Onex Reports Third-Quarter 2020 Results

13 Novembro 2020 - 9:00AM

Onex Corporation (TSX: ONEX) today announced its financial results

for the third-quarter and nine-months ended September 30, 2020 and

an update on matters following quarter end.

“Building on our portfolio improvements last

quarter, we continue to demonstrate increased momentum in our

private equity and credit portfolios, resulting in a very good

quarter for Onex,” said Gerry Schwartz, Chairman and Chief

Executive Officer of Onex. “Earlier this quarter, I was delighted

to announce Bobby Le Blanc as President of Onex, in recognition of

his leadership ability and the positive role he continues to play

in our success.”

Highlights

- Onex reported

segment net earnings for the three months ended September 30, 2020

of $515 million ($5.39 per fully diluted share), comprised of

net earnings of $492 million from its investing segment and net

earnings of $23 million from its asset and wealth management

segment.

- Onex reported

segment net earnings for the nine-months ended September 30, 2020

of $152 million ($1.55 per fully diluted share), comprised of

net earnings of $164 million from its investing segment and a net

loss of $12 million from its asset and wealth management

segment.

- Onex’ private

equity investments generated gross returns of 14% and 9% during the

three and nine-months ended September 30, 2020, respectively.

- Onex’ total

shareholder capital per fully diluted share increased by

approximately 10% in the third-quarter to $74.04 (C$98.76),

primarily driven by net increases in Onex’ private equity and

credit investments.

- In August, Onex

Partners sold approximately 32.0 million shares of SIG Combibloc

Group (SWX: SIGN) at a price of CHF 15.50 per share. Onex’ share of

the net proceeds was $162 million as a Limited Partner in Onex

Partners IV and as a co-investor.

- In August, Onex

invested $35 million in Onex Partners V as part of the Fund’s

investment in preferred shares of Emerald Holdings, Inc. (NYSE:

EEX). This attractively valued investment supports a business with

a solid collection of assets with an opportunity remaining to

improve operations.

- In September,

Onex invested $64 million in Onex Partners V as part of the fund’s

investment in Independent Clinical Services Group Ltd.

- In October, Onex

Partners agreed to make a majority investment in OneDigital, a

leading U.S. provider of employee benefits insurance brokerage and

retirement consulting services. The transaction values OneDigital

at $2.65 billion. The new equity investment of approximately $725

million will be made by Onex Partners V, Onex’ share will be

approximately $200 million.

- Onex deployed

$444 million (C$595 million) during the first ten months of 2020 by

repurchasing 9,780,411 Subordinate Voting Shares at an average cost

per share of C$60.86.

Financial

Results

For the three-months ended September 30, 2020,

total segment net earnings were $515 million ($5.39 per fully

diluted share). Investing segment earnings of $492 million ($5.17

per fully diluted share) were primarily driven by net gains on

Onex’ private equity and credit investments consistent with the

recovery in those markets during the quarter. Third-quarter asset

and wealth management segment earnings of $23 million ($0.22 per

fully diluted share) were driven by management and advisory fees as

well as an increase in unrealized carried interest.

For the nine-months ended September 30, 2020,

total segment net earnings were $152 million ($1.55 per fully

diluted share). Investing segment earnings of $164 million ($1.67

per fully diluted share) were primarily driven by a net gain on

Onex’ private equity investments which reflects the overall

resiliency and diversification of the operating businesses that

Onex has invested in. The asset and wealth management segment loss

for the nine-months ended September 30, 2020 was $12 million ($0.12

per fully diluted share) driven primarily by a net reversal of

unrealized carried interest.

Enclosed are supplementary schedules and

non-IFRS measures related to Onex’ consolidated net earnings for

the three- and nine-months ended September 30, 2020, shareholder

capital at September 30, 2020 and cash and near-cash changes for

the nine-months ended September 30, 2020. The financial statements

prepared in accordance with International Financial Reporting

Standards (IFRS), including Management’s Discussion and Analysis of

the results, are posted on Onex’ website, www.onex.com, and are

also available on SEDAR at www.sedar.com. A supplemental

information package with additional information is available on

Onex’ website, www.onex.com.

