Alstom SA: Alstom launches its share capital increase with

preferential subscription rights of an amount of approximately €2

billion as part of the financing of the acquisition of Bombardier

Transportation

Not to be published, distributed or circulated

directly or indirectly in the United States, Australia or

Japan.

This press release is for information purposes

only and does not constitute an offer to sell or a solicitation of

an offer to buy any Alstom securities in any jurisdiction.

Alstom launches its share capital

increase with preferential subscription rights of an amount of

approximately €2 billion as part of the financing of the

acquisition of Bombardier Transportation

November 16, 2020

Terms of the transaction

- Subscription ratio: 3 new shares per 10 existing shares

- Subscription price: €29.50 per new share; theoretical value of

the preferential subscription rights: €2.90

- Preferential subscription rights trading period: from November

17th to November 26th, 2020, inclusive

- Subscription period: from November 19th to November 30th, 2020,

inclusive

Following the signing of the sale and purchase

agreement with Bombardier Inc. and Caisse de dépôt et placement du

Québec (“CDPQ”) for the acquisition of Bombardier

Transportation (the “Acquisition”) on September

16th, 2020 under revised terms, and the approval at Alstom’s

Shareholders’ Meeting held on October 29th of all resolutions

related to the Acquisition, Alstom reaches today a key milestone in

the acquisition process, with the launch of its share capital

increase with shareholders’ preferential subscription rights in an

amount of approximately €2 billion (including issue premium).

The proceeds of the rights issue will be used to

finance in part the Acquisition price which is expected to amount

to up to €5.3 billion1. The rights issue is part of the total

equity financing of approximately €5 billion that also includes

capital increases reserved for CDPQ and Bombardier Inc., in minimum

amounts of €2.632 billion and €5003 million, respectively. A bond

issue in an amount of approximately €400 million is also being

contemplated.

The Acquisition announced on February 17th, 2020

will enable Alstom to accelerate its strategic roadmap by bringing

together complementary commercial, products and industrial

platforms and represents a key milestone in the strengthening of

Alstom’s operational profile. With a significant broader reach, a

larger portfolio of solutions and enhanced innovation capabilities,

Alstom will be in an ideal position to respond to the increasing

demand for sustainable mobility.

With an objective to restore Bombardier

Transportation’s margin at a standard level in the medium-term and

to generate €400m synergies in annual run-rate synergies by the

fourth or fifth year post-closing4, the Acquisition should be

strongly value-creative for the Group’s shareholders, with an

expected double digit EPS accretion as from the second year

post-closing5.

The Acquisition will also enable Alstom to

welcome CDPQ as a new long-term shareholder, who will become

Alstom’s largest shareholder with approximately 17.8% of the share

capital.

The Acquisition is expected to close in Q1 2021

subject to regulatory approvals and customary closing conditions.

As of the date of this press release, all applicable competition

authorities have authorized the Acquisition other than those in

China and South Africa whose review is ongoing.

”We are now entering the final stretch of the

acquisition of Bombardier Transportation, the completion of which

is now expected to occur in Q1 2021. Alstom’s core purpose is to

develop mobility solutions that are more respectful of the

environment for the wellbeing of all, and thus to improve quality

of life in our cities and lands. The acquisition of Bombardier

Transportation is at the heart of this strategy. Along with

Alstom’s and Bombardier Transportation’s employees, we are going to

build a world leader extremely well positioned to have a

significant impact on the future of mobility, and at the same time

create strong value for all stakeholders. We are pleased to offer

as of today to Alstom’s shareholders and to investors the

opportunity via this circa €2 billion rights offering to

participate in this key milestone of the Group’s development.”,

said Henri Poupart-Lafarge, Alstom’s Chairman and Chief Executive

Officer.

Key terms of the rights issueThe rights issue will

be carried out with preservation of the shareholders’ preferential

subscription rights, pursuant to the 4th resolution of the combined

general meeting of October 29th, 2020, and will result in the

issuance of 68,077,926 new shares at a subscription price of €29.50

per share (i.e., a nominal value of €7 plus an issue premium of

€22.50), to be fully paid up upon subscription, representing gross

proceeds, including the issue premium, of €2,008,298,817 (which may

be increased to a gross amount, including the issue premium, of

€2,009,623,397, by issuance of 68,122,827 new shares in the event

of exercise of all currently-exercisable share subscription options

of the Company6).

Holders of existing shares recorded on their

accounts as of the end of the accounting day on November 16th, 2020

will be entitled to receive preferential subscription rights which

will be detached from the underlying existing shares on November

17th, 2020. Existing shares will therefore trade ex-right from

November 17th, 2020.

Each existing share will entitle its holder to

receive one (1) preferential subscription right. 10 rights will

entitle holders to subscribe for 3 new shares on an irreducible

basis (à titre irréductible), at a subscription price of €29.50 per

share.

