North Sea.

- Multi-client after-sales were at $34 million this quarter

driven by Brazil and US Gulf of Mexico, up 120%

quarter-on-quarter.

The segment library Net Book Value was $345

million ($499 million after IFRS 15 adjustments) at the end of

September 2020, split 86% offshore and 14% onshore.

GGR segment EBITDAs was $56

million, with 38% margin.

GGR Adjusted

segment EBITDAs $85 million with 57% margin before

$(28) million of COVID-19 plan costs.

GGR segment operating income

was $(25) million.

GGR

Adjusted segment

operating income was $10 million with 6% margin before

$(35) million of non-recurring charges.

GGR capital employed was stable

at $1.7 billion at the end of September 2020.

Equipment

|

EquipmentIn million $ |

2020Q2 |

2020Q3 |

Variances, % |

|

Segment revenue |

58 |

50 |

(14)% |

|

Land |

45 |

31 |

(30)% |

|

Marine |

10 |

15 |

52% |

|

Downhole gauges |

3 |

2 |

(28)% |

|

Non Oil & Gas |

1 |

3 |

92% |

|

Segment EBITDAs |

0 |

(1) |

- |

|

EBITDAs margin |

0% |

(1)% |

(18) bps |

|

Segment operating income |

(7) |

(9) |

(27)% |

|

OPINC Margin |

(12)% |

(18)% |

(51) bps |

|

|

|

|

|

|

Capital employed (in billion $) |

0.5 |

0.6 |

5% |

|

Supplementary information |

|

|

|

|

Adjusted segment EBITDAs before NRC |

1 |

0 |

- |

|

EBITDAs margin |

2% |

0% |

(25) bps |

|

Adjusted segment OPINC before NRC |

(6) |

(9) |

(38)% |

|

OPINC Margin |

(11)% |

(17)% |

(58) bps |

Equipment segment revenue was

$50 million, down 14% quarter-on-quarter. External sales were $50

million.

-

Land equipment sales represented 62% of total sales, as we

delivered in Q3 over 50 thousand 508XT channels mainly in Russia

and India. Sercel also delivered its first land node WiNG system in

North America.

-

Marine equipment sales represented 29% of total sales driven by

spares sections sales of Sentinel streamers’ installed base.

-

Downhole equipment sales were $2 million and sales from non Oil

& Gas equipment were $3 million

Equipment segment EBITDAs was

$(1) million.

Equipment

Adjusted segment EBITDAs was $0m

before $(1) million of COVID-19 plan costs.

Equipment segment operating

income was $(9) million.

Equipment

Adjusted segment operating income

$(9) million before $(0.5) million of non-recurring charges.

Equipment capital employed was

up at $0.6 billion at the end of September 2020.