Webcast

Onex management will host a webcast to review

Onex’ third-quarter 2020 results on Friday, November 13 at 11:00

a.m. ET. The webcast will be available in listen-only mode from the

Presentations and Events section of Onex’ website,

https://ir.onex.com/events-and-presentations. A 90-day on-line

replay will be available shortly following the completion of

the event.

About Onex

Founded in 1984, Onex invests and manages

capital on behalf of its shareholders, institutional investors and

high net worth clients from around the world. Onex’ platforms

include: Onex Partners, private equity funds focused on larger

opportunities in North America and Europe; ONCAP, private equity

funds focused on middle market and smaller opportunities in North

America; Onex Credit, which manages primarily non-investment grade

debt through collateralized loan obligations, senior loan

strategies and other private credit strategies; and Gluskin Sheff’s

wealth management services including its actively managed public

equity and public credit funds. In total, Onex has approximately

$36.6 billion of assets under management, of which

approximately $6.7 billion is its own shareholder capital. With

offices in Toronto, New York, New Jersey and London, Onex and its

experienced management teams are collectively the largest investors

across Onex’ platforms.

The Onex Partners and ONCAP businesses have

assets of $36 billion, generate annual revenues of $22 billion and

employ approximately 149,000 people worldwide. Onex shares trade on

the Toronto Stock Exchange under the stock symbol ONEX. For more

information on Onex, visit its website at www.onex.com. Onex’

security filings can also be accessed at www.sedar.com.

Forward-Looking Statements

This press release may contain, without

limitation, statements concerning possible or assumed future

operations, performance or results preceded by, followed by or that

include words such as “believes”, “expects”, “potential”,

“anticipates”, “estimates”, “intends”, “plans” and words of similar

connotation, which would constitute forward-looking statements.

Forward-looking statements are not guarantees. The reader should

not place undue reliance on forward-looking statements and

information because they involve significant and diverse risks and

uncertainties that may cause actual operations, performance or

results to be materially different from those indicated in these

forward-looking statements. Except as may be required by Canadian

securities law, Onex is under no obligation to update any

forward-looking statements contained herein should material facts

change due to new information, future events or other factors.

These cautionary statements expressly qualify all forward-looking

statements in this press release.

Non-GAAP Financial Measures

This press release may contain non-GAAP

financial measures which have been calculated using methodologies

that are not in accordance with IFRS. The presentation of financial

measures in this manner does not have a standardized meaning

prescribed under IFRS and is therefore unlikely to be comparable to

similar financial measures presented by other companies. Onex

management believes these financial measures provide helpful

information to investors. Reconciliations of the non-GAAP financial

measures to information contained in the consolidated financial

statements have been presented where practical.

For

Further

InformationJill

HomenukManaging Director, Shareholder Relations and Communications

Tel: +1 416.362.7711

Supplementary

and Non-IFRS Measures

Summarized Consolidated Net

Earnings

(Loss)

|

(Unaudited) ($ millions except per share amounts)Three months ended

September 30, 2020 |

|

Investing(i) |

|

|

Asset

andWealthManagement(i) |

|

|

Total |

|

|

Segment income |

$ |

492 |

|

$ |

93 |

|

$ |

585 |

|

|

Segment expenses |

|

- |

|

|

(70) |

|

|

(70) |

|

|

Segment net earnings |

$ |

492 |

|

$ |

23 |

|

$ |

515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation recovery |

|

|

|

|

|

|

|

3 |

|

|

Amortization of property and equipment and other intangible assets,

excluding right-of-use assets |

|

|

|

|

|

|

|

(12) |

|

|

Integration expense |

|

|

|

|

|

|

|

(5) |

|

|

Net earnings |

|

|

|

|

|

|

$ |

501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment net earnings per share(ii) |