Subscriptions on a reducible basis (à titre

réductible) will be accepted. Any new shares not subscribed on an

irreducible basis (à titre irréductible) will be distributed and

allocated to the holders of the rights having submitted additional

subscription orders on a reducible basis (à titre réductible)

subject to reduction in the event of oversubscription.

Based on the closing price of Alstom stock on

the regulated market of Euronext Paris

(“EuronextParis”) on November

12th, 2020, i.e. €42.06:

- the theoretical value of 1 preferential subscription right is

€2.90 (this value may fluctuate during the rights trading period,

in particular depending on changes in the price of Alstom

share)

- the theoretical value of the ex-right share is €39.16

- the subscription price for the new shares of €29.50 per share

(representing a nominal value of €7 plus an issue premium of

€22.50) reflects a discount of 24.7% to the theoretical ex-right

share price and 29.9% to the closing price on November 12th,

2020

The

only offer to the public in the context of the rights issue will be

in France.

Subscription

intentionsBouygues, which owns 9.7% of Alstom’s share

capital, committed towards Alstom to participate in the rights

issue in a “tail swallow” transaction (“operation blanche”) by

selling part of its preferential subscription rights to cover the

cost of taking up the remainder exclusively with the proceeds of

this sale. Upon completion of this transaction, Bouygues is

expected to hold approximately 8%7 of Alstom’s share capital. 8

Alstom is not aware of the subscription

intentions of any other shareholder.

Lock-up agreementsAlstom has

agreed to a lock-up period starting on the date of signing of the

underwriting agreement and ending 180 calendar days after the

settlement and delivery date of the rights issue, subject to

certain exceptions.

Bouygues has agreed to a lock-up period starting

on the date of approval by the Autorité des marchés financiers

(AMF) of the prospectus relating to the rights issue and ending 90

calendar days after the settlement and delivery date of the rights

issue, subject to certain exceptions.

Dilution

For illustrative purposes only, a shareholder

holding 1% of the Company’s share capital as of November 12th,

2020, and who does not participate in the rights issue, would hold

0.77% following the rights issue and 0.60% following the rights

issue and the capital increases reserved for affiliates of CDPQ and

Bombardier Inc..

UnderwritingThe rights issue is

being underwritten pursuant to an underwriting agreement entered

into on November 13th, 2020 with a syndicate of banks including

BofA Securities, Crédit Agricole Corporate and Investment Bank,

HSBC and Société Générale acting as Joint Global Coordinators, Lead

Managers and Joint Bookrunners, Goldman Sachs, Natixis and

Santander acting as Joint Bookrunners and BBVA, Commerzbank and

Unicredit acting as Co-Bookrunners. This underwriting agreement

does not constitute an irrevocable guarantee (garantie de bonne

fin) within the meaning of Article L. 225-145 of the French

Commercial Code.

Indicative timetable of the rights

issueThe preferential subscription rights will be traded

on Euronext Paris under the ISIN code FR0014000IN0 from November

17th, 2020 until November 26th, 2020 inclusive. It will not be

possible to buy or sell the preferential subscription rights on the

market after the close of trading on November 26th, 2020. The

subscription period for the new shares will run from November 19th,

2020 to November 30th, 2020, inclusive.

Any preferential subscription rights not

exercised before the end of the subscription period, i.e. the close

of trading on November 30th, 2020, shall automatically become null

and void. Settlement and delivery of the new shares and

commencement of trading on Euronext Paris are expected to take

place on December 7th, 2020. The new shares, which will entitle

their holders to any dividends declared by Alstom as from the date

of issuance, will be, as from their issuance date, fully fungible

with Alstom’s existing shares and will be traded under the same

trading line and ISIN code as Alstom’s existing shares (ISIN code

FR0010220475).

Availability of the Prospectus

The prospectus (the “Prospectus”) including (i) the 2019/20

universal registration document (document d’enregistrement

universel) of Alstom filed with the AMF on June 2nd, 2020 under

number D.20-0508, (ii) the first amendment to the 2019/20 universal

registration document filed with the AMF on October 7th, 2020 under

number D.20-0508-A01, (iii) the second amendment to the 2019/20

universal registration document filed with the AMF on November

13th, 2020 under number D.20-0508-A02 and (iv) a securities note

(note d’opération) (including the summary of the prospectus) which

was filed with the AMF and received approval under number 20-555

dated November 13th, 2020 is available on the website of the AMF

(www.amf-france.org) and the company (www.alstom.com). Copies of

the Prospectus are available free of charge at the Company’s

registered office (48, rue Albert Dhalenne, 93400

Saint-Ouen-sur-Seine).