Third Quarter

2020 Financial Results

|

Consolidated Income StatementsIn million

$ |

2020Q2 |

2020Q3 |

Variances % |

|

Exchange rate euro/dollar |

1.10 |

1.17 |

6% |

|

Segment revenue |

202 |

199 |

(1)% |

|

GGR |

144 |

150 |

4% |

|

Equipment |

58 |

50 |

(14)% |

|

Elim & Other |

(1) |

(1) |

7% |

|

Segment Gross Margin |

24 |

27 |

13% |

|

Segment EBITDAs |

68 |

52 |

(24)% |

|

GGR |

81 |

85 |

6% |

|

Equipment |

1 |

0 |

- |

|

Corporate |

(6) |

(5) |

7% |

|

Elim & Other |

0 |

1 |

- |

|

COVID-19 plan |

(7) |

(28) |

- |

|

Segment operating income |

(53) |

(38) |

29% |

|

GGR |

9 |

10 |

7% |

|

Equipment |

(6) |

(9) |

(38)% |

|

Corporate |

(7) |

(6) |

8% |

|

Elim & Other |

(1) |

1 |

- |

|

Non recurring charges |

(49) |

(34) |

31% |

|

IFRS 15 adjustment |

21 |

(5) |

- |

|

IFRS operating income |

(32) |

(43) |

(32)% |

|

Equity from investments |

0 |

0 |

- |

|

Net cost of financial debt |

(33) |

(34) |

(4)% |

|

Other financial income (loss) |

1 |

(4) |

- |

|

Income taxes |

(24) |

1 |

104% |

|

NRC (Tax & OFI) |

(46) |

(8) |

83% |

|

Net income / (loss) from continuing

operations |

(134) |

(88) |

34% |

|

Net income / (loss) from discontinued operations |

(13) |

(5) |

62% |

|

IFRS net income / (loss) |

(147) |

(93) |

37% |

|

Shareholder's net income / (loss) |

(147) |

(93) |

37% |

|

Basic Earnings per share in $ |

(0.21) |

(0.13) |

37% |

|

Basic Earnings per share in € |

(0.19) |

(0.11) |

40% |

Segment revenue was $199

million, stable quarter-on-quarter. The respective contributions

from the Group’s businesses were 38% from Geoscience, 37% from

Multi-Client (75% for the GGR segment) and 25% from Equipment.

Segment EBITDAs was $52 million

and Adjusted*

segment EBITDAs

was $80 million

before $(28) million of Covid-19 plan costs, up 6% sequentially, a

40% margin.

Segment

operating

income was $(38) million and

Adjusted*

segment

operating

income was $(4)

million before $(34) million of non-recurring charges.

IFRS 15 adjustment at operating

income level was $(5) million and IFRS operating

income, after IFRS 15 adjustment, was $(43) million.

Cost of financial debt was

$(34) million. The total amount of interest paid during the quarter

was $(7) million.

Other Financial Items were

$(12) million including $(8) million of non-recurring charges

related to remeasurement of fair value of other financial assets

and liabilities.

Taxes were at $1 million.

Net loss

from continuing operations was $(88) million.

|

Discontinued operationsCorrespond to the former

Contractual Data Acquisition and Non-Operated Resources segments.

Main aggregates are as follows:- Q3 revenue from

discontinued operations was $6 million.- Net loss

from discontinued operations was $(5) million this

quarter.- Net Cash flow from discontinued

operations was $7 million before Plan 2021 |

Group

net loss was $(93) million.

After minority interests,

Group net

loss attributable to CGG

shareholders was $(93) million/ €(79) million.

Adjusted Net loss from

continuing operations, excluding

$(41) million of non-recurring charges, was $(47) million.

Global economic crisis, triggered by Covid-19

pandemic and unprecedented drop in oil price and E&P spending

lead CGG to launch cost reduction actions («Covid-19 plan») and

recognize other non-recurring charges.

$(41)

million of non-recurring

charges were booked during the third quarter of 2020:

- $(28)

million of severance costs

- $(6)

million of non-cash fair value remeasurement of assets available

for sale

- $(8)

million of non-cash remeasurement of other financial assets and

liabilities mainly related to Marine Acquisition exit

transaction

|

Non-recurring charges (in m$) |

Q3 2020 |

|

Operational costs provisions |

(28) |

|

Multi-client library Impairment |

|

|

Asset impairment |

(6) |

|

Goodwill impairment |

|

|

Other Financial Items (OFI) adjustment |

(8) |

|

Deferred Tax Assets impairment |

|

|

Total |

(41) |

Third Quarter 2020

Cash Flow

|

Cash Flow itemsIn million $ |

2020Q2 |

2020Q3 |

Variances % |

|

Segment Operating Cash Flow |

81 |

12 |

(85)% |

|

CAPEX |

(89) |

(71) |

(20)% |

|

Industrial |

(4) |

(5) |

21% |

|

R&D |

(12) |

(8) |

(33)% |

|

Multi-Client (Cash) |

(73) |

(58) |

(20)% |

|

Marine MC |

(62) |

(56) |

(9)% |

|

Land MC |

(11) |

(2) |

(84)% |

|

Proceeds from disposals of assets |

0 |

0 |

- |

|

Segment Free Cash Flow |

(8) |

(59) |

- |

|

Lease repayments |

(15) |

(15) |

1% |

|

Paid Cost of debt |

(32) |

(7) |

78% |

|

Plan 2021 |

(22) |

(19) |

15% |

|

Free cash flow from discontinued operations |

0 |

7 |

- |

|

Net Cash flow |

(77) |

(92) |

(20)% |

|

Financing cash flow |

0 |

(5) |

- |

|

Forex and other |

(1) |

16 |

- |

|

Net increase/(decrease) in cash |

(78) |

(81) |

(4)% |

|

|

|

|

|

|

Supplementary information |

|

|

|

|

|

|

|

|

|

Change in working capital and provisions,

included in Segment Operating Cash Flow |

15 |

(37) |

- |

|

COVID-19 plan Cash |

(3) |

(7) |

- |

|

Segment Free Cash Flow before COVID-19 plan |

(5) |

(52) |

- |

Total capex was $(71) million, down (20)%

quarter-on-quarter:

-

Industrial capex was $(5) million,

- Research

& Development capex was $(8) million,

-

Multi-client cash capex was $(58) million, down

(20)% quarter-on-quarter

Segment Free Cash

Flow, including $(37) million change in

working capital and $(7)m of non-recurring severance cash costs,

was $(59) million.

After $(15) million lease repayments, $(7)

million paid cost of debt, $(19) million 2021 plan cash costs and

$7 million free cash flow from discontinued operations, Net

Cash Flow was $(92) million.

First 9 months

2020 Financial

Results

|

Consolidated Income StatementsIn million

$ |

2019SeptYTD |

2020SeptYTD |

Variances % |

|

Exchange rate euro/dollar |

1.13 |

1.12 |

(0)% |

|

Segment revenue |

1,004 |

672 |

(33)% |

|

GGR |

685 |

492 |

(28)% |

|

Equipment |

329 |

183 |

(44)% |

|

Elim & Other |

(9) |

(2) |

74% |

|

Segement Gross Margin |

284 |

124 |

(57)% |

|

Segment EBITDAs |

515 |

243 |

(53)% |

|

GGR |

463 |

289 |

(37)% |

|

Equipment |

74 |

9 |

(88)% |

|

Corporate |

(21) |

(17) |

19% |

|

Elim & Other |

0 |

0 |

- |

|

COVID-19 plan |

0 |

(38) |

- |

|

Segment operating income |

175 |

(122) |

- |

|

GGR |

148 |

66 |

(55)% |

|

Equipment |

51 |

(15) |

- |

|

Corporate |

(23) |

(19) |

17% |

|

Elim & Other |

0 |

(0) |

- |

|

Non-recurring charges |

0 |

(154) |

- |

|

IFRS 15 adjustment |

(6) |

7 |

- |

|

IFRS operating income |

169 |

(115) |

- |

|

Equity from investments |

0 |

0 |

- |

|

Net cost of financial debt |

(98) |

(100) |

1% |

|

Other financial income (loss) |

4 |

3 |

(21)% |

|

Income taxes |

(11) |

(28) |

- |

|

NRC (Tax & OFI) |

- |

(53) |

- |

|

Net income / (loss) from continuing

operations |

63 |

(293) |

- |

|

Net income / (loss) from discontinued operations |

(151) |

(45) |

70% |

|

IFRS net income / (loss) |

(87) |

(338) |

- |

|

Shareholder's net income / (loss) |

(94) |

(340) |

- |

|

Basic Earnings per share in $ |

(0.13) |

(0.48) |

- |

|

Basic Earnings per share in € |

(0.12) |

(0.43) |

- |

Segment revenue was $672

million, down (33)% compared to last year. The respective

contributions from the Group’s businesses were 38% from Geoscience,

35% from Multi-Client (73% for the GGR segment) and 27% from

Equipment.

GGR segment revenue was $492

million, down (28)% year-on-year

-

Geoscience revenue was $253 million, down (9)%

year-on-year and more resilient mainly due to backlog.

-

Multi-Client sales were $239 million, down (41)%

year-on-year.

-

Prefunding revenue was $143 million, down (9)% year-on-year.

Multi-Client cash capex was $(198) million, up 29% year-on-year and

cash prefunding rate was 72%.

-

After-sales were $96 million, down (62)% year-on-year, including

large one-off transfer fees in Q3 2019.

Equipment revenue was $183

million, down (44)% year-on-year with a drop in equipment market

triggered by the Covid-19 crisis.

Segment EBITDAs was $243

million and Adjusted

segment EBITDAs

was $281 million, before $(38) million of Covid-19 plan costs, down

46% year-on-year, a 42% margin.

GGR adjusted EBITDA margin was at 59% and

Equipment adjusted EBITDA margin at 4%.