$ |

5.17 |

|

$ |

0.22 |

|

$ |

5.39 |

|

|

Net earnings per

share |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

$ |

5.30 |

|

|

Diluted |

|

|

|

|

|

|

$ |

5.29 |

|

|

(i) |

Refer to the unaudited interim consolidated financial statements

for segment presentation and allocation considerations. |

| (ii) |

Calculated on a fully diluted basis. |

|

(Unaudited) ($ millions except per share amounts)Nine months ended

September 30, 2020 |

|

Investing(i) |

|

|

Asset andWealthManagement(i) |

|

|

Total |

|

|

Segment income |

$ |

164 |

|

$ |

182 |

|

$ |

346 |

|

|

Segment expenses |

|

- |

|

|

(194) |

|

|

(194) |

|

|

Segment net earnings (loss) |

$ |

164 |

|

$ |

(12) |

|

$ |

152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation recovery |

|

|

|

|

|

|

|

108 |

|

|

Amortization of property and equipment and other intangible assets,

excluding right-of-use assets |

|

|

|

|

|

|

|

(35) |

|

|

Integration expenseImpairment of goodwill |

|

|

|

|

|

|

|

(7)(85) |

|

|

Net earnings |

|

|

|

|

|

|

$ |

133 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment net earnings (loss) per share(ii) |

$ |

1.67 |

|

$ |

(0.12) |

|

$ |

1.55 |

|

|

Net earnings per

share |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

$ |

1.36 |

|

|

Diluted |

|

|

|

|

|

|

$ |

1.36 |

|

|

(i) |

Refer to the unaudited interim consolidated financial statements

for segment presentation and allocation considerations. |

| (ii) |

Calculated on a fully diluted basis. |

Shareholder Capital

|

(Unaudited) ($ millions except per share amounts)As at September

30, 2020 |

|

Investing |

|

|

Asset and

WealthManagement |

|

Total |

|

Total segmented assets |

$ |

6,260 |

|

$ |

780 |

|

$ |

7,040 |

|

|

Accounts payable and accrued liabilities |

|

- |

|

|

(33) |

|

|

(33) |

|

|

Accrued compensation |

|

- |

|

|

(86) |

|

|

(86) |

|

|

Lease and other liabilities |

|

- |

|

|

(118) |

|

|

(118) |

|

|

DSU hedge assets |

|

- |

|

|

(61) |

|

|

(61) |

|

|

Total shareholder capital(i) |

$ |

6,260 |

|

$ |

482 |

|

$ |

6,742 |

|

|

Shareholder capital per

share(i)(ii) |

$ |

68.74 |

|

$ |

5.30 |

|

$ |

74.04 |

|

|

(i) |

Shareholder capital and shareholder capital per share are non-GAAP

financial measures which have been calculated using methodologies

that are not in accordance with IFRS. A reconciliation of total

segmented assets to shareholder capital is presented in this table.

The presentation of financial measures in this manner does not have

a standardized meaning prescribed under IFRS and is therefore

unlikely to be comparable to similar financial measures presented

by other companies. Management believes that shareholder capital is

useful to investors as the metric is used, in part, to assess Onex’

performance. |

| (ii) |

Calculated on a fully diluted basis using the treasury stock

method. Fully diluted shares for shareholder capital per share were

91.1 million at September 30, 2020. |

Cash and Near-Cash

The table below provides a reconciliation of the

change in cash and near-cash from December 31, 2019 to September

30, 2020.

|

(Unaudited) ($ millions) |

|

|

|

Cash and near-cash on hand at December 31, 2019(i) |

$ |

1,842 |

|

|

Private equity realizations |

|

582 |

|

|

Private equity investments |

|

(325) |

|

|

Real estate distributions |

|

15 |

|

|

Net Onex Credit strategies investment activity, including warehouse

facilities |

|

(53) |

|

|

Onex share repurchases, options exercised, dividends and director

DSU redemption |

|

(472) |

|

|

Net other, including capital expenditures, management fees,

operating costs and treasury income |

|

12 |

|

|

Cash and near-cash on hand at

September 30,

2020(i) |

$ |

1,601 |

|

|

(i) |

Includes $934 million (December 31, 2019 – $395 million) of

treasury investments, $96 million (December 31, 2019 – $97 million)

invested in an Onex Credit unlevered senior secured loan strategy

fund and $192 million (December 31, 2019 – $190 million) of

management fees. |

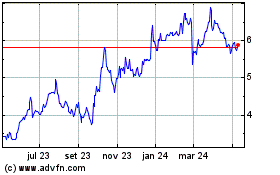

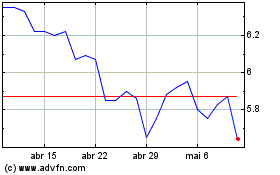

Emerald (NYSE:EEX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Emerald (NYSE:EEX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024