Risk factorsInvestors’

attention is drawn to the risk factors included in chapter 4 “Risk

Factors, internal control and risk management” of the 2019/20

universal registration document, in section 2 “Risk Factors” of the

first amendment to the universal registration document, in section

2 “Risk Factors” of the second amendment to the universal

registration document and in chapter 2 “Risk Factors” of the

securities note (note d’opération).

In particular, investors are invited to take

into consideration the risks related to the contemplated

Acquisition, in particular those related to Bombardier

Transportation’s performance and contingent liabilities, as well as

to the integration of Bombardier Transportation’s activities and

potential failure to achieve expected synergies, as set out in

section 2 “Risk Factors” of the first and second amendments to the

2019/20 universal registration document.

1 Revised price range of €5.5bn – €5.9bn.

Preliminary contractual purchase price estimated at €5.3bn, after

taking into account estimated potential post-closing adjustments

and obligations linked to Bombardier Transportation’s net cash

protection mechanism. The final purchase price amount will be

determined on the basis of Bombardier Transportation’s accounting

books as of December 31, 2020 and the transaction completion date

and of the mechanisms set forth in the share purchase agreement. 2

Total amount subscribed through a reserved capital increase

(i) by set-off of CDPQ and its affiliates’ claim in connection

with the Bombardier Transportation purchase price, for an amount

between €1.93 billion and €2.08 billion, depending on the final

amount of the Acquisition Price, (ii) increased by an amount

in cash of €700 million, pursuant to the terms provided for in the

investment agreement entered into with CDPQ and its affiliates.3

Amount which may be increased to a maximum of €650 million,

pursuant to the terms of the investment agreement entered into with

Bombardier UK Holding.4 Post-closing of the Acquisition.5 After

cost synergies and implementation costs, and before amortization of

the purchase price allocation (PPA).6 The right to exercise the

share subscription options corresponding to option plans for which

the exercise period is underway is suspended as of November 13,

2020 at 5:00 pm (Paris time) for a maximum period of three months.7

This percentage does not take into account the capital increases

reserved for affiliates of CDPQ and Bombardier Inc., respectively.8

Assuming the completion of a “tail swallow” transaction as

described in section 5.2.2 of the securities note, estimated on the

basis of an assumption given for illustrative purposes only and

based on the theoretical value of the shareholders’ preferential

subscription rights calculated on the basis of the closing price of

Alstom stock on November 12th, 2020.

|

|

About Alstom |

|

|

|

Leading the way to greener and smarter mobility worldwide, Alstom

develops and markets integrated systems that provide the

sustainable foundations for the future of transportation. Alstom

offers a complete range of equipment and services, from high-speed

trains, metros, trams and e-buses to integrated systems, customised

services, infrastructure, signalling and digital mobility

solutions. Alstom recorded sales of €8.2 billion and booked orders

of €9.9 billion in the 2019/20 fiscal year. Headquartered in

France, Alstom is present in over 60 countries and employs 38,900

people. |

|

|

|

| |

Contacts |

Press:Coralie COLLET - Tel.: +33 (1) 57 06 18

81coralie.collet@alstomgroup.com Samuel MILLER - Tel.: +33

(1) 57 06 67 74Samuel.miller@alstomgroup.com Investor

relations:Julie MOREL - Tel.: +33 (6) 67 61 88

58Julie.morel@alstomgroup.com Claire LEPELLETIER - Tel.: +33

(6) 76 64 33 06claire.lepelletier@alstomgroup.com |

|

IMPORTANT INFORMATION

This press release includes "forward-looking

statements". All statements other than statements of historical

facts included in this press release, including, without

limitation, those regarding Alstom’s financial position, business

strategy, plans and objectives of management for future operations,

are forward-looking statements. Such forward-looking statements

involve known and unknown risks, uncertainties and other factors,

which may cause the actual results, performance or achievements of

Alstom, or industry results, to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Such forward-looking statements

are based on numerous assumptions regarding Alstom’s present and

future business strategies and the environment in which Alstom will

operate in the future. Additional factors could cause actual

results, performance or achievements to differ materially.

The contents of this press release have been prepared by and are

the sole responsibility of Alstom.

This press release does not constitute an offer

to sell nor a solicitation of an offer to buy, nor shall there be

any sale of ordinary shares in any state or jurisdiction in which

such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

The distribution of this document may, in

certain jurisdictions, be restricted by local legislations. Persons

into whose possession this document comes are required to inform

themselves about and to observe any such potential local

restrictions.

This press release is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017 (as amended

the “Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the member states of the

European Economic Area (other than France) and the United Kingdom

(each a “Relevant State”), no action has been undertaken or will be

undertaken to make an offer to the public of the securities

referred to herein requiring a publication of a prospectus in any

Relevant State. As a result, the securities may not and will not be

offered in any Relevant State except in accordance with the

exemptions set forth in Article 1 (4) of the Prospectus Regulation

or under any other circumstances which do not require the

publication by Alstom of a prospectus pursuant to Article 3 of the

Prospectus Regulation and/or to applicable regulations of that

Relevant State.