Segment operating income was

$(122) million and Adjusted

segment operating

income, was $32 million, before $(154) million of

non-recurring charges.

IFRS 15 adjustment at operating

income level was $7 million and IFRS operating

income, after IFRS 15 adjustment, was $(115) million.

Cost of financial debt was

$(100) million. The total amount of interest paid during the first

9 months 2020 was $(47) million.

Other Financial Items were

$(42) million, including $(45) million of non-recurring charges

related to remeasurement of fair value of other financial assets

and liabilities.

Taxes were at $(28)

million.

Net loss

from continuing operations was $(293) million.

|

Discontinued operationsCorrespond to the former

Contractual Data Acquisition and Non-Operated Resources segments.

Main aggregates are as follows:-First 9 months 2020 revenue

from discontinued operations was $25 million.-Net

loss from discontinued operations was $(45)

million.-Net Cash flow from discontinued

operations was $17 million before Plan 2021. |

Group

net loss was $(338) million.

After minority interests,

Group loss attributable

to CGG shareholders was $(340) million/

€(302) million.

Adjusted Net Loss from continuing

operations, excluding $(207) million

non-recurring charges, was $(86) million.

Global economic crisis, triggered by Covid-19

pandemic and unprecedented drop in oil price and E&P spending

lead CGG to launch cost reduction actions and recognize other

non-recurring charges.

$(207)

million of non-recurring

charges were booked during the first 9 months of 2020:

- $(38) million

severance cash costs related to Covid-19 plan

- $(69) million

non-cash impairment of the multi-client library

- $(23) million

non-cash fair value remeasurement of GeoSoftware business available

for sale

- $(24) million

non-cash goodwill impairment related to GeoConsulting business

mainly focused on exploration and appraisal

- $(45) million

non-cash remeasurement of other financial assets and liabilities

mainly related to Marine Acquisition exit transaction

- $(9) million

non-cash impairment of Deferred Tax Assets

|

Non-recurring charges (in m$) |

9 months 2020 |

|

Operational costs provisions |

(38) |

|

Multi-client library Impairment |

(69) |

|

Asset impairment |

(23) |

|

Goodwill impairment |

(24) |

|

Other Financial Items (OFI) adjustment |

(45) |

|

Deferred Tax Assets impairment |

(9) |

|

Total |

(207) |

First 9 months 2020 Cash

Flow

|

Cash Flow items(in

m$) |

2019SeptYTD |

2020SeptYTD |

Variances % |

|

Segment Operating Cash Flow |

572 |

238 |

(58)% |

|

CAPEX |

(205) |

(248) |

21% |

|

Industrial |

(28) |

(18) |

(36)% |

|

R&D |

(24) |

(32) |

31% |

|

Multi-Client (Cash) |

(153) |

(198) |

29% |

|

Marine MC |

(131) |

(169) |

29% |

|

Land MC |

(22) |

(29) |

30% |

|

Proceeds from disposals of assets |

0 |

0 |

- |

|

Segment Free Cash Flow |

367 |

(9) |

- |

|

Lease repayments |

(41) |

(44) |

(6)% |

|

Paid Cost of debt |

(47) |

(47) |

2% |

|

Plan 2021 |

(65) |

(69) |

(7)% |

|

Free cash flow from discontinued operations |

(35) |

17 |

- |

|

Net Cash flow |

179 |

(152) |

- |

|

Financing cash flow |

0 |

(5) |

- |

|

Forex and other |

(18) |

11 |

- |

|

Net increase/(decrease) in cash |

161 |

(146) |

- |

|

Supplementary information |

|

|

|

|

Change in working capital and provisions,

included in Segment Operating Cash Flow |

77 |

(1) |

- |

|

COVID-19 plan Cash |

- |

(11) |

- |

|

Segment Free Cash Flow before COVID-19 plan |

367 |

1 |

- |

Segment Operating Cash Flow was

$238 million compared to $572 million for the first nine months of

2019, a (58)% decrease year-on-year.

Capex was $(248) million, up

21% year-on-year:

-

Industrial capex was $(18) million, down (36)%

year-on-year,

-

Research & Development capex was $(32)

million, up 31% year-on-year,

-

Multi-client cash capex was $(198) million, up 29%

year-on-year.

Including negative change in working capital of

$(1) million and $(11) million of COVID-19 plan severance cash

costs, Segment Free Cash Flow before lease

repayments was at

$(9)

million.

After lease repayments of $(44) million, payment

of interest expenses of $(47) million, CGG 2021 Plan cash costs of

$(69) million and positive free cash flow from discontinued

operations of $17 million, Group

Net Cash Flow was $(152) million.

Balance Sheet

Group gross

debt before IFRS 16 was

$1,213 million

at the end of September 2020 and net debt was

$749

million.

Group gross

debt after IFRS 16 was

$1,375

million at the end of September 2020 and

net debt was

$910

million.

Group’s

liquidity amounted to

$465 million at

the end of September 2020.

Q3 2020 Conference

call

An English language analysts’ conference call is scheduled today

at 8:15 am (Paris time) – 7:15 am (London time)

To follow this conference, please access the live

webcast:

| From your

computer at: |

www.cgg.com |

A replay of the conference will be available via webcast on the

CGG website at: www.cgg.com.

For analysts, please dial the following numbers 5 to 10 minutes

prior to the scheduled start time:

| France

call-in: |

+33 (0) 1 70 70

07 81 |

|

|

| UK

call-in: |

+44(0) 844 4819

752 |

|

|

| Access

Code: |

8151668 |

|

|

About CGG

CGG (www.cgg.com) is a global geoscience

technology leader. Employing around 4,000 people worldwide, CGG

provides a comprehensive range of data, products, services and

equipment that supports the discovery and responsible management of

the Earth’s natural resources. CGG is listed on the Euronext Paris

SA (ISIN: 0013181864).