The distribution of this press release has not

been made, and has not been approved, by an “authorised person”

within the meaning of Article 21(1) of the Financial Services and

Markets Act 2000. As a consequence, this press release is only

being distributed to, and is only directed at, persons in the

United Kingdom that (i) are “investment professionals” falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the “Order”), (ii)

are persons falling within Article 49(2)(a) to (d) (“high net worth

companies, unincorporated associations, etc.”) of the Order, or

(iii) are persons to whom an invitation or inducement to engage in

investment activity (within the meaning of Article 21 of the

Financial Services and Markets Act 2000) in connection with the

issue or sale of any securities may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “Relevant Persons”). Any investment

or investment activity to which this document relates is available

only to Relevant Persons and will be engaged in only with Relevant

Persons. Any person who is not a Relevant Person should not act or

rely on this document or any of its contents.

This press release may not be published,

distributed or transmitted in the United States (including its

territories and dependencies).

This press release does not constitute or form

part of any offer of securities for sale or any solicitation to

purchase or to subscribe for securities or any solicitation of sale

of securities in the United States. The securities referred to

herein have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (the “Securities Act”) or the

law of any State or other jurisdiction of the United States, and

may not be offered or sold in the United States absent registration

under the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. Alstom does not intend to register all or any

portion of the Securities in the United States under the Securities

Act or to conduct a public offering of the Securities in the United

States.

This announcement is not, and under no

circumstances is it to be construed as, a prospectus, offering

memorandum, advertisement or an offer to sell or solicitation of an

offer to buy any of the securities referred to herein in Canada.

Any offering in Canada will be made on a private placement basis

only to purchasers purchasing, or deemed to be purchasing, as

principal that are accredited investors, as defined in National

Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of

the Securities Act (Ontario), and are permitted clients, as defined

in National Instrument 31-103 Registration Requirements, Exemptions

and Ongoing Registrant Obligations.

This announcement may not be published, forwarded or

distributed, directly or indirectly, in the United States of

America, Australia or Japan.

Alstom, as well as BofA Securities Europe SA

(“BofASE”), Crédit Agricole Corporate and Investment Bank, HSBC,

Société Générale, Goldman Sachs, Natixis, Santander, BBVA,

Commerzbank et Unicredit (together, the “Underwriters”) and any of

their respective affiliates expressly disclaim any obligation or

undertaking to update or revise any forward-looking statements

contained in this press release, whether as a result of new

information, future developments or otherwise.

The Underwriters are acting exclusively for

Alstom and no one else in connection with the offer of new shares

and will not regard any other person as their respective clients

and will not be responsible to anyone other than Alstom for

providing the protections afforded to their respective clients in

connection with any offer of new shares of Alstom or otherwise, nor

for providing any advice in relation to the offer of new shares,

the content of this press release or any transaction, arrangement

or other matter referred to herein.

In connection with the offering of ordinary

shares of Alstom, the Underwriters and any of their affiliates may

take up a portion of the ordinary shares as a principal position

and in that capacity may retain, purchase, sell, offer to sell for

their own accounts such shares and other securities of the Alstom

or related investments in connection with the offer of ordinary

shares of Alstom or otherwise. Accordingly, references in the

Prospectus to the new ordinary shares being issued, offered,

subscribed, acquired, placed or otherwise dealt in should be read

as including any issue or offer to, or subscription, acquisition,

placing or dealing by the Underwriters and any of their affiliates

acting in such capacity. In addition, the Underwriters and any of

their affiliates may enter into financing arrangements (including

swaps, warrants or contracts for differences) with investors in

connection with which they may from time to time acquire, hold or

dispose of shares. The Underwriters do not intend to disclose the

extent of any such investment or transactions otherwise than in

accordance with any legal or regulatory obligations to do so.

None of the Underwriters or any of their

respective directors, officers, employees, advisers or agents

accepts any responsibility or liability whatsoever for or makes any

representation or warranty, express or implied, as to the truth,

accuracy or completeness of the information in this press release

(or whether any information has been omitted from this press

release) or any other information relating to Alstom, its

subsidiaries or associated companies, whether written, oral or in a

visual or electronic form, and howsoever transmitted or made

available or for any loss howsoever arising from any use of this

announcement or its contents or otherwise arising in connection

therewith.

- 2020-11-16 PR Capital increase_FINAL

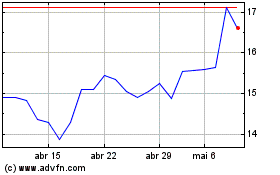

Alstom (EU:ALO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Alstom (EU:ALO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024