Contacts

|

Group Communications

& Investor RelationsChristophe BarniniTel: + 33 1 64

47 38 11E-Mail: : christophe.barnini@cgg.com |

|

CONSOLIDATED FINANCIAL

STATEMENTS

September

30,

2020

Unaudited Interim Consolidated statements of

operations

| |

|

Nine months ended September 30, |

|

(In millions of US$, except per share data) |

|

2020 |

2019 |

|

Operating revenues |

|

668.9 |

930.1 |

|

Other income from ordinary activities |

|

0.5 |

0.5 |

|

Total income from ordinary activities |

|

669.4 |

930.6 |

|

Cost of operations |

|

(538.4) |

(652.3) |

|

Gross profit |

|

131.0 |

278.3 |

|

Research and development expenses - net |

|

(12.9) |

(17.9) |

|

Marketing and selling expenses |

|

(25.2) |

(34.3) |

|

General and administrative expenses |

|

(52.9) |

(54.0) |

|

Other revenues (expenses) - net |

|

(154.8) |

(2.9) |

|

Operating income (loss) |

|

(114.8) |

169.2 |

|

Expenses related to financial debt |

|

(101.6) |

(100.8) |

|

Income provided by cash and cash equivalents |

|

1.9 |

2.5 |

|

Cost of financial debt, net |

|

(99.7) |

(98.3) |

|

Other financial income (loss) |

|

(41.8) |

3.5 |

|

Income (loss) before incomes taxes |

|

(256.3) |

74.4 |

|

Income taxes |

|

(36.8) |

(11.2) |

|

Net income (loss) from consolidated companies before share

of income (loss) in companies accounted for under the equity

method |

|

(293.1) |

63.2 |

|

Share of income (loss) in companies accounted for under the equity

method |

|

0.1 |

(0.1) |

|

Net income (loss) from continuing operations |

|

(293.0) |

63.1 |

|

Net income (loss) from discontinued operations |

|

(45.0) |

(150.5) |

|

Net income (loss) |

|

(338.0) |

(87.4) |

|

Attributable to : |

|

|

|

|

Owners of CGG S.A |

|

(339.6) |

(94.2) |

|

Non-controlling interests |

|

1.6 |

6.8 |

|

Net income (loss) per share |

|

|

|

|

Basic |

|

(0.48) |

(0.13) |

|

Diluted |

|

(0.48) |

(0.13) |

|

Net income (loss) from continuing operations per

share |

|

|

|

|

Basic |

|

(0.41) |

0.08 |

|

Diluted |

|

(0.41) |

0.08 |

|

Net income (loss) from discontinued operations per

share |

|

|

|

|

Basic |

|

(0.06) |

(0.21) |

|

Diluted |

|

(0.06) |

(0.21) |

Unaudited Consolidated statements of financial

position

|

(In millions of US$) |

|

September 30, 2020 |

December 31, 2019 |

|

ASSETS |

|

|

|

|

Cash and cash equivalents |

|

464.5 |

610.5 |

|

Trade accounts and notes receivable, net |

|

259.0 |

436.0 |

|

Inventories and work-in-progress, net |

|

236.9 |

200.1 |

|

Income tax assets |

|

86.2 |

84.9 |

|

Other current assets, net |

|

84.9 |

116.7 |

|

Assets held for sale, net |

|

134.3 |

316.6 |

|

Total current assets |

|

1,265.8 |

1,764.8 |

|

Deferred tax assets |

|

10.7 |

19.7 |

|

Investments and other financial assets, net |

|

33.9 |

27.4 |

|

Investments in companies under the equity method |

|

3.6 |

3.0 |

|

Property, plant and equipment, net |

|

278.9 |

300.0 |

|

Intangible assets, net |

|

654.5 |

690.8 |

|

Goodwill, net |

|

1,181.5 |

1,206.9 |

|

Total non-current assets |

|

2,163.1 |

2,247.8 |

|

TOTAL ASSETS |

|

3,428.9 |

4,012.6 |

|

LIABILITIES AND EQUITY |

|

|

|

|

Financial debt – current portion |

|

73.4 |

59.4 |

|

Trade accounts and notes payables |

|

83.0 |

117.4 |

|

Accrued payroll costs |

|

123.1 |

156.6 |

|

Income taxes payable |

|

73.0 |

59.3 |

|

Advance billings to customers |

|

22.3 |

36.9 |

|

Provisions — current portion |

|

55.5 |

50.0 |

|

Other current financial liabilities |

|

37.0 |

— |

|

Other current liabilities |

|

230.9 |

327.3 |

|

Liabilities directly associated with the assets classified as held

for sale |

|

8.1 |

259.2 |

|

Total current liabilities |

|

706.3 |

1,066.1 |

|

Deferred tax liabilities |

|

15.8 |

10.4 |

|

Provisions — non-current portion |

|

48.0 |

58.1 |

|

Financial debt – non-current portion |

|

1,301.1 |

1,266.6 |

|

Other non-current financial liabilities |

|

47.9 |

— |

|

Other non-current liabilities |

|

47.8 |

4.0 |

|

Total non-current liabilities |

|

1,460.6 |

1,339.1 |

|

Common stock: 1,194,086,134 shares authorized and 711,324,363

shares with a €0.01 nominal value outstanding at September 30,

2020 |

|

8.7 |

8.7 |

|

Additional paid-in capital |

|

1,687.1 |

3,184.7 |

|

Retained earnings |

|

(371.9) |

(1,531.1) |

|

Other Reserves |

|

(33.1) |

(23.5) |

|

Treasury shares |

|

(20.1) |

(20.1) |

|

Cumulative income and expense recognized directly in equity |

|

(0.8) |

(0.7) |

|

Cumulative translation adjustment |

|

(48.9) |

(56.3) |

|

Equity attributable to owners of CGG S.A. |

|

1,221.0 |

1,561.7 |

|

Non-controlling interests |

|

41.0 |

45.7 |

|

Total equity |

|

1,262.0 |

1,607.4 |

|

TOTAL LIABILITIES AND EQUITY |

|

3,428.9 |

4,012.6 |

Unaudited Consolidated statements of cash flows

| |

|

Nine months ended September 30, |

|

(In millions of US$) |

|

2020 |

2019 |

|

OPERATING |

|

|

|

|

Net income (loss) |

|

(338.0) |

(87.4) |

|

Less: Net income (loss) from discontinued operations |

|

(45.0) |

(150.5) |

|

Net income (loss) from continuing operations |

|

(293.0) |

63.1 |

|

Depreciation, amortization and impairment |

|

136.5 |

98.0 |

|

Multi-client surveys impairment and amortization |

|

227.4 |

175.6 |

|

Depreciation and amortization capitalized in Multi-client

surveys |

|

(13.2) |

(5.9) |

|

Variance on provisions |

|

22.5 |

1.7 |

|

Share-based compensation expenses |

|

3.9 |

4.0 |

|

Net (gain) loss on disposal of fixed and financial assets |

|

— |

(0.1) |

|

Equity (income) loss of investees |

|

(0.1) |

0.1 |

|

Dividends received from investments in companies under the equity

method |

|

— |

— |

|

Other non-cash items |

|

41.8 |

(2.8) |

|

Net cash-flow including net cost of financial debt and

income tax |

|

125.8 |

333.7 |

|

Less : net cost of financial debt |

|

99.7 |

98.3 |

|

Less : income tax expense (gain) |

|

36.8 |

11.2 |

|

Net cash-flow excluding net cost of financial debt and

income tax |

|

262.3 |

443.2 |

|

Income tax paid |

|

(3.4) |

(19.3) |

|

Net cash-flow before changes in working

capital |

|

258.9 |

423.9 |

|

Changes in working capital |

|

(20.5) |

148.5 |

|

- change in trade accounts and notes receivable |

|

70.6 |

199.6 |

|

- change in inventories and work-in-progress |

|

(34.8) |

(17.7) |

|

- change in other current assets |

|

(6.1) |

(13.8) |

|

- change in trade accounts and notes payable |

|

(14.9) |

(1.8) |

|

- change in other current liabilities |

|

(35.3) |

(17.8) |

|

Net cash-flow provided by operating

activities |

|

238.4 |

572.4 |

|

INVESTING |

|

|

|

|

Total capital expenditures (including variation of fixed assets

suppliers, excluding Multi-client surveys) |

|

(49.8) |

(52.3) |

|

Investment in Multi-client surveys, net cash |

|

(198.0) |

(153.2) |

|

Proceeds from disposals of tangible and intangible assets |

|

0.3 |

(0.1) |

|

Total net proceeds from financial assets |

|

— |

— |

|

Acquisition of investments, net of cash and cash equivalents

acquired |

|

(0.4) |

— |

|

Variation in loans granted |

|

— |

— |

|

Variation in subsidies for capital expenditures |

|

— |

— |

|

Variation in other non-current financial assets |

|

12.0 |

0.6 |

|

Net cash-flow used in investing activities |

|

(235.9) |

(205.0) |

| |

|

Nine months ended September 30, |

|

(In millions of US$) |

|

2020 |

2019 |

|

FINANCING |

|

|

|

|

Repayment of long-term debt |

|

(5.2) |

— |

|

Total issuance of long-term debt |

|

— |

— |

|

Lease repayments |

|

(43.6) |

(41.1) |

|

Change in short-term loans |

|

— |

0.1 |

|

Financial expenses paid |

|

(46.5) |

(47.5) |

|

Net proceeds from capital increase: |

|

|

|

|

— from shareholders |

|

— |

— |

|

— from non-controlling interests of integrated companies |

|

— |

— |

|

Dividends paid and share capital reimbursements: |

|

|

|

|

— to shareholders |

|

— |

— |

|

— to non-controlling interests of integrated companies |

|

(7.2) |

(3.8) |

|

Acquisition/disposal from treasury shares |

|

— |

— |

|

Net cash-flow provided by (used in) financing

activities |

|

(102.5) |

(92.3) |

|

Effects of exchange rates on cash |

|

6.5 |

(14.5) |

|

Impact of changes in consolidation scope |

|

— |

— |

|

Net cash flows incurred by discontinued

operations |

|

(52.5) |

(99.1) |

|

Net increase (decrease) in cash and cash

equivalents |

|

(146.0) |

161.5 |

|

Cash and cash equivalents at beginning of year |

|

610.5 |

434.1 |

|

Cash and cash equivalents at end of period |

|

464.5 |

595.6 |

- CGG - Press Release pdf version

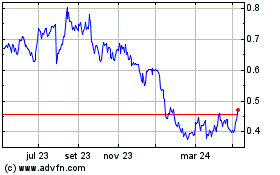

CGG (EU:CGG)

Gráfico Histórico do Ativo

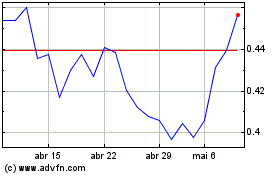

De Mar 2024 até Abr 2024

CGG (EU:CGG